Home » Ecosystem » $1.5 trillion Franklin Templeton launches tokenized treasury fund on Solana after hinting at SOL ETF filing

Feb. 12, 2025

Franklin Templeton embraces Solana for its effectivity and innovation.

Key Takeaways

- Franklin Templeton has expanded its tokenized treasury fund to Solana, making it the eighth blockchain platform for FOBXX.

- The agency on Monday registered the Franklin Solana Belief, indicating plans for a Solana ETF in the US.

Share this text

Franklin Templeton, managing round $1.5 trillion in resources, is bringing its tokenized treasury fund to Solana, the company announced on X this day. The delivery comes after the asset manager registered its Franklin Solana Belief in Delaware on Monday.

Novel chain unlocked. BENJI is now stay on @solana!

Solana is a rapid, rep and censorship resistant Layer 1 blockchain encouraging global adoption through its originate infrastructure.

Download the Benji app here: https://t.co/ITah6qMtns

Read more: https://t.co/4j3TDC9VHM pic.twitter.com/3aiODzkK3T— Franklin Templeton Digital Property (@FTDA_US) February 12, 2025

The fund, additionally acknowledged as the Franklin OnChain U.S. Govt Money Fund, or FOBXX, is now readily available on eight blockchains, beforehand collectively with Stellar, Aptos, Avalanche, Arbitrum, Polygon, Inferior, and Ethereum.

“Solana is a rapid, rep and censorship resistant Layer 1 blockchain encouraging global adoption through its originate infrastructure,” the agency defined its dedication.

Launched on Stellar in 2021, FOBXX has grown to alter into surely one of many realm’s main cash-market funds.

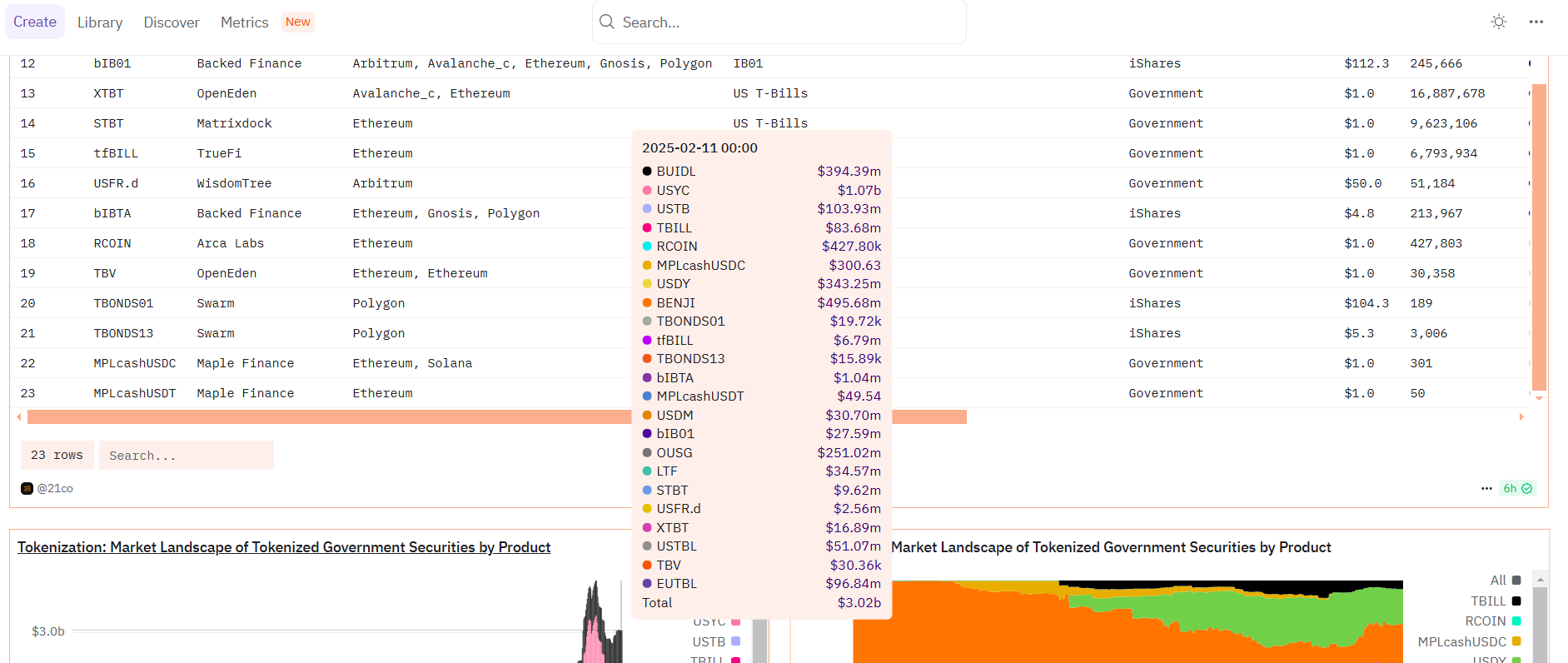

As of Feb. 11, the fund had round $495 million in market cap, completely in the support of USYC, the on-chain representation of Hashnote Global Brief Duration Yield Fund Ltd. (SDYF), with a market cap exceeding $1 billion, in accordance with Dune Analytics.

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which in an instant challenged FOBXX following its delivery final yr, had approximately $394 million in market cap as of Tuesday.

BUIDL beforehand surpassed FOBXX to steer the tokenized treasury fund market.

Early endorsement

The Wall Road giant has proven ongoing hobby in Solana’s ecosystem.

Following the SEC approval of US-listed snarl Bitcoin ETFs, collectively with Franklin’s EZBC, the agency shared in a chain of posts on X that they had been in the imaginative and prescient of Anatoly Yakovenko, Solana’s co-founder.

Franklin additionally identified key tendencies in the Solana ecosystem in Q4 2023, such as tendencies in DePIN, DeFi, the meme coin market, NFT innovation, and the delivery of the Firedancer scaling solution.

The asset manager established the Franklin Solana Belief in Delaware this week, indicating plans to delivery a Solana ETF in the US.

The trust’s registration by CSC Delaware Belief Company indicators Franklin’s plot to file a actually fundamental sorts with the SEC to officially introduce the ETF, which targets to word the value motion of SOL, the fifth-supreme crypto by market cap.

Share this text