2024 used to be a landmark 300 and sixty five days for the cryptocurrency market. It used to be a 300 and sixty five days when the market matured, boundaries to the institutional investing world came down, and global regulations started to pave the formula for digital currencies to enter the mainstream global financial machine.

With a President-elect fascinated about making the US a global crypto hub, the market experienced most fundamental growth. As crypto adoption rose, more users turned to crypto platforms and ETFs to speculate. 2024 used to be a transformative skills for the crypto market and the blockchain skills that powers it.

The conventional public, buoyed by certain sentiment and rising crypto costs, has flocked to DeFi platforms to download their first wallet. Diverse those original users have chanced on their technique to the extremely trusted crypto mark Binance.

It takes a trudge-setter to assist an industry proceed to inclined and Binance CEO Richard Teng has taken on that role throughout 2024’s massive growth. Teng commented on his leadership and the long speed, “we have served in basically the most easy interests of our users since day one, main the industry’s customary and proceed constructing the arrangement forward for the industry responsibly.”

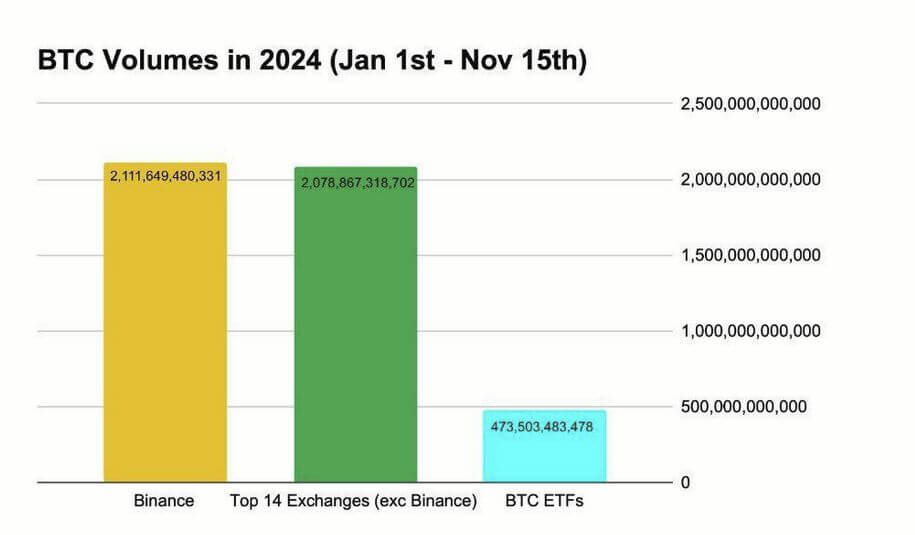

Binance accounts for roughly 50% of all trading quantity globally. This amount has most productive increased from Jan-Nov 2024. For the length of the 2024 US Presidential election week, Binance captured $7.7 billion out of the $20 billion complete inflows throughout all exchanges. Combine that with the main crypto alternate reaching a original milestone surpassing 200 million users and safeguarding over $130 billion in individual sources.

So, these are interesting times for the crypto industry that come off the assist of a total lot of labor in 2024. The highlights of the 300 and sixty five days incorporated:

Institutional Involvement and Stylish Adoption

In 2024, BlackRock launched its role Bitcoin ETF IBIT, before bringing alternatives to the table on November Nineteenth 2024, and broke the total data on day one with 354,000 contracts traded and $1.9 billion in notional designate. This used to be a landmark 2d for the crypto industry, nonetheless it came at the kill of a 300 and sixty five days of institutional investment.

Pension funds, hedge funds, and sovereign wealth funds have labored mighty into crypto this 300 and sixty five days as they’re on the lookout for to make basically the loads of the growth ability and protect against considerations with fiat forex. They notice on the heels of Goldman Sachs, Morgan Stanley, and Constancy Investments, who all provide Bitcoin as fragment of their Wealth Management companies and products.

Institutional investment has curbed market volatility, and this 300 and sixty five days, Bitcoin emerged as one imaginable safety against inflation. Unusual clarity with the regulations, improved custody alternatives, and improved likelihood management frameworks all gave the institutions the self perception to soar into crypto toes first in 2024.

The Rise and Rise of DeFi

Decentralized Finance (DeFi) is altering the enviornment we dwell in and providing a staunch alternative to broken-down banking. The enviornment’s unbanked wretched and privacy-obsessed High Salvage Price Other folks alike have chanced on the delights of downloading a crypto wallet and sending cash with low charges and no questions.

In accordance with one most modern search, the worldwide DeFi market need to be value nearly $440 Billion in 2030, up from fair over $20 billion in 2023.

We can now tokenize any asset, from staunch estate and supreme art to autos and stocks, to style more liquidity without the assist of a broken-down financial institution. Here is opening up original techniques of borrowing, saving, lending, and earning passion that do the energy in the fingers of the oldsters.

Unbanked contributors throughout the enviornment can have acquire admission to to traditional financial companies and products, together with sending and receiving cash from mates or families, without massive charges. We’re moreover seeing an ecosystem of liquidity pools and borrowing facilities initiate up that can replace the enviornment of finance.

Retail Market Integration

In the background, the Web3 skills that underpins the crypto market has chanced on a dwelling with DeFi platforms, as well to retail and e-commerce. Blockchain skills is now the root of provide chain management, healthcare services, and a monumental amount of firm processes. If the blockchain continues to rob over company and public life, then the tokenized crypto ecosystem has to head with it.

Stores are more and more counting on the blockchain, with Starbucks the usage of it to hint their coffee from the farm to the cup and Nike tokenizing every pair of sneakers on its Swoosh platform for authenticity and traceability.

In October 2023, Ferrari started accepting crypto funds for its excessive-kill sportscars, becoming a member of the likes of Tesla, PayPal, Shopify, and Microsoft. Here is a gradual direction of, nonetheless crypto has slowly acquired the social proof it requires to interrupt thru with mainstream retail outlets. The blockchain that forms its foundations and is popping into such a mainstream hit used to be an surprising bonus.

Regulatory Frameworks: Chaos to Readability

Fragmented regulations that replace from country to country are unpleasant for the crypto industry, and 2024 used to be the 300 and sixty five days it indirectly acquired its dwelling in uncover. The Monetary Balance Board, Global Monetary Fund, and World Financial Discussion board helped book disparate countries in the direction of one role of customary practices for crypto taxation, Anti Money Laundering compliance, and individual safety. A easy basis of regulations that works throughout borders might well well work wonders for the industry. We’re no longer there yet, nonetheless we are getting nearer.

Technological Advancements Utilizing Maturity

It isn’t fair the political landscape that had to replace to present the crypto market a shot at mass adoption. Proper technical considerations with the early blockchain techniques kept them as a distinct section passion in preference to an on a customary basis prevalence.

Blockchain congestion, gradual transactions, excessive energy consumption, and scalability were all staunch considerations. Ethereum 2.0 and Layer 2 alternatives indicate that Ethereum, basically the most ubiquitous blockchain by a ways by formula of dApps and Web3 skills, is now mighty more scalable, with lower charges and no more blockchain congestion. Solana and alternative blockchains adore BNB Excellent Chain moreover provide alternative alternatives, with blockchain bridges seamlessly connecting the networks.

AI integration has already modified the enviornment of trading, analytics, likelihood management, and provide chain management. Synthetic Intelligence has unlocked yet any other diploma of efficiency from Web3 skills and automated complex processes that can streamline nearly any firm.

Conclusion

These components have all combined to style a market that is ready, full of life, and ready for mass adoption. Institutional adoption, regulatory clarity, cultural acceptance, and technical enhancements have all helped the cryptocurrency industry trip from a sideshow to a central participant in 2024. Now we haven’t any longer viewed the relaxation yet, and next 300 and sixty five days might well well even be the largest yet.