36% Hedge Funds and 32% Managers with $10 Billion in AUM Query to Expand Crypto Publicity: EY Take into memoir

Because the alternate better understands the asset class, “the alpha-generating opportunities will with out a doubt make more incentive for different fund managers to make a decision half in this procedure.”

Handiest 1 in 10 managers currently contain exposure to cryptocurrencies, based mostly on a locate published on Monday by one in every of the massive four accounting companies Ernst & Young. However the lawful component is companies are planning to elongate their exposure in the arriving One year.

While 10% of the hedge fund managers contain exposure to crypto, a mere 4% of the non-public equity managers are currently reporting crypto allocations through diverse methodology corresponding to crypto derivatives, checklist funds, and crypto companies. AUM dedicated to crypto also stays dinky, at 1%-2% for hedge fund managers.

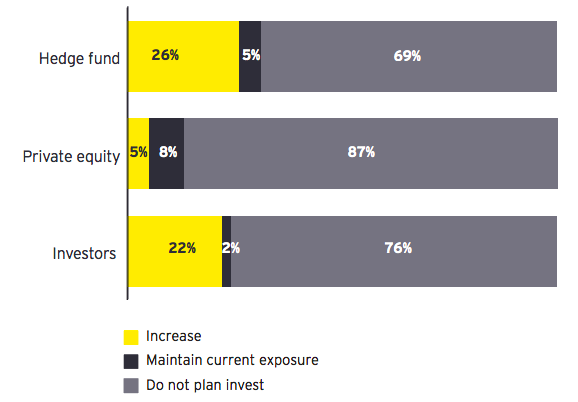

But in the next one to 2 years, better than 20% of institutional traders and 25% of hedge fund managers acknowledged they request to elongate their exposure to cryptocurrencies.

Among these traders, the very top managers are presumably to elongate their exposure, with 36% of hedge fund managers which contain over $10 billion in AUM and 32% of managers with $2 billion – $10 billion in AUM reporting that they request to elongate their crypto AUM, as per the file.

By methodology of boundaries to investing in crypto, the #1 became that crypto would now not align with their investment procedure, adopted by volatility, regulatory uncertainty, lack of consciousness of crypto, and immature market infrastructure.

Tax implications, lack of suitable investment opportunities, crypto now not being ESG-friendly, and crypto being a bubble had been the lowest factors combating them from investing in crypto sources.

Greenwich Buddies conducted the locate from July to September 2021 that polled 264 different institutional traders collectively conserving about $5 trillion.

“2021 appears to be like to be an inflection level the build this asset class is gaining the eye of all institutional different fund managers,” notes the hunt for. It extra provides that different fund managers contain turn out to be more active participants in crypto sources, drawn by uncorrelated returns and persisted investment in institutional-grade infrastructure to enhance the dwelling.

“Because the alternate and regulators proceed to better realize this asset class, the alpha-generating opportunities will with out a doubt make more incentive for different fund managers to make a decision half in this procedure.”

![]()