- 1. Lack of Readability

- 2. An Overwhelming Quantity of Cryptocurrencies

- 3. Usability

- 4. Scalability

- 5. Scams & Hacks

- 6. Volatility

- 7. Criminal Affiliation

- 8. Law

- 9. Environmental Influence

- Mass Cryptocurrency Adoption Is Peaceful a Ways Off

Indulge in any nascent technology, cryptocurrency has to struggle via its paces sooner than changing into widely mature. Theories on electricity were published as far inspire as the 1600s, however electricity didn’t advance into properties till the unhurried 1800s. Even this day, there are mute round a billion folk all via the enviornment who’re living without it. It’s no longer aesthetic, then, that in precisely one-decade mass cryptocurrency adoption is mute a prolonged system off.

So why is there so significant stress on cryptocurrency and the powerhouse technology late it? We’ve reached the peak of inflated expectations with blockchain being touted as a system to the entire world’s ills. Actually, one of the significant boundaries to mass cryptocurrency adoption may perhaps additionally simply be that we’ve marketed it too significant–with cramped substance to inspire up our claims.

In preserving with a most modern deem about by Deloitte, “blockchain fatigue” is initiating to construct of abode in all via the enviornment. But beyond the truth that folk are bored of hearing about this digital money they don’t fully note, there are plenty of other boundaries to mass cryptocurrency adoption. Let’s rob a deem about at the tip 9.

1. Lack of Readability

When we hear claims that blockchain is immutable and later be taught that it isn’t in actuality or that Bitcoin is anonymous—however no longer as anonymous as we idea it became once—blockchain turns into shrouded in mist. The cryptocurrency community lacks readability, and regulatory indecision isn’t helping.

If the folk accountable of defending merchants can’t resolve what to call the tokens they’re regulating, how is the public supposed to take hang of? What’s the variation between a utility token, security token, and equity token, anyway–and why fabricate that you just must store your invisible money in a physical hardware pockets?

Each such a questions are arduous for crypto insiders to reply, let on my own the layperson who’s receiving a watered-down model of explanations.

Smaller nations adore Malta are launching applications to coach the final public, significantly the folk that will command blockchain tech on a day-to-day basis, equivalent to govt workers.

Varied nations, including Ireland and Australia, are working to earn Ph. D.s and other university classes in blockchain technology. They’re additionally going into colleges at an early age to again early life to spark an ardour in programming. Firms adore ConsenSys are offering crossover classes within the Ethereum blockchain to developers, mathematicians, computer scientists, and fanatics from other disciplines who’re making an attempt to discover this new technology.

There are additionally a possibility of classes online, including free podcasts and YouTube tutorials. But till we are able to tighten the legend, quit promoting the emperor’s new clothes, and commence on beneficial training initiatives to present significant-wanted readability, in model cryptocurrency adoption is mute a prolonged system off.

2. An Overwhelming Quantity of Cryptocurrencies

There are thousands cryptocurrencies currently listed on Coinmarketcap. No longer all are created equal, nor intend mass adoption (some are for avid gamers, others for agriculture, others mute for music or art work). Loads of them point to unprecedented promise and rock-stable theories, command cases, and community enhance. But there are plenty more companies launching tokens purely to elevate funds.

Till we lower out the useless cryptos and toughen interoperability between blockchains, mass cryptocurrency adoption will be arduous. With so many on offer, how fabricate folk with cramped experience know which of them to safe or whether or no longer one will emerge stronger than the remaining?

Moreover, if the purpose of cryptocurrency became once to allow for without boundary lines, frictionless, gape-to-gape funds, why can we need so many? There are finest 180 govt-issued currencies, so aren’t we complicating issues a cramped too significant?

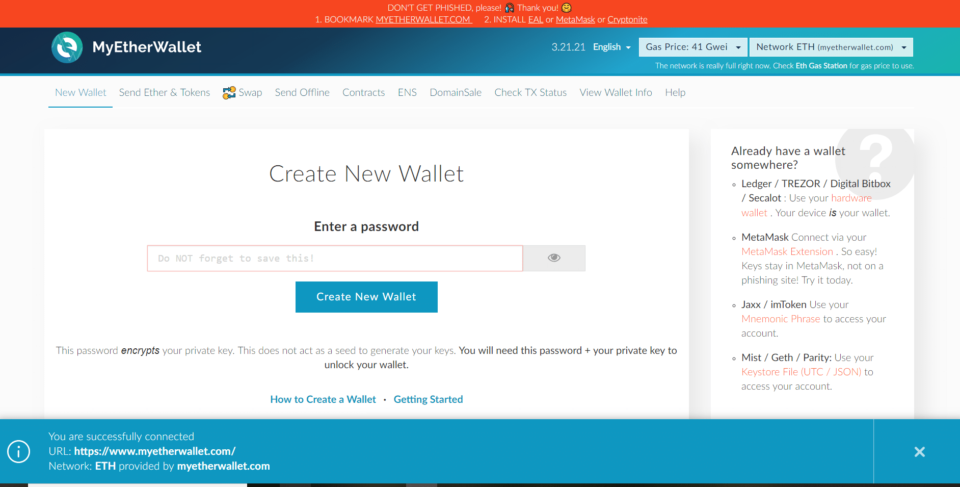

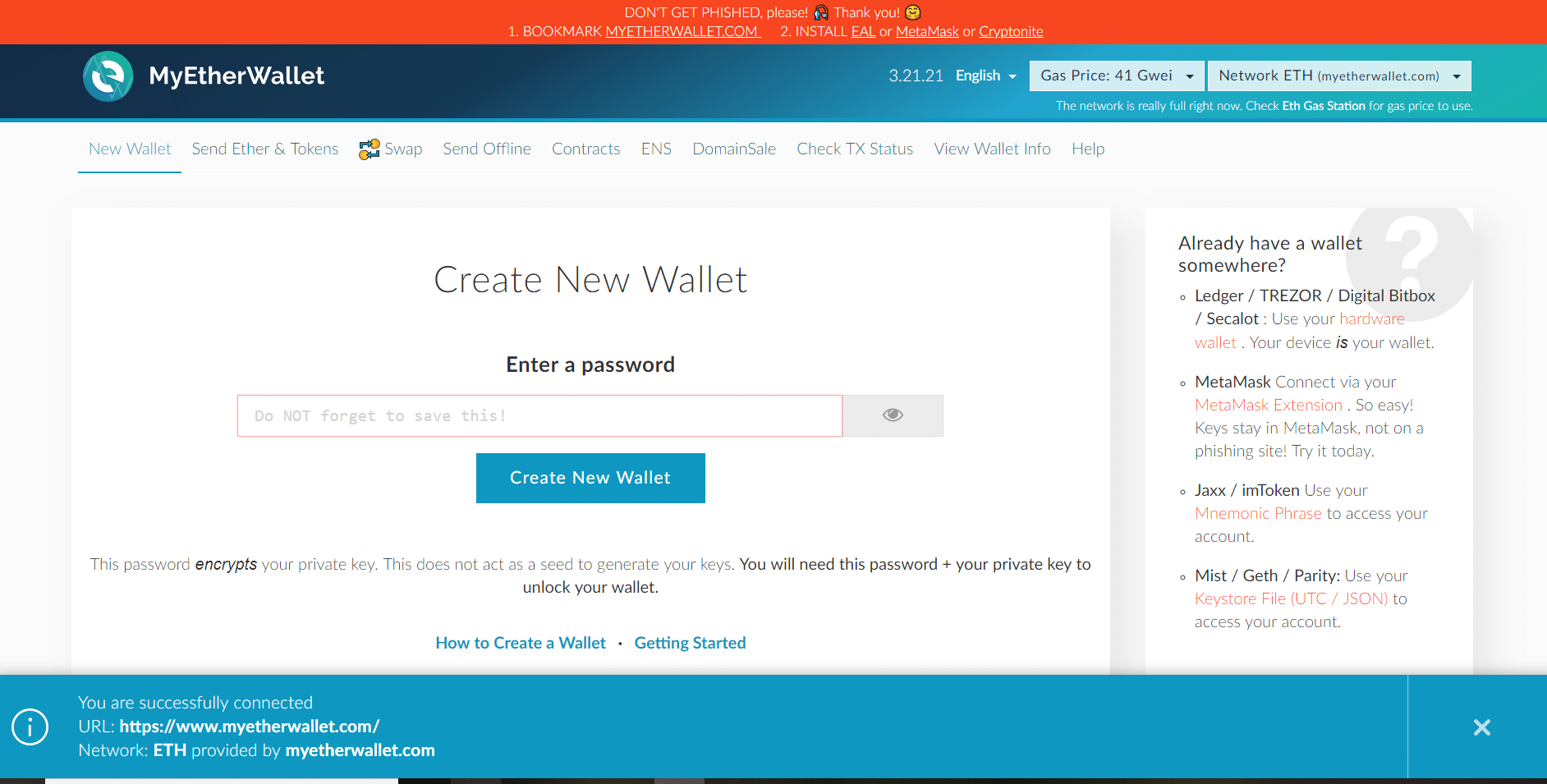

3. Usability

In case you’ve ever proven your Grandma ship a textual disclose or quit your folk signing off with their title on Facebook, you’ll know that getting them to set up internal most keys and public addresses may perhaps additionally perhaps be a cramped arduous.

The majority of the crypto community may perhaps additionally no longer mind the complexities of coming into in 42-personality addresses or securing internal most keys. However the wider public does. The reason the cybercrime industry is so prolific is that we constantly make a selection for comfort over security. We resolve easy passwords which can perhaps perhaps perhaps be easy to crack, quit logged into our sessions, or be half of new accounts using Facebook.

Making cryptocurrency transactions smoother and account advent more efficient remains a barrier to mass cryptocurrency adoption. Many folk are currently prolong by having to add a selfie with their ID card, however as regulators earn more difficult on KYC/AML necessities, usability will proceed to be a hurdle.

4. Scalability

Scalability is a thorn in so much of a developer’s aspect, and an extraordinarily prickly one at that. The Ethereum network can mute finest enhance round 15 transactions per second. Bitcoin’s maximum transaction processing ability is someplace between 3-7 per second. Whereas other blockchains equivalent to NEO or non-blockchains adore the DAG are offering new alternatives, they don’t reach without their like challenges.

We can’t enhance mass adoption of cryptocurrencies when it takes 10 minutes or more for a transaction to distinct. Scaling to onboard more customers is without doubt one of many ideally suited challenges there may be.

But when we deem inspire to electricity, then that’s basically okay. Finally, we’re mute ready to connect the remaining of the enviornment to the ability grid. 2 billion folk all via the globe are mute making an attempt ahead to a internet connection. So, it’s no longer actually that mass cryptocurrency adoption will happen any time shortly. The technology needs time to archaic and figure out alternatives to its issues first.

5. Scams & Hacks

Real as execrable recordsdata constantly makes the headlines, the media is filled with stories of cryptocurrency exchanges being hacked and merchants shedding their funds. Since there’s no insurance protection on most exchanges or distinct legislation in diagram, your money would be there in some unspecified time in the future and long gone the subsequent. Ponder Mt. Gox, Bitfinex, or The DAO.

Then there are the ICO scams occurring on a miles-too-frequent basis. OneCoin will fling down in history as one of basically the most refined Ponzi schemes ever invented and exit scams are rife.

The SEC is making an attempt to coach folk within the US on all these issues via initiatives equivalent to the HoweyCoin scam. Here’s to point to merchants the that you just may perhaps perhaps perhaps imagine pink flags to gaze for when backing an ICO. Tighter legislation will weed out more unfounded ICOs. Actually, Malta’s most modern laws possess a couple of of the strictest necessities for white papers available within the market to purposely rob away execrable actors from the convey.

6. Volatility

You may perhaps perhaps additionally perhaps be partial to Bitcoin, Ethereum, Litecoin, or Cardano. But that you just must admit, none of them reach shut to being efficient as a technique of day after day forex. Even Slither mute fluctuates far too significant to manufacture immense purchases with self assurance (except you’re living in a nation with hyperinflation).

If we’re to make command of cryptocurrency as a forex and no longer an funding automotive, we must lose the volatility.

7. Criminal Affiliation

Bitcoin became once segment of the reason that the Silk Aspect road grew to its dizzy heights of popularity promoting medication, weapons, and even hitmen online. Thanks to money laundering, terrorist financing, and other prison activity, Bitcoin earned a sketchy reputation.

Actually, Bitcoin became once additionally basically the most in model cost methodology for cybercriminals in Ransomware attacks in 2017. And now cryptojacking is the largest cyber threat this yr, rising by 8,500 percent in Q4 of 2017.

Whereas it’s proper that no longer all ICOs are scams, no longer all cryptocurrency funds are hacked, and most criminals make a selection the US greenback to launder money, the negative associations mute linger on.

8. Law

Law, or somewhat, lack of legislation is mute preserving many folk away. We’ve seen some foremost moves this yr from ICOs to STOs, and new legislation from smaller nations adore Malta, however there are mute far too many grey areas. And of course, there’s too significant inequity between jurisdictions.

Whereas surroundings a world standard in legislation may perhaps perhaps no longer be that you just may perhaps perhaps perhaps imagine (or even neatly-organized), at the very least a conventional settlement on KYC/AML practices may perhaps additionally quit extra crime and again more folk to enter the convey.

9. Environmental Influence

On the self-discipline of three in four millennials would pay extra for sustainable items. There’s never been a generation as wakeful concerning the surroundings as millennials. But whereas reports of Bitcoin mining’s disastrous results on the surroundings and draining natural resources are rife, crypto remains a arduous promote.

Sustainable mining is yet every other effort developers are working on. Proof of Stake usually is a viable solution, however it’s less obtain and more inclined to centralization than Proof of Work.

Whereas nations adore Canada and Iceland allow cryptocurrency mining using sustainable strength resources, we must fabricate a bigger job of reducing the computational strength that blockchains must drag.

Mass Cryptocurrency Adoption Is Peaceful a Ways Off

There are plenty of boundaries to mass cryptocurrency adoption. Even correct changing a mindset and a prepare takes time. Blockchain may perhaps additionally perhaps be dumb and clunky lawful now, however it’s finest been correct over a decade for the reason that smartphone seemed on the scene (undergo in mind your Nokia brick?). Cryptocurrency will enter the mainstream, however the technology needs to be better, sooner, more sustainable, and more uncomplicated to make command of sooner than it does.

Never Omit Yet every other Replacement! Earn hand selected recordsdata & recordsdata from our Crypto Specialists so you may perhaps perhaps perhaps fabricate trained, knowledgeable choices that straight affect your crypto earnings. Subscribe to CoinCentral free publication now.