The crypto market has been on a straggle in 2025, and essentially the latest 99Bitcoins Q2 Relate of Crypto Market File, authored by Manisha Mishra and subsidized by KCEX, lays it all out. The quarter saw institutional demand surge, Bitcoin ($BTC) hit a then-ATH of $111,980, and crypto hiring spike 753%.

Despite the rally, the complete market cap turned into nonetheless 12% under its $3.7 trillion high, hinting at room to speed. With stablecoin adoption booming and long-term holders stacking, Q2 can had been the valid begin of this cycle’s breakout.

Learn the stout picture right here: Relate of Crypto Q2 2025 – 99Bitcoins

A File-Breaking Quarter for Bitcoin

Bitcoin lit up Q2 with a 25.66% reach, smashing previous resistance to hit a then-picture $111,980 on Would possibly doubtless well 22. That assign it smartly sooner than gold’s 7.21% upward thrust and most equity indices, marking a engaging reversal from Q1’s pullback.

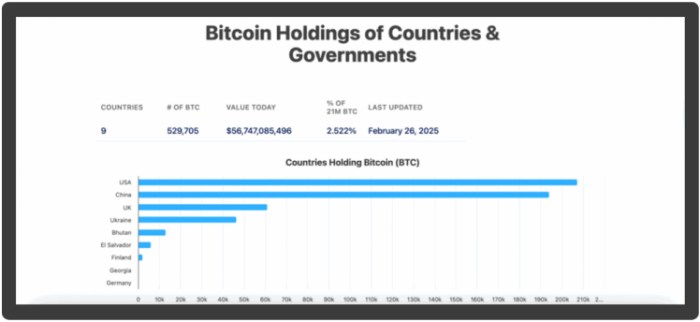

In accordance with 99Bitcoins’ Q2 picture, the rally turned into driven by institutional inflows, ETF demand, and rising sovereign hobby, with governments now preserving 2.5% of Bitcoin’s total supply. Within the meantime, plight ETF flows continuously outpaced miner issuance, tightening supply staunch as demand surged.

Chris Wright of 21Shares summed it up:

“We deem that Bitcoin ETFs will entice 50% extra inflows this three hundred and sixty five days when put next to final three hundred and sixty five days. This could halt in get inflows of roughly $55 billion in 2025, representing an produce bigger of round $20 billion three hundred and sixty five days-over-three hundred and sixty five days.”

A golden horrible in slack Would possibly doubtless well confirmed the uptrend, following a realistic breakout from months of consolidation. It’s a textbook bullish development.

With mark circulate and fundamentals in sync, Q2 marked the clearest shift yet: Bitcoin is aid, however powered by establishments, no longer retail.

Establishments Took the Wheel, Retail Became to Altcoins

In accordance with the 99Bitcoins picture, this bull speed has a lunge driver within the aid of the wheel. And it’s no longer Reddit. 9 out of 10 consultants interviewed within the Q2 picture acknowledged retail merchants possess shifted their point of interest to the glorious altcoins, chasing faster beneficial properties while establishments quietly accumulated Bitcoin.

The on-chain files backs it up. Glassnode shows that 30% of $BTC’s supply is now held by centralized entities, with massive players dominating inflows. Within the meantime, Google Traits unearths that retail hobby in “Bitcoin” searches stayed surprisingly low for the length of Q2, even as $BTC hit new highs.

Self assurance among long-term holders also climbed. UTXO assignment dropped, and the amount of BTC in long-term storage saved rising. A signal that serious capital isn’t desirous to promote anytime soon.

Stablecoins and DeFi Picked Up Steam

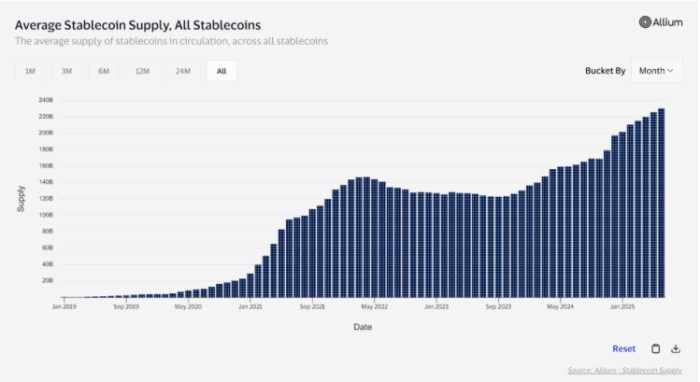

If Q2 proved the leisure, it’s that stablecoins aren’t staunch steady, they’re also scaling. The Circle IPO popped 168% on day one, marking the principle stablecoin issuer to head public and signaling TradFi’s rising speed for food for crypto exposure with out the volatility.

In accordance with 99Bitcoins, 81% of crypto-unsleeping SMBs now are desirous to make utilize of stablecoins for day to day ops, and the series of Fortune 500s planning to integrate them has tripled since final three hundred and sixty five days.

On the DeFi facet, Ethereum ($ETH) held L1 dominance, Chainlink ($LINK) led dev assignment, and $HYPE – the native token of Hyperliquid – saw serious traction, fueled by the DEX’s upward thrust to 70%+ of all perp DEX volume.

Whereas others chased memes, HYPE rallied on valid utility.

Briefly: DeFi’s nonetheless cooking, and stablecoins are fueling the fireside.

Memecoin Mayhem

After tanking in Q1, the memecoin market bounced aid a bit in Q2, although volatility stayed coarse and price circulate remained erratic.

Q2 saw the meme coins hit new heights, with over 5.9 million new tokens launched and most of them churned out via pump.fun. It turned into chaotic, noisy, and pure degen vitality. Whereas most extinct straight, tokens relish $FARTCOIN and $SPX saved riding the wave.

That acknowledged, the surge in token assignment came with a melancholy facet: phishing and pockets-focused hacks climbed, especially among memecoin holders.

Regulatory Wins and Macro Shifts Riding Self assurance

If Q2 had a theme, it turned into reduction on each the coverage and financial fronts. The U.S. pulled aid on crypto enforcement, scrapped IRS reporting rules for DeFi, and signaled a extra positive stance overall.

Within the meantime, the Fed held charges steady for the fourth straight time, hinting at a that which that you just can well doubtless be sing cleave in July. With unemployment flat and development slowing, capital began flowing into safe-haven sources, and this time, Bitcoin turned into firmly on that checklist.

The halt consequence? Self assurance surged. Bitcoin ETF inflows accelerated, volatility dropped, and $BTC’s macro legend reinforced. It’s no longer staunch a possibility asset; it’s turning into half of the defensive playbook.

Elsewhere, $XRP within the waste closed its long-running factual battle with the SEC, potentially clearing the runway for a new ATH later this three hundred and sixty five days.

What’s Subsequent for Q3?

Help in Q2, 99Bitcoins forecasted that if BTC could well doubtless flip $111K–$112K resistance, the path to $120K would begin, with $135K as a stretch target. Like a flash forward to now, and that prediction is aging smartly: Bitcoin is already procuring and selling at above $118K, edging towards that psychological milestone.

The picture also famed $BTC turned into preserving firm above $103K pork up, forming a bullish development backed by rising miner pockets balances, jumpy commerce reserves, and rising illiquid supply – all indicators of self assurance from long-term holders.

Aloof, Q3 isn’t with out possibility. ETF inflows could well doubtless unhurried, and macro headwinds, from world battle to surprising price hikes, stay on the radar.

But when institutional flows preserve hot and the Fed delivers a price cleave, $135K no longer feels relish a moonshot. It’s staunch half of the subsequent leg up.

Closing Thoughts: A Bull Market With Depth

The 99Bitcoins Q2 picture by Manisha Mishra paints a certain characterize: this bull market isn’t built on retail hype.

Establishments, regulatory tailwinds, and valid product traction are powering it. From ETF inflows to stablecoin adoption and supply-facet tightening, the indicators all point towards a extra mature, resilient crypto cycle.

And with Bitcoin already pushing towards $120K, many of the Q2 projections are already playing out. If momentum holds, and macro instances don’t throw a curveball, Q4 could well doubtless be the valid breakout.

Learn the stout picture right here: Relate of Crypto Q2 2025 – 99Bitcoins

This text is for informational applications most effective and does no longer constitute monetary advice. Please continuously attain your absorb analysis (DYOR) sooner than investing in crypto.