Key Takeaways

- The Swiss litigation finance neighborhood Liti Capital has raised $5 million to sue Binance on behalf of a neighborhood of cryptocurrency traders.

- Many traders articulate that Binance’s futures market and leveraged tokens products stopped working as meant at some level of a well-known crypto smash on Also can 19.

- Binance has allegedly refused to utterly compensate users affected.

A loosely organized neighborhood of traders is pursuing Binance for compensation over losses caused by a malfunction on the exchange at some level of one amongst the bloodiest days in crypto historical past earlier this 300 and sixty five days.

Millions Lost At some level of Binance Outage

A neighborhood of cryptocurrency traders is suing Binance over an outage the exchange suffered in Also can. The Swiss litigation finance neighborhood Liti Capital has committed over $5 million to abet the traders warfare an international arbitration case towards Binance, with Current York legislation agency White & Case discipline to describe these affected.

On Also can 19, at some level of a well-known crypto market smash that saw Bitcoin and Ethereum plummet over 30% in worth, a few sources reported that Binance’s futures and leveraged tokens products stopped working as meant. Many Binance customers suffered liquidations and lost principal sums of cash as a results of the incident.

Fawaz Ahmed, an experienced Canadian crypto trader who shared his tragic legend with Crypto Briefing, says he lost approximately $9 million at some level of the incident. “I clicked the “discontinuance space” and “cease loss” buttons over 70 instances interior an hour. They didn’t work. They wouldn’t click. Nothing would happen after I tried clicking these buttons,” Fawaz recounted.

If Binance’s platform had been working worship it’s imagined to, Fawaz says he would’ve walked away with 3,300 Ethereum, worth spherical $8.5 million at the time. In its put, he lost all the pieces and walked away traumatized. “I without a doubt possess modified since Also can 19,” he says. “I don’t mediate I will be the identical all but again. It became the worst abilities of my lifestyles.”

One other trader who spoke with Crypto Briefing below prerequisites of anonymity lost $80,000 trading Binance Leveraged Tokens (BLVT) the use of algorithmic trading bots. In accordance with him, Binance’s API malfunctioned, inflicting his trading bots to fail, meaning they did now no longer sell when the market crashed.

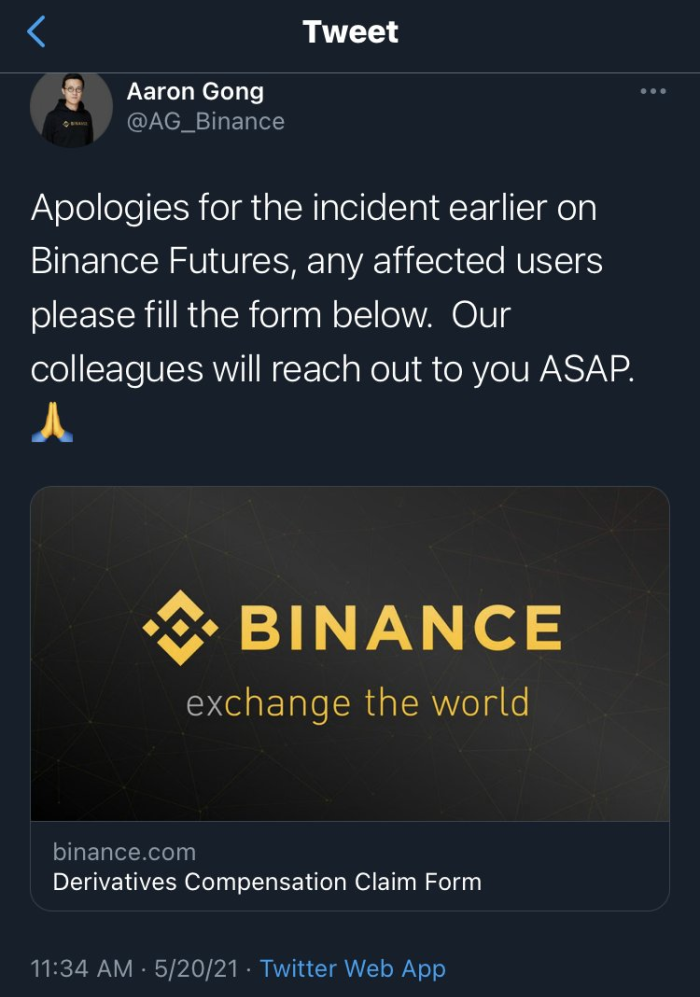

When he reached out to Binance, the exchange originally denied all felony responsibility. A buyer toughen manual suggested him that it became “completely favorite for the tokens to drop as they did.” Then all but again, on Also can 20, Binance’s VP of Derivatives Aaron Gong sent out a tweet apologizing for an “incident” on its Binance Futures market, promising that employees would attain out to these affected. The tweet became deleted the identical day.

The sufferer pressed Binance on the topic and confirmed the patron toughen crew a screenshot of Aaron Gong’s tweet. Binance offered him $18,000 worth of BLVT tokens as compensation. BLVT tokens are a leveraged Binance product representing an underlying asset; some are negatively correlated to pass in the reverse route, while others note the asset’s worth with leverage. They’re standard amongst day traders.

“Hours after I authorised the compensation, I bought an electronic mail pronouncing my myth is flagged and that I must discontinuance it straight. After I outlined that if I discontinuance my myth, I gained’t have the opportunity to switch the leveraged tokens out of Binance as they’re now no longer worship minded with other exchanges, they bluntly suggested me, ‘then you definately’ll possess to sell,’” he says.

The API malfunction wasn’t the utterly topic. In accordance with a few video reviews considered by Crypto Briefing, Binance’s futures platform encountered problems at the end of the smash, between 12: 40 and 13: 10 UTC. Many traders struggled to add collateral to shedding prolonged positions, while others were utterly locked out of the exchange.

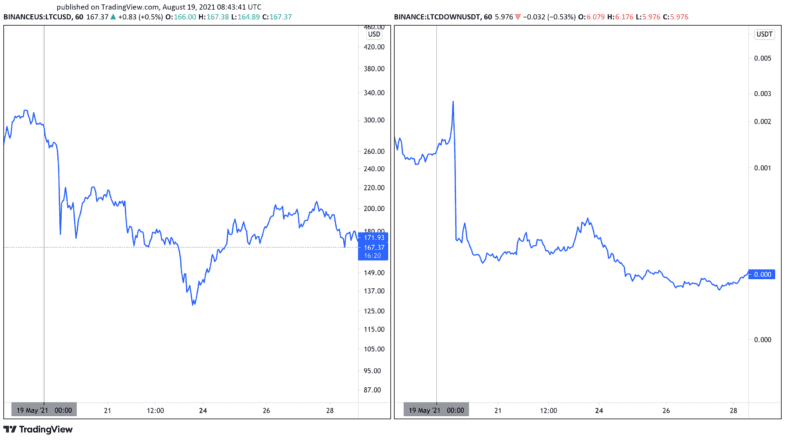

What’s extra, on the day of the incident, the BLVTs didn’t work as marketed. To illustrate, when the worth of Litecoin (LTC) decreased, the LTCDOWN BLVT could perchance per chance fair silent possess increased (there’s additionally an LTCUP BLVT token designed to magnify when LTC does). In its put, all BLVTs crashed, ensuing in many traders shedding the money they had deposited.

“Binance Has Been Very Aggressive”

Aaron Gong’s deleted tweet suggests that Binance could perchance per chance fair possess had plans to compensate the users affected. In its put, the victims articulate that Binance took a distinct route. Of us who agreed to any compensation arrangement were reportedly made to imprint a contract and non-disclosure settlement.

Talking to Crypto Briefing, Aija Lejniece, an attorney without a doubt excellent in unhealthy-border disputes and international arbitration who’s now working with Liti Capital to describe the victims, outlined:

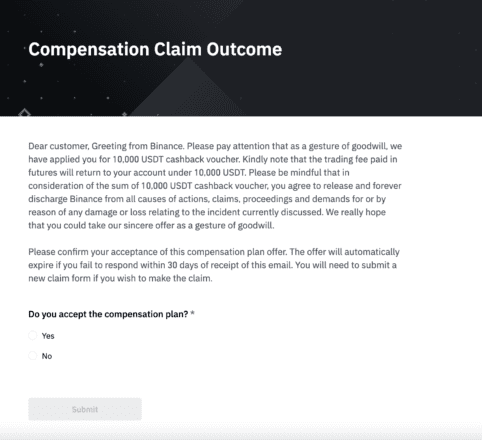

“Binance has been very aggressive. The compensations Binance offered to users came with strings connected. They acknowledged we’re now no longer going to compensate correct a cramped little bit but then made these that authorised the compensation imprint a contract, releasing Binance from any other responsibility and waiving their rights to sue or ask for extra money. Moreover, Binance additionally requested users to imprint a non-disclosure settlement containing one other arbitration clause that allows Binance to sue the claimants could perchance per chance fair silent they release files regarding this settlement plus monetary fines.”

In accordance with Ms. Lejniece and evidence gathered by Crypto Briefing, the compensations offered vary between 5% and 30% of the actual losses. In Fawaz’s case, Binance offered $10,000 to compensate for his nearly $9 million loss.

“Obviously I refused,” Fawaz suggested Crypto Briefing, but other victims authorised the provide and signed the NDA. Explaining her gaze on how Binance has been in a position to shun any responsibility for the incident, Ms. Lejniece cites two key factors: their decentralized nature, and the Terms of Employ traders agree to after they use the platform. Detailing the 2 factors, she explains:

“One, they don’t possess an official headquarters. They’ve a worldly corporate structure—which is favorite for a fashion of corporations—but Binance is de facto now no longer clear. It’s now no longer clear where they’re registered. There are a fashion of Binance entities: one is registered in Lithuania, one in Germany, the Cayman Islands, Malta, China, and lots others. So it’s without a doubt now no longer easy to pin them down. Two, by the use of being sued, they’ve made their Terms of Employ very restrictive for these that trade on their platform.”

“They’ll attain what will be called jurisdiction hopping,” says Ms. Lajniece. In other phrases, Binance could perchance per chance fair register an entity in one space. If that entity disappears after two months, tracking can develop into very delicate. Upon registering on the exchange, users must waive their rights to any neighborhood or class actions or the flexibility to sue Binance as participants in any nationwide courtroom. Users searching for out compensation are as a exchange required to file disputes with the Hong Kong Global Arbitration Centre (HKIAC), which charges as a minimal $65,000 in expenses alone—barring many from attempting.

A Probability to Battle Support

David Kay of Liti Capital, which makes a speciality of elevating capital for upright instances, claims that Binance has made “pursuing justice towards them unviable for a lot of folk.”

However that will now no longer be the case for some distance longer, Kay insists. A loosely organized neighborhood of traders that suffered losses due to the Binance’s platform failure possess now fashioned a Steering Committee and organized for Liti Capital to provide funding for the case and affords them a excellent probability to warfare aid.

Liti Capital has raised over $5 million up to now, while the White & Case agency employed to warfare the case is ranked because the utterly international arbitration legislation agency globally.

Possibly the latest neighborhood action towards Binance comes at a time of increased regulatory stress from international regulators. Within the closing two months alone, the U.Okay., Malaysia, Italy, Japan, Poland, the Cayman Islands, and Thailand possess issued warnings to Binance inserting forward that the company is now no longer registered and thus now no longer allowed to operate of their jurisdictions legally. Binance is additionally reportedly being investigated by the U.S. Division of Justice (DoJ) and the Internal Earnings Provider (IRS) referring to that it’s seemingly you’ll mediate of tax evasion and money laundering offenses. The exchange has since taken a lot of steps to conform with regulators, with the agency’s CEO Changpeng Zhao currently claiming that it intends to take care of “proactive compliance.”

Binance responded to Crypto Briefing’s ask for a press release explaining that it does now no longer touch upon pending upright disorders. Then all but again, a manual acknowledged:

“Our policy is intellectual in that we compensate users who experienced exact trading losses due to the our intention’s disorders. We attain now no longer conceal hypothetical ‘what could perchance had been’ instances akin to unrealized profits.”

Liti Capital has discipline up a web explain for users plagued by the Binance outage. A display veil reads that there’s “no threat or worth” to enroll in as Liti Capital is covering all of the funding for the case. It additionally says that the total loss incurred could perchance per chance quantity to over $100 million.