Key Takeaways

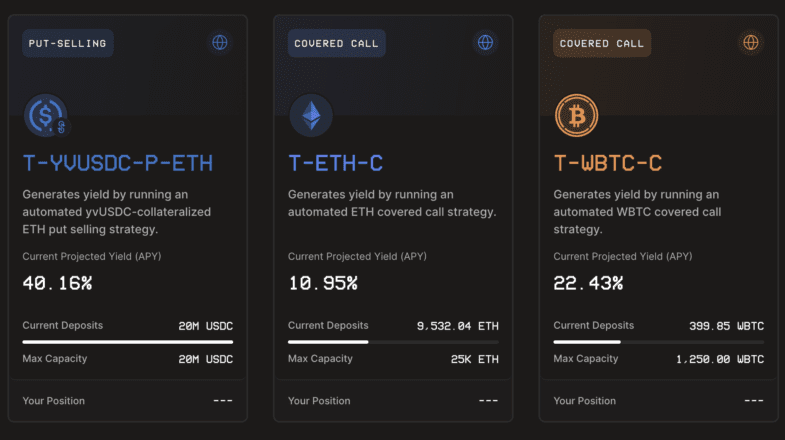

- Ribbon Finance provides probability-primarily based suggestions on BTC, ETH, and USDC with one of the most finest yields in DeFi.

- The greater rewards comprise greater menace, as users can lose their capital if the market is simply too volatile.

- A contemporary version of the protocol is scheduled to be launched this month. A liquidity mining advertising and marketing campaign and Balancer token offering are moreover due soon.

No yield farming, no impermanent loss, and unconstrained by market prerequisites: Ribbon Finance is building the Holy Grail for DeFi’s energy users by offering sustainable high yields thru alternatives-primarily based suggestions.

What’s Ribbon Finance?

Ribbon Finance started off the aid of a downside.

After closing year’s “DeFi summer,” decentralized finance has change into known for offering three-figure yields that could most certainly moreover place most TradFi veterans faint. Nonetheless, these yields have a tendency to be no longer sustainable in due route. They customarily come from an activity ceaselessly called yield farming, the place contemporary protocols distribute their tokens in replace for liquidity. Yield farming is a enormous resolution to enhance early growth, however protocols can’t incentivize users with out a sign of ending.

Julian Koh, the CEO of Ribbon, says that alternatives suggestions are a technique to grab sustainable high yields. He explains:

“Discovering a sustainable source of yield is the bread and butter of Wall Avenue trading companies. Folk in DeFi favor the high yields however the snarl technique to place that sustainably is thru alternatives suggestions.”

The alternatives suggestions Koh mentions are no longer extraordinarily advanced. They agree with minting out of the money (OOTM) alternatives and promoting them for a profit. Ribbon automates this contrivance so that users finest want to position their property in a vault and let the protocol place the relaxation.

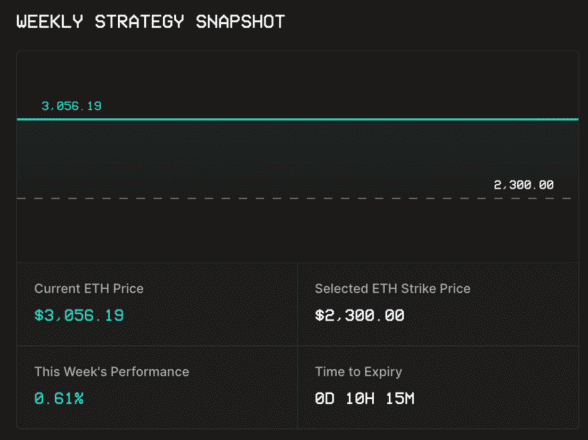

Every technique a chunk differs looking on the asset deposited. The USDC vault, shall we embrace, invites users to deposit USDC in the vault. Per week, the vault supervisor selects a mark for ETH below its recent market mark and mints OOTM alternatives to this selected strike mark on Opyn. When a bunch of users or market makers eradicate the alternatives, the vault supervisor redistributes the profit to the vault’s users. If the ETH mark expires above the strike mark, the users place a profit. If the selection expires in the money, the selection buyer can bewitch ETH at the strike mark, and the users lose some of their USDC.

Reasonably than distributing a governance token, Ribbon’s alternatives suggestions generate yield from a bunch of merchants. There are no causes for Ribbon to cease making money, even in a agree with market. So long as there is a crypto alternatives market, Ribbon will proceed to feature. Julian Koh moreover says that Ribbon can moreover scale previous the on-chain market, explaining:

“Some folks are jumpy we are able to’t scale thanks to the pretty minute dimension of the on-chain alternatives market, however we’re no longer constrained to the on-chain market. The total crypto alternatives market is our finest bottleneck, however that’s removed from the place we’re standing. We work with market makers and skilled alternatives merchants who can place greater their trading 10x as nicely. The a bunch of facet of the replace is neat alternatives trading companies who procure a astronomical tear for food.”

Leveraging Crypto Alternatives

Ribbon’s vaults are with out a doubt a short probability against crypto volatility. By a ways, the worst performing week for Ribbon’s USDC vaults came when your total crypto market suffered a dramatic fracture in Could per chance well. The vault’s users lost 15% of their funds as the mark of ETH crashed nicely below the alternatives’ strike mark. Since then, it has recovered 11% in three months.

So long as the markets don’t experience the stage of volatility viewed in Could per chance well, Ribbon’s vaults could most certainly moreover still proceed to prosper. The more frequent the market, the greater for Ribbon. For the time being, nonetheless, the crypto markets are still known for altering mercurial. Ribbon’s profit is that a potential agree with market wouldn’t procure an mark on its technique.

When when put next with a bunch of common vault-primarily based DeFi protocols, Ribbon’s technique is appealing. Whereas their yields is also among the many finest in DeFi, they arrive with menace. Sudden volatility can search for users lose portion of their investments. Koh says here is key to the technique, though. He explains:

“Must you explore at Yearn Finance, they grab to place vaults that finest amplify in mark. That’s very relaxed for his or her users, they don’t must awe. Ribbon’s suggestions procure the next menace, however greater rewards as nicely. Yearn will potentially no longer place greater to those riskier suggestions as nicely, they’re mainly a yield farming aggregator. On the a bunch of hand, Ribbon uses monetary engineering to place yield.”

Koh’s explanation highlights why Yearn Finance was overjoyed to partner with Ribbon for its most contemporary USDC-primarily based alternatives vault. Apart from to the yield from the selection technique, depositors get the yield Yearn provides to all USDC deposits. The two protocols don’t search for his or her relationship as a contention. On the opposite, they decided to settle on composability and make on high of every a bunch of.

For the time being, Ribbon’s alternatives technique doesn’t procure assert concurrency. For Koh, the menace fairly lies in copycats.

How many @ribbonfinance copycats by December? 5? 10?

— Julian 🤹 (@juliankoh) August 10, 2021

Ribbon’s Irregular Token Initiate

One in every of the most attention-grabbing beneficial properties of Ribbon’s open technique was its token open. To this level, 3% of RBN tokens had been distributed to early users of Ribbon’s vaults, and an additional 1% was distributed at some stage in a liquidity mining program in July. The settle on, nonetheless, is that the token is rarely any longer easy-coded so it is no longer yet transferrable. There is now not a market for RBN, and as such, there’s now not this form of thing as a mark for it either. Explaining the resolution to salvage the ability to switch the token, Koh says that the team desired to reward “the correct folks” and incentivize folks who supported the mission early on. “We’re seeking to be team driven and obtain solutions from early users thru governance. For that, we’re giving tokens to the correct folks in the early days,” he says.

Koh moreover says Ribbon will open one more liquidity mining program imminently, followed by a liquidity bootstrapping protocol on Balancer. The mission is hoping for 10% of the tokens to head to “actual users” before trading launches.

One other peculiarity of Ribbon’s early days lied in its capped vaults. For heaps of of the principle few months after Ribbon’s open, vaults were customarily beefy. This was done first to ensure the protection of the vaults before too worthy ETH was deposited. The protocol acquired one audit, however Koh says that Ribbon wanted more than one audits before opening too worthy plan.

This controlled growth has allowed Ribbon to test their market makers and alternatives platforms to ensure every little thing works nicely before scaling. “It moreover generated a chunk FOMO,” Koh laughs. “Folk consistently saw the beefy vaults, so at any time after we opened more plan, we had hundreds of users speeding.”

The Subsequent Steps for Ribbon

As Koh exclusively informed Crypto Briefing, the next step for Ribbon is the open of a 2nd version in the arriving weeks. The code is ready and audited, and could most certainly be made accessible to the general public after some internal testing. Koh says V2 isn’t a prime departure from V1, though. Ribbon’s next focal level is composability—treasure the Yearn Finance partnership, and the motivate of contemporary kinds of property to the suggestions (Ribbon currently helps BTC, ETH, and USDC). Koh says:

“Our recent predicament of suggestions is working the truth is nicely, and alternatives will most certainly be our necessary focal level for the next six months. We’ll be doubling down on what’s working as we procure our vault can with out problems grow 5 to 10 times in TVL. Other monetary engineering solutions treasure mounted profits, tranching, or a bunch of kinds of menace exchanges could most certainly be added on high of our recent suggestions.”

One in every of the finest changes will lie in the formula vaults are managed. A human vault supervisor from Ribbon’s team is currently guilty for picking the strike mark. In V2, this could most certainly be modified to a truly automatic gadget. The swish contract would judge itself what the strike mark would be. To illustrate, it could most certainly moreover mint alternatives 20% below or over the asset’s recent mark every week. Ribbon seeks to salvage any human enter from the functioning of the vaults.

The notify with Ribbon, in the interim, is that their vaults are a technique to short volatility. This can feel treasure a losing technique in bull markets treasure the one crypto is currently experiencing. Since Ribbon’s inception, two of the four vaults procure yielded negative returns. The USDC vault lost a prime amount of mark at some stage in the Could per chance well fracture and the WBTC vault, which runs a lined call technique, suffered from Bitcoin’s unexpected upward slump in mid-July.

Ribbon has a truly engaging product, and its technique is irregular. In DeFi, tokens are king. Nonetheless, Ribbon refuses to let its products rely on tokens alone. The mission goes as a ways as making these tokens untransferrable to manual decided of the form of speculation we customarily search for on the open of contemporary tokens. This near could most certainly be viewed as Ribbon tying one hand to their support. The liquidity mining advertising and marketing campaign saw vaults filling up, which hasn’t been the case since these incentives were eliminated and vaults caps were raised.

In point of fact, this reveals that the Ribbon team is here to handle. If Ribbon’s team wanted fleet, explosive growth, they could most certainly moreover distribute their tokens at a faster fee. Their near, particularly of their token open schedule, reveals a enormous deal of patience and care. In 5 years, protocols that distribute their token too rapid acquired’t procure something else left to incentivize their communities. Ribbon is letting their products place the talking for them: no tricks, no yield farming, no incentives.

As Aave CEO Stani Kulechov remarked in a recent Crypto Briefing interview, the fad “will cease at some level.” He stated:

“Many of the liquidity mining incentives are reproduction-pasted from a bunch of important initiatives and place no longer provide inventive methods for communities to distribute token governance and let communities obtain more sharp into the mission.”

Ribbon has time firmly on its facet. Its monetary products are one of the most most advanced in DeFi, and they demonstrate the form of affected person almost about governance that implies actual care.