September 1, 2021

Biking On-Chain (COC) is a monthly column that uses on-chain and value-connected files to better perceive most traditional market actions and estimate the build we’re in bitcoin’s market cycle. This fourth edition briefly reflects on the recovering hash rate and then takes a more in-depth glimpse at the somewhat low on-chain switch exercise on Bitcoin. After introducing loads of contributing components, we discuss to what extent low on-chain exercise is reflective of market demand for bitcoin (the asset) or whether monitoring HODLing habits is if fact be told more critical in the context of bitcoin’s cost proposition.

Two months ago, in COC #2 (July 1, 2021), we identified two significant components that wanted a minute bit time to resolve on, sooner than doubtlessly increasing a favorable misfortune for Bitcoin from a elementary point of view later this summer season — which is now initiating to unfold. One modified into the El Salvador executive making bitcoin a correct at ease in their nation, which is now dwelling to head into invent subsequent week (September 7, 2021).

The more than a number of modified into the dear crackdowns on bitcoin by the Chinese executive, driving miners out of their nation, doubtlessly if fact be told bettering the geological distribution of bitcoin mining exercise that modified into carefully concentrated in China up to that time. Some feared a antagonistic takeover (a 51% assault) of the community by the Chinese executive, which has now not took field (but?).

Hash Fee Recovery

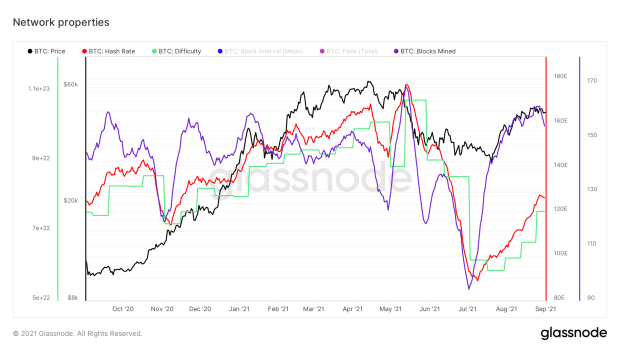

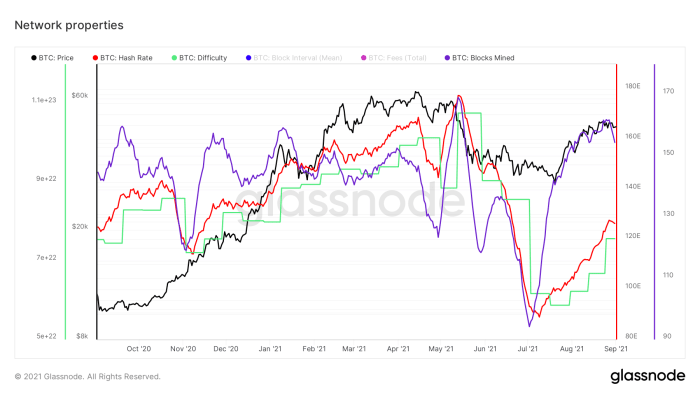

After reaching a low of 89 TH/s on July 9, 2021, the 2-week engrossing common of Bitcoin’s hash rate has already recovered to 127 TH/s (+43%) since then, as Bitcoin’s venture wanted to be elevated three times in a row to memoir for the new hash rate. It is unknown to what extent this hash rate is miners that relocated from China or right new miners, but it indubitably is a definite designate both formula. Identify 1 displays the bitcoin label (black) and venture (green), as successfully as the 14-day engrossing common of its hash rate (red) and series of blocks mined (red).

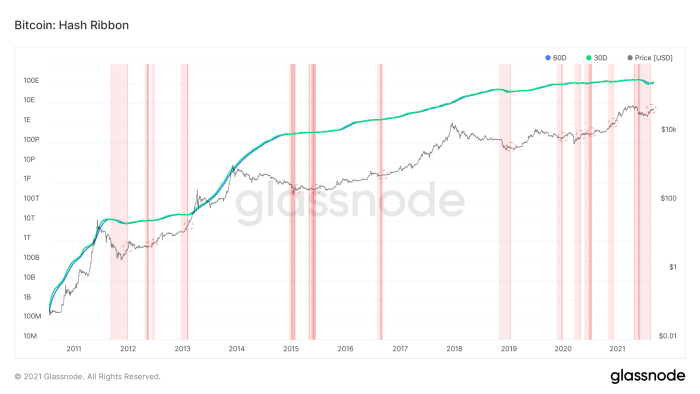

After the gigantic fall in Bitcoin’s hash rate at some stage in Would possibly and June, the hash ribbon indicator signaled severe miner capitulation. Now that the hash rate is recovering, resolve 2 shows that the 30-day engrossing common of Bitcoin’s hash rate (green) has crossed the 60-day engrossing common (blue) to the upside. This bullish crossover on the hash ribbon indicator is interpreted as a capture signal, as this gain of hash rate recovery after miner capitulation has historically preceded subsequent label increases.

Block Dwelling Galore

One implication of the immediate rising hash rate at some stage in this recovery duration is that many more blocks are being created than every so most frequently can be. In spite of the entirety, Bitcoin’s venture adjustment mechanism adjusts every 2,016 blocks (~two weeks), but when hash rate rises steeply at some stage in that duration, Bitcoin block creation is take care of a runaway educate. Logically, when more blocks are created, it technique that there is more block condominium accessible to include transactions.

Apart from this right (non everlasting) amplify in accessible block condominium, the adoption of loads of Bitcoin technologies that optimize block condominium utilization (so successfully, scaling) technique that each piece of block condominium is also initiating to be inclined more successfully. One example of here is transaction batching, the build exchanges combine many transactions into one, limiting their bid on Bitcoin block condominium and thus also their fill transaction charges.

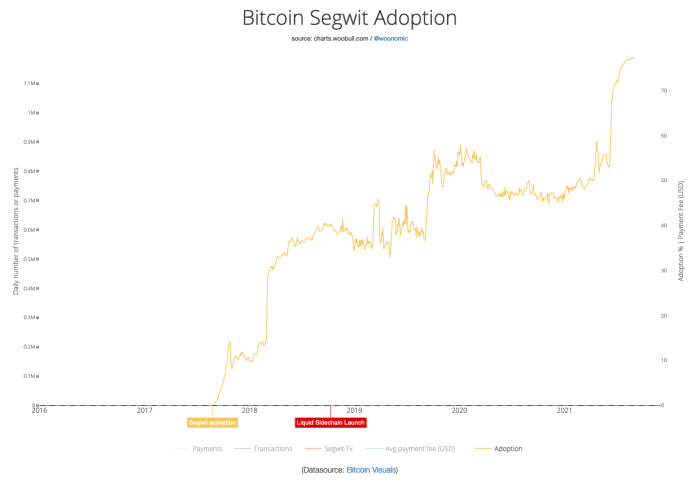

One other example is Segwit adoption, which saw a mountainous amplify now not too long ago (resolve 3). Segwit transactions segregate the signature files from bitcoin transactions, which successfully permits more transactions to be included internal each block.

This most traditional surge is the implications of Blockchain.com, a semi-custodial pockets and alter platform that is below scrutiny internal parts of the Bitcoin community, sooner or later upgrading its machine — four years after Segwit become accessible. Since Blockchain.com is estimated to memoir for ~33% of the bitcoin transactions, this action successfully takes away a mountainous chunk of the market demand for Bitcoin block condominium, leaving more space for all people else. (Fun truth: This also technique that Blockchain.com has been overpaying for transaction charges for almost four years, successfully subsidizing bitcoin miners all this time.)

Lightning Network Adoption

In phrases of optimizing the series of right-world transactions that would possibly maybe maybe just moreover be fitted into a Bitcoin block, Layer 2 technologies take care of the Lightning Network are much more promising than any present on-chain scaling solution. By the utilization of a spruce-contract-take care of solution on Bitcoin, the Lightning Network permits users to open up a cost channel and ship an countless series of transactions (at some stage in the barriers of the accessible funds off beam), limiting the inclined block condominium of all these transactions to correct two on-chain transactions to open and later discontinuance the channel.

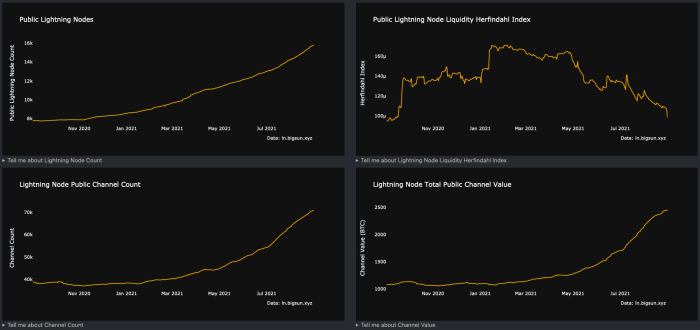

As would possibly maybe maybe just moreover be viewed in resolve 4, Lightning Network adoption is every so most frequently hovering factual now, as for example the series of public nodes, the series of public channels and the rate internal these channels are going parabolic. The Lightning Network is going to play a significant position in El Salvador’s bitcoin adoption as successfully, that technique that this Lightning Network adoption will doubtless continue to grow in the upcoming years.

At closing, it will just aloof be identified that various Layer 2 technologies than Lightning exist. An example is Blockstream’s Liquid Network, but to a diploma custodial alternate solutions take care of these of mountainous gamers take care of Square, PayPal and Visa that (conception to) enable their users to make BTC-denominated transactions. Skeptics would rightfully point out that the utilization of a custodial solution is now not the utilization of bitcoin but a bitcoin IOU, however the existence of these products and services impacts the demand for Bitcoin block condominium nonetheless at some stage in the context that we’re discussing here.

Cooled Down Block Dwelling Market

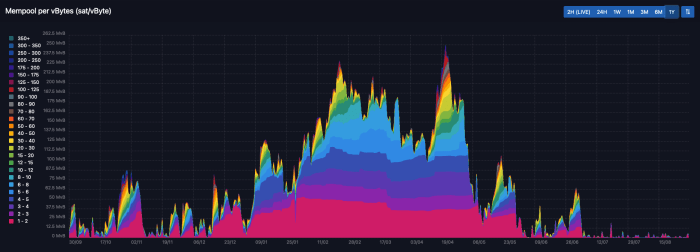

As a outcomes of the hash rate recovery and lowered block condominium demand attributable to the now not too long ago elevated adoption of Segwit and the Lightning Network, the provision of accessible block condominium has elevated. On the same time, the bitcoin market saw a mountainous label downturn that alarmed away a kind of speculators, also reducing the demand for block condominium as there are much less entities having a glimpse to transact on-chain. For the duration of this period, the Bitcoin mempool (the queue of transactions which would possibly be ready to be confirmed) has gotten a possibility to certain — and has stayed almost empty over the closing couple of weeks (resolve 5).

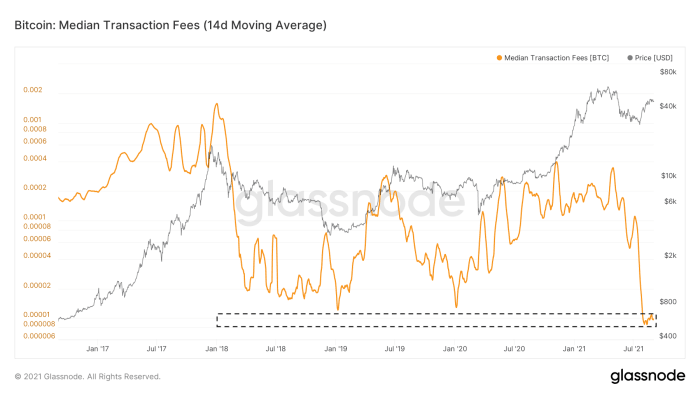

As with every market, a present shock the build an amplify available in the market-accessible present is blended with a decrease in market demand, prices fall. This also applies to the Bitcoin block condominium market, the build transaction charges include now not too long ago dropped to ranges which would possibly be even under these of the 2018–2019 undergo market (resolve 6). This resolve, attributable to this truth, also shows that it’s now not correct demand for block condominium being decrease after the label fall that triggered the on-chain silence, as indubitably there are more entities having a glimpse to transact now than at the depth of that previous undergo market.

This chain of events is moderately irregular in Bitcoin’s history, both essentially, in phrases of right scaling alternate solutions being adopted, and in phrases of the divergence between the trends in the bitcoin label, and Bitcoin’s underlying on-chain exercise.

The low transaction charges are referring to to some, as Bitcoin’s long-term security mannequin is reckoning on transaction charges overtaking the block subsidy as the major offer of miner earnings. Even even supposing I trust that observation, I invent have faith in that we include got much more time to search out a suitable equilibrium in Bitcoin’s block condominium market.

Mining Is Still (Very) Worthwhile

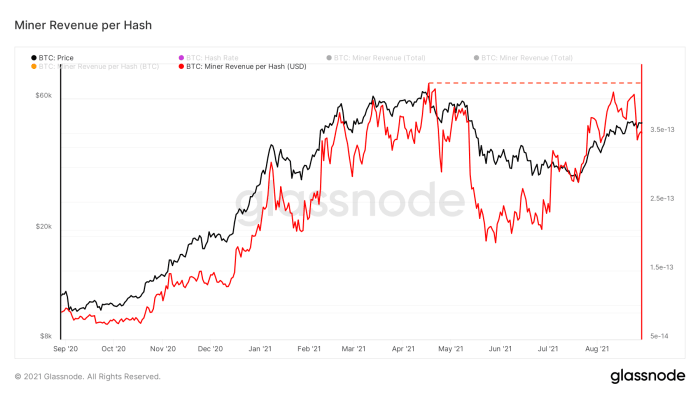

A brief example for here is that the present (USD-denominated) miner earnings per hash is already discontinuance to the yearly highs all every other time (resolve 7). China’s onerous crackdowns were painful for Chinese miners, but attributable to Bitcoin’s ingenious incentive structure, their concern modified into if fact be told any individual else’s accomplish. Thanks to the actions by the Chinese executive along side the enviornment chip shortages which would possibly be limiting opportunities of competing mining operations to discontinuance on-line, bitcoin mining is if fact be told very a success factual now — despite handiest ~1.3% of their present earnings coming from transaction charges.

In phrases of Bitcoin’s long-term security guarantees, we would possibly maybe maybe just aloof zoom out, as the adoption of bitcoin (the asset), Bitcoin (the machine) and connected technologies much just like the Lightning Network guarantee unstable times in bitcoin-connected markets — both for the bitcoin market and the Bitcoin block condominium market.

Low Attach a query to For Block Dwelling Does Now not Equal Low Attach a query to For Bitcoin

When on-chain exercise increases plenty internal a brief timeframe, it technique that there is a clear amplify in the demand to switch bitcoin around on-chain. Since segment of that demand would possibly maybe maybe near from traders having a glimpse to retract or sell their situation, such spikes would possibly maybe maybe indubitably be connected to temporary label volatility, along side elevated demand for bitcoin.

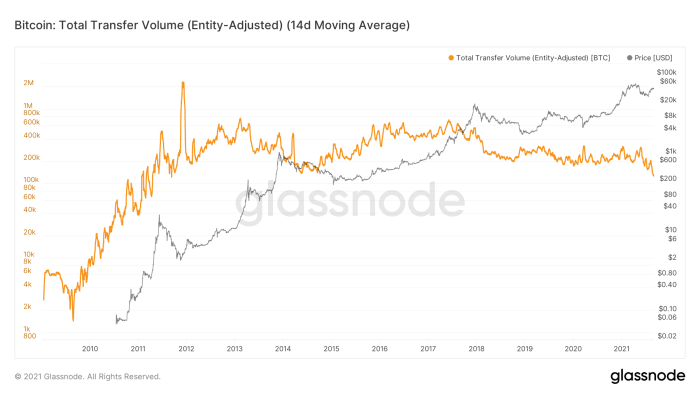

However, the opposite is now not essentially correct. As confirmed in figures 3 via 6, a decrease in on-chain switch quantity would possibly maybe maybe even be the implications of scaling technologies. To further improve this bid, resolve 8 shows that the final bitcoin switch quantity per entity on the community has been in a typical decline ever since Bitcoin’s infrastructure has viewed fundamental maturation enhancements (introduction of futures markets and loads of new exchanges, Segwit, Lightning, Liquid, and loads of others.).

The significance of this pattern for the interpretation of transaction-connected, on-chain metrics would possibly maybe maybe just aloof now not be understated. A favorite example of here is the Network Worth to Transactions (NVT) ratio that we’ll take a more in-depth glimpse at.

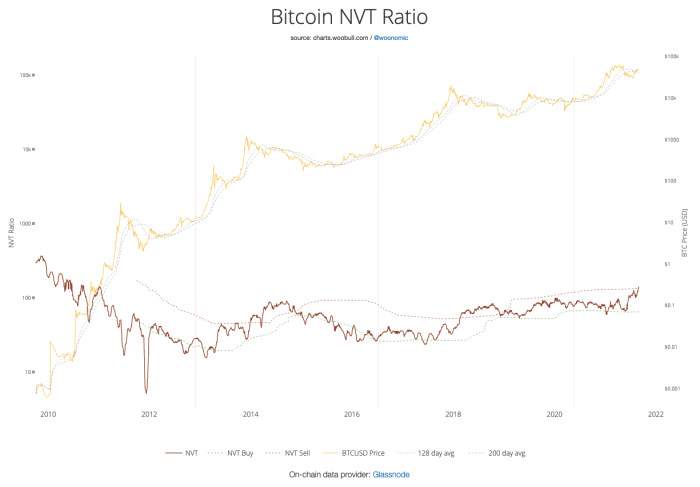

How Bitcoin Scaling Is Skewing The NVT Ratio

The Bitcoin NVT ratio modified into launched by Willy Woo in February 2017 as a Bitcoin-more than a number of to the label-per-earnings (PE) ratio that is inclined in (cost) stock investing. By introducing the NVT ratio, Woo now not handiest launched an engrossing new metric but in actuality began the on-chain diagnosis sector that has modified into very standard since then. The NVT ratio is calculated by dividing Bitcoin’s market cap by its day to day switch quantity (USD) and is displayed in resolve 9.

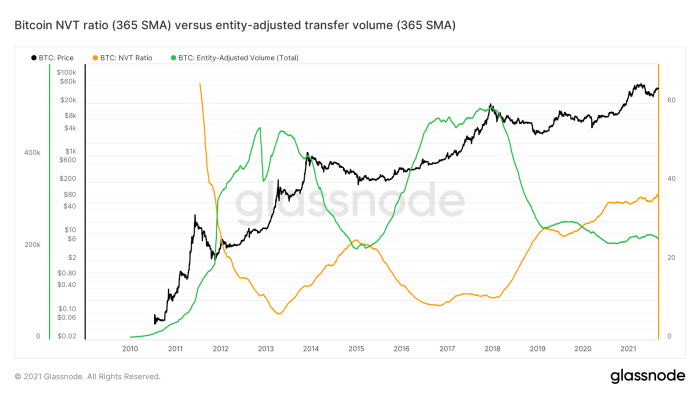

As modified into already talked about, since the introduction of this metric, a series of scaling alternate solutions had been adopted which would possibly be reducing the amount of on-chain transfers per entity, and thus the “T” segment of the NVT ratio. Identify 10 displays a 365-day engrossing common of the entity-adjusted switch quantity that we launched in resolve 8 (green), as successfully as the 365-day engrossing common of the NVT ratio (orange).

Identify 10 also shows that since early 2013, the NVT ratio has been in a smartly-liked uptrend, with a non everlasting decrease at some stage in the 2016–2017 bull market, the build the NVT ratio lowered as Bitcoin’s on-chain transaction quantity outpaced its market cap development. For the duration of the 2020–2021 bull market, this kind of non everlasting decline didn’t occur, as the adoption of scaling technologies shrimp the on-chain footprint of essentially the most traditional influx of new traders.

Under the assumptions that the adoption of the Lightning Network and infrastructure that has a the same affect in limiting the on-chain footprint per transaction will continue and the bitcoin label also keeps increasing, the NVT ratio would possibly maybe maybe just moreover be expected to take care of trending up over time.

In concept, the NVT ratio can aloof be a connected metric to evaluate more temporary adjustments in the ratio between bitcoin market valuation and transaction quantity, but internal that context it’s handiest valid on timeframes the build the adoption of scaling technologies is also valid. Both formula, analysts would possibly maybe maybe just aloof be cautious to aloof consume the NVT ratio at some stage in the context of more long-term bitcoin label valuation ideas.

Does ‘The utilization of’ Bitcoin Mean Transacting Or HODLing?

On a more philosophical level, one can also surprise if a ratio of the final bitcoin market valuation and its transaction quantity is if fact be told the factual metric to glimpse at at some stage in the context of Bitcoin’s overarching cost proposition. Historically, there are two colleges of belief regarding Bitcoin’s final consume case.

The first one considers Bitcoin to essentially be a censorship-resistant medium of change, and thus for transacting bitcoin to certainly be its final consume case. Inside of that formula of thinking, the root in the abet of the NVT ratio certainly is moderately reflective of Bitcoin’s relative valuation when compared to its final consume case.

The 2nd college of belief considers Bitcoin to essentially be a store of cost — a dilution-proof money that is designed to take care of its procuring energy over time. Inside of that formula of thinking, HODLing bitcoin is its final consume case, whereas transacting it’s more of an occasional (but aloof very significant) functionality. Inside of that mindset, it’s now not transaction quantity but investor time preference and hardiness to take care of onto the asset which would possibly be central in its cost proposition.

Having a glimpse at Bitcoin from that time of view, present “utilization” doesn’t glimpse bleak at all.

HODLing Is On The Upward thrust Again

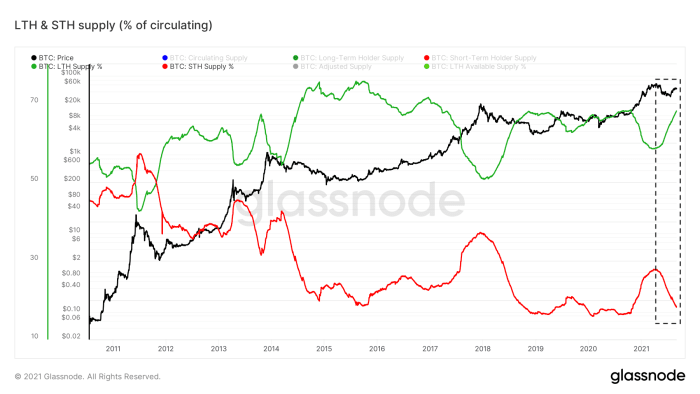

Identify 11 displays the long-term holder (LTH) and temporary holder (STH) present as a share of the circulating bitcoin present. On this resolve, any present bitcoin is quantified as LTH present when it has now not moved on the blockchain in 155 days or more (~five months).

The provision that is in the fingers of long-term holders has been slightly constant at around 50–75% of the final present (apart from bitcoin that is estimated to be lost). The proportion of STH present has been on a downtrend since bitcoin first bought a market label, but briefly increases at some stage in euphoric market prerequisites that entice new traders.

For the duration of the 2020–2021 bull market we also witnessed a clear decrease in LTH present and amplify in STH present, which has almost fully retraced to pre-bull-market ranges. This re-accumulation of bitcoin by long-term holders is, in itself, now not essentially a temporary signal for a market turnaround but has historically confirmed to usually coincide with label ranges that give up up forming a label floor.

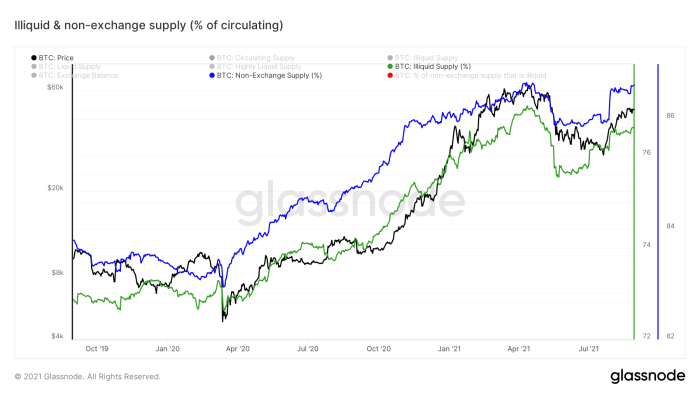

The utilization of coin-aging as a mechanism to estimate HODLing habits is effective but leans on some assumptions that make it a critically mammoth estimation. Because of the clear nature of the Bitcoin blockchain, it’s (sadly, from a privateness point of view) doable to be aware the right on-chain flows and determine certain groups of addresses that belong to the same entity. By doing so, it’s doable to estimate how grand percent of the final bitcoin present is now not on exchanges (resolve 12, blue) and how grand percent of the final bitcoin present is in the fingers of illiquid entities that have not any history of promoting (resolve 12, green). (For advice on the technique to enhance your fill Bitcoin-connected privateness and restrict your fill on-chain traceability, make certain to verify up on @BitcoinQ_A’s superior “Bitcoin Privacy Details.”)

Identify 12 clearly shows that at some stage available in the market sell-off in Would possibly 2021, a factual chunk of beforehand illiquid present immediate become liquid all every other time (fall in green line) and that cash that were beforehand now not on exchanges were despatched there (fall in blue line). However, both trends include already retraced discontinuance to their pre-sell-off ranges. This shows that the bitcoin that modified into dumped on the market at some stage in market uncertainty include doubtless already been re-gathered into the fingers of traders which would possibly be much less doubtless to be shaken out of their positions.

Overall market demand for bitcoin is doubtless now not as high because it modified into at some stage in the euphoric times that we saw first and valuable of the yr. However, the bitcoin market appears to be like to be in a converse the build if something sparks new bitcoin demand, the somewhat low amount of market-accessible present technique that it will spark a immediate label amplify (present shock).

On the flipside, if something does trigger a fundamental a part of these long-term holders with a somewhat illiquid market habits history to sell their cash, the bitcoin label would possibly maybe maybe immediate switch down as successfully. Monitoring these metrics is, attributable to this truth, major to obtain up doable pattern adjustments that would possibly maybe maybe signal a market turnaround.

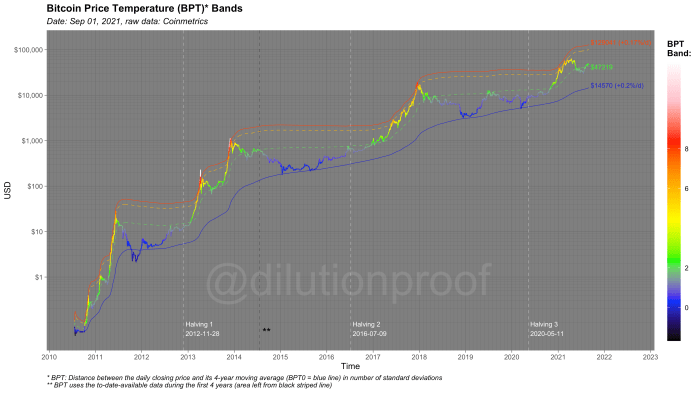

Signs Of A Cooled Down Bitcoin Market

The market downturn over the closing few months has given the bitcoin label a possibility to vastly frigid down on a relative basis. One metric that presents a fairly impart estimate of here is the Bitcoin Set Temperature (BPT), which compares the present bitcoin label to its four-yr engrossing common (resolve 13, blue line). Set temperatures of two (green), six (orange) and eight (red) include historically signaled doable market turnarounds. In the initiating of the yr, the label bounced off the BPT6 band more than one times sooner than retracing. The present BPT is correct above two, despite being at the same label ranges to the grand higher temperatures that we saw first and valuable of the yr, illustrating how the bitcoin label has cooled off on a relative basis when compared to its fill four-yr market cycle.

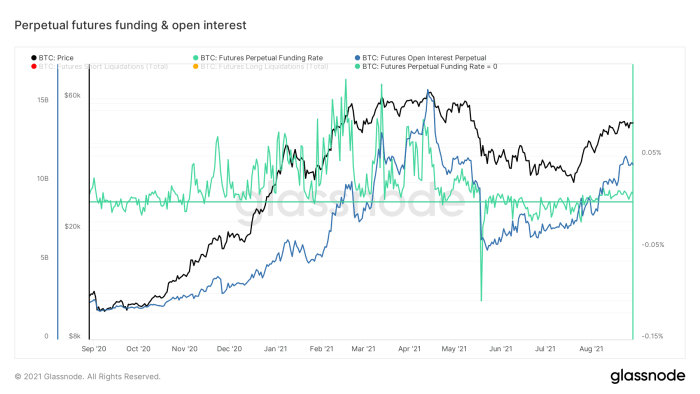

A the same conclusion would possibly maybe maybe just moreover be drawn when having a glimpse at the funding charges in perpetual bitcoin futures. These funding charges would possibly maybe maybe just moreover be viewed as a smartly-liked proxy for the extent by which futures markets are long (funding >0) or immediate (funding <0). Identify 14 shows that, at some stage in essentially the most traditional market downturn, funding charges went from extremely certain to extremely negative, illustrating a clear shift in market sentiment. Basically the most traditional native bottom funding charges include become a minute bit certain all every other time, but they are very modest in comparison to what we saw all the diagram in which via the commence of the yr, suggesting that the speculative markets are now not as overextended as they were abet then.

Whales Are Liking The Low cost

This most traditional re-accumulation duration appears to be like to be particularly handsome for somewhat mountainous market gamers (whales). Identify 15 visualizes the bitcoin label, overlayed by blue bubbles that signify mountainous (1,00010,000 BTC) bitcoin addresses that saw capital inflows at these label ranges.

Two things stand out in resolve 15: (1) the 2020–2021 cycle has more mountainous pockets (1,000–10,000 BTC) inflows than the peak of the 2017 cycle, and (2) inflows at some stage in essentially the most traditional label hop over the closing month had been slightly high in comparison to the relaxation of this cycle.

Most standard Market Sentiment

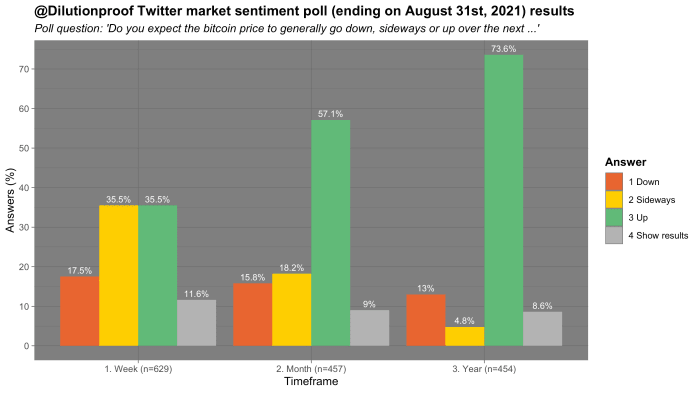

I include a monthly bitcoin market sentiment balloton Twitter. Even even supposing the implications of such polls continuously would possibly maybe maybe just aloof be interpreted with a grain of salt attributable to doable preference bias, this month’s ballotsuggests that (a a part of) the market aloof has high expectations for the bitcoin label constructing over the upcoming yr (resolve 16).

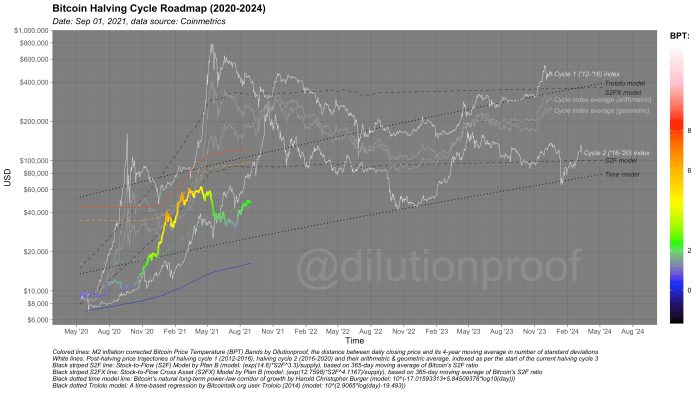

Halving Cycle Roadmap

As continuously, I take care of to discontinuance off this edition of Biking On-Chain by having a glimpse at the Bitcoin Halving Cycle Roadmap for 2020–2024 (resolve 17). This chart visualizes the present bitcoin label, overlayed by the BPT that we talked about above and with label extrapolations in step with two time-based devices (dotted black lines), the stock-to-drift (S2F) and stock-to-drift tainted asset (S2FX) mannequin (striped black lines) and cycle indexes for cycles 1 and a pair of (white lines) and the geometric and arithmetic averages of these (gray lines). All these devices include their fill statistical barriers, but together they offer us a tough estimate of what would possibly maybe maybe just be forward for the bitcoin label if history does flip out to rhyme all over all every other time.

Old editions of Biking On-Chain: