With a 4.5% APY on BTC and up to 9.5% on stablecoins, the BlockFi Ardour Memoir (BIA) is one amongst the most aggressive cryptocurrency hobby accounts in the marketplace. The corporate is valued at over $3B from its most up-to-date Sequence D and has attracted attention from cryptocurrency and traditionally non-crypto audiences alike.

Our BlockFi explores how BlockFi and barely about a cryptocurrency hobby accounts work, and whether or no longer it’s value your time.

BlockFi Ardour Memoir Rapid Abstract

BlockFi is a privately held Unusual Jersey-primarily primarily based lending platform primarily based in 2017.

BlockFi’s flagship product is the BlockFi Ardour Memoir (BIA), which has about a valuable ingredients. The BIA

- Allows customers to construct compound hobby on cryptocurrencies equivalent to BTC, ETH, LTC, USDC, USDT, GUSD, and PAXG.

- It keeps cryptocurrency deposits stable. BlockFi’s cryptocurrency holdings are held by the Gemini Have faith Company, which is regulated by the Unusual York Division of Financial Products and companies.

- It’s obtainable worldwide, out of doors of sanctioned or perceive-listed worldwide locations.

- Allows for anytime withdrawals. Users easiest receive one free withdrawal per month.

- It provides straightforward and straight forward registration, with the general overall “Know Your Customer” KYC stuff you’re potentially aged to offering.

Is BlockFi good for me? BlockFi is a pretty good-attempting possibility for individuals that get a newbie to moderate stage skillability with digital sources. Since the platform now provides order ACH deposits, you easiest need minimal cryptocurrency literacy to open earning hobby.

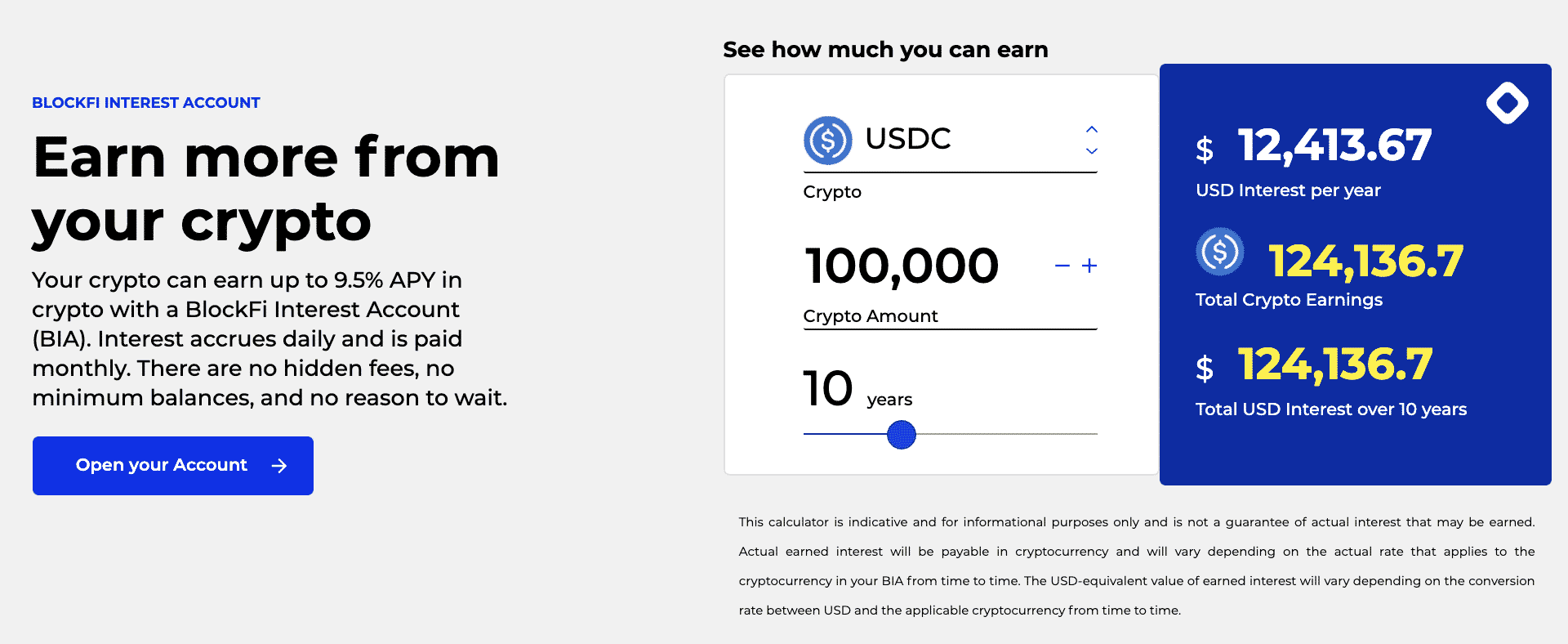

Screenshot from BlockFi’s hobby calculator. 100,000 USDC will build 124,136.70 USDC in 10 years and 12,413.67 USDC in 1 twelve months.

BlockFi is commonly valuable for these eager in producing passive earnings. When put next to passe investment accounts, BlockFi provides 43x extra than “excessive-hobby” savings accounts with Ally Bank (0.2%) and 4.7x than WealthFront (1.82%). On the opposite hand, it’s value noting that BlockFi deposits aren’t FDIC insured. A BlockFi narrative shouldn’t be belief of as a savings narrative; it’s an investment narrative with a particular role of risks that passe fiat savings accounts in banks attain no longer.

- Minimal Deposit: $0

- Stablecoin Ardour Rate: 9% to your first 40,000 USDC, and GUSD, and 8% for any amount over that. USDT will get 9.5%, which is one amongst the highest stablecoin APYs in the marketplace.

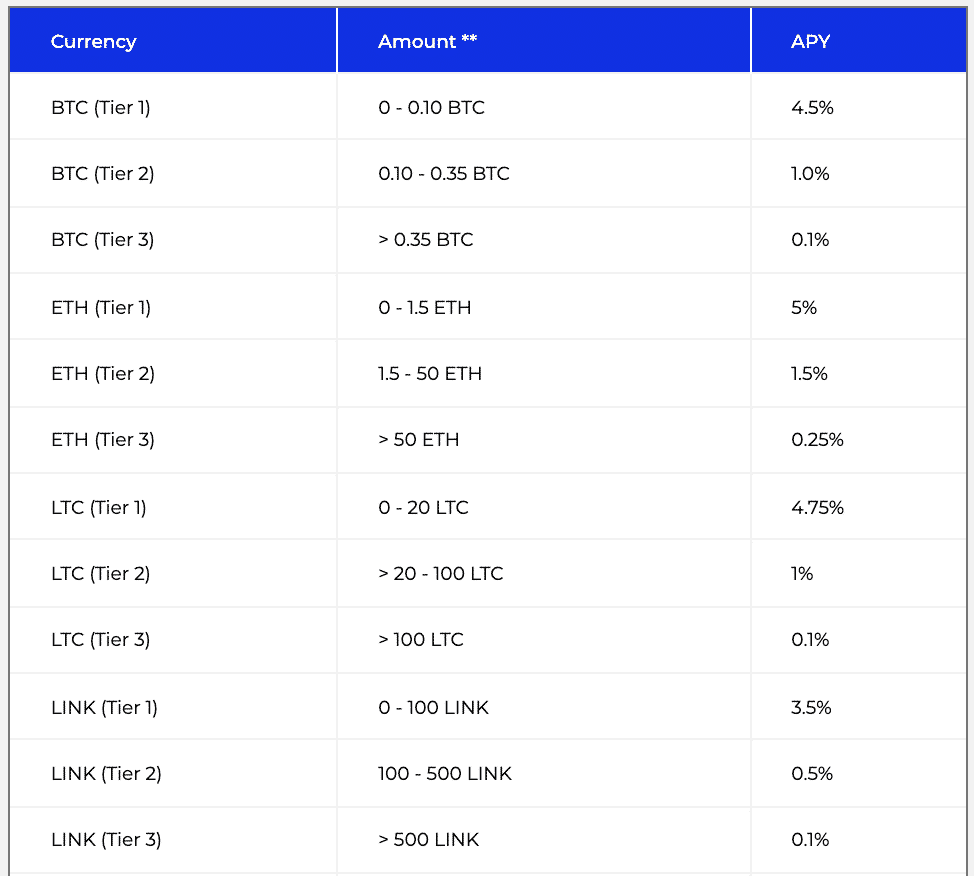

- Bitcoin Ardour Rate: 4.5% in annual hobby on deposits up to 0.1 BTC, 1% on any BTC between 0.1% and 0.35%, and 0.1% for 0.35 BTC and above.

- Ethereum Ardour Rate: 5% up to 1.5 ETH, 1.5% between 1.5 and 50 ETH, and 0.25% above that.

- Monthly Costs: $0

- BlockFi Referral Code & Promotions: Gain up to $250 (starting at $25) in USDC Bonus When You Click on And Fund A Unusual BlockFi Memoir With At Least $500. Terms Bid.

BlockFi provides loans backed by your cryptocurrency with a 50% LTV ratio.

The next BlockFi review contains an irregular interview with the BlockFi team. It has been written and on a licensed foundation updated for the BlockFi Ardour Memoir, no longer for the loan products, BlockFi bank card, or commerce.

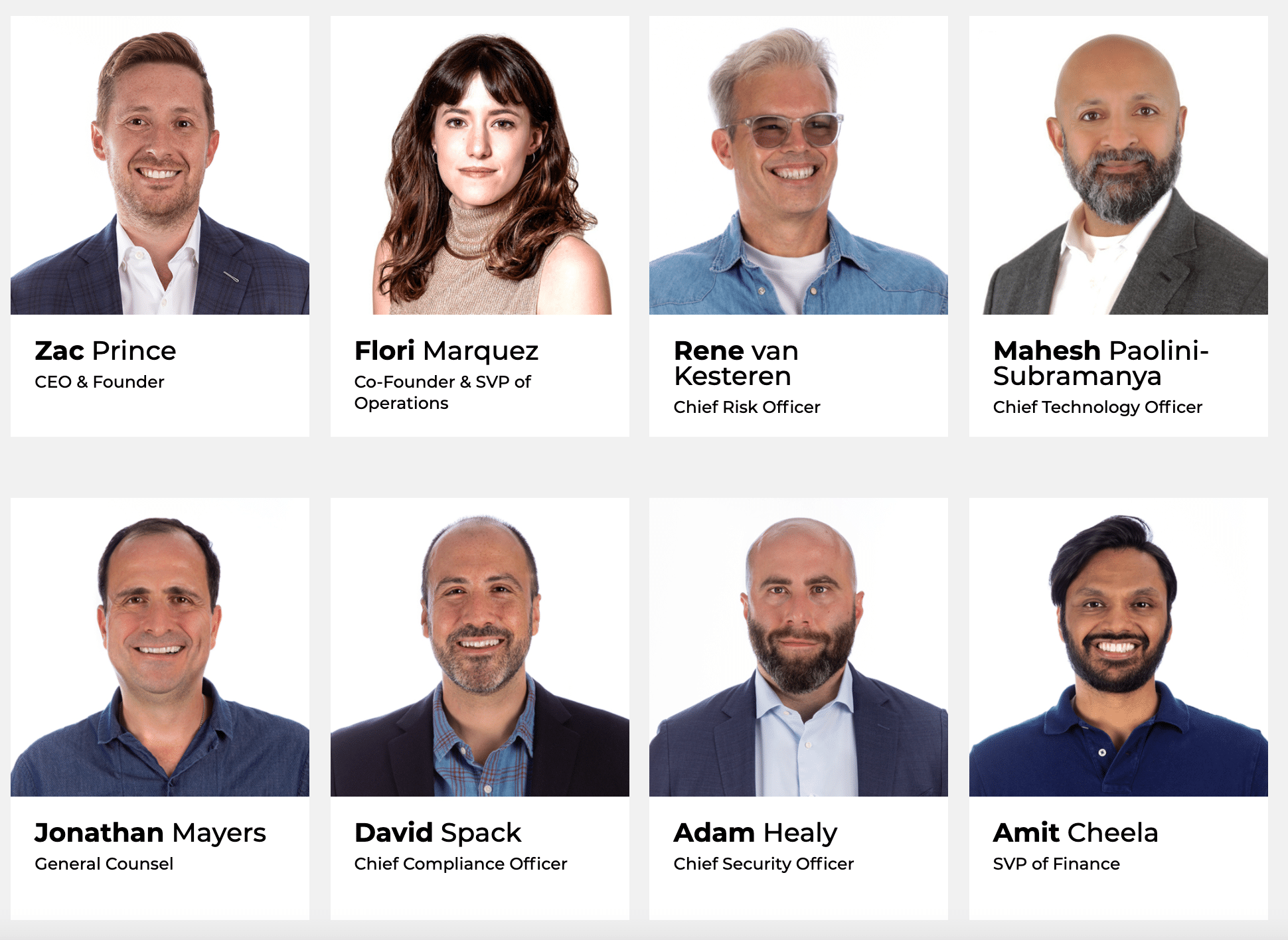

The BlockFi Team

BlockFi’s leadership team has a long time of skills in the passe monetary products and companies and banking world. The corporate claims to buy a conservative attain to regulation to deliver itself favourably for sustainable prolonged-term boost and expansion.

BlockFi Management team, collectively with Founders Zac Prince and Flori Marquez

Founder & CEO, Zac Prince has leadership skills at multiple a hit tech firms. Sooner than starting BlockFi, he led business model groups at Orchard Platform, a dealer-dealer and RIA in the web lending sector, and Zibby, an on-line user lender.

Co-Founder & VP of Operations Flori Marquez has skills managing quite loads of lending products. She helped get and scale a $125MM portfolio for Bond Aspect road (got by Goldman Sachs) as Head of Portfolio Management. She managed all operations collectively with point of origination, default, and litigation.

Chief Menace Officer, Rene Van Kesteren spent over 15 years at BAML as a Managing Director of ML Reliable Clearing Top Brokerage. He built the equity structured lending platform, collectively with possibility and regulatory compliance frameworks. Rene furthermore labored as an equity derivatives dealer in Caxton’s Strategic Quantitative Funding Division.

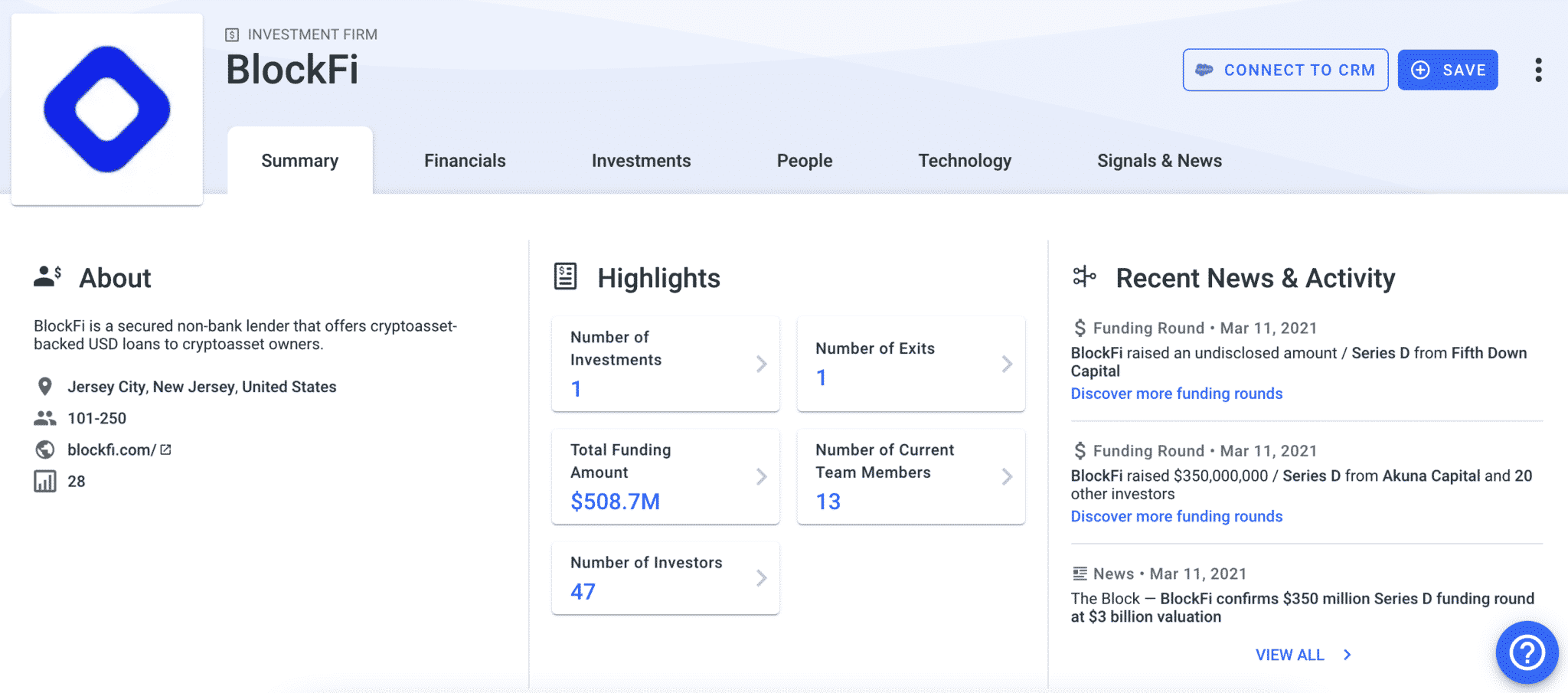

BlockFi Funding: How Much Money has BlockFi Raised?

BlockFi has raised a total of $508.7M, valuing the younger company at $3 billion. BlockFi’s income has grown 10x true thru the last twelve months, striking it now on notice to realize $100M in income over the subsequent twelve months. With over $1.5B in sources on the platform, and a 0% loss price across its lending portfolio, BlockFi has made a solid case for setting up itself as a dominant entity in the overarching rising FinTech home.

BlockFi raised its lion’s portion of funding in a $350M Sequence D, led by recent traders equivalent to Bain Capital Ventures, Pomp Investments, Tiger World, and partners of DST World. In an announcement, BlockFi eminent it plans to exercise the influx of capital to search out additional innovation in its product suite, bustle recent market expansion, and potentially fund recent acquisition opportunities.

BlockFi raised $50 million in its Sequence C led by Morgan Creek Digital, with taking portion traders equivalent to Valar Ventures, Winklevoss Capital, Kenetic Capital, CMT Digital, Fortress Island Ventures, SCB 10X, HashKey, Avon Ventures, Crimson Arch Ventures, Michael Antonov, NBA participant Matthew Dellavedova, and two university endowments.

Sooner than its recent Sequence C, BlockFi raised $18.3 million in Sequence A funding led by the Peter Thiel-backed Valar Ventures with participation from Winklevoss Capital, Galaxy Digital, ConsenSys Ventures, Akuna Capital, Avon Ventures, Susquehanna, CMT Digital, Morgan Creek, and PJC.

BlockFi’s fundraising on March 15th, 2021 (offer: Crunchbase)

BlockFi has furthermore raised earlier rounds by SoFi and Crimson Arch Ventures.

The team notes that they now stay wide awake for elevating additional capital one day to facilitate continued product model and rapidly boost.

As of March 2021, the platform has over 265,000 retail and 200,000 institutional purchasers, with reported monthly income of $50m in 2021, when when put next with $1.5m monthly income in 2020.

BlockFi Ardour Memoir Overview and BlockFi Ardour Charges

The BlockFi hobby rates are above-moderate in the cryptocurrency hobby narrative market, and some distance greater, albeit inherently riskier, than cryptocurrency on an hobby-free commerce or pockets.

- Bitcoin Ardour Rate: 4.5% in annual hobby up to 0.1 BTC, 1% on any BTC between 0.1% and 0.35%, and 0.1% for 0.35 BTC and better.

- Ethereum Ardour Rate: 5% up to 1.5 ETH, 1.5% between 1.5 and 50 ETH, and 0.25% above that.

BlockFi’s most up-to-date rates on 10/11/21

Except for Tether at 9.5%, all stablecoins receive 9% hobby on all deposits below 40,000, and 8% on any amount above

- Gemini Greenbacks (GUSD): 9% hobby on GUSD deposits.

- USDC Greenbacks (USDC): 9% hobby on USDC deposits.

- PAX: 9% hobby on PAX deposits.

- PAXG: 9% hobby on PAXG deposits.

- USDT: 9.5% hobby on USDT deposits.

- BUSD: 9% hobby on USDT deposits.

The hobby is paid in its nominal cryptocurrency, so consider of the asset’s volatility– the cryptocurrency earned may per chance perchance perchance either be roughly than its USD the same at the time of deposit, so notion accordingly.

On the opposite hand, since stablecoins are pegged 1:1 to USD, they theoretically don’t raise the identical volatility possibility as an asset enjoy BTC.

$10,000 in GUSD will build you $750 in GUSD for the rotund twelve months, and since it’s pegged to the U.S. Greenback, you won’t must be about its label being drastically barely about a (equipped one thing catastrophic doesn’t happen to Gemini or its GUSD.)

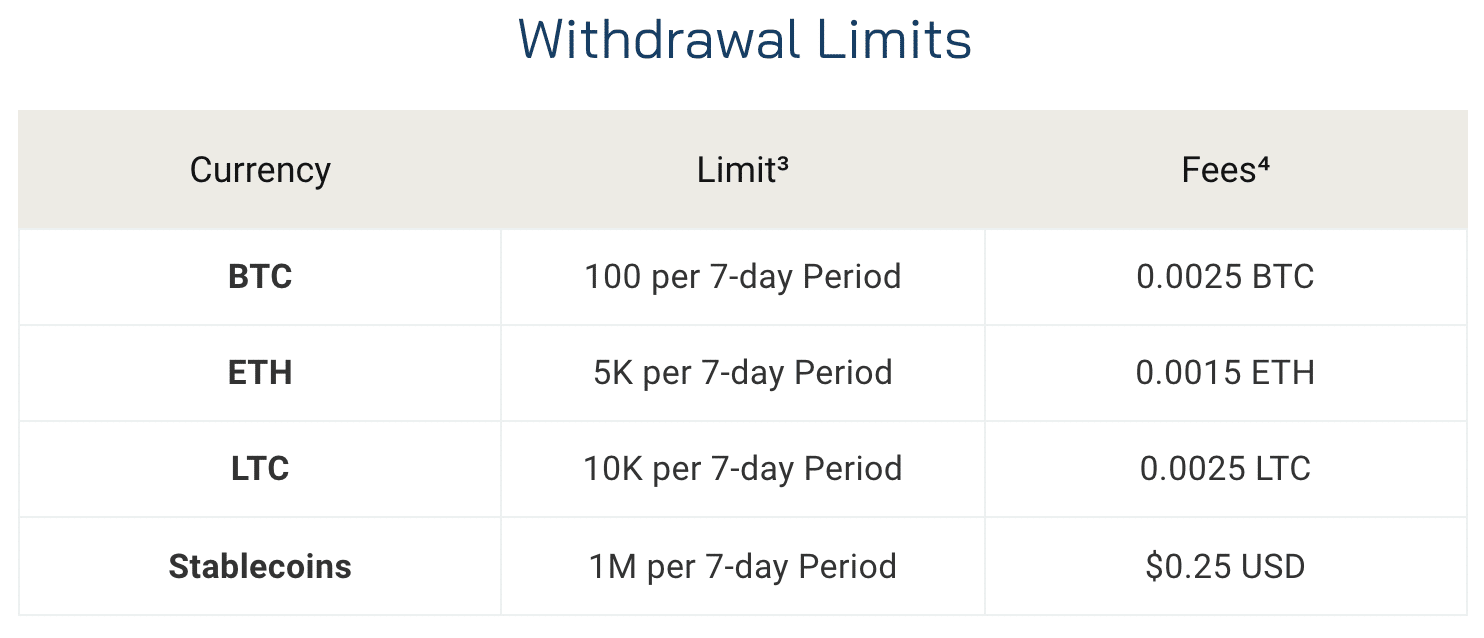

Please demonstrate that BlockFi prices flat withdrawal prices. which will probably be subtracted from the general withdrawal amount. Users receive 1 free withdrawal per month.

How Does BlockFi Manufacture Money?

BlockFi is an expansion business that makes money by borrowing capital at a particular price (the hobby rates it pays to customers) and lends it a increased price (the hobby rates it provides for BTC/ETH/GUSD loans). A BlockFi blog publish notes that the corporate primarily works with institutional counter-occasions to offer them liquidity. These debtors consist of:

- Traders and investment funds looking out for arbitrage procuring and selling opportunities in a fragmented marketplace. They borrow cryptocurrency to shut mispricing gaps between exchanges or dispersed markets. Margin traders will borrow to gasoline their procuring and selling methods.

- Over the counter (OTC) market makers that connect traders and sellers that have interaction now to now not transact over public exchanges, in overall at a steep designate-up. These occasions prefer to preserve cryptocurrency stock readily obtainable to meet achieve a query to. Since proudly owning the cryptocurrency is extraordinarily capital intensive and bears the dangers of label volatility, OTC market makers will borrow from lenders equivalent to BlockFi to facilitate their wants.

- Other companies that desire a list of cryptocurrency to offer their purchasers with liquidity. This class contains companies equivalent to cryptocurrency ATMs that preserve the bulk of their cryptocurrency sources in frigid storage and desire some stage of liquidity to feature on a day-to-day foundation.

Is BlockFi Protected? Is Your Money Protected on BlockFi?

In step with our compare and conversations, BlockFi passes the security check. Well, it’s about as stable as Gemini, its predominant custodian. Gemini keeps 95% of its sources in frigid storage and 5% in sizzling wallets which will probably be insured by Aon.

Gemini is a licensed custodian and controlled by the NYDFS, and it currently got SOC2 compliance from Deloitte for its custody solution.

While BlockFi’s hobby rates are attention-grabbing, it’s natural for cryptocurrency aficionados to be skeptical– and rightfully so, we are inclined to be a paranoid breed. That’s what this Blockfi review is for!

What happens to person funds at some stage in each of these eventualities? How are they stable?

Despite the proven fact that we believe a business, which there may per chance be cramped to point to BlockFi can’t be depended on, the doomsday “what if’s” retain predominant true property in our brains.

We requested the BlockFi team some doomsday questions:

What happens if BlockFi will get hacked?: “Gemini is BlockFi’s predominant custodian and BlockFi doesn’t retain non-public keys without lengthen. Gemini keeps the overwhelming majority of its sources in frigid storage and is insured by Aon. Gemini is a licensed custodian and controlled by the NYDFS. They currently got SOC2 Form 1 compliance audit from Deloitte for their custody solution. We encourage customers to read extra about Gemini’s security. “

What happens if an particular person narrative is compromised?: “Since inception, BlockFi has no longer lost any customer funds. Within the occasion that an particular person’s narrative is compromised, which our security protocols get caught previously, we freeze the particular person’s narrative for one week. Then, we conduct a Videoconference with the affected person to check their identification. We are able to then commerce their email deal with and password, so they’ll earn alter of their narrative.”

What happens if with out warning everyone defaults on their cryptocurrency loans?: “When we lend crypto sources to generate yield, now we get an awfully thorough possibility management and credit score prognosis process. We easiest primarily lend to mountainous, neatly-capitalized, institutional debtors, or to counter-occasions prepared to publish collateral and provide the flexibility to margin call them on a 24/7 foundation.”

“What which suggests is, if we’re lending $1M value of BTC to Firm XYZ, Firm XYZ collateralizes the loan (every so ceaselessly ~120%) by giving us ~$1.2M USD. If the loan had been to then enter margin call and the borrower modified into unable to offer additional collateral (default), we may per chance perchance exercise their USD collateral to have interaction crypto.”

“We have actively lent since January of 2018, collectively with all over multiple durations of excessive volatility, with none losses across our entire lending portfolio. BlockFi is accelerate by NDA’s to focus on phrases of explicit debtors/rates.”

How attain I apply for a BlockFi Memoir?

Signing up for a BlockFi narrative is pretty straightforward and would perchance be performed in below two minutes.

- It’s probably you’ll perchance be ready to open good from this BlockFi review. Trek to the BlockFi web sing material. Utilizing this code, it is probably you’ll perchance perchance receive up to $500 to your deposit as a model-up bonus, starting at $25 ought to you deposit a minimal of $500.

- Trek to the “Assemble Ardour” possibility in the homepage slider, or “Gain Started” in the menu.

- Enter your email and build a password to originate your narrative.

- Enter the verification code sent to that email.

- Once logged in, buy “Deposit” to check your identification and build your first deposit.

- Enter your internal most data for verification (section 1)

- Add a enjoy of ID equivalent to a passport, driver’s license, or ID card and wait to be licensed.

How attain I receive in contact with BlockFi Customer Provider?

Within the occasion you’d have interaction to contact customer support, it is probably you’ll perchance perchance attain them at [email protected].

Up to now, BlockFi give a enhance to has been neatly above moderate. Enable us to take hold of how your skills modified into any barely about a!

Is BlockFi insured?

Is BlockFi FDIC insured? Well, since FDIC insurance doesn’t apply to digital sources equivalent to cryptocurrencies, your deposits in BlockFi are no longer lined by FDIC insurance. On the opposite hand, BlockFi makes exercise of accomplice company Gemini as its custodial service, and Gemini does get its have insurance for its deposits. On the opposite hand, buy this with a grain of salt, as BlockFi has yet to skills a hack for person funds– insurance is easiest as appropriate because it works, and it has yet to be determined (and confidently below no conditions would perchance be!)

How is offering a 4.5% on BTC hobby price sustainable?

“The hobby we’re ready to pay is in accordance with the yield that we’re ready to generate from lending, which without lengthen correlates to the market achieve a query to in the home (I.e. what price establishments are prepared to pay to borrow explicit crypto sources, because it varies from asset to asset). We’re accelerate by NDAs to focus on specifics (establishments, explicit rates, etc).”

How in regards to the 9% hobby price on Stablecoins enjoy GUSD?

“We’re ready to exercise stablecoin deposits to fund our user loans (moderate APR is ~10-13%) so we can get ample money to pay increased hobby to GUSD / Stablecoin depositors.”

The BlockFi hobby price is self-discipline to commerce on a monthly foundation, may per chance perchance perchance you point to why this is?

“Upcoming changes are announced every so ceaselessly 1-2 weeks before a recent month, giving purchasers gargantuan query and time to organize. The hobby we’re ready to pay is a feature of the borrowing achieve a query to.

You can read extra about why our rates are variable and the intention the lending market works right here and right here.”

What happens in the case of a BTC/ETH fork? Will an particular person’s balance be credited with the forked coin as neatly?

“Gemini is our custodian and has all the info about what happens in the case of a forked network. Please focus on with their person agreement right here where it is probably you’ll perchance perchance read extra about that.”

What does the future belief enjoy for BlockFi? How will this BlockFi review be barely about a in a twelve months?

“We’re confident that we are able to become a in point of fact mountainous and a hit company that provides monetary products and companies on a world scale to the benefit of tens of millions of purchasers. We notion on going thru three sure boost phases in accordance with our addressable market and products:

- Piece 1

- Products for of us that already have Bitcoin or one other crypto asset that’s supported on BlockFi’s platform

- Skill to construct hobby borrow USD secured by your crypto

- Piece 2

- Manufacture bigger the addressable market to include of us that don’t have cryptocurrency yet.

- Start the flexibility to have interaction and sell on the platform and payments class products enjoy a Bitcoin rewards bank card

- Piece 3

- Heart of attention on world expansion and amplify the addressable market to include customers that is rarely always going to ever prefer to have crypto

- Closely exercise stablecoins to offer passe banking products on blockchain rails

BlockFi’s most up-to-date product, the BlockFi Credit Card (offer: BlockFi)

Final Solutions: Is BlockFi Legit?

All of our indicators for this BlockFi review (historical past, team, dialog with give a enhance to, and business model evaluation) demonstrate sure: BlockFi is legit. There may per chance be extraordinarily cramped evidence that implies in any other case. There are a handful of negative critiques on-line from disgruntled customers, however they mostly seem like rooted in misunderstanding, enjoy assuming the hobby modified into paid in USD and no longer in BTC/ETH/GUSD.

Whether or no longer or no longer BlockFi is value it comes appropriate down to your possibility profile and what you’re doing alongside with your cryptocurrency. The BlockFi hobby rates are barely aggressive for the commerce, and for some digital sources, commerce-leading.

If it’s just sitting on an commerce, that it is probably you’ll furthermore merely as neatly profit from compounded hobby. 10 BTC would yield a no longer insignificant originate of about $850, as neatly as the advantages or downside of Bitcoin’s label fluctuation, so preserve that in mind.

It’s value remembering that any time your cryptocurrency leaves your hardware wallets, it’s uncovered to a increased level of possibility. If BlockFi or Gemini had been to skills some (extremely no longer going) catastrophic hack, your cryptocurrency may per chance perchance perchance be in worry.

Our BlockFi review comes abet sure. After talking with team representatives, and with their give a enhance to team on the consumer-side, we dwell up for seeing BlockFi achieve itself additional in the home.

BlockFi Referral Code: Gain A $25 USDC Bonus When You Click on And Fund A Unusual BlockFi Memoir With At Least $500. Terms Bid.

Projects equivalent to BlockFi merely present provide cryptocurrency traders a principal-well-known diversification of income streams, one thing that die-noteworthy HODLers get ignored thru the past few years.