Key Takeaways

- Vesper Finance is a yield aggregator that aims to provide a exact reach to fetch curiosity on crypto resources.

- Vesper stands out for its conservative “pass unhurried and don’t wreck issues” ethos.

- The two-part make and modular and multi-pool structure differentiate Vesper’s technology from other same products available on the market.

Vesper Finance is a yield aggregator offering an accessible, exact, and conservative trip for DeFi novices and establishments. It aims to provide a bunch of yield-producing products that allow users to deposit and develop their crypto resources in a exact, house-and-omit reach.

Vesper Finance Defined

DeFi is shifting at breakneck velocity in phrases of development and innovation. No longer like ragged finance that tends to work in silos, DeFi is start and prides itself on being inclusionary and cooperative. This hardcoded ethos begets permissionless, combinatorial innovation the assign developers collaborate, invent upon, and even fork every other’s initiatives to force unprecedented organic development and collectively propel the gap ahead.

The fresh modus operandi, alternatively, is a double-edged sword that contains primary dangers and a steep studying curve for the sensible client. While DeFi’s “test in manufacturing” mentality may per chance per chance give it a appreciable edge over its ragged counterpart in phrases of nimbleness and lunge of innovation, it at all times translates into heightened security dangers and inability to expend up for the sensible client, resulting in paralyzing emotions of being left in the back of.

Vesper Finance is an Ethereum-basically basically based entirely DeFi venture that seeks to alleviate these components by adopting a more conservative reach—one remarkable nearer in ethos to Bitcoin‘s “pass unhurried and don’t wreck issues” philosophy than DeFi’s “test in manufacturing.” Probably ironically, this conservative reach is a breath of sleek air in the gap and precisely what sets Vesper aside. With various yield aggregators available on the market, Vesper’s financial moat lies in optimizing for simplicity, security, and longevity over time to market.

For the subsequent edition of DeFi Mission Highlight, Vesper CEO and co-founder Jordan Kruger sat down with Crypto Briefing to discuss the venture’s path to this level, and what may per chance per chance lie ahead. Speaking of the inducement to invent the protocol, she says that, being in DeFi since 2018, the crew seen a must professionalize yield farming and invent DeFi more approachable. “We house out to compose a DeFi immense app, with the most important product being the development pools the assign users can deposit crypto and fetch curiosity on their resources in a extraordinarily passive formula,” she explains.

Vesper offers products tailor-made to users who are both fresh in DeFi or these who desire a more passive approach to expend part. Extra importantly, Kruger emphasizes, Vesper is “for these who desire something more exact and something that takes due diligence seriously.”

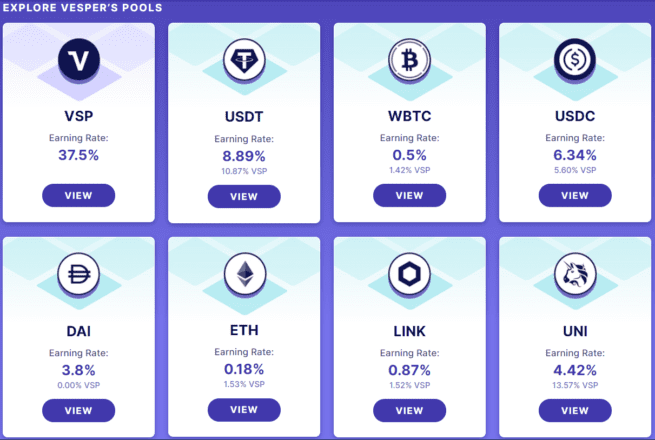

The protocol in the purpose out time offers two products: Vesper Develop and Vesper Create. The outmoded represents a house of pools that offers users a house-and-omit scheme of incomes in-form yield with their tokens in an accessible formula, while the latter pools allow users to deposit one form of token and fetch yield in one more. Shall we embrace, a client may per chance per chance deposit ETH to fetch USDC, or vice versa.

In principle, Vesper’s products work equally to every other yield farming protocols available on the market. Users deposit their tokens in unquestionably one of many pools and the pools then automatically place their tokens to work in other DeFi protocols to generate passive returns—both in the deposited tokens (Develop pools) or in varied tokens (Create pools). In relate, even though, there is a long way more to Vesper’s products than meets the glimpse.

What Makes Vesper Unique?

Moreover the gruesome distinction in ethos and building reach, Vesper additionally differentiates itself from other yield aggregators in its underlying technology.

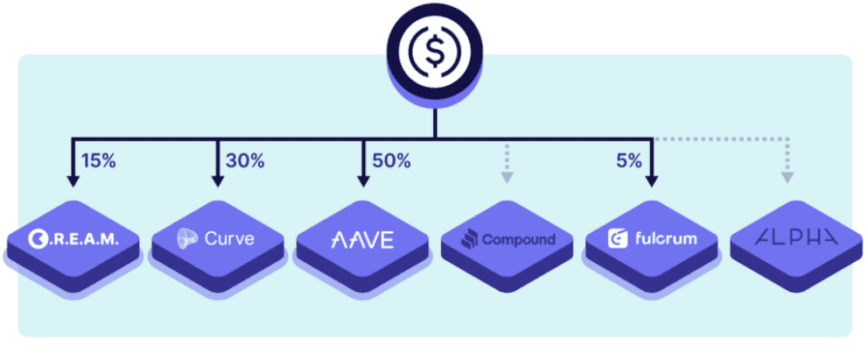

Specifically, Vesper’s resolution stands out for its modular and multi-pool structure. The modular structure reach that pools can simply transition between funding programs without requiring neat contract upgrades and capital migrations on behalf of users, while the multi-pool reach reach that pools can lumber a pair of programs and farm on a pair of protocols on the same time.

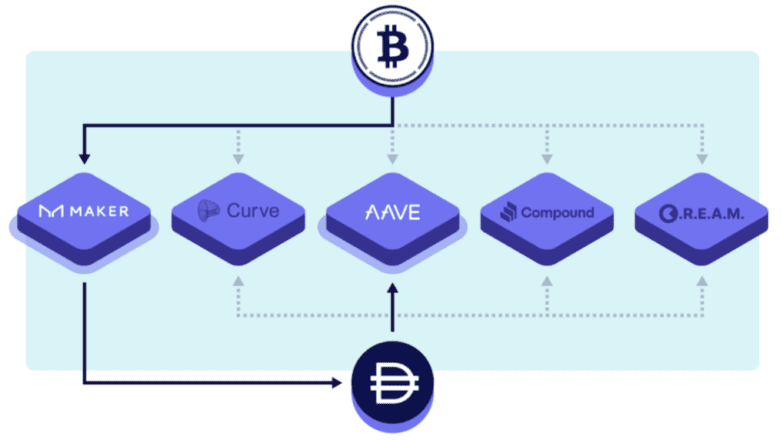

These substances are possible due to Vesper’s modern two-part make, which includes entrance pools that most sharp contend with the deposits and withdrawals and back programs that yelp the deposits and generate the yield. This structure lets in developers to compose any selection of yield farming programs and back pools as separate modules and then stack them on every other like lego bricks. In other words, this implies that, now not like same products, Vesper pools aren’t certain to relate a single, pre-house funding approach over their lifetime. As a change, they’ll continuously change or change between the reward programs in the background to plug and contend with shut the very best yields available on the market.

Shall we embrace, Vesper’s wBTC entrance pool employs two varied programs in the background: the most important deposits BTC as collateral on Maker to borrow DAI and then lends that DAI on Aave to fetch curiosity, and the second deposits BTC straight to Aave and then reinvests or compounds the yield. Reckoning on which approach produces the greater yield at any time, the pool swaps and allocates capital between the 2 programs to contend with shut the very best returns possible.

From this, it becomes positive how Vesper optimizes for simplicity and longevity. The modular structure lets in users to luxuriate in a house-and-omit trip without ever having to stress about pools being abandoned due to out of date programs.

One other weird ingredient to Vesper is its reach to likelihood and security. Concerning likelihood, Kruger says that Vesper is weird in that it categorizes pools as “conservative” or “aggressive.” She explains:

“We’re taking it a step extra and looking out on the technical likelihood of the underlying programs aged. Those are no longer looking out on the yield however the technical likelihood. Conservative pools use programs by nicely-seasoned, audited protocols like Compound, Aave, Maker—the monumental ones which contain been around for some time—while the aggressive pools may per chance per chance encompass programs leveraging protocols that contain no longer been in manufacturing for as prolonged and may per chance per chance restful no longer contain got audits.”

As for the reach to security, here’s the assign the impression of Vesper’s co-founder and chief vogue designer Jeff Garzik if truth be told shines via. Before Vesper, Garzik used to be unquestionably one of many most important Bitcoin core developers and the third-most sharp contributor to its code from when he began in 2010 via 2015. Unsurprisingly, then, Vesper’s modus operandi is to accommodate due diligence and optimize for security over time to market, which explains why its products may per chance per chance be better-suited for investors with a low time preference. Speaking of Vesper’s reach to security, Kruger says:

“We fetch all of the due diligence ourselves; here’s what we point out by professionalizing DeFi. All our product releases plow via a extraordinarily rigorous testing time desk, the assign we fetch rounded interior testing earlier than it goes to audits. Then after audits, it goes to beta, the assign we test the programs dwell with our hang capital, and then after two audits by expert third-occasion auditors and beta testing, the products accelerate to manufacturing.”

This conservative reach, specializing in accessibility, quality, and longevity, is how Vesper seeks to reach mainstream adoption and entice each novices to DeFi and establishments looking out for to contend with shut about a of DeFi’s high-yield alternatives.

Governance and Tokenomics

While Vesper used to be created and on the starting assign managed entirely by the Bloq company, the venture has continuously aspired to change into a DAO that is entirely owned and operated by the community stakeholders. To that dwell, the founding crew has been gradually relinquishing preserve an eye on over the protocol’s operations via phases of revolutionary decentralization.

Within the purpose out time, the protocol’s governance is basically in the fingers of VSP token holders who can propose Vesper Development Proposals (VIPs) and yelp the protocol’s development via Snapshot balloting. Each client’s balloting weight is denoted by their vVSP steadiness or the quantity of VSP tokens staked in Vesper’s governance pool.

VSP represents the platform’s governance and price-sharing token, which affords token stakers the capability to expend part in decision-making via balloting. Vesper’s tokenomics contain been designed to compose a sustainable financial mannequin that converts members and token holders into stakeholders by incentivizing liquidity provisioning and lowering them in on the income generated by the protocol.

Kruger says that the income mannequin is something that the crew has spent remarkable time concerned with earlier than launching. “Sustainability is unquestionably one of basically the most sharp substances to Vesper, and I believe something that is that if truth be told crucial to DeFi in favorite,” she explains.

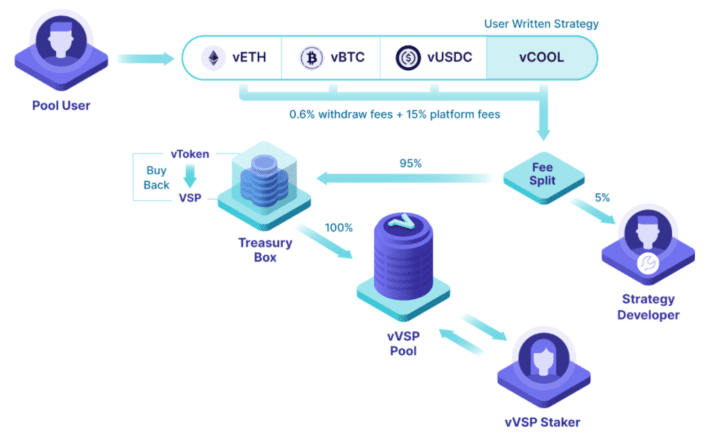

The income mannequin features a 0.6% withdrawal price, which in the purpose out time makes up for 93% of the protocol’s income, and a 15% platform price. 95% of the income generated from the costs then gets sent to the Treasury Field, swapped for VSP tokens, and then redistributed to stakers in the vVSP governance pool. The final 5% gets reserved for the developers who author specific yield-farming programs, which may per chance per chance encompass anybody in the Vesper or DeFi community.

The Design forward for Vesper Finance

Vesper’s roadmap plans encompass expanding the product suite past Ethereum to EVM-like minded blockchains, launching more Create programs on alpha, and launching more Develop pools and primitives just like the VUSD stablecoin, the Vesper Mounted Rate Pool, and Vesper Lend.

The most important Vesper Create pool, which lets in users to deposit Ethereum and fetch yield in DAI, is already available in beta. Vesper’s Create product is a fresh DeFi used which offers for what the crew calls “programmable yield,” that lengthen the yield may per chance per chance be utilized in many varied programs, in conjunction with donating to charities or redirecting it to other pools for various applications.

Having a gape ahead, Kruger says that the crew is building more Create programs and specializing in enlargement. “I’m if truth be told concerned with DeFi because it bridges into more chains and if truth be told becomes this multi-chain universe,” she says. “We’ve already launched Develop pools on Polygon, which is in beta, and I believe here’s precisely the assign we want to accelerate in the gap. Gas prices on Ethereum are too high, and we’re looking out for to fetch rid of this barrier to entry.”

In conclusion, Vesper Finance is a peculiar venture built by industry veterans that seeks to fetch a extraordinarily ambitious aim: turning into the 401(okay) of crypto. On the floor, while it may per chance per chance discover about like every other DeFi yield farm in DeFi, deep down it’s surprisingly novel, each in technology and ethos. If the past two years in DeFi contain proven the rest, it’s that it’s straightforward to fork code but no longer doable to fork talent and community—and that stands seriously factual for Vesper. As DeFi continues to develop and march against the mainstream, the pool of more conservative, passive investors with a decrease time preference may per chance per chance restful continue to lengthen. And with that, so may per chance per chance restful Vesper’s possible market.