Key Takeaways

- Curve has broken past its yearly excessive.

- Elevated inquire of for the CRV token and low circulating supply are riding up the price.

- At the moment, over 89% of all CRV tokens are locked up in DeFi protocols.

Curve has broken past its April highs, fueled by elevated inquire of for CRV tokens and a low circulating supply.

Curve Breaks Out

CRV tokens are in excessive inquire of.

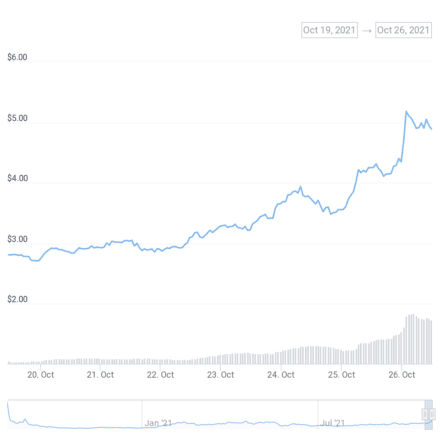

The DeFi DAO token is climbing elevated, breaking past its yearly excessive of $4.66 done in April. The CRV token is currently buying and selling at $4.91, up 75% over the last week.

Curve Finance, the issuer of CRV tokens, is a DeFi protocol specializing in cherish-asset swaps equivalent to stablecoins and wrapped resources. Users can present liquidity to Curve’s swap pools to originate CRV tokens rewards, which is inviting to then be deposited into diverse DeFi protocols to generate extra yield.

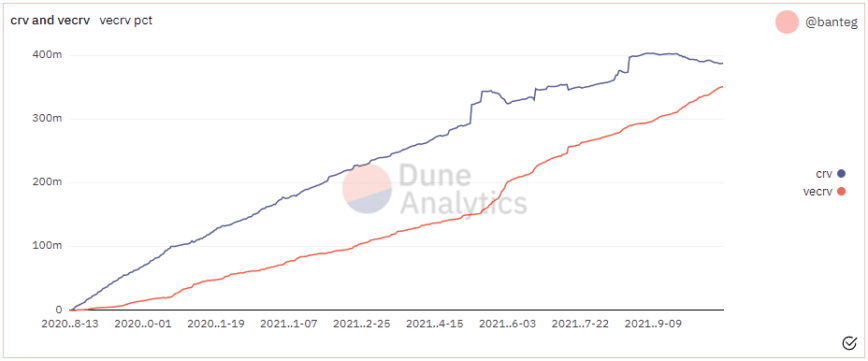

This one year a total sub-DeFi ecosystem has fashioned spherical yield optimization for CRV tokens. Each Yearn Finance and Convex Finance supply sexy yields to customers willing to lock up their CRV tokens in vaults for as a lot as four years.

The competitors between these two protocols, most ceaselessly called “The Curve Wars,” has impulsively consumed a mountainous part of the total CRV token supply. Additionally, a peculiar “DeFi 2.0” protocol, abracadabra.money, permits customers to borrow its MIM stablecoin the utilize of Curve Liquidity Provider tokens as collateral, extra reducing the CRV supply.

Over 89% of all CRV tokens are currently locked up in diverse DeFi protocols, with a median vesting time of 3.68 years. With the provision disturbed and inquire of staying fixed, the CRV token is impulsively increasing in cost. Objective these days, the provision of CRV tokens has turn into disinflationary, which formulation that more tokens are being locked up than unusual ones distributed.

Since May well well per chance’s market wreck, DeFi protocol tokens include underperformed when compared to the market average. While Layer 1s equivalent to Solana and Avalanche include loved main beneficial properties, Aave and Yearn finance’s tokens include remained stagnant. Whether or no longer Curve’s contemporary impress action is the open of a DeFi revival out there remains to be viewed.