Despite basically the most standard market correction, investment banking big Morgan Stanley appears to be like bullish on Bitcoin.

Shutterstock duvet by 24K-Production.

Key Takeaways

- Tuesday SEC filings revealed that Morgan Stanley has elevated its indirect Bitcoin exposure thru several of its funds.

- Over the Jun. 30 – Sep. 30 interval, the firm obtained greater than 2.6 million Grayscale Bitcoin Belief shares price around $118 million.

- At most standard the firm holds approximately 6.6 million GBTC shares price over $300 million at most standard market prices.

In conserving with basically the most standard U.S Securities and Change Price (SEC) filings, Morgan Stanley has added to its Bitcoin exposure thru the Grayscale Bitcoin Belief, elevating hopes for seemingly Grayscale Bitcoin ETF approval.

Morgan Stanley Doubles Down On Bitcoin

The enviornment’s third-splendid wealth supervisor, Morgan Stanley, has dramatically elevated its Bitcoin exposure.

In conserving with a Tuesday SEC submitting, Morgan Stanley has elevated its indirect Bitcoin exposure by shopping a fundamental series of Grayscale Bitcoin Belief (GBTC) shares thru a pair of investment funds.

As per the filings, for the interval ending Sep. 30, the bank’s Sigh Portfolio fund added 1.5 million GBTC shares, whereas the Insight and the Global Opportunity Portfolio funds added nearly 600,000 and 500,000 shares, respectively. Across these three funds, Morgan Stanley for the time being holds greater than 6.6 million GBTC shares price over $300 million on its balance sheet. This marks an increase in GBTC exposure of about $118 million over the Jun. 30 – Sep. 30 interval.

Moreover to to diversified Morgan Stanley funds adding GBTC exposure to boot, the firm moreover holds a fundamental series of shares of the splendid company holder of Bitcoin, Microstrategy. The wealth supervisor decided to make investments $500 million in Microstrategy stock wait on in January, thereby gaining extra indirect exposure to Bitcoin.

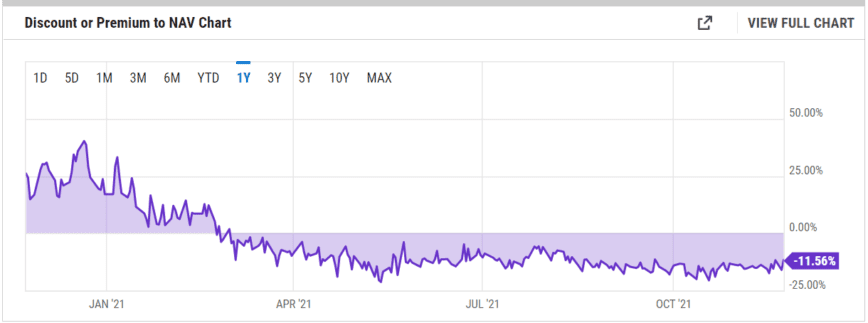

Traded on the OTCQX market, the Grayscale Bitcoin Belief enables institutional traders to invent indirect exposure to Bitcoin thru shopping the fund’s shares. Nonetheless, GBTC has been trading at a decrease mark to the fund’s receive asset payment since February this 300 and sixty five days. At the moment, the decrease mark to BTC is around 11.56%, seemingly due to the 12-month lock-up interval for the shares and Grayscale’s excessive administration charges.

(GBTC decrease mark or premium to NAV data from ycharts.com)

Competition for institution-grade crypto investment products is moreover heating up. Valkyrie’s and VanEck’s Bitcoin futures ETFs were popular by the SEC in October and November and started trading on Nasdaq and CBOE, respectively.

Grayscale has moreover announced plans to convert its belief to a internet page ETF, but to date there appears to be like to be no appetite for approving internet page products at the SEC. In November, the U.S. securities regulator rejected VanEck’s internet page Bitcoin ETF utility, claiming the proposed product had no longer met its burden in regard to fighting “false and manipulative acts and practices” and “[protecting] traders and the overall public ardour.”

In light of Morgan Stanley’s most standard elevated exposure to GBTC, some contributors of the Bitcoin neighborhood are in truth speculating that the investment banking big can even abet Grayscale get its internet page Bitcoin ETF popular.