Key Takeaways

- Info of a unique Covid stress in South Africa has shaken the crypto market. The promote-off has worn out $350 billion from the entire crypto market capitalization.

- Bitcoin and Ethereum crashed by bigger than 8% as downward stress mounts.

- The 2 main crypto resources are with no doubt keeping severe areas of strengthen.

Bitcoin and Ethereum appear to possess reached an distinguished strengthen stage after posting appreciable losses on the news of a unique Covid variant in South Africa. The essential inquire of wall could well well resolve whether or no longer BTC and ETH will dip additional or resume their uptrends.

Crypto Market Suffers Crash

Cryptocurrency investors appear to possess entered a assert of “dread” over the news that a unique Covid variant became as soon as identified in South Africa. The variant became as soon as first identified Tuesday and fear has ensued at some point soon of the week, with several countries in Europe and Asia issuing dart back and forth bans to southern Africa.

Alongside the crypto market dip, the FTSE 100 fell 3% Friday, while oil costs additionally tumbled. Dow futures are down 700 facets in anticipation of a bloody market opening.

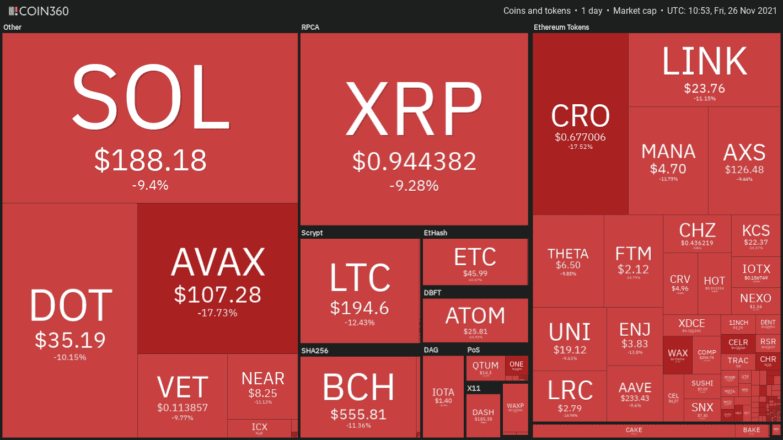

The unexpected spike in promoting across the cryptocurrency industry has resulted within the entire market capitalization shaving off 9% of its impress within the final 12 hours. Round $350 billion became as soon as worn out of the market, and better than $530 million became as soon as liquidated across the market within the same length.

Avalanche’s AVAX, Crypto.com’s CRO, and Cosmos’ ATOM movement among the biggest losers, every crashing by bigger than 17%. Bitcoin and Ethereum additionally incurred essential losses but appear to be keeping on a proper strengthen.

Bitcoin, Ethereum Hit Trace-Or-Atomize Level

Bitcoin fell 8% rapidly after being rejected by the $60,000 resistance zone.

The downswing became as soon as essential ample to push costs all of the vogue down to envision the lower boundary of a parallel channel, where BTC has been contained since mid-June. The distinguished strengthen stage coincides with the 200-twelve-hour shifting moderate at $54,000.

There is a excessive likelihood Bitcoin could well well leap off this inquire of zone because each time costs possess dropped to the channel’s lower trendline since mid-June, the downtrend has reached exhaustion, ensuing in a bullish impulse to the pattern’s middle or upper edge. Identical market behavior could well well now happen, especially when brooding about a bullish divergence forming on the 12-hour chart between the relative energy index or RSI and the value of BTC.

If purchase orders expand across the $54,000 strengthen stage, Bitcoin could well well leap toward $65,000 or even originate a unique all-time excessive at $75,000.

Nonetheless, a sustained 12-hour candlestick shut under $54,000 could well well invalidate the bullish thesis. Below such queer circumstances, BTC could well well fall to $51,000 or even $47,000.

Ethereum has additionally reached an distinguished assert of inquire of after experiencing a 12% impress correction.

The $3,985 strengthen stage has as a lot as now prevented the amount two crypto from incurring essential losses over the final month. Every time ETH has hit this severe hobby zone since Oct. 20, costs possess all of a sudden rebounded. The latest retest could well well now symbolize the final opportunity for sidelined investors to safe encourage into the market.

A spike in procuring for stress across the $3,985 zone could well well achieve Ethereum encourage on course to meet the $9,000 target presented by a cup and cope with pattern.

It’s price noting that a decisive 12-hour candlestick shut under the $3,985 strengthen stage could well well invalidate the optimistic outlook. Breaching this sort of essential inquire of wall could well well additionally support investors to exit their positions in anticipation of additional losses immediate. The promote-off could well well then push Ethereum to the 200-twelve-hour shifting moderate at $3,700 or even $3,300.