On the outside, Bitcoin looks to be poised to retract over as the sector reserve forex in preserving with the game concept of individuals converging on the adoption of a single laborious and sound forex.

The authentic cryptocurrency has formally entered into its teenage years following the e-newsletter of the white paper on October 31, 2008. Plebs occupy been stacking bitcoin for the reason that genesis block changed into mined on January 3, 2009. Each and every personal and public corporations occupy been amassing it, and even governments occupy taken the drop. Having a beget in mind on the macro image is certainly thrilling from the standpoint of an early adopter.

Every ten minutes, blocks are being added to this decentralized timechain and Bitcoin is working as designed. The task at hand is for Bitcoiners to conclude vigilant in notify to retain it that diagram. One approach for right here is to consistently be pondering of assault vectors in all of their forms. To that conclude, this half makes a speciality of conceivable social and governmental sabotage.

El Salvador And Bitcoin Vs. The Globalists

On November 20, 2021, Nayib Bukele, the president of El Salvador, launched plans to assemble a “Bitcoin City,” funded by bitcoin-backed bonds.

The metropolis would price 0% profits, capital good points, property, payroll and municipal taxes. The actual tax levied shall be a price-added tax. To boot to to all of those 0% taxes, the metropolis plans to occupy 0% carbon emissions by utilizing the geothermal vitality from the nearby Conchagua volcano.

The country is funding this centrally-deliberate challenge through bitcoin-backed “Volcano Bonds” spearheaded by Blockstream. Bukele has been praised by the Bitcoin neighborhood for adopting bitcoin as factual comfy in El Salvador. He has welcomed Bitcoiners with originate arms, offering citizenship to individuals who invest 3 bitcoin within the country and even changed the roam back and forth necessities to exclude proof of vaccination and unfavorable COVID-19 take a look at results, which coincidentally went into enact on the same day that the Adopting Bitcoin conference started.

Bukele’s duration of time has no longer been without criticism. In Can also fair, he ousted 5 Supreme Court justices and the attorney frequent, purportedly because they ruled that his COVID-19 conclude-at-house notify changed into unconstitutional.

In September, Bukele handed legal systems casting off judges who occupy been over 60 years fresh, effectively firing approximately 30% of the sitting judges. About a days later, Bukele’s courts ruled that presidents could possibly maybe plug for consecutive phrases, defying El Salvador’s constitution and setting Bukele up for an additional duration of time.

Following this, the National Assembly handed a rules taking into account land and property expropriations (be taught: seizure) within the name of an ambiguously outlined “public interest.” There’s extra questionable habits from Bukele and his cronies, but the theme right here’s a magnificent pattern of nationalization and squashing opposition that is paying homage to assorted authoritarian regimes.

These are no longer qualities that Bitcoiners laud and we should be wary of the kind of statist habits. Adopting Bitcoin does no longer preclude governments from being totalitarian empires and we should be responsive to the cognitive dissonance that includes praising a country for adopting a free and originate monetary community while furthermore ignoring its evident tyrannical traits.

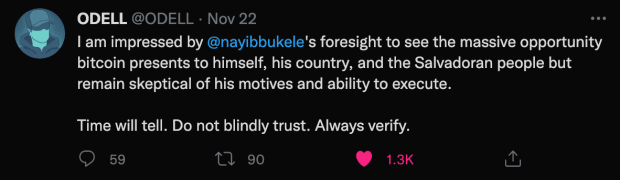

The announcement of “Bitcoin City” changed into met with pleasure by Bitcoin news stores and plenty of of us on Bitcoin Twitter, even though there are some who in actual fact feel skeptical of this conception, myself incorporated.

I mediate it’s conceivable and even doubtless that Bukele in actuality “will get it” and wishes Bitcoin to be triumphant. I furthermore salvage it fresh that his approach to assemble bitcoin factual comfy and facilitate certain tax policy for bitcoin patrons within the country is being largely omitted/allowed by the Financial institution of Global Settlements (BIS), the Global Financial Fund (IMF) and the World Financial institution.

Bukele changed into furthermore no longer too prolonged within the past launched as a speaker at Bitcoin 2022 in Miami, FL. I’m especially suspicious because he shall be in attendance for the speech within the very country whose energy he’s straight usurping by abandoning the buck long-established. Particularly, the United States has been extremely tranquil about El Salvador’s adoption of Bitcoin.

So, what’s occurring right here? Are these world organizations largely ignoring this radical transfer because El Salvador is deemed too inconsequential of a nation? An govt on the BIS said El Salvador’s adoption of bitcoin as factual comfy is an “attention-grabbing experiment,” the World Financial institution denied El Salvador’s question for encourage adopting bitcoin as factual comfy, and now that the country did it regardless, the IMF has issued a carefully-worded enlighten advising in opposition to the country the use of bitcoin as factual comfy due to this of its volatility. Most no longer too prolonged within the past, the chief on the Financial institution of England known as El Salvador’s transfer to adopt Bitcoin as its forex referring to.

Why are these predominant globalist organizations being so gentle-handed of their responses to this openly subversive transfer? And who would be the first Bitcoiners to transfer to Bitcoin City on the inappropriate of a volcano?

The establish Are The “Financial Hit Males”?

I admit that my worldview is biased toward ready for the United States authorities to address this with some form of renegade, extrajudicial “accident” à la the Bay of Pigs, Gulf of Tonkin, Mossadeq coup, plenty of assassinations in Africa, and plenty of others. Why are the three-letter companies within the United States ignoring El Salvador and their adoption of bitcoin as factual comfy?

In “Confessions Of An Financial Hit Man,” John Perkins writes in regards to the presidents of Ecuador and Panama, Roldós and Torrijos, respectively, who occupy been assassinated by the CIA for no longer going in accordance with world imperialism.

The e-book most critical aspects plenty of examples, such as those by which brokers of the corporatocracy went into constructing worldwide locations, projected unrealistic electrical infrastructure boost and sold the locals the most critical services to entire it, placing them in wide debt to the United States so that the worldwide locations would be with out a discontinuance in sight subservient to the pursuits of Washington and Wall Avenue.

This originated with the Monroe Doctrine, which took manifest future a step additional within the 1850s by the use of it to boom that the U.S. had particular rights in each establish the hemisphere, at the side of the correct to invade any nation in Central or South The united states that refused to succor U.S. insurance policies. Later, this changed into invoked to define intervention within the Dominican Republic, in Venezuela and in Panama in notify to possess the Panama Canal. The leaders who had the foresight to perceive this financial subjugation for what it changed into and selected no longer to comply in most cases had coincidental accidents and occupy been changed by authoritarian dictators.

In his e-book, Perkins most critical aspects how the Panama Canal changed into executed after a coup orchestrated by Theodore Roosevelt, whose troops killed a native militia commander and declared Panama an just nation the establish a puppet authorities changed into place in and the first Panama Canal Treaty changed into signed, without Panamanian influence or enhance.

Panama changed into then ruled by oligarchic households with ties to Washington and who allied with United States’ pursuits by supporting the CIA, NSA, wide businesses, and anti-communist factions. The end result changed into an opulent, U.S.-controlled Canal zone surrounded by destitute Panamanian slums. The individuals hero and politician, Omar Torrijos, negotiated a take care of the Carter administration to repatriate the Panama Canal. This angered the Reagan-Bush administration so indispensable that it sought to abolish him. Torrijos died in a plane smash for the length of a routine flight which most of the sector originate air of the United States seen as a CIA assassination.

That is finest one instance of United States authorities intervention in world affairs from the e-book. Perkins explains how the Mountainous Despair resulted within the New Deal, which additional evolved financial regulation and governmental financial manipulation within the country, straight resulted in the creation of the World Financial institution, the IMF and the Total Settlement on Tariffs and Switch after WWII.

A spotlight of this time period changed into the promotion of Robert McNamara. This Keynesian point out rose within the ranks at Ford Motor Firm to changed into the corporate’s president. He changed into then appointed secretary of defense and later president of the World Financial institution. McNamara changed into concept to be one of the most principle, early examples of the military-industrial complex, having served as the head of a predominant company, a authorities cupboard and basically the most powerful bank within the sector. That is a clear instance of the blurred traces of company and authorities pursuits which continues to for the time being, with individuals of Congress proudly owning most critical amounts of Pfizer and Johnson & Johnson stock while pushing for most critical vaccination.

Is the sector’s ostensible acceptance of El Salvador opting into bitcoin as factual comfy due to this of negligence, or is there one thing else occurring?

Paranoiac, Adversarial Bearing in mind

One chances are El Salvador and its adoption of bitcoin as factual comfy is being omitted by central banks in some unspecified time in the future of the sector and the U.S. alphabet soup companies for the reason that time of American Imperialism is coming to an conclude due to this of insolvency and the implosion of buck hegemony.

And even there is a bigger play at work to result within the Mountainous Reset the use of bitcoin as a backstop. That is a extremely inconceivable likelihood, but a likelihood alternatively.

On a fresh “Tales From The Crypt “episode, Matt Hill of Start9 spoke with host Marty Bent in regards to the ingenuity of governments making Bitcoin rules increasingly cumbersome for those interacting with on/off ramps through institutional programs, but without making Bitcoin outright unlawful. His point changed into bringing consideration to the effectiveness of wearing individuals down by making a undeniable habits inconvenient.

Hill said, “The web, as is, and the server/client architecture, as is, is no longer conducive to a viable future for Bitcoin. Bitcoin can no longer dwell on a centralized web. Not as ‘Bitcoin,’ anyway. If there’s one node, operating on one server, controlled by one entity, it’s no longer in actual fact Bitcoin anymore.”

Bent then mentioned the censorship-resistant assurances that Bitcoin offers when it’s operating in a disbursed diagram and Hill went on to boom that consensus rules shall be changed extra without problems (when centralized) and in contrast Bitcoin to a surveillance tool if it’s operating on a centralized server.

“Bitcoin within the palms of a pair of individuals on a pair of servers, which all any other time, it’s no longer going to happen, but it unquestionably is form of a statist’s moist dream… It’s , public, originate ledger of each transaction on Earth, but whenever it is doubtless you’ll possibly maybe appropriate pin identities to those issues it’s supreme,” Hill said.

This form of pondering is extremely vital for us to beget in mind when we mediate about conceivable assault vectors for Bitcoin.

Catherine Austin Fitts, broken-down assistant secretary of housing and federal housing commissioner on the U.S. Department of Housing and Urban Pattern within the first Bush Administration, is an outspoken critic of COVID-19 lockdowns, vaccine passports, central bank digital currencies (CBDCs), and the Mountainous Reset in frequent.

Recently, videos occupy been circulating of her speaking about central bankers, “exercising a coup d’état the establish they’re taking retain a watch on of fiscal policy [from the electorate] as effectively [as monetary policy]. With the advances of digital know-how, vaccine passports is maybe no longer about effectively being. Vaccine passports are fragment of a financial transaction retain a watch on grid that will completely conclude human liberty within the West.”

This speculation is no longer original to those on Bitcoin Twitter nor to many of the individuals who factor in within the freedom and financial sovereignty that Bitcoin offers.

In an interview with Greg Hunter, Austin Fitts said, “We’re in Never, Never Land. Now we occupy two groups in our society: One team that could possibly maybe print money, and the assorted who can carry out money. What we saw remaining 300 and sixty five days is the individuals who could possibly maybe print money declared warfare on the individuals who carry out money. And they said we are going to shut down your businesses, and we are going to suck up and retract your market half or engage you out with money we print out of thin air… There shouldn’t be the kind of thing as a virulent disease. What right here is is an financial warfare.”

She suggested getting corrupt institutions out of your lifestyles, at the side of preserving money with Federal Reserve-associated banks, but surprisingly, she furthermore said in an interview with Daniel Liszt that, “It’s doubtless you’ll possibly maybe well possibly’t solve a political field with a financial product.”

That is irreconcilable with what many Bitcoiners factor in because, as they disclose, “repair the money, repair the sector.”

Austin Fitts has been wary of Bitcoin for a pair of years and spoke publicly in opposition to it as early as January 2014. In her interviews, she makes some associated aspects that Bitcoiners must retract into account, even though oftentimes, she clearly misunderstands how Bitcoin works on a considerable stage. I obtained’t obtain into all the issues she has said about Bitcoin that is factually unsuitable, but she believes that the authorities could possibly maybe retract the bitcoin tag all the procedure in which down to zero or shut it down within the same diagram that social media corporations are shutting down individuals’s accounts. She furthermore has equated the seizure of sources from Silk Aspect street as proof that the plot is terrified. While the aforementioned aspects occupy been disproven through assorted examples, admire police being unable to acquire entry to “seized” bitcoin and Marathon Digital Holdings pronouncing it would no longer be censoring transactions (with reasons no longer specified), Austin Fitts does half some most critical aspects from her interview with Greg Hunter that Bitcoiners must heart of attention on, especially interested by that the digital forex is entering the sector stage:

1. “The top diagram to develop the detention heart is to acquire freedom fans in all areas constructing it for you.”

CBDCs will in all likelihood be modeled after bitcoin, even though the diagram shall be entire retain a watch on of individuals spending habits with unsanctioned purchases being disabled and/or leading to a unfavorable affect on a social credit scoring plot, admire the one China is for the time being the use of.

Austin Fitts thinks that governments in some unspecified time in the future of the sector are letting Bitcoin builders develop out a plot, but will then usurp its functions for their very have globalist agenda. She has mentioned “The Grasp Switch” by Tim Wu, who most critical aspects that, when original know-how arises, there’s a duration of innovation after which it centralizes because it’s more cost effective and less complicated that diagram.

As Bitcoin customers, now we occupy to continue staying vigilant (be taught: toxic) about conserving the Bitcoin community from malicious actors by preserving the community decentralized. This diagram operating a Bitcoin corpulent node. It’s no longer too costly to plug a node, but it unquestionably’s extremely most critical. “Not your node, no longer your rules,” as the pronouncing goes.

In her most modern video originate, Austin Fitts declared some steps to decentralize the money.

“Now we occupy to come to a decision on out easy systems to retract succor retain a watch on of the money plot,” she said. “The most critical thing about any money or financial plot comes all the procedure in which down to the quality of governance. The motive the latest financial programs are so powerful is because their governance is backed up by superior power. We obtained’t occupy superior power to succor up ours. We desire excellence in governance, a dedication to rule of rules, and a culture because there’s no longer ample enforcement within the sector to backup a sizable culture. That enforcement has to approach no longer appropriate from rules, but from culture.”

She went on to boom, “That plot is going to must be each physical and digital. We desire the digital for efficiency, but we need the physical to retain it fair appropriate and true.”

To be frank, it sounds admire she’s talking about Bitcoin: digital price transferred the use of hardware nodes and miners which use physical electricity.

2. “Invest your money into issues that will develop resiliency for your self and your loved ones. Are you spending your entire money on bitcoin and no longer supporting your native farmers?”

In an August interview with Whitney Webb, Austin Fitts shared some recommendations for surviving the arriving instability. Her finest reminder is to be resilient. Following resiliency, her solutions include securing ways to source healthy meals and finding water independence through drilling a effectively.

She furthermore urged the use of jurisdictional arbitrage to transfer the establish the price of residing is low to lead certain of inflation as indispensable as conceivable. Transferring additional from cities will enhance the possibilities that the individuals round you perceive easy systems to carry out issues for themselves.

Bitcoin citadels are frequently mentioned as a process of constructing sovereign communities. Meals security through native economies is finest cultivated through farmers’ markets and disclose enhance through neighborhood supported agriculture (CSA). All of this advice involves constructing “residing” equity. As Fitts said, “Ought to it is doubtless you’ll possibly maybe very effectively be placing your entire money into Bitcoin and likewise it is doubtless you’ll possibly maybe even occupy no farmland, no cattle, and no farmer, it is doubtless you’ll possibly maybe even be rich on Bitcoin, but you’re going to occupy to eat synthetic meat from Invoice Gates.”

3. “What number of hours are you spending on Bitcoin? Could possibly well that time be weak supporting your loved ones or in some other case being place to work?”

There are millions of hours of out of the ordinary podcasts about Bitcoin, plenty of Bitcoin books and articles to be taught, and plenty of video interviews and documentaries to beget in mind — let on my own the time it takes to come to a decision on out easy systems to use Bitcoin, join your pockets to your node, and assemble multisignature quorums. These are all extremely most critical pratices, but so are assorted universal abilities. Ought to you put money into constructing your abilities, they’re going to roam at the side of you if or no longer it is some distance a must to transfer: increasing meals, constructing, coding, canning, barren region survival, plant/fungus identification, first lend a hand, sewing, and plenty of others. These are all issues that could possibly maybe well also be weak in plenty of varied contexts.

In conclusion, as Bitcoiners, now we occupy to stay skeptical of all the issues, and I point out all the issues. Preserve vigilant and use adversarial pondering in notify to lead certain of becoming complacent so that we are in a position to give protection to the monetary sovereignty that the Bitcoin community offers.

G. Michael Hopf said, “Hard instances assemble strong males. Solid males assemble appropriate instances. True instances assemble broken-down males. Old males assemble laborious instances.” It looks to ensure that we are in a duration of laborious instances appropriate now. Now we should ensure that that as we possess into the strong males (and females) that will assemble appropriate instances within the discontinuance, we are in a position to continue them for as prolonged as conceivable.

As Austin Fitts urged as she ended her speech, “Don’t request if there’s a conspiracy, whenever you’re no longer in a conspiracy, or no longer it is some distance a must to originate one.”

Bewitch all the issues you be taught, hear, and leer with a hint of suspicion, at the side of this text.

Shared without enlighten, source

That is a customer put up by Craig Deutsch. Opinions expressed are completely their very have and carry out no longer basically contemplate those of BTC Inc or Bitcoin Journal.