Key Takeaways

- Ethereum has risen by nearly 22% in the previous five days, a ways outpacing Bitcoin.

- A bullish continuation sample suggests prices can double.

- In the intervening time, the ETH/BTC shopping and selling pair appears to be like be pleased or no longer it is heading to 0.1.

Ethereum appears to be like to contain entered a brand original leg up after checking out a well-known role of make stronger. The natty contract platform’s ETH token can be trending up in opposition to BTC.

Ethereum Breaks Out Towards Bitcoin

Bitcoin could per chance be the area’s largest cryptocurrency, nonetheless it’s on the second trending down in opposition to Ethereum.

ETH has experienced ticket volatility month after atmosphere a story high of roughly $4,870 on Nov. 10, sooner than plummeting by nearly 20% alongside with grand of the relaxation of the market.

On the opposite hand, traders seem to contain taken earnings of the unique correction in opposition to $3,900 to re-enter the market. The primary amplify in shopping strain has helped ETH rebound, gaining over 800 points in market price over the last five days.

Now, the second-largest cryptocurrency by market cap would be heading in the right kind route to hit original all-time highs.

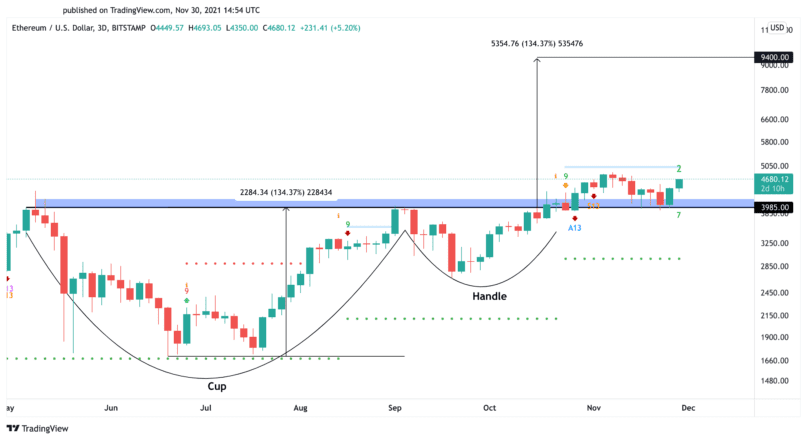

The formation of a cup and contend with sample on ETH’s three-day chart prints an optimistic outlook for the asset. The distance between the backside of the cup and the sample’s breakout degree at $3,985 means that ETH’s ticket could per chance per chance double to hit a target of $9,400 over the subsequent few weeks.

Depsite the strength ETH has confirmed in the market in unique weeks, a decisive three-day candlestick shut below the $3,985 make stronger degree could per chance per chance invalidate the bullish thesis.

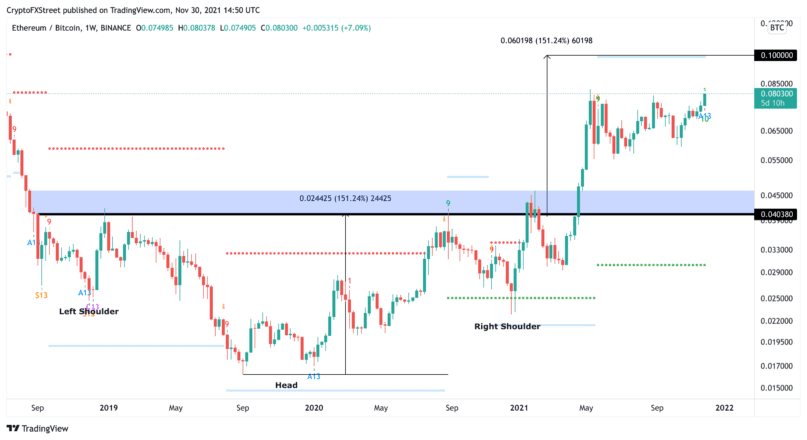

Whereas ETH has risen in opposition to the U.S. greenback, the ETH/BTC shopping and selling pair has also won primary momentum after enduring a seven-month-long consolidation segment. The ratio between ETH and BTC hit 0.08 for the dear time in six months on the unique time. The ratio refers back to the ticket of the 2 resources: at a ratio of 0.08, one BTC is charge 12.5 ETH. Crypto traders frequently discuss about the ratio in tandem with “The Flippening,” an hypothetical tournament that would eye Ethereum overtake Bitcoin in market cap terms. The ratio would must be about 0.16 for Ethereum to overhaul Bitcoin on the unique time. In U.S. greenback terms, the ETH ticket would must roughly double to around $9,100.

Whereas Ethereum is some system from overtaking Bitcoin, ETH is edging nearer to printing a greater high on the ETH/BTC weekly chart. It’s on the second shopping and selling elegant a couple of Satoshis a ways from the Might also 15 high of 0.0824. ETH appears to be like to contain broken out of a head and shoulders sample in opposition to BTC in late April, which capability that further gains would be on the horizon. The multi-year consolidation sample initiatives a bullish target of 0.1.

Ethereum appears to be like mighty in opposition to both the U.S. greenback and Bitcoin, especially now that its circulating present is skittish at an exponential charge. Ethereum launched a price burning replace known as EIP-1559 in August, which has taken bigger than 1 million ETH out of circulation to this level. Next, Ethereum is anticipated to merge Ethereum mainnet to the Beacon chain sometime in Q1 or Q2 of 2022, marking the network’s transition to Proof-of-Stake. It’s belief that the transition could per chance per chance eye ETH change into a deflationary asset, which would be a predominant driver for ETH achieving its upside potential.

Disclosure: At the time of writing, the creator of this selection owned BTC and ETH.

The recordsdata on or accessed thru this internet site is got from honest sources we contain in suggestions to be prison and decent, nonetheless Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any recordsdata on or accessed thru this internet site. Decentral Media, Inc. is no longer an investment consultant. We attain no longer give personalized investment recommendation or quite loads of monetary recommendation. The recordsdata on this internet site is field to alternate without discover. Some or all of the recordsdata on this internet site could per chance per chance also change into older-long-established, or it could per chance actually well per chance be or change into incomplete or unsuitable. We could per chance per chance also, nonetheless are no longer obligated to, replace any outdated-long-established, incomplete, or unsuitable recordsdata.

You might want to in no device bear an investment resolution on an ICO, IEO, or quite loads of investment essentially based totally on the recordsdata on this internet site, and it is most realistic to in no device elaborate or in any other case depend upon any of the recordsdata on this internet site as investment recommendation. We strongly recommend that you just seek the recommendation of a licensed investment consultant or quite loads of qualified monetary knowledgeable whenever you occur to are seeking investment recommendation on an ICO, IEO, or quite loads of investment. We attain no longer settle for compensation in any make for inspecting or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized sales, securities, or commodities.

ZK-Rollups and the Path to Scaling Ethereum

As the ticket of the utilization of Ethereum will increase, the must scale the network has change into more obvious than ever. Zero-Recordsdata Rollup technology promises to lower gasoline charges without compromising on…

EIP-1559 Has Burned 1 Million Ethereum

EIP-1559 has now burned over 1 million ETH charge roughly $4.3 billion. EIP-1559 Hits 1 Million ETH Burned Ethereum’s EIP-1559 replace has taken over 1 million ETH out of circulation….

Viewers Gape: Utilize A $360 Subscription To Pro BTC Seller

We’re doing this on story of we must be greater at selecting advertisers for Cryptobriefing.com and explaining to them, “Who’re our company? What attain they care about?” Solution our questions…

Bitcoin, Ethereum Drag Whereas Market Picks Up

Bitcoin and Ethereum contain faced broad ticket drops over the final 9 days. Whereas traders are showing indicators of dismay, one indicator means that a prime rebound is underway. Lower…