Inflation used to be one in all essentially the most broadly-debated issues within the mainstream media for the period of 2021. We’ve been fed lies for the period of the year, with some shops suggesting that inflation doesn’t exist, inflation is low, inflation is transitory or inflation is nice. Someone paying attention is aware of none of this stuff are correct. Inflation is with out a doubt here, it’s not going anyplace anytime quickly, and while we might perhaps well perhaps debate whether or not modest inflation is nice or unsuitable for an economic system, the ranges of inflation we’re on the 2d seeing are very regarding.

As I protect up for 2022, here are some questions on my mind regarding inflation:

- How excessive will inflation stagger within the U.S. and other nations with pretty steady currencies?

- Will we glance one other currency crisis cherish that which is on the 2d taking place in Lebanon?

- What’s going to be the overall public sentiment essentially based on sustained, excessive inflation?

- Will more of us wake up to the actuality that the label of their money is eroding by the day?

- Will bitcoin adoption explode over the following year as more of us come to this actuality?

How Will Inflation Impact Bitcoin In 2022

It looks fairly evident that prime inflation is destined to continue for the foreseeable future. Over the summer season, within the U.S., we saw one of the best year-over-year upward push in inflation since 2008, and that used to be at a reported 5% extend. Folk would be good to wonder what the “correct payment” of inflation is.

The Client Impress Index (CPI) is a statistic venerable by the likes of the Federal Reserve and other government agencies to indicate a typical cost of residing, nonetheless the measuring stick has modified more than one cases over the years, persistently ensuing in decrease reported numbers with each and every methodological shift. Per Shadow Stats, utilizing an older and more right measure of inflation from 1980, inflation sits on the novel time closer to 15%. I’m confident that most of us would reveal inflation feels loads closer to 15% than it does to 5%.

So, what does this mean for bitcoin? Bitcoin is an inflation hedge in spite of the entirety, good?

I’m not so determined that sustained, excessive inflation will result in a transient-time period label jump for bitcoin. The motive I reveal that is attributable to this sense that the monetary plot underpinning the arena economic system is broken and due for a day of reckoning. The contemporary-day fiat currency experiment that took shape 50 years within the past when President Nixon severed our last ties to the gold normal has failed. Versus brooding about what bitcoin’s label can be in U.S. dollar terms in six months, one year and even five years from now, I in most cases discover myself brooding about the compounding damage being precipitated by reckless monetary policy everywhere the arena.

I strongly help you to maintain a look on the below interview with Lawrence Lepard the place he discusses this very self-discipline:

Many factor in that a crumple of the U.S. dollar would be an indecent scenario, nonetheless would a severe monetary pullback within the come future be that a ways fetched? The argument that inflation is nice for bitcoin is mostly correct. It opens peoples’ eyes to a higher plot, nonetheless a ensuing recession or despair would no doubt result in a challenging topple in asset costs all the plan in which by the board, bitcoin included.

Bitcoin’s Correlation To Diverse Markets In 2022

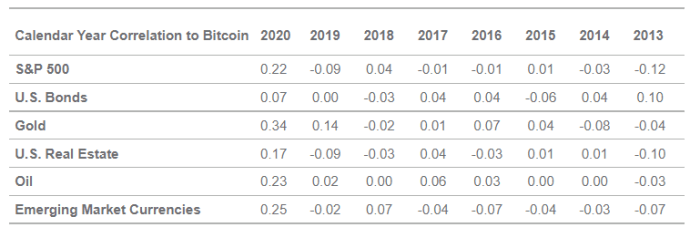

One other idea discussed within the above video is bitcoin’s increasing correlation to the S&P 500. By 2019, there used to be almost no relationship between bitcoin and the S&P 500 (or with out a doubt any other significant asset class for that matter), nonetheless a slight correlation used to be illustrious in 2020 and it’s bolstered for the period of 2021.

Is that this a model that can continue as more institutional investors come on board and now we maintain more publicly-traded bitcoin companies? If more investors who in most cases haven’t regarded at bitcoin originate procuring for it, then bitcoin’s “behavior” will originate to more closely mirror that of these investors and asset managers.

While these are just a few issues that I’ll be conserving a shut perceive on for the period of 2022, the factors above don’t impact my non-public funding thesis: clutch bitcoin. I’d be mendacity if I said I didn’t song its short-time period label actions, nonetheless whether or not we rip past $100,000 or fall attend the overall plan down to $30,000, it received’t swap my conviction within the slightest. A upward push within the label of bitcoin simply formula that I’m ready to clutch much less and dips mean I’m ready to stack more.

Are Bitcoiners Rooting For Inflation?

The premise that bitcoiners root for inflation is troubling to me and inconsistent with my interactions with the bitcoin community.

Quite a bit of the bitcoiners I’ve met care deeply about the arena. They salvage not appear to be degenerate label speculators because the mainstream media has painted them out to be, they are investors, inexperienced persons, builders, humanitarians and philosophers. Bitcoiners correct happen to pursue a direction in the direction of the betterment of humanity that most of us don’t mark and that many incumbents of the recent monetary and social plot are threatened by.

What I’ve discovered is that Bitcoiners don’t “root” for inflation, nonetheless fairly, they see it, and they hate it. Inflation strips laborious working girls and males people of their shopping energy. Inflation hurts the unlucky on the expense of the rich. It breeds corruption, it encourages greed and it distracts from monetary obligation.

These solutions are antithetical to that of Bitcoin. Hell, they are antithetical to that of a absolute best and prosperous society. So, no, we’re not rooting for inflation. We simply see it. We see the lies being fed to us pretending that it doesn’t exist or that it’s transitory or that it isn’t a enormous deal. Bitcoiners don’t root for inflation, we idea for it.

Planning Ahead For 2022

Are we on the tipping level that Foss references within the quote above? Per chance we’ve already handed it? Is Lepard’s prediction of the fall of the U.S. dollar in as dinky as just a few years alarmist? Or is he on to one thing?

Last rhetorical anticipate, for now: Possess you idea about what you’d impress if he’s good?

While I don’t know the plan a ways off Lepard’s prediction will conclude up being (if at all), I impress know this: fiat currencies are trending to zero and that model has accelerated in recent years. The nice part is, now we maintain an lumber hatch. An ark for the coming flood.

I fear the day of the following recession or despair, the day of reckoning that looks destined to come because our reckless monetary policy. I fear it a lot much less, personally, attributable to bitcoin.

Alternatively, I will be capable of’t attend nonetheless factor within the damage that can be precipitated to of us’s livelihoods. Even though that day doesn’t come within the following couple of years, that doesn’t stagger away us with out damage. Excessive inflation persevering with for the period of 2022 will trigger a range of damage by itself: rising hire costs will kick of us out of their properties, these saving for years in hopes of shopping their first house will maintain to abet, decrease-earnings households will discover it more advanced correct to position food on the table, these with disposable earnings can be inspired to spend in insist of build.

Inflation isn’t going anyplace. Now not in 2022 and never anytime quickly after. The idea that simply fixing provide chain factors will conclude inflation in its tracks is naive at most effective. Even though that used to be the sole trigger of the order, the idea that deeply-rooted provide chain factors can be addressed within the short time period is equally as naive.

All I do know is that whether or not it is seemingly you’ll perhaps per chance also very wisely be taking a look to hedge inflation, prepare for a monetary reset or simply opt out of a damaged plot, it’s an awfully good part now we maintain bitcoin.

It is a ways a visitor put up by Sever Fonseca. Opinions expressed are completely their very own and impress not essentially agree with these of BTC Inc or Bitcoin Journal.