Shutterstock quilt by F. ENOT

Key Takeaways

- Bridge Mutual is an modern possibility protection platform that lets users steal and underwrite insurance for crypto resources and protocols.

- The usage of Bridge Mutual’s Leveraged Portfolios unbiased, users can underwrite insurance for a pair of protection swimming pools simultaneously and fabricate a rather excessive, stable yield on USDT deposits.

- Not like varied identical protocols, Bridge Mutual has no KYC requirements attributable to it’s some distance decentralized, permissionless, and privateness-centered.

Bridge Mutual is a decentralized protection platform that lets users prefer or underwrite insurance for crypto resources, decentralized protocols, and varied centralized companies and products. Customers can present protection to their crypto portfolios from hacks, bugs, exploits, and rug pulls, or fabricate excessive yields on stablecoins as insurance underwriters.

Bridge Mutual Defined

Crypto, and seriously decentralized finance, has considered staggering boost over the closing two years. The worldwide crypto market capitalization has grown from roughly $200 billion in the start of January 2020 to around $2.25 trillion nearing the cease of this 300 and sixty five days. The full rate locked in DeFi protocols, in the meantime, has soared from roughly $500 million to over $244 billion over the same duration.

Sadly, this parabolic boost has been accompanied by an astronomical elevate in hacks, exploits, and varied security-connected points, leading to fundamental losses of users’ funds. In step with data from blockchain intelligence firm Elliptic, over $10.5 billion in rate used to be misplaced attributable to theft and fraud in the field in 2021 by myself. Spherical $2 billion of that used to be stolen straight from decentralized functions.

The excessive assortment of assaults has increased the build an explain to for possibility-mitigating solutions. Tasks on the total survey to lower the hazards from bugs, hacks, or exploits by providing profitable malicious program bounty programs and hiring third-occasion natty contract auditors. For investors, on the opposite hand, these procedures nearly by no methodology guarantee complete safety, because the alternate has already considered a pair of seasoned and fully audited protocols abilities costly security breaches.

One of the legitimate solutions for crypto investors has been shopping natty contract protection policies for crypto resources. One of the few crypto protocols that provides such insurance-esteem merchandise is Bridge Mutual—a decentralized and permissionless discretionary possibility protection platform that lets investors steal or underwrite insurance policies for crypto resources, decentralized protocols, and varied centralized companies and products.

Bridge Mutual’s chief executive officer Mike Miglio and chief of operations Lukas Napiorkowski sat down with Crypto Briefing to discuss how the protocol works, and Napiorkowski revealed that the project took inspiration from one other decentralized crypto asset quilt supplier, Nexus Mutual. On the opposite hand, Bridge Mutual takes a special skill in that it’s some distance permissionless. Napiorkowski explained:

“While Nexus Mutual admittedly impressed us, we’re going a special route. Namely, we’re a permissionless, privateness-centered platform and not utilizing a KYC requirements. As the controlling entity, we’re also ceaselessly relinquishing alter of the protocol to the Bridge Mutual DAO, intending to finally poke away it fully in the hands of the users.”

Discussing how the platform and the boost crew in the succor of it currently operate, Napiorkowski acknowledged that Bridge Mutual is no longer a protection company, but rather a decentralized entity building a platform that joins the dots between protection companies and the users who need quilt. “It’s an insurance hivemind of forms,” he acknowledged, including that the protocol mostly functions autonomously.

Bridge Mutual launched its minimal viable product in July, gathering more than $30 million in complete rate locked within days of the start no matter releasing most attention-grabbing about a sides. The preliminary model of the protocol most attention-grabbing let users underwrite and prefer insurance policies for a resolve assortment of pre-celebrated DeFi protocols. While the MVP serves its cause and works as designed, Miglio says it’s some distance a shadow of the fully-fledged Model 2 the crew released earlier this month.

Bridge Mutual Model 2: The Immense Reinforcement

Even though it’s still most attention-grabbing on hand for beta sorting out, Bridge Mutual Model 2 is an improved model of the protocol with several modern individual-going thru sides and better capital efficiency.

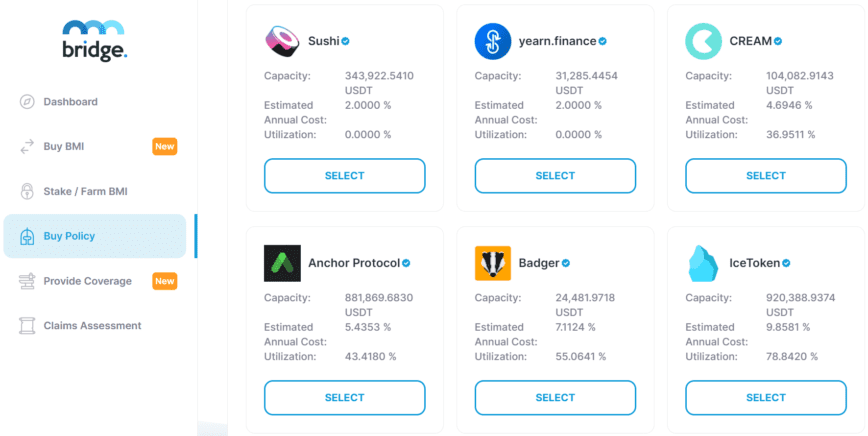

Bridge Mutual works by connecting protection companies and protection purchasers. Protection companies underwrite insurance policies by depositing collateral in USDT to particular protection swimming pools. In alternate for providing liquidity, insurance underwriters fabricate revenue from token rewards and the premiums paid by the insurance purchasers in the order protection swimming pools. The rewards are paid in BMI, Bridge Mutual’s native token. The capital equipped by the underwriters is feeble to quilt protection holders after they make insurance claims against the protocol. On the assorted hand, users attempting to discover to prefer protection for their resources deserve to pay the required top class of the particular protection pool. In alternate, they obtain receipt tokens that describe their insurance protection.

Possibly the most critical of the modern sides in Model 2 is the so-known as “Leveraged Portfolios,” representing excessive-yield and excessive-possibility profile swimming pools that permit users maintain out insurance policies all over a pair of resources or protocols without delay. Beneath the hood, when any person makes a deposit thru the Leveraged Portfolios unbiased, the capital gets deployed a pair of instances over in a single pool all over a complete lot of separate swimming pools.

This original insurance former tremendously improves Bridge Mutual’s capital efficiency. This cuts the value of its insurance policies and affords tremendously higher yields to the underwriters that offer liquidity to the swimming pools.

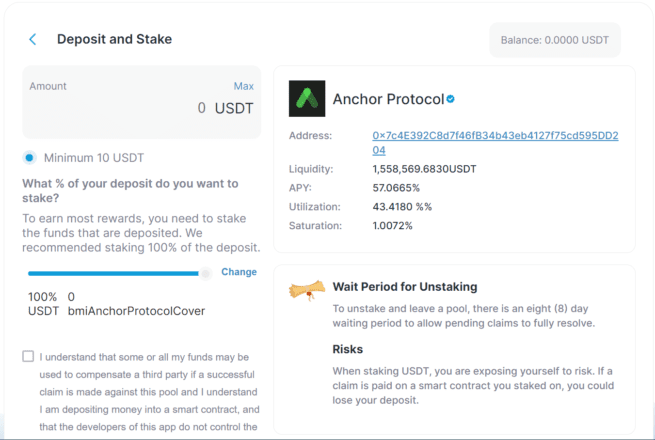

As Bridge Mutual is a decentralized and permissionless protocol, it lets anybody present insurance protection and fabricate a rather excessive yield on stablecoin deposits. To illustrate, underwriting insurance for Anchor Protocol, a lending platform on Terra that provides 19.5% passion on UST deposits, currently yields roughly 57% APY. Anchor holds over $10 billion in complete rate locked and has by no methodology been exploited, which also can make underwriting insurance an elegant proposition for some users.

Of us that don’t genuinely feel safe leaving their resources on Anchor without safety can leverage the Bridge Mutual platform to steal insurance on their deposits. At expose, the value for such a protection is around 5%, which would poke away investors with around 14.5% of yield on their insured investments given Anchor’s 19.5% mounted rate.

The pricing every protection on the platform is sure completely by present and build an explain to. Insurance protection policies change into more expensive when the build an explain to for protection, or the “utilization ratio,” is excessive and the present of protection is scarce. Conversely, when a protection pool has a tidy quantity of unused liquidity, the value for shopping an insurance protection is lower.

While procuring for and providing protection seems esteem a easy route of from the users’ point of see, the protocol uses a assortment of advanced improvements in the succor of the scenes to make certain capital efficiency and take care of competitive profit at some stage in the decentralized insurance niche. To illustrate, Bridge Mutual Model 2 has introduced two internal swimming pools: the Reinsurance Pool and the Capital Pool.

The Reinsurance Pool uses protocol-owned resources to boost the present of cheap insurance on chosen protection swimming pools, thus bettering operational and capital efficiency all around the board. It’s funded thru 20% of all premiums paid by protection holders and the revenue generated from the Capital Pool.

The Capital Pool represents Bridge Mutual’s DAO-managed funding arm. It’s an externally oriented liquidity pool that utilizes slothful, protocol-owned resources to fabricate yield all over resolve DeFi platforms and generate revenue for the protocol and BMI holders. The Capital Pool works to combination the slothful USDT from the protection swimming pools, build it to work on low-possibility DeFi platforms, and let the DAO judge on how the generated revenue is spent.

Insurance protection Designed for Web3

Bridge Mutual’s form out Web3 assemble principles has given it a moat enact against varied identical protocols. It’s decentralized, permissionless, DAO-managed, and functions autonomously. “We’re gigantic on decentralization and Web3,” says Napiorkowski. “We predict about Bridge Mutual needs to be accessible and uncomplicated for everyone to make spend of—wherever that that you just might presumably presumably also be on this planet, join your wallet and obtain your protection. That is the energy of accessible crypto.”

Bridge Mutual will at this time let any particular individual or project assemble and present liquidity for protection swimming pools for any natty contract, alternate, or listed service in crypto. Apart from that, Model 2 also affords a defend mining unbiased that DeFi initiatives can spend to assemble protection swimming pools for their protocols and spend their native tokens to incentivize liquidity. Defend mining helps each and each particular individual DeFi initiatives and insurance underwriters: DeFi initiatives obtain to stable protection liquidity for their protocols, whereas underwriters take advantage of publicity to multi-token rewards.

“Anybody can add their protocol or asset to our platform and make an insurance pool for it,” emphasizes Miglio, arguing that this affords the protocol a competitive profit in the market. “Within the long term, Bridge Mutual might well bask in protection for anything else and everything, whereas varied insurance protocols will most attention-grabbing bask in the time to whitelist so-known as “blue chip” initiatives.”

Bridge Mutual’s equipped policies are currently restricted to natty contract insurance. On the opposite hand, sooner or later, the protocol plans to elongate its offerings to encompass stablecoin insurance to give protection to against de-pegging, and insurance for resources deposited on centralized service companies and exchanges equivalent to Nexo, Blockfolio, Binance, and FTX. Miglio says he hopes that Bridge Mutual can even be ready to make more primitive forms of protection, equivalent to health, car, or malpractice insurance.

Final Suggestions

While hacks and exploits are a protracted-established incidence in the crypto dwelling, build an explain to for crypto insurance merchandise has to this point remained rather low. On the opposite hand, right here is unlikely to dwell the case for too long. As the alternate matures and more subtle investors with a more balanced flee for food for possibility enter the market, the build an explain to for crypto insurance merchandise also can still elevate.

The full addressable market for such merchandise is huge and goes previous the dimensions of the cryptocurrency market itself. As Bridge Mutual is one in every of the fitting privateness-centered and genuinely permissionless insurance protocols on the market, it has the aptitude to change into a family name in crypto insurance. Its newly constructed-in Leveraged Portfolios product represents an fully modern and groundbreaking insurance former that also can exchange all of the outlook of the crypto insurance market. By providing excessive, mounted-rate yields on stablecoin deposits, it will also entice a modern wave of investors on the possibility-taking aspect of insurance and doubtlessly lower the protection charges and elevate the capital efficiency all over all of the field.

Disclosure: At the time of writing, the creator of this unbiased owned ETH and several varied cryptocurrencies.

The certainty on or accessed thru this web location is obtained from honest sources we have confidence to be honest and legit, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any data on or accessed thru this web location. Decentral Media, Inc. is no longer an funding manual. We attain no longer give personalized funding recommendation or varied financial recommendation. The certainty on this web location is enviornment to exchange without stare. Some or all of the details on this web location also can change into outdated, or it will likely be or change into incomplete or incorrect. We are able to also, but are no longer obligated to, update any outdated, incomplete, or incorrect data.

That you just would be succesful to presumably also still by no methodology make an funding decision on an ICO, IEO, or varied funding in accordance to the details on this web location, and that that you just might presumably presumably also still by no methodology clarify or in every other case rely on any of the details on this web location as funding recommendation. We strongly counsel that you just consult a certified funding manual or varied qualified financial legitimate in case that that you just might presumably presumably also be attempting to discover funding recommendation on an ICO, IEO, or varied funding. We attain no longer get compensation in any assemble for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Fetch out about beefy terms and prerequisites.

DeFi Challenge Highlight: Abracadabra.Money, DeFi’s Magic Money Sp…

Abracadabra.Money is a lending protocol that enables users to deposit passion-bearing resources as collateral to borrow a stablecoin known as Magic Net Money that will likely be feeble all over a pair of blockchains. Abracadabra.Money…

Target audience Gawk: Ranking A $360 Subscription To Pro BTC Trader

We’re doing this attributable to we want to be higher at deciding on advertisers for Cryptobriefing.com and explaining to them, “Who are our company? What attain they care about?” Resolution our questions…

DeFi Challenge Highlight: Orion Money, the Contaminated-Chain Stablecoin Bank

Orion Money is aiming to change into a irascible-chain stablecoin financial institution in accordance to an modern suite of DeFi merchandise providing seamless and frictionless obtain entry to to stablecoin saving, lending, and spending. Its…

DeFi Challenge Highlight: Tokemak, the Liquidity Shadowy Hole

Tokemak is DeFi’s first Liquidity-as-a-Carrier product. It’s designed to mitigate impermanent loss for liquidity companies and stable deep and sustainable liquidity for DeFi protocols. Tokemak reactors can attend initiatives…