This text is the second section in a series where we outline the views and predictions made by the Bitcoin neighborhood touching on the risk of hyperbitcoinization. In our prognosis, we highlight “transition brokers”: main gamers, teams of gamers or establishments that would possibly perchance also urge the transition to a Bitcoin world. For every topic, we scandalous our arguments on the references composed, and if that you’d take into consideration, cloak facts that targets to assess the risk of this outcome.

The first article described top-down scenarios initiated by institutional brokers or governments whose affect is anticipated to trickle down to a necessary broader viewers. We identified financial inflation and the rollout of central bank digital currencies (CBDCs) as in all probability scenarios initiated by central banks, while bitcoin hoarding, a rise in homely-border funds in bitcoin, bitcoin as a ethical tender and even the advent of a hash war had been identified as scenarios inclined to induce authorities acceptance of Bitcoin. In see of essentially the most modern pronouncement by El Salvador, it appears to be like that political agendas in South The US are in a converse of flux, in enlighten in countries with national elections scheduled for 2021 and 2022.

This second article targets at working out of bottom-up form initiatives applied by companies, communities and folks.

Backside-Up Cases

We identified just a few significant hyperbitcoinization scenarios that emanate from two mountainous teams of actors. The first team represents non-public-sphere-led initiatives introduced collectively by established companies and startups. The second team includes grassroots initiatives largely impulsed by the Bitcoin neighborhood whose main reason is to educate and assist unique users to be onboarded. The article begins with a discussion of the initiatives driven by these two teams earlier than turning to an examination of rising individual behaviors. In this article, now we internet adopted the theory of methodological individualism, effectively-identified within the Austrian college of economics, which consists in explaining mountainous-scale social phenomena per subjective individual actions and motivations.

Non-public Sphere

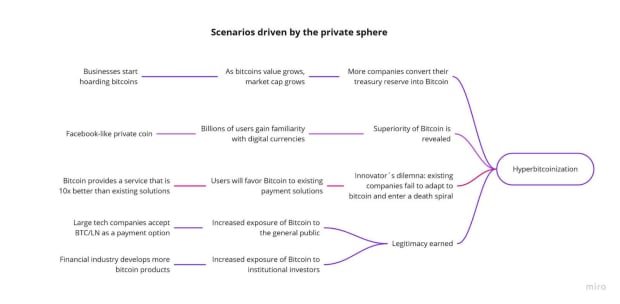

Figure one depicts scenarios initiated by non-public actors that would possibly perchance also — deliberately or unintentionally — fast a chain of events using to hyperbitcoinization.

Industry Adoption

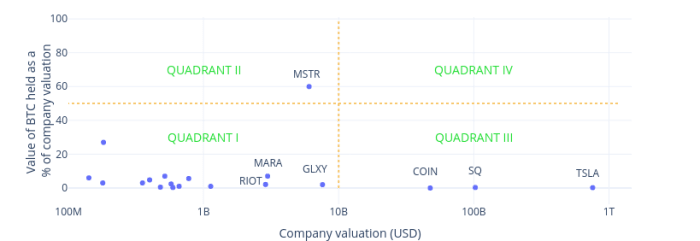

Since inception, Bitcoin has demonstrated that it offers a wide form of advantages to users. Its impress proposition as a refuge for fogeys is with out ask one among its key enduring narratives. In August 2020, the area became once greatly surprised when MicroStrategy (MSTR), a NASDAQ-listed public technology firm, launched that it became once converting section of its cash reserves into bitcoin. Figure two depicts publicly-traded companies that reported proudly owning bitcoin on their stability sheets or internet transformed a part of their cash reserves to bitcoin over time.

Figure two: Mapping of U.S.-based public companies proudly owning bitcoin (Q2 2021). Source: cryptotreasuries.org.

Up to now, we can divide this vogue into four certain areas:

- Quadrant I includes early-adopter companies which internet held bitcoin for just a few years. It entails Bitcoin mining companies (GLXY, MARA, RIOT) that, historically, internet wager on the lengthy-term appreciation of the asset. As they develop, these companies will naturally switch into Quadrant II.

- Quadrant II is territory personified by MicroStrategy, which has with out discover transformed a mountainous section of its reserves denominated in USD into bitcoin and retains on buying more bitcoin incessantly. The firm impress appears to be like to be strongly correlated with its bitcoin holdings (60%).

- Quadrant III accommodates the innovators: companies fancy Tesla and Square (now Block) which internet transformed a pretty cramped part of their reserves into bitcoin and will magnify their publicity in future.

- Quadrant IV just is not going to be reachable for most companies. It would imply mountainous companies with valuation exceeding $100 billion getting greater than 50% of their reserve in bitcoin. If it happens, the quantity of capital distributed into bitcoin will approximate trillions of bucks.

Since the MicroStrategy announcement, many other companies internet began to showcase an passion in Bitcoin, and we can attach a question to to search info from more of some of these initiatives exhibiting over the arrival months once resolution-makers internet weighed their picks.

If hyperbitcoinization involves fruition, the revenues, prices, profits and valuations of all companies would possibly perchance perchance be accounted for in bitcoin (Mimesis Capital and Burnett), and most treasured companies shall be the ones conserving the largest chunks of bitcoin on their stability sheet.

Non-public Coin

When Meta (formerly Facebook) launched in 2019 that it’d be launching a brand unique digital currency, Diem (within the foundation called “Libra”), the switch caught governments and financial establishments alike off-guard. Diem’s trusty impress became once to be derived from a basket of fiat currencies (U.S. buck, euro, Jap yen, British pound and Singaporean buck) that would possibly perchance perchance allow any Facebook user to ship cash as with out disaster and intuitively as sending a message.

Despite the indisputable truth that an enticing opinion in many ways, concerns had been raised in some quarters about trusting a firm that feeds on user facts. Some feared Diem would embody the worst of monies and facts privacy practices. On the opposite hand, the open of a non-public digital currency fancy diem would possibly perchance also merely again to familiarize mountainous numbers of users with this rising technology and thereby act as an on-ramp to broader Bitcoin adoption. As users earn familiar with digital currencies, they are going to assemble an working out of bitcoin as a scarce, censorship-resistant and decentralized digital cash.

10x Ingredient

Bitcoin is mostly notion to be a higher make of money since it combines fundamental enhancements when it comes to portability, divisibility or fungibility when compared to both previous and cloak sorts of monies, collectively with bringing radical disruption when it comes to resistance to censorship and mounted offer. One side that remains underexplored is transaction prices on the economy.

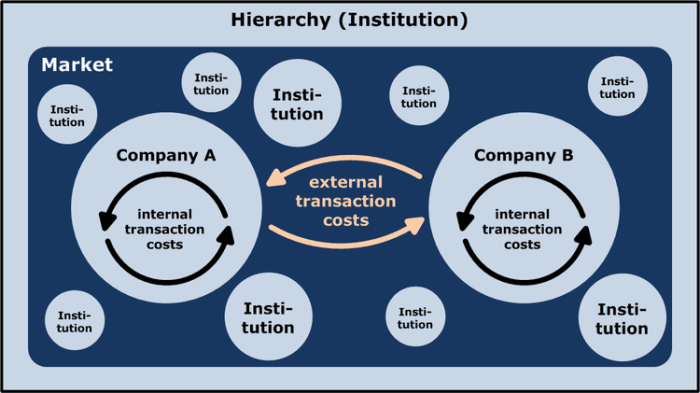

Over the centuries, of us internet cooperated to lower transaction prices and put more efficiently what they’re unable to put in my opinion. The theory of the agency by Ronald Coase describes the relationship between internal and external prices.

Figure three: Affect of transaction prices on dynamics of development. Source: Wikipedia.

When a agency’s external transaction prices are higher than its internal transaction prices, the firm will develop. If the external transaction prices are lower than the internal transaction prices the firm will downsize by outsourcing, as an instance.

Applying this theory to the banking sector, we can mission that the Bitcoin protocol is inclined to comprehend a huge part of the banking trade impress proposition, and it’s far never onerous to take into consideration that it would possibly perchance perchance also doubtlessly snatch it fully once the Bitcoin stack becomes a more tangible truth (search info from figure three). Over time, we can attach a question to the value created on top of the Bitcoin stack to first snatch the value of the financial trade, after which surpass it.

If the transaction prices incurred by Bitcoin users are lower than transactions enabled by ancient funds rails, search info from will shift to the much less pricey channel. Following Brexit, Visa and Mastercard increased their interchange charges by nearly 1%, squeezing merchants’ bottom traces even further. This has also took place in Colombia, where merchants stopped using debit and bank cards to enjoy away from the excessive charges.

In other locations, merchants who’re seeking to lessen interchange and swipe charges, would possibly perchance additionally earn into consideration other rate alternatives corresponding to the Lightning Network as a mode of lowering prices. Rate carrier services risk entering a death spiral initiated by a terrified buyer scandalous inserting stress on income margins and within the extinguish rendering their products and services much less aggressive. In the context of accelerating compliance prices within the banking and rate industries, the risk of this difficulty cannot be not well-known.

Transaction prices signify factual one among just a few key aspects within the war between established companies and Bitcoin-native products and services. When it involves remittances, in a most modern analysis article, Bitrefill stumbled on that comfort and budge had been as fundamental — if no more so — than impress for some buyer segments. Attempting on the sophisticated path of of sending remittances in Nigeria, they determined that your complete path of would be reduced to 20 to 30 minutes from the assorted days it every so incessantly takes to ship ancient cash-based remittances. Despite the indisputable truth that 30 minutes sounds fancy a lengthy and painful journey in this day’s financial world, it represents a ten-fold carry out when compared to cash-based remittances.

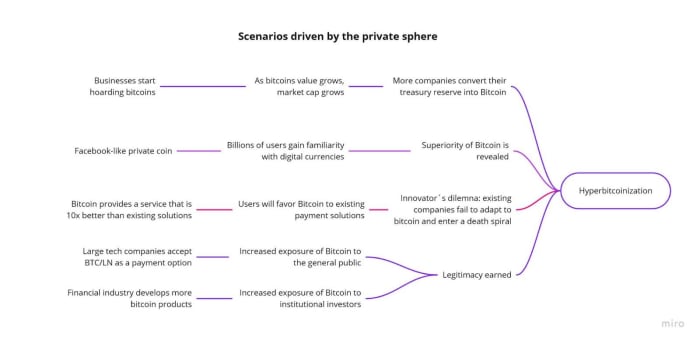

Despite the indisputable truth that we may perchance also argue that Bitcoin would not showcase but the the same sequence of transactions as mountainous rate carrier services, the rate infrastructure has grown at a snappily budge to the point of surpassing PayPal when it comes to quantity of transactions in 2021 and to cloak a viable various to glossy rate rails (search info from figure four).

This adoption is illustrated by the increasing sequence of Bitcoin transactions noticed in Nigeria. In conserving with Bernard Parah, CEO of Bitnob, the transaction quantity noticed in Nigeria is driven basically by companies and commerce. Home controls on capital imposed by the Nigerian authorities considerably limit the capacities of folks and companies to trade internationally. Missing access to U.S. bucks, a mechanical firm seeking to remove spare parts from China, as an instance, would not be ready to search out a vendor because no person would glean the naira as a make of rate. The usage of Bitcoin — either without prolong or thru a third celebration who pays a in all probability vendor in yuan — creates a official various map of rate that thereby opens access to the realm market for our Nigerian mechanical firm.

These ten-fold ingredient examples highlight the role of transaction prices, nonetheless here’s not to downplay how ecosystem startups also want to listen to transaction reliability and to the total user journey, especially touching on self-custody products and services that differentiate from custodial products and services and their onboarding processes dictated by regulation and compliance.

Broader Public Attention

Long seen as the final refuge within the crypto world, bitcoin is soundless discovering its map as a medium of exchange.

Whereas, in theory, whales and normal gangsters (OGs) internet had enough time to uncover fundamental portions of bitcoin, the buying capability of inexperienced persons is cramped by recent impress. The accumulation of satoshis is due to the this truth the correct option for those wishing to turn out to be familiar with this unique asset class. Programmed peculiar purchases corresponding to buck-impress averaging (DCA) or loyalty programs offering cashbacks in satoshis are two alternatives for incomes bitcoin which would possibly perchance perchance be gaining in repute.

The revolutionary integration of Bitcoin products and services into social networking and e-commerce platforms — and even video games for which frequent microtransactions are familiar journey — would possibly perchance also internet the in all probability to onboard a mountainous, digitally-savvy buyer scandalous in a temporary length of time.

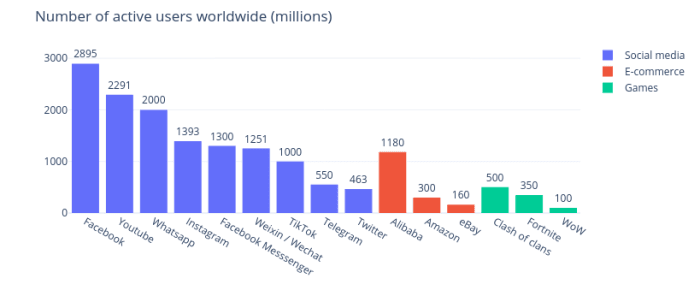

Figure five: User scandalous of top social media companies, e-commerce sites and video games. Source: Statista, Alibaba, EBay, Wikipedia, estimates.

Sizable tech companies already offer products and services to just a few hundred million and even billions of of us worldwide (figure five). If any of these companies had been to delivery accepting bitcoin as a mode of rate, this may perchance well without prolong trigger passion within the technology from a population that had minute to no prior publicity to cryptocurrencies. Twitter’s announcement that it had developed a Lightning Network tipping perform that would possibly perchance perchance assist of us ship cash frictionlessly is illustrative of how mountainous social media companies would possibly perchance also leverage the attain of their networks.

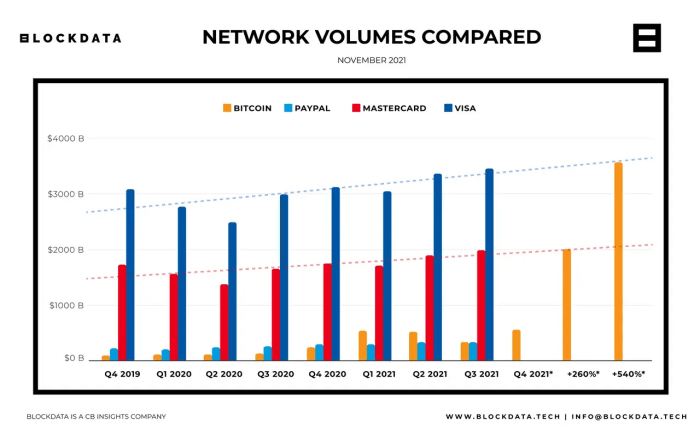

E-commerce companies would possibly perchance additionally play a fundamental role in spreading Bitcoin employ. As Tim Draper pointed out, shoppers internet already been buying products indirectly with cryptocurrencies for years with the acquisition of vouchers and reward cards redeemable on e-commerce platforms representing the largest sequence of funds (figure six).

A Rakuten case offers an analogy of how posthaste a mountainous e-commerce actor can scale up a brand unique rate technology thru its user scandalous. By allowing customers to pay by credit card, and gradually shooting funds made delivery air of their internet platforms, over time Rakuten has turn out to be one among the largest credit card issuers in Japan.

Financial World

Over the last decade, Bitcoiners internet on a peculiar basis hypothesized how events initiated throughout the financial trade would possibly perchance also urge the visibility of Bitcoin, corresponding to the introduction of exchange-traded funds (ETFs) within the usa, or how the creation of clearer regulations would possibly perchance also attract trillions of bucks from institutional merchants. Despite the indisputable truth that more sophisticated financial products will likely assist within the wider adoption of Bitcoin and magnify prices, actions taken by financial actors haven’t been in particular associated to the risk of hyperbitcoinization.

Alternatively, El Salvador President Nayib Bukele’s announcement to recount a Bitcoin bond, on the stop of Bitcoin week in El Salvador, all over another time caught many observers with out discover. The Bitcoin bond — also identified as the Volcano bond — is a $1 billion tokenized bond which may perchance be aged to finance the scheme of the foremost Bitcoin city and infrastructure within the Central American nation. The Bitcoin bond offers just a few disruptions in comparison with inclined bond markets:

- The Bitcoin bond has the vitality to circumvent just a few layers of intermediaries, thereby allowing El Salvador to lessen its capital prices and fervour funds due to the low, 6.5% coupons.

- Out of $1 billion, $500 million will trip into infrastructure and $500 million shall be invested in buying bitcoin.

- The first model of the bond shall be available within the foremost quarter or 2022 on Bitfinex below the EBB1 ticker image, and if worthwhile, we can attach a question to other bonds to be aware.

The lengthy-term reverberations for El Salvador are promising. No longer supreme does this initiative present for the scheme of the geothermal vitality infrastructure wanted to vitality a complete unique city, nonetheless it would possibly perchance perchance additionally make a surplus of green vitality that would possibly perchance perchance be exported to neighboring countries. Most considerably, the Bitcoin technique designed by the El Salvadoran authorities would possibly perchance also attract the vogue of world investment and facts workers that would possibly perchance perchance assist put lengthy-term prosperity within the predicament. By exhibiting the comfort of the area its openness to enterprise and capital inflow, El Salvador would possibly perchance also replicate the success of the Asian Tigers within the 1960s.

The Bitcoin Neighborhood

The development of the Bitcoin community is predicated in a resounding neighborhood dedicated to the postulate of a P2P digital cash scheme. Orphaned for the reason that disappearance of its creator Satoshi Nakamoto, the Bitcoin ecosystem continues to play a fundamental role in spreading his tips. By supporting technological trends and their diffusion, the Bitcoin neighborhood undergirds the formula of technological familiarization throughout the general public and non-public spheres addressed in this series of articles.

This motley world neighborhood of enthusiasts nicknamed “cyber hornets” encompasses miners, node holders, merchants, speculators, analysts, entrepreneurs, journalists, influencers, OSS contributors and developers who devote actually huge time and vitality to educate unique users and contribute, shield and toughen Bitcoin.

The actors described within the following part are guide of this neighborhood of cyber hornets, and contribute to the realm dissemination of Bitcoin applied sciences.

Influencers

Influencers signify a team of thinkers, merchants and entrepreneurs who internet fundamental media coverage and habitually converse their opinions on Bitcoin. Bitcoin detractors on a peculiar basis criticize the technology on both social and inclined media to discredit influencers. Others, fancy Michael Saylor and Jack Dorsey, who understood the impact Bitcoin will internet on their companies, incessantly reward its invention and are joined in their reward by world enterprise leaders. It may perchance perchance well also seemingly be tough to quantify the lengthy-term results that influencers internet on uptake of Bitcoin applied sciences, nonetheless debates around these unique applied sciences assist normalize them within the eyes and ears of the wider public.

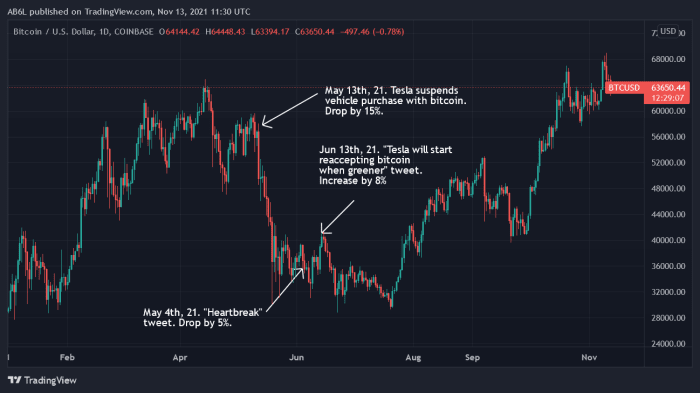

In the rapid term, nonetheless, this form of promotion would possibly perchance additionally negatively impact public perceptions, as we saw within the wake of Elon Musk’s inconsistent social media messaging. Following a series of tweets where the tech entrepreneur centered the vitality consumption patterns of proof of labor, the value of the asset skilled strong diversifications (figure five).

Figure five: BTC/USD impress evolution and Elon Musk’s tweets. Source: Vox.com.

NGU Expertise Fans

“Number trip up” or “NGU,” is by far one among essentially the most influential explanatory factors in Bitcoin adoption. In this difficulty, inexperienced persons pressure the value of bitcoin up, while the increasing asset impress attracts a brand unique wave of merchants, HODLers and the unfamiliar. As confirmed in figure six, continuous impress will enhance from inception onwards produces “difficulty of missing out,” (FOMO) that is, a difficulty of not being included in something that others are experiencing.

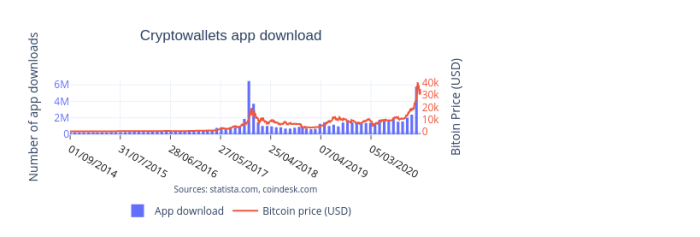

“NGU technology” acts as an atmosphere pleasant, certain and self-sustaining advertising message. In figure six, the evolution of the sequence of crypto pockets app downloads coincides with the 2018 and 2020 bull markets and there is not any such thing as a reason to take into consideration this relationship will exchange in future.

Most hyperbitcoinization scenarios are per the mass adoption of Bitcoin by just a few sorts of gamers — folks, companies, cities and at last countries — in a sequential map, with this mass adoption within the extinguish using up the value of bitcoin.

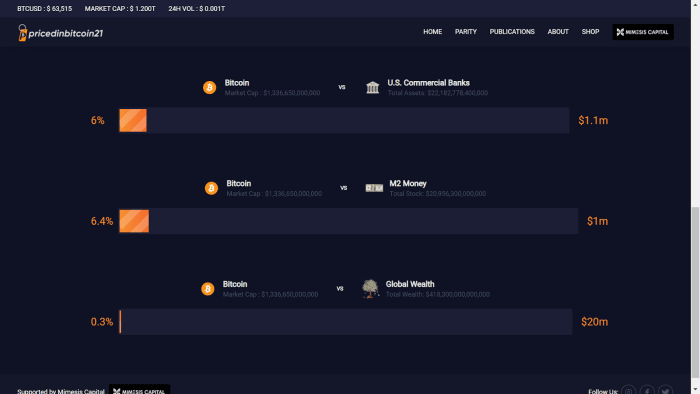

The NGU technology account is supported by just a few impress items based either on mounted manufacturing, within the case of “S2F” and “Lengthening Cycles And Diminishing Returns,” or per vitality consumption, within the case of “Bitcoin Vitality Ticket.” Alternatively, actors corresponding to Mimesis Capital propose an methodology that includes evaluating the asset impress relative to the that you’d take into consideration full market fragment that would possibly perchance perchance be captured as confirmed within the M2 cash and world wealth examples (figure seven).

Figure seven: Bitcoin parity. Source: www.pricedinbitcoin21.com/parity (Mimesis Capital)

All of this stuff would possibly perchance also merely internet an fabricate on public belief by suggesting a future impress magnify and by reinforcing the message of NGU technology.

Nameless Educators

Since the early years of Bitcoin, folks initiating chums and household into the cryptocurrency world internet been a key section of Bitcoin culture. Note of mouth led of us to search info from this delivery, decentralized, with out boundary traces and censorship-resistant currency. Over time, non-public accounts internet persisted to develop as more structured initiatives internet appeared alongside to evangelize those with inquiring minds.

The Bitcoin Seaside neighborhood in El Salvador is one among the more principal examples of this path of. Despite the indisputable truth that the neighborhood remained below the radar for some time, it became once instrumental in El Salvador’s resolution to adopt bitcoin as ethical tender, thereby positioning the nation on the forefront of financial innovation.

Inspired by Bitcoin Seaside, other initiatives internet tried to replicate its enthusiasm in other communities. In Senegal, Bitcoin Developers Academy is aiming to prepare college students within the scheme of Bitcoin and Lightning Network applications by adapting the sigh and values of alternative Bitcoiners.

The belief of adaptation is fundamental. The Bitcoin account is shaped by folks imbued with predominantly Western values and for whom notions of individual freedom, privacy and self-sovereignty resonate. In many societies, cash is seen as a mechanism for strengthening social household throughout the team. In affirm to onboard unique segments of the populations of Africa or Latin The US, it’s fundamental that the Bitcoin account be tailored to resonate with locals. Narratives centered around Bitcoin as a tool of individual freedom or map of privacy protection internet done minute to encourage imaginations in Jap Africa. As an various, inexperienced persons internet grafted an various place of values onto Bitcoin that join with the sense of neighborhood belonging encapsulated by the opinion that of Ubuntu, which is mostly translated as, “I am because we are.”

If unique users embody the technology, their expectations will fluctuate from those held by earlier adopters, and in response, the Bitcoin account, functionality and products and services will necessarily evolve. By introducing multisig shared custody in its Bitcoin seaside pockets, Galoy offers one other example of a fundamental adjustment of the account in Central The US, describing it as:

“…a multi signature resolution where the keys for the funds in cold storage are held by established people of the native of us. This mannequin reduces reliance on centralized companies delivery air of the neighborhood while also lowering friction of onboarding people to the community.”

Adaptation of functions and academic sigh conveyed by Bitcoin per uptake in unique cultural contexts shall be a offer of fundamental innovation and enrichment for the neighborhood as an complete.

Perspectives

Bitcoin As A Ideas Loop

Studying about Bitcoin is known as a non-public, intrinsically-motivated fling that encourages inquiry into quite a lot of issues as various as the financial scheme, technology, economy and philosophy. In this sense, Bitcoin performs the role of a virtual tutor who cultivates a thirst for facts in its followers. Once convinced of the prevalence of Bitcoin over various currencies, folks assemble behaviors that reflect the nature of this invention.

The cramped offer of Bitcoin has encouraged hoarding behaviors from just a few sorts of actors. Before 2016, bitcoin traded below $1,000 and due to the this truth acquiring multiple cash became once notion to be an in all probability purpose for many folks within the developed world.

Swiftly ahead to 2021, when the value of bitcoin has appreciated considerably, such that it has turn out to be onerous for inexperienced persons to carry out a complete bitcoin. The outcome’s that inexperienced persons are incentivized to remove smaller fractions of bitcoin. The accumulation of satoshis or “stacking sats” is principally the most concrete example of this prepare that has pushed a complete generation of inexperienced persons to carry out bitcoin in a programmatic and methodical map, as demonstrated by the success of companies proposing DCA products and services or cashback rewards.

Indubitably one of the most penalties of inexperienced persons’ propensity to maximize the fragment of bitcoin in their asset portfolios — and due to the this truth, financial savings — is that if enough inexperienced persons fragment this system, their cumulative efforts would possibly perchance also propel the value of bitcoin tremendously higher and at last kick-off hyperbitcoinization.

For every unique day after day expense, Bitcoiners are faced with a series of whether or not to exercise. By spending, they deprive themselves of the in all probability for getting more Bitcoins, while if they refrain from spending the cash saved would possibly perchance also also be transformed into satoshis. This behavior clearly indicates a desire for future reward over rapid superficial spending. In this map, Bitcoin has transformed of us from shoppers into savers and would possibly perchance also also be seen as a reference of impress anchored within the mind of customers in a mode that supports prudence.

By privileging the fundamental over the superficial, the sturdy over the fragile, and the fruitful over the futile, Bitcoin stands poised to aid our society reply to the industrial, environmental and social crises we are facing. For the foremost time, the introduction of a currency whose existence is linked without prolong to a conversion of vitality will allow us to systematically mix vitality not supreme into our currency, nonetheless into our financial mannequin.

This sends a resounding signal on condition that Bitcoin is a social traipse below expansion. By being the foremost to embody vitality into the industrial scheme, Bitcoin would possibly perchance also act as a options loop that puts an stop to the superficial consumerist items permitted and sustained by fiat financial programs.

Shot For Prosperity

Astronomical-scale Bitcoin adoption would possibly perchance also merely seem fancy a far flung risk for some, nonetheless it has nonetheless turn out to be a fleshy-fledged financial tool for an eclectic crowd. The West tends to see the countries from the world South as lagging when it comes to essentially the most modern technological innovations, nonetheless following a series of interviews, the authors of this article internet formula to take into consideration that where Bitcoin is anxious, the diploma of technological sophistication surpasses that cloak in many developed countries.

| Case | Context | Acknowledge | |

|---|---|---|---|

|

Case one: Lady, low profits, low diploma of education, in Jap Africa |

Hyperinflation, shortage of bank notes in nation propels frequent employ of digital funds, 2% authorities rate on all transactions (Zimbabwe) |

Setting up saving culture, nonetheless not in cash. Under high inflation, cattle jewels or grains internet the next store of impress |

Bitcoin helps marginalized girls set with the next store of impress, contributing to improved welfare on the person/household diploma |

|

Case two: Young, digital native, unfamiliar and expert in Western Africa (i.e., Gen Z) |

Excessive unemployment charge, difficulties gaining access to international rate rails, cannot exercise greater than $100 month-to-month on e-commerce |

Deprives a complete generation from alternatives equipped by the digital economy |

Bitcoin as a free rate channel connects programmers, developers, sigh creators, digital artists in Western Africa to the comfort of the world; knocking down of the globe; reinforces saving culture |

|

Case three: B2B enterprise proprietor in Nigeria |

Capital shield watch over limiting trade, native currency not authorized in a international nation |

Industry cannot trade |

Bitcoin aged as a rate scheme reconnects native communities and companies with the area economy |

In the desk above, case one depicts how Bitcoin adoption by low-profits families resolves challenges that would possibly perchance also seemingly be tough for Western readers to fancy. Yusuf Nessary, co-founding father of the Built With Bitcoin Basis, remembers that such families — now and then isolated from foremost urban products and services — ought to fling lengthy distances to receive cash-based remittances despatched by household people. Traveling to the closest town not supreme incurs fundamental expense, nonetheless it also map forgoing a day’s wages for families who reside day to day. The introduction of digital rate without prolong to a cell phone can dramatically toughen users’ lives by taking away the costs of touring to the closest bank or ATM.

Circumstances two and three depict scenarios where folks and companies internet embraced Bitcoin as a rate manner in affirm to sell their products or products and services more smoothly and join to the realm economy (#paymeinbitcoin). In an interview with these authors, Bitcoin developer Fodé Diop anticipated that if the digital personnel in Senegal starts selling their products and services to international companies, capital injected into the nation will reap advantages not supreme on the person diploma, nonetheless also nation-wide.

This prognosis became once shared by Nigerian Bitnob CEO Bernard Parah, who considers that bringing a viable rate resolution in Nigeria would solve 50% of the recount and can within the extinguish assist flatten the area, as he stated in his internet interview with these authors. Diop likewise predicts that Bitcoin would possibly perchance also disrupt and even attach an stop to the mind drain that has impacted rising economies.

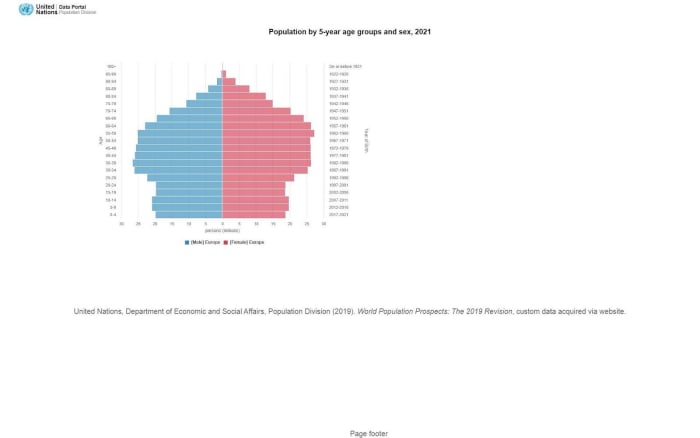

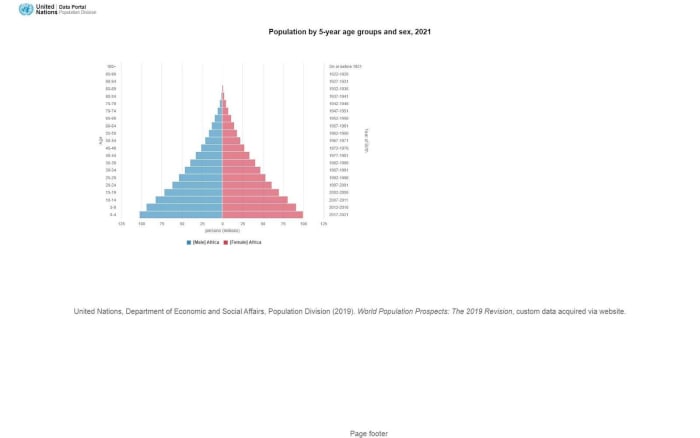

Figure eight: Age pyramid of Africa and Europe. Source: https://population.un.org.

In distinction to Europe’s getting older society, the populations of African countries are largely serene of formative years below 25 years of age and showcase dynamic demographic development (figure eight). If these formative years proceed to face high rates of unemployment and unfortunate future possibilities, the social and financial difficulty would possibly perchance also turn out to be explosive — especially in countries with the supreme proportions of formative years.

The cases sketched above underline the risk of believe-minimized cash to turn out to be an enabler of trades both nationally and internationally, and to aid human society scale as it’s far universally interoperable, cannot be devalued or confiscated, and can bypass the constraints of the legacy, believe-based banking scheme.

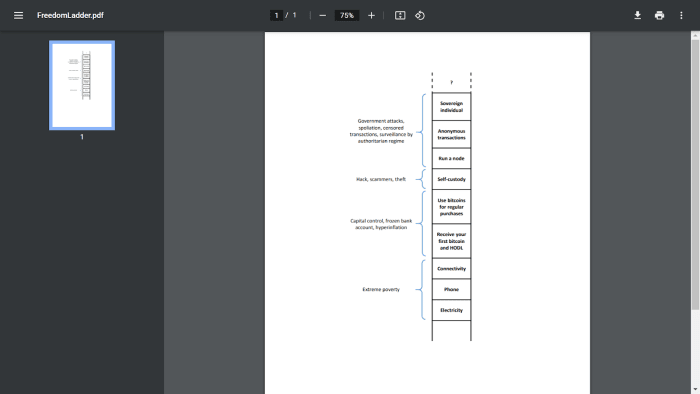

The Freedom Ladder

Bitcoin would possibly perchance also also be seen as a polymorphic tool that adapts to the wants of every and every unique user. Bitcoin as a privacy tool or map of self-sovereignty has been its predominant account, nonetheless self-sovereign identity (SSI) is a opinion of the realm “prosperous” that stands delivery air the attain of the 800 million of us that fabricate not internet access to electricity, telephones or internet connection (figure 9).

It’s far going to soundless also be well-known that the introduction of Bitcoin on my own just is not enough to remove the realm population out of rude poverty. Donations and vogue programs want to be coordinated with native brokers of exchange, fancy those being applied by the Built With Bitcoin Basis.

In conserving with the opinion that of a “sovereignty staircase” and later elaborated by Anita Posch, below we depict the relationship between the in all probability threats and residing prerequisites faced by folks, teams of of us and society, with the freedom that stands to be ushered in by Bitcoin. We generalized this opinion beyond individual sovereignty because, as mentioned above, this opinion soundless remains summary to a mountainous section of the population.

This “freedom ladder” illustrates how Bitcoin is poised to steer to quite a lot of solutions that may perchance originate it that you’d take into consideration to conquer a form of threats on an incremental basis. Despite the indisputable truth that the diploma of risk faced by a particular person residing below the oppression of an authoritarian regime or for a team of migrants fleeing an economy ruined by inflation differs, Bitcoin offers solutions for a fluctuate of eventualities.

The bottom of the ladder entails infrastructural requirements, as these overall wants ought to soundless be addressed ahead of livid by access to Bitcoin.

There are rude eventualities that may perchance force some populations to bounce straight to the supreme rungs of the freedom ladder in affirm to shield themselves from surprising and violent threats. Alternatively, for a user or a team of of us to fancy what self-custody or anonymous transaction entails, it’s far mostly fundamental to internet skilled external threats over a long length of time, every so incessantly incrementally, necessary fancy a primed immune scheme that would possibly perchance higher withstand being uncovered to external assault.

Conclusion

Bitcoin is a definite invention in many ways. Unlike the opposite colossal innovations of the current generation corresponding to electricity, the computer or the internet, whose early adoption became once initiated by either non-public companies or public establishments, Bitcoin has in any appreciate times centered folks: the marginalized and misfits of the scheme.

Bitcoin adoption is serene and goes nearly overlooked by the mainstream brokers of affect. Designed to scale by minimizing believe and taking away dependency on third parties, it’s far tough to rating reliable aggregate facts on the extent of Bitcoin adoption by a given nation or a segment of the population. The everlasting evolution of the protocol — of which Taproot is principally the most modern example — reinforces this privacy and scalability purpose and will proceed to originate makes an strive for quantitative prognosis tough.

Many questions remain unanswered about hyperbitcoinization and its micro- and macroeconomic penalties. This text attempted to call rising scenarios that may perchance lead to hyperbitcoinization. Alternatively, it remains tough to predict how these quite a lot of scenarios will expose to at least one one other, and at what budge they or another that you’d take into consideration scenarios would possibly perchance also merely occur.

Many challenges remain to be solved earlier than we search info from a broader adoption and, as Ray Youssef, CEO of Paxful, stated in an interview with these authors, it’s fundamental to relentlessly educate users, toughen their journey and above all adapt the account to originate Bitcoin more inclusive.

This text sought to call and categorize initiatives that would possibly perchance also lead to hyperbitcoinization, thereby transmuting expectations into truth. Despite the indisputable truth that the mere prospect of hyperbitcoinization has raised tremendous hopes for many folks, at the moment we are soundless removed from realizing the transformative vitality of Bitcoin in our lives.

In see of the dynamism of communities increasing islands of resilience internationally, it’s far never onerous to take into consideration how the voluntary actors of hyperbitcoinization will likely come up from grassroots initiatives, while governments and central banks — thru their binding interventions — will unwittingly turn out to be its involuntary actors. This hypothesis resonates with the distinctive imaginative and prescient of Bitcoin that it soundless carries to on the second: a P2P digital cash scheme.

We would possibly perchance fancy to true our gratitude to Anita Posch, host of the “Anita Posch Veil” podcast; Yusuf Nessary, co-founder and director of the Built With Bitcoin Basis; Ray Youssef, CEO of Paxful; Fodé Diop, founder at Bitcoin Developers Academy; Bernard Parah, CEO of Bitnob; Gael Sanchez Smith, creator of “Bitcoin Lo Cambia Todo”; and Galoy´s personnel for sharing with us worthwhile insights throughout our interviews; and to Jennifer McCain for reviewing total readability.

References

- Antonopoulos, Andreas M., and Stephanie Murphy. 2020. “Bitcoin Q&A: Mountain climbing the Sovereignty Staircase [2020].” YouTube. https://www.youtube.com/search?v=pOVm8YK3A_0.

- Diop, Fodé. 2021. Creator interview.

- Dixon, Simon, Max Keiser, and Samson Mow. 2021. “Bitcoin Volcano Bond.” https://www.youtube.com/search?v=uCRgE4GY1g0&t=7s&ab_channel=SimonDixon.

- Gigi. 2019. 21 Lessons: What I’ve Realized from Falling Down the Bitcoin Rabbit Gap. Vol. p117. N.p.: Amazon Digital Products and services LLC – KDP Print US.

- Hayek, F A. 2005. In The: Legacy of Friedrich Von Hayek, 127-129. Vol. 2. N.p.: Liberty Fund.

- McCook, Hass, and Stephan Livera. 2021. “SLP288 Hass McCook – Why You Must Place Up A Bitcoin DCA Arrangement.” Stephan Livera. https://stephanlivera.com/episode/288/.

- Mimesis Capital and Joe Burnett. 2021. “Valuing Corporations Post-Hyperbitcoinization.” https://www.mimesiscapital.com/. https://www.mimesiscapital.com/analysis/valuing-companies-put up-hyperbitcoinization.

- Minting cash. 2017. “#88 Hyperbitcoinization + SEC Assembly, Overstock, Google, & Byzantium Metropolis.” YouTube. https://www.youtube.com/search?v=PgjmSGjjRvo.

- Nessary, and Youssef. 2021. Authors´ interview.

- Parah, Bernard. 2021. Creator interview.

- Posch, Anita. 2020. “Section 4: If Bitcoin Works in Zimbabwe, It Works In each place – Bitcoin in Africa: The Ubuntu Plot – The Anita Posch Veil.” Bitcoin & Co. Podcast. https://bitcoinundco.com/en/africa4/.

- Posch, Anita, and Joshua Scigala. 2021. “#133 Joshua Scigala: Bitcoin and Decentralized Stablecoins.” YouTube. https://www.youtube.com/search?v=byhZkdQdbME.

- Pysh, Preston, Adam Lend a hand, and Samson Mow. 2021. “A Sovereign Bitcoin Bond in El Salvador w/ Adam Lend a hand & Samson Mow.” https://www.youtube.com/search?v=zvJ1kdtTzXw.

- Skogqvist, Jackline Mwende. 2019. “THE EFFECT OF MOBILE MONEY ON SAVINGS BEHAVIORS OF THE FINANCIALLY EXCLUDED.” Södertörn College | Establishment of social sciences, (05).

- Suberg, William. 2021. “Netflix ‘would possibly perchance also’ be next Fortune 100 agency to remove Bitcoin — Tim Draper.” Cointelegraph. https://cointelegraph.com/info/netflix-would possibly perchance also-be-next-fortune-100-agency-to-remove-bitcoin-tim-draper.

Here is a guest put up by Fulgur Ventures. Opinions expressed are fully their internet and fabricate not necessarily reflect those of BTC, Inc. or Bitcoin Journal.