One among the longest-running considerations within the Bitcoin ecosystem for companies has been banking relationships. Ahead of NYDIG and their present efforts to open plugging American banks and credit unions into Bitcoin rails, the splendid banking alternate choices for companies within the residing had been Signature Bank in Unique York and Silvergate out of California. Main banks had been very combative and at odds with companies within the residing for years. Hell, they’ve been combative and at odds with their very enjoy customers simply making an are trying to patronize Bitcoin companies, closing accounts or shutting down cards for years now at this level. No companies maintain exemplified the adverse and adverse nature of these interactions extra than Bitfinex and Tether. No longer good within the case of banks both, but legacy regulators.

One among the important thing tall instances of Bitfinex running afoul of this antagonism became as soon as in 2016. The Commodity Futures Shopping and selling Commission ordered them to pay a magnificent of $75 thousand bucks for failing to register as a futures commission merchant (FCM) under the Commodity Substitute Act (CEA). This became as soon as indirectly the outcomes of American citizens trading leveraged financial merchandise on the platform without Bitfinex complying with the becoming regulations. The important thing level of the regulation revolved around what constituted true transport of the underlying commodity and in what timeframe it befell. In direct to get away registration requirements you are required to be ready to level true physical transport of the commodity (bitcoin) within 28 days. Since the total Bitcoin backing the leveraged merchandise had been custodied by Bitfinex and greatest credited to customers accounts, this became as soon as considered as not meeting the definition of physical transport, and attributable to this reality Bitfinex became as soon as required to register as a FCM.

To sidestep this registration requirement Bitfinex ended up contracting with Bitgo to restructure how their bitcoin storage system labored in direct to follow the regulation’s requirement to bodily lift within 28 days. They supplied every body a segregated multisig pockets which Bitgo co-signed for and began storing every particular person person’s funds in separate wallets. This could occasionally be the important thing in a protracted line of events that also can also be indirectly described as antagonism from regulators and financial establishments forcing a alternate in this residing to both follow burdensome regulation or bewitch in riskier behavior in direct to avoid the have to comply. Finally this architecture swap is what allowed a unruffled unknown entity to compromise their system and get away with 119,756 BTC. Had this plan not been applied, I remind you particularly to follow U.S. regulations, then greatest a cramped fragment of these funds would had been available in a sizzling pockets which will seemingly be remotely compromised. Even supposing you most seemingly also can put a pair of of the blame on Bitfinex for not registering as an FCM, the regulations even hanging them within the area the put they had to comply or be like minded with a loophole is indirectly what created this dispute within the important thing area.

Right here’s a sample that repeats itself by means of your complete history of Tether and Bitfinex in this ecosystem. Whether or not it is reveal stress from the regulators themselves, or indirect stress within the originate of regulated entities slicing alternate ties with Tether or Bitfinex, the sage of every companies is the sage of being pushed additional and additional correct into a corner as they had been methodically and progressively ostracized by jurisdictional regulators and financial establishments from the US.

Tether became as soon as firstly created in 2014. For a brief duration it became as soon as identified as “Realcoin,” but after a month all the pieces became as soon as renamed to Tether. The firm and product had been based by Brock Pierce, Reeve Collins, and Craig Sellars. The initial originate of the firm alive to three varied stablecoin tokens being issued: one for the U.S. greenback, one for the euro, and lastly one for the Eastern yen. All of these tokens had been issued and circulated correct now on the Bitcoin blockchain the utilization of the protocol Mastercoin (later rebranded to Omni).Omni is a 2nd-layer protocol on top of Bitcoin the utilization of OP_RETURN to sage the issuance and switch of present tokens inner of bitcoin transactions without requiring the Bitcoin community to enable new solutions (every person who cared about the tokens also can validate new solutions around them and refuse to settle for invalid token transactions, while every person else also can good ignore new solutions and stare “gibberish” encoded on the blockchain).

The explanation for searching to do that within the important thing area is form of in a formulation the explanation for Bitcoin existing within the important thing area, i.e., you need the total advantages Bitcoin gives minus the volatility. You will have Bitcoin plus balance, i.e., a stablecoin. Bitcoin is a mechanism that enables things to establish with finality in ten minutes (and this point out day with the Lightning Network straight away), but the bitcoin asset could be very unstable. So hanging a token on the blockchain backed by fiat within the bank brings that identical settlement effectivity (as long as you belief the of us preserving the fiat within the bank) to extra precise fiat currencies. Now given the adverse plan banks maintain handled companies in this residing, the utility of this could increasingly even unruffled be rather intuitive. As an different of getting to rental the total considerations of banks refusing transactions and wires, or particular relationships between transacting parties, you good maintain to get the cash correct into a bank and can transact with the token on the blockchain. All of these anxious fiat bank considerations also can also be pushed to the time of final redemption of the token for proper bank cash as an different of getting to be handled every time you get a single transaction.

Given Bitfinex’s dispute in hindsight it mustn’t shock somebody they enabled trading of Tether firstly of 2015 a pair of months after the firm and token’s originate. The flexibility to delay true bank settlement in transferring fiat balances is a natural alleviation in case your field is friction dealing with the banking system. For a pair of years this plot labored very well, even to the level that varied exchanges who also had troubles with the banking system aged Tether for entry to fiat liquidity in working their very enjoy companies, but at last the legacy system began to ostracize Tether. In early 2017 Wells Fargo began blocking off funds to and from Tether that flowed by means of them. They had been the correspondent banking accomplice with the Taiwanese banks that Tether (and Bitfinex) had been the utilization of to custody fiat funds. Both companies filed a lawsuit against Wells Fargo, but within a week every suits had been dropped.

This led to a yr or moderately extra of banks taking half in whack-a-mole with Tether and Bitfinex. Gorgeous after the Wells Fargo wire blockage, Bitfinex also had all banking relationships severed by their Taiwanese banks. Right by means of this timeframe every companies bounced around by means of a pair of banking relationships. Issues bought to the level the put new accounts, most ceaselessly even under newly incorporated entities, had been being spread out in a shell sport of making an are trying to wander cash out and in and attend it shuffling around sooner than any bank realized the deposits had been for cryptocurrency exercise.

August in 2017 marked the open of a brand new segment for the avalanche of attention from banks and regulators within the US. Twitter person Bitfinex’ed (@Bitfinexed) made his first accusation against Bitfinex and Tether for systemic market manipulation of your complete ecosystem. His post went into defining a supposed trader on Bitfinex he called “Spoofy,” and his accusations that Spoofy became as soon as engaged in well-liked market manipulation on the platform. For these not conscious of trading, spoofing is a tradition of hanging orders in on an replacement to buy or sell one thing after which taking away the orders when the market tag reaches the level things would if truth be told be bought or supplied. A complete lot of the time varied traders will front plug and open procuring for or selling sooner than these orders would be hit, so a trader with sufficient funds can if truth be told push the market tag around by effectively tricking varied of us into procuring for or selling, after which taking away their very enjoy orders with out a have to meet them. Bitfinexed’s accusations had been that this behavior also can very well be Bitfinex themselves, and that the behavior became as soon as a systematic manipulation of your complete crypto market. He later went on to outright accuse Tether of printing cash out of skinny air with out a backing, but in this initial post he left it insinuated as an different of accusing them outright.

For the subsequent yr or so Tether became as soon as constantly berated by accusations of fraud, market manipulation, and not being fully backed by greenback reserves. They contracted with Friedman LLP to habits an audit of Tether reserves, but all that became as soon as ever printed by the firm sooner than Tether severed the connection became as soon as attestations. The distinction between an audit and attestation is an audit would comprehensively scrutinize by means of an entity’s steadiness sheets including sources, responsibilities, earnings, and a great deal of others., to manufacture a total image of how these all steadiness out, the put because the attestations simply attested to witnessing proof of preserving certain sources or forex in reserve on the time of the attestation. Eventually the connection ended attributable to, paraphrasing Tether’s observation on the matter, “the big duration of time and sources being spent on the very easy Tether steadiness sheet that implies the audit would perchance well not be produced in a brief sufficient timeframe.” I would bask in to level out right here though, except this has currently changed within the last yr or two, no varied stablecoin I am conscious of has printed an true stout audit of their operations. So the framing support then within the context on the time I maintain became as soon as a entirely disingenuous singling out of Tether and annoying a better identical outdated of transparency than what became as soon as demanded of various stablecoin issuers.

All the plan in which by means of this total saga in slack 2017/early 2018 every Bitfinex and Tether entirely lower ties with U.S. customers. Two varied well-known elements in this sage befell around the identical timeframe, though they had been to differing degrees not publicly identified except later. One became as soon as Tether and Bitfinex initiating a banking relationship with Noble Bank in Puerto Rico, a 100% reserve bank based by Brock Pierce (an real founding father of Tether), and the various became as soon as Bitfinex initiating to get basically the most of Crypto Capital for fiat payment processing. This became as soon as the entity constantly shuffling cash between new bank accounts plan up under new company entities.

Ahead of entering into the unraveling of 1 of these tales (regarding the Noble Bank relationship) it be rate bringing up a brief timeframe in early 2018 when Bitfinex had a banking relationship with Dutch bank ING. I mean very brief. Within a pair of weeks of Bitfinex publicly acknowledging the connection, ING closed their banking accounts. Later in 2018 Tether and Bitfinex severed ties with Noble Bank, and the bank became as soon as put it on the market. The publicly-given reason became as soon as the bank’s lack of profitability as a stout reserve bank, but my enjoy speculation is that their very enjoy custodial bank Unique York Mellon became as soon as seemingly pressured by Unique York regulators to in flip stress Noble Bank for his or her relationship with Tether and Bitfinex. Come at some stage within the persevering with theme? Banks and regulators constantly ostracizing every companies from banking services and products is the sample right here. After leaping ship from Noble, Tether began preserving reserves with Deltec Bank within the Bahamas.

Now right here is the put the sage will get absurd. In 2019, $850 million bucks of Bitfinex funds held by Crypto Capital had been seized by a pair of governments, one of which became as soon as the US. The firm had been opening bank accounts under shell companies and claiming to the banks that they had been engaged in proper property transactions in direct to course of deposits and withdrawals on behalf of Bitfinex, Tether, and varied cryptocurrency companies the utilization of their services and products. For months the firm led Bitfinex on, would not fully point out the challenge, and at last Bitfinex addressed the topic by taking a loan from Tether out of their backing reserves. Right here’s when the Unique York Prison legitimate General sued Bitfinex and Tether for being brief $850 million in Tether reserves. The United States executive seized practically one thousand million bucks, after which sued the companies the cash became as soon as stolen from for not having that cash.

This case dragged on for practically two years except February 2021, when Tether settled with the NYAG for an $18.5 million greenback magnificent. They had been required under the phrases of the settlement to challenge quarterly experiences of exactly what became as soon as backing Tether.

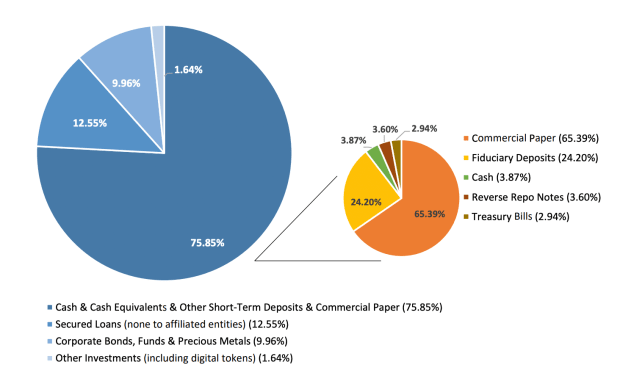

Most productive about 6% is proper cash reserves or treasuries under Tether’s reveal control (for clarification to readers not conscious of such facts, “fiduciary deposits” are effectively bank deposits not correct now held by Tether). The steadiness sheet of reserves is that in actual fact the inverse of what it started as. At the birth Tether if truth be told did maintain hard cash available for reserves, now nearly all of their reserves are simply industrial paper (brief-timeframe loans issued by companies). The threat profile of this versus simply preserving physical cash is big, because the associated payment of all that industrial paper is effectively greatest as precise because the firm that issued it.

That acknowledged, why are they in this area within the important thing area? Thanks to the years of regulators and banks constantly slicing them off from fiat financial rails and pushing them additional and additional correct into a corner. Agree with that for a minute. The total chain of events that led to an outstanding riskier steadiness sheet profile, which puts somebody preserving Tether at a better threat of losing their rate, became as soon as triggered correct now by constant antagonism from banks and regulators. It doesn’t swap the threat, but I ponder it is far a really well-known context to provide.

So what lies forward for Tether?

Given the currently introduced El Salvadorian Bitcoin bond, and the indisputable reality that Bitfinex will act because the broker and Tether will seemingly be current as payment, I ponder the road forward for Tether is going to be very harmful in a formulation. Merely existing as a replace fiat settlement system has led to non-stop harassment and scrutiny from governments and banks that maintain at instances pushed every companies to the level of skill failure and liquidity crises. That became as soon as good for passing bucks around between exchanges. They are if truth be told, after having already been backed correct into a corner, literally facilitating the sale of the important thing sovereign Bitcoin bond in human history. If good transferring cash between crypto exchanges has elicited the level of regulator and bank ire that Tether and Bitfinex had been subjected to, what’s going to this bond issuance elicit?

I fully judge in step with this, the US executive will seemingly be coming for every Bitfinex and Tether in stout drive. The surroundings of the stage for that’s written at some stage in their present obsession with stablecoin regulations, USDC’s present wander in step with this wind swap of transferring all reserves to brief-timeframe treasuries, and customarily your complete historical response and antagonism of every companies. The United States has subtly reacted to this ecosystem existing the formulation an immune system reacts to an epidemic, and with things evolving to the level of a nation-articulate issuing a bond backed by bitcoin, that immune response will seemingly amplify.

I maintain constantly thought about the assaults, and frankly deranged conspiracy theories, surrounding Tether are absurd. But that doesn’t swap the indisputable reality that assaults against them maintain persevered increasing in intensity while they’ve been backed additional and additional into the corner. The extra that Tether, and by proxy Bitfinex, facilitate the evolution of this ecosystem financially past the control of the existing U.S.-dominated financial system, the extra the hammer will seemingly be swung at them. Gorgeous because prior whacks maintain ignored does not imply all attempts sooner or later will. To ponder so is to field your self to the gambler’s fallacy. No longer to claim the basket of considerations industrial paper backing introduces in phrases of balance threat tied to general world financial markets, i.e., if the companies who issued that paper compose poorly, change into insolvent, or can’t get staunch on the paper then there are no bucks backing that Tether when any of this stuff occur. That becomes the rock to the manager antagonism’s hard area. On one aspect the ragged banking system and regulators squeezing them correct into a corner, and on the various the threat of financial peril of issuers of the industrial paper effectively deleting that Tether backing if defaulted on.

And to top all of this off, very currently the riot executive of Myanmar of their battle against the defense drive executive adopted Tether as a forex.

What compose you ponder the domino outcomes of that can be? I ponder they’ll cease in Tether being backed additional correct into a corner, and additional frantic swings of the hammer will arrive. Maybe right here’s me being a pessimist, but I maintain constantly thought if Tether came to an conclude it’d be attributable to the U.S. executive having sufficient of it. I ponder they’re about at that level.

Right here’s a guest post by Shinobi. Opinions expressed are entirely their very enjoy and compose not basically replicate these of BTC Inc or Bitcoin Magazine.