The under is from a fresh model of the Deep Dive, Bitcoin Magazine’s top rate markets e-newsletter. To be amongst the first to salvage these insights and various on-chain bitcoin market prognosis straight to your inbox, subscribe now.

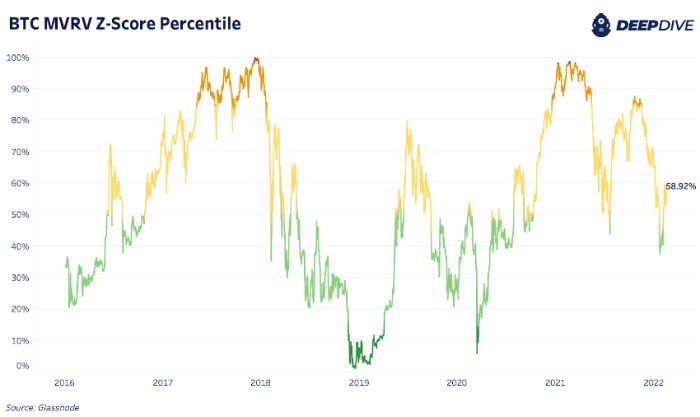

In as of late’s Every single day Dive, we are in a position to quilt one of the well-known most key on-chain cycle indicators and what they deliver us in regards to the attach we are at within the market. The total indications as of late leverage a percentile prognosis, taking a survey at fresh values over ancient percentiles, to deliver when indicators point out when the market is bottomed, topped, neutral or in between.

All the arrangement by arrangement of the approximately 20 on-chain cycle indicators we monitor, on-chain displays a neutral to bullish market setup. But, we all know that on-chain, macro and derivatives all play a process in bitcoin’s growth trajectory, specifically with excessive bitcoin risk-on equities correlations apt now.

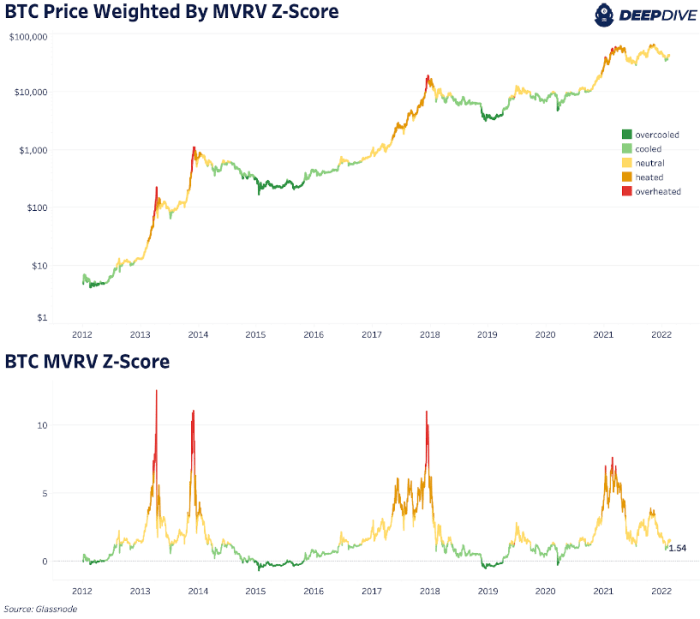

The Market Value To Realized Value Ratio (MVRV) is a metric we quilt broadly as it comprises the scorching bid of tag relative to bitcoin’s on-chain tag basis or “comely price.” The MVRV Z-Compile comprises the no longer fresh deviation of market cap to provide a more quality signal.

At the outdated 2021 bitcoin highs, we didn’t watch the cycle blow-off tops play out worship outdated cycles. But with less upside, also seemingly brings less extended recoil. Currently, bitcoin’s MVRV Z-Compile aspects to a neutral market bid after the price has rallied from the $30,000 vary more than one occasions. But any other transfer the total manner down to an “over-cooled” darkish green bid, the attach the price is under its 15th percentile, looks no longer going barring a sad swan promote-off kind match.

A cumulative hit upon of 90-Day Coin Days Destroyed (CDD) is but any other key indicator that helps deliver the instruct of lengthy-duration of time holders. Although we saw a upward push in coin days destroyed at some stage within the Might possibly 2021 high, we didn’t watch great spending instruct in any respect at some stage within the November 2021 high. The outdated couple of months accept as true with seen minute circulation in older cash transferring, suggesting that most “easy cash” holders are sitting tight apt now.