The below is from a fresh edition of the Deep Dive, Bitcoin Journal’s top charge markets e-newsletter. To be amongst the principal to fetch these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Volatility Spikes, Bitcoin Follows

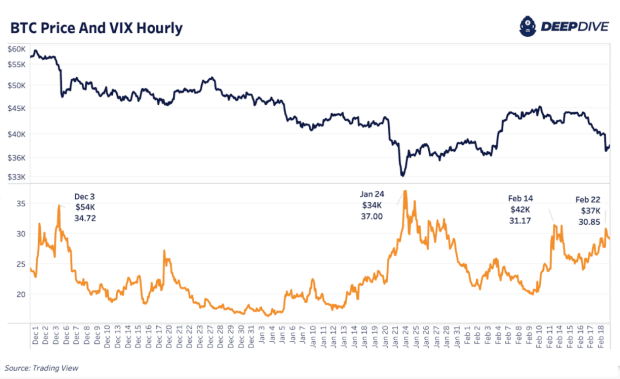

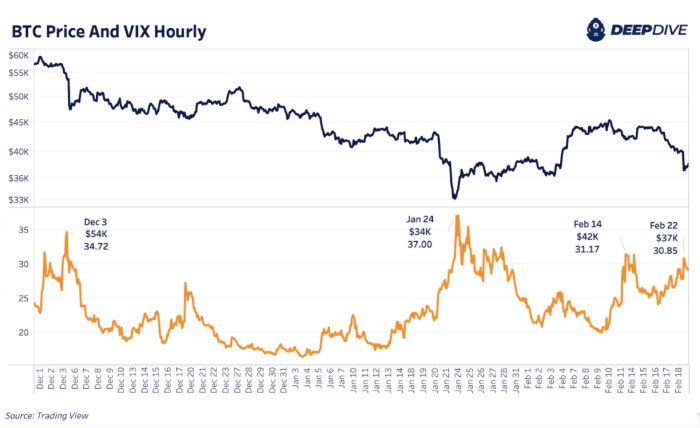

We have lined the relationship between equity market volatility and bitcoin tag motion extensively since the originate of the new 365 days, as the inverse correlation between the tag of bitcoin and the VIX (S&P 500 Volatility Index) remains extremely solid. Volatility spiked once more on the present time as markets reacted to Putin’s speech from the day prior to this, recognizing the independence and sovereignty of the Donetsk Of us’s Republic and the Luhansk Of us’s Republic.

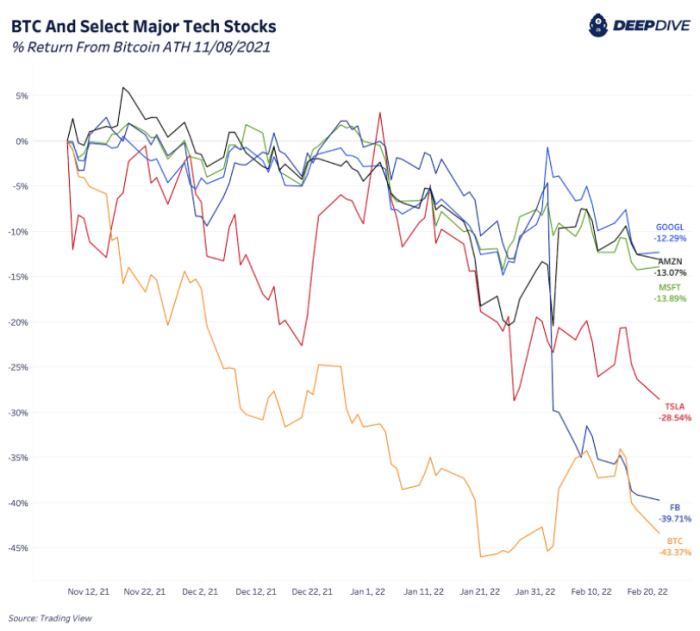

With bitcoin currently down 43% from the highs on the time of writing, other resources (particularly the tech sector) were getting hammered as of slack. We compared the performance of bitcoin since its all-time high to principal, exhaust tech shares across Google, Amazon, Microsoft, Tesla, and Fb below.

Whereas bitcoin is the worst performer of the bunch over the chosen time frame, market volatility in bitcoin is historically elevated compared to the opposite asset classes, attributable to the increase/bust monetization and adoption cycles of the monetary asset.

Bitcoin And The Dollar

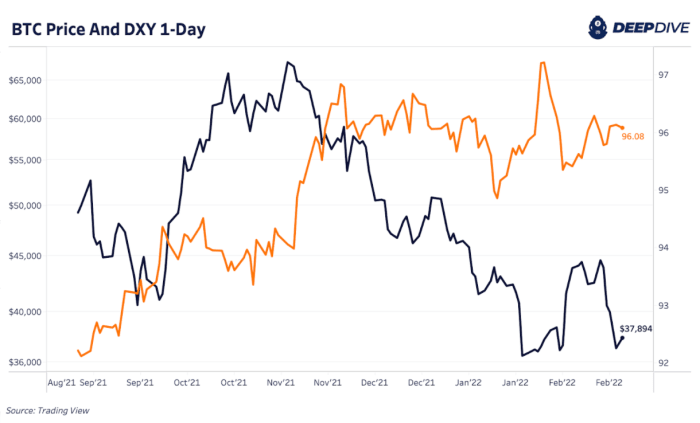

Equally, we have monitored the DXY (U.S. Dollar Foreign money Index) and its relationship to the bitcoin market, as a strengthening USD relative to other foreign forex echange.

A strengthening dollar seems to be to inversely correlate with a selling off of bitcoin and other distress markets.

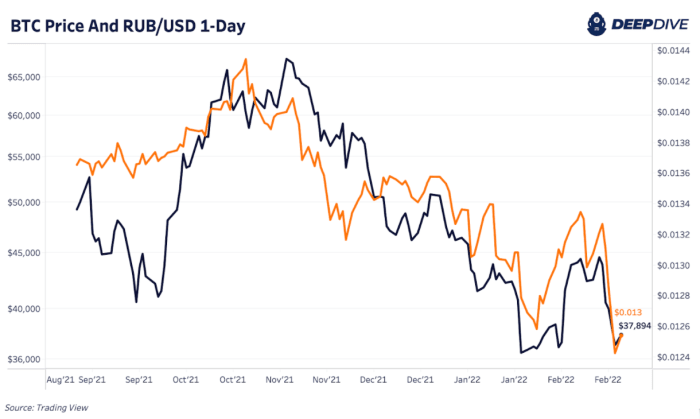

A rather attention-grabbing pattern objective no longer too long in the past has been the correlation between the Russian ruble and the tag of bitcoin over fresh months. Whereas world distress markets were selling off on news that Russia would per chance per chance clutch in warfare with Ukraine, the ruble has weakened in opposition to the dollar, in tandem with bitcoin’s tumble.

Whereas there are a mess of reasons for this potential correlation, it’s per chance attributable to the flight to safety across distress resources (into the dollar) since the fourth quarter of 2021.