The below is from a recent model of the Deep Dive, Bitcoin Journal’s top fee markets newsletter. To be amongst the most predominant to score these insights and other on-chain bitcoin market prognosis straight to your inbox, subscribe now.

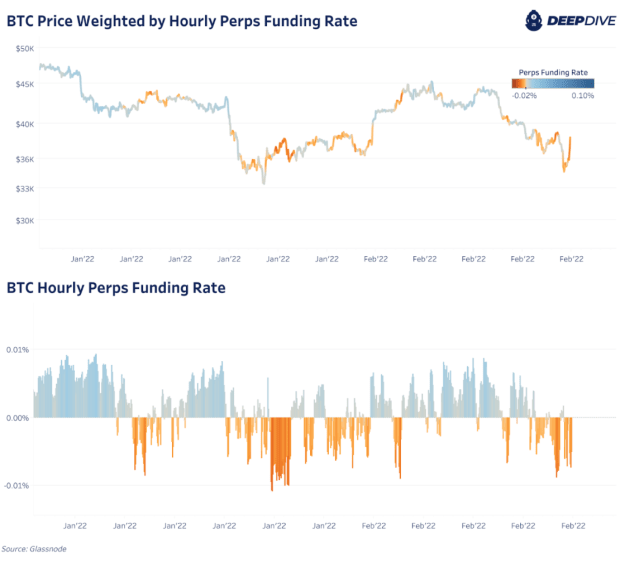

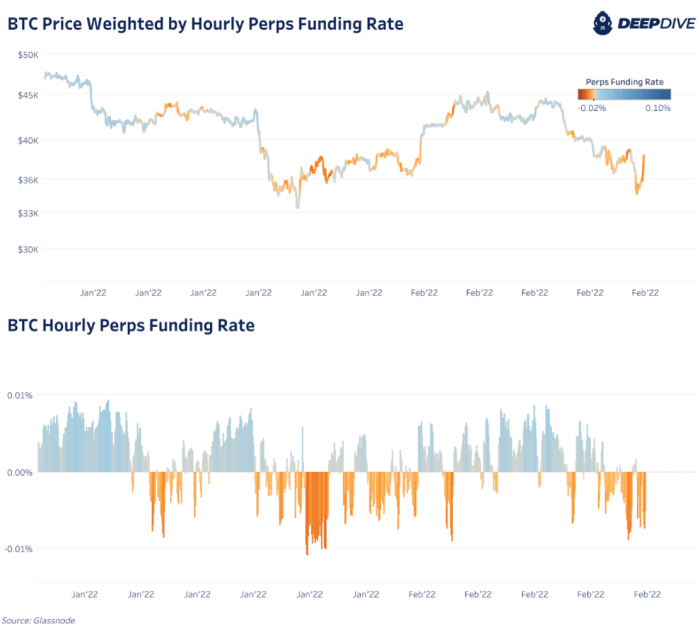

Bitcoin persisted to behave fancy a high beta, threat-on asset identical to heaps of the overrated tech sector. As Russia’s announcement of military intervention used to be proliferating across financial markets, U.S. equity markets reached as far down as -3% within the evening session, with bitcoin moreover plummeting to a low of $34,300, earlier than bottoming and aggressively rebounding to a high of $40,000 in a significant fast squeeze.

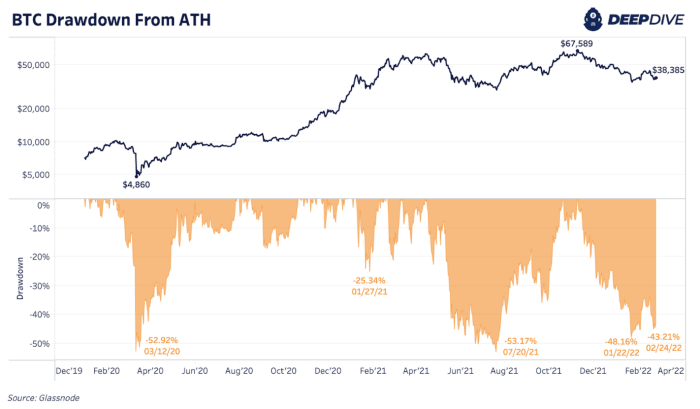

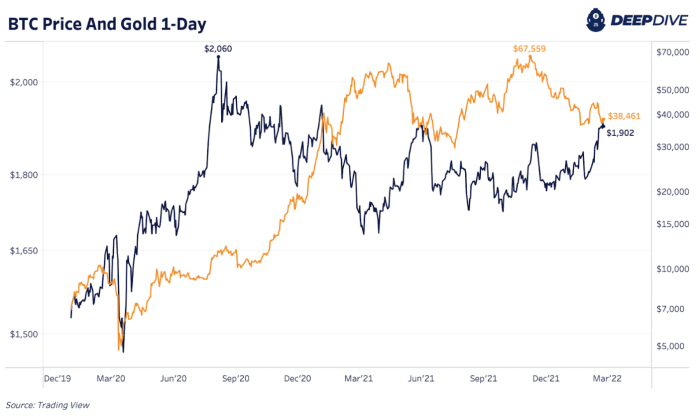

On the time of writing bitcoin is down 43% from its highs from November, and 12% off the lows procedure leisurely final evening. On the shut of the day the Nasdaq closed a phenomenal 3.4% within the inexperienced within the day to day session, as threat resources traded as if maximum anguish and uncertainty own been priced in quickly after the battle declarations. Gold within the starting put popped and hit over a one-one year high, touching $1974 an ounce earlier than shedding sharply, in an inverse sample from U.S. equity markets and bitcoin.

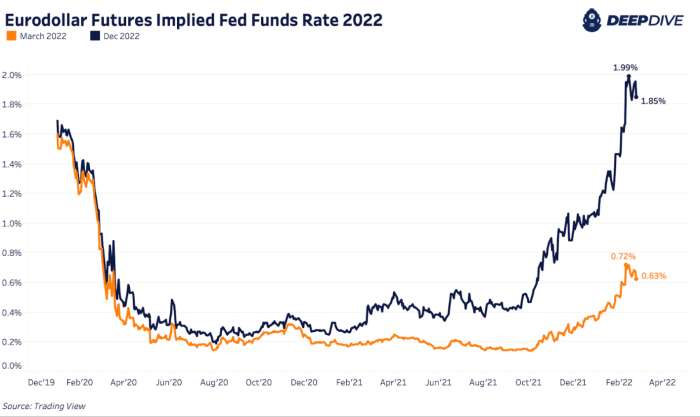

Since the battle, the markets own snappy priced in lower Federal Reserve Board fee hikes for 2022. Taking a witness on the eurodollar futures market, the implied federal funds fee has now dropped over 10 bps for March and a little extra for the remainder of the one year.

A trend that shall be significant to sight is if the Fed walks befriend the timeline for tightening monetary protection attributable to the outbreak of battle in Ukraine. If ancient previous is any precedent, this will doubtless maybe very nicely be the case as central banks esteem the choice to deflect accountability for defense error and proceed to ease markets.