BlackHoleDAO is a decentralized asset administration protocol per DAO governance. “BlackHole DAO Protocol (BHDP)” is a new standardized model constructed per DeFi 3.0. The BHDP burn mechanism, by drawing on the stock destroy up and stock merge within the standard stock market, resolves the imbalance between high inflation and deflation within the market. It additionally rolls out the DAOs credit score-essentially based mostly mortgage provider.

1.0 BHDP Formulation

1.1 BHDP Compose Highlights

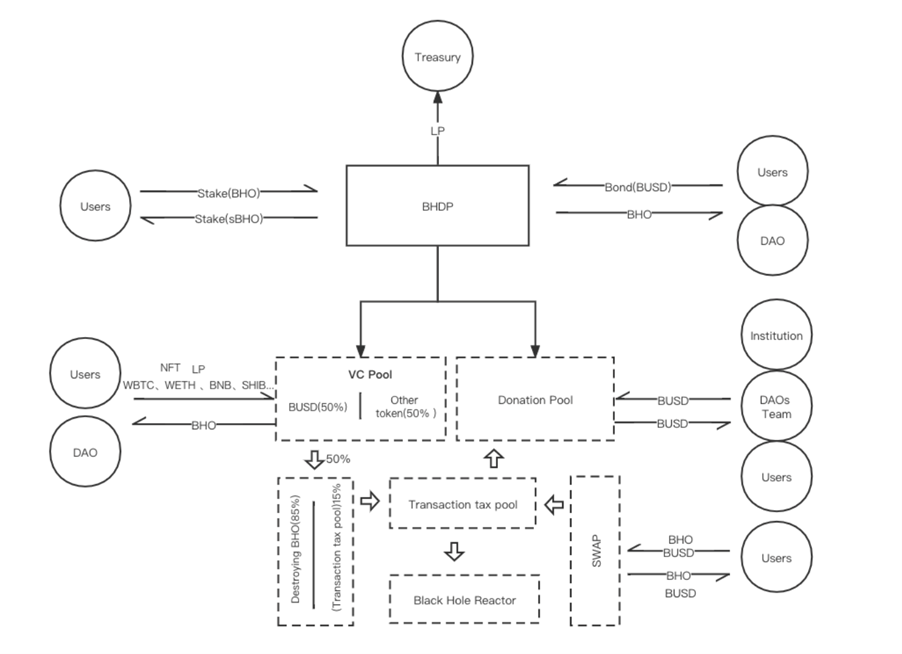

From the above describe, BHDP (BlackHole DAO Protocol) is supported by a Treasury, with orderly contracts to connect VC Pool and Donation Pool. VC Pool supports multi-asset certificates investments, allotment of which is former to burn BHO within the liquidity pool and the leisure for credit score loans after the DAOs investment succeeds.

3 BHDP Strategies of Deflation:

- It is a usual option to burn straight 60% BHO of the transaction tax

- 50% of VC Pool is additionally former to burn BHO within the liquidity pool,

- The BHDP low deflation mechanism can be ended in when the low inflation happens:

When the stock (BHO) within the market reaches an very most attention-grabbing amount with a 0 enhance price, the deflation mechanism can be ended in. The hobby on Stake will progressively decrease by a percentage.

X-[X/(Y*H)]=Z

x: amount when the burn mechanism is ended in

y: burn price

h: Time (days)

z: amount remained when the enhance price is elevated than 0

2.0 Vivid Order of Olympus Stake and Bond

2.1 Evolved Stake and Bond

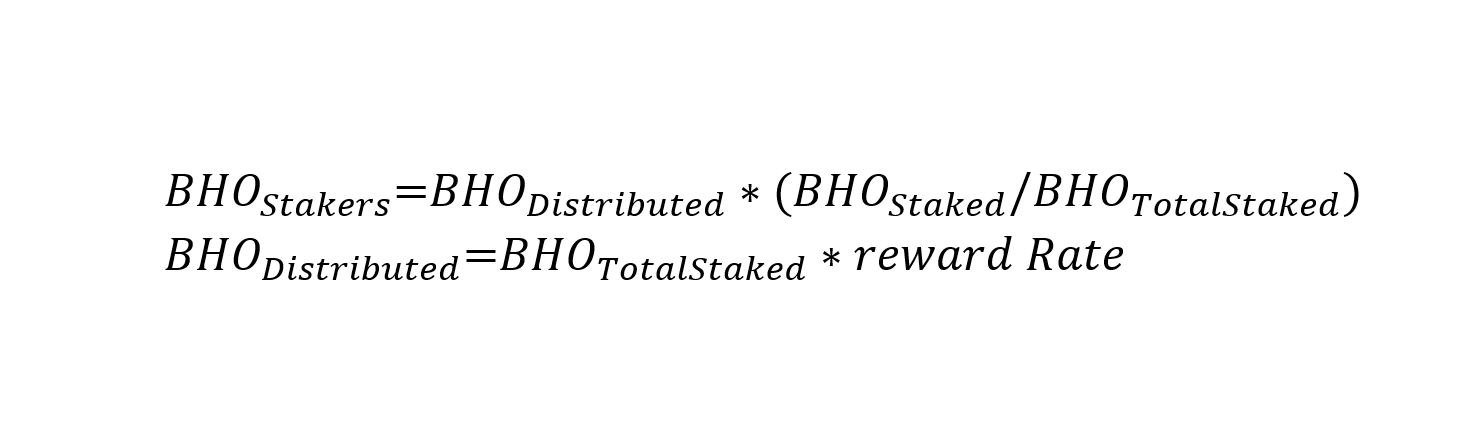

BlackHole DAO Stake regulates minting dynamically by the percentage of the total staking amount. In varied words, when the market is in inflation, the staking hobby will decrease, whereas in deflation, this can make bigger. However, it received’t ever exceed the total staking amount. The merit of dynamic legislation is, this free market transaction prevents the collective habits to float after making a profit.

Staking reward is calculated as:

Enhancements:

Enhancements:

- Olympusdao can mint tokens on a traditional foundation, whereas BlackHole DAO dynamically regulates the percentage of minted tokens per the inflation price. In a somewhat high inflation price, the percentage of BHO minted by Bond will decrease. Upon a 0 enhance price, Bond will quit minting.

- It presents a low cost to consume Tokens thru Olympusdao, whereas to consume Tokens thru BlackHole DAO is the identical because the market mark, but saves 15% of transaction tax.

For both picks, the most critical point is that after the market circulation price is equal to the treasury price, Bond is now not any longer the earlier high premium minting, but stopped minting, indicating that sooner than the market is in inflation, the percentage of minting within the channel will progressively decrease till the minting is stopped, combating extra asset shrinkage for the length of inflation.

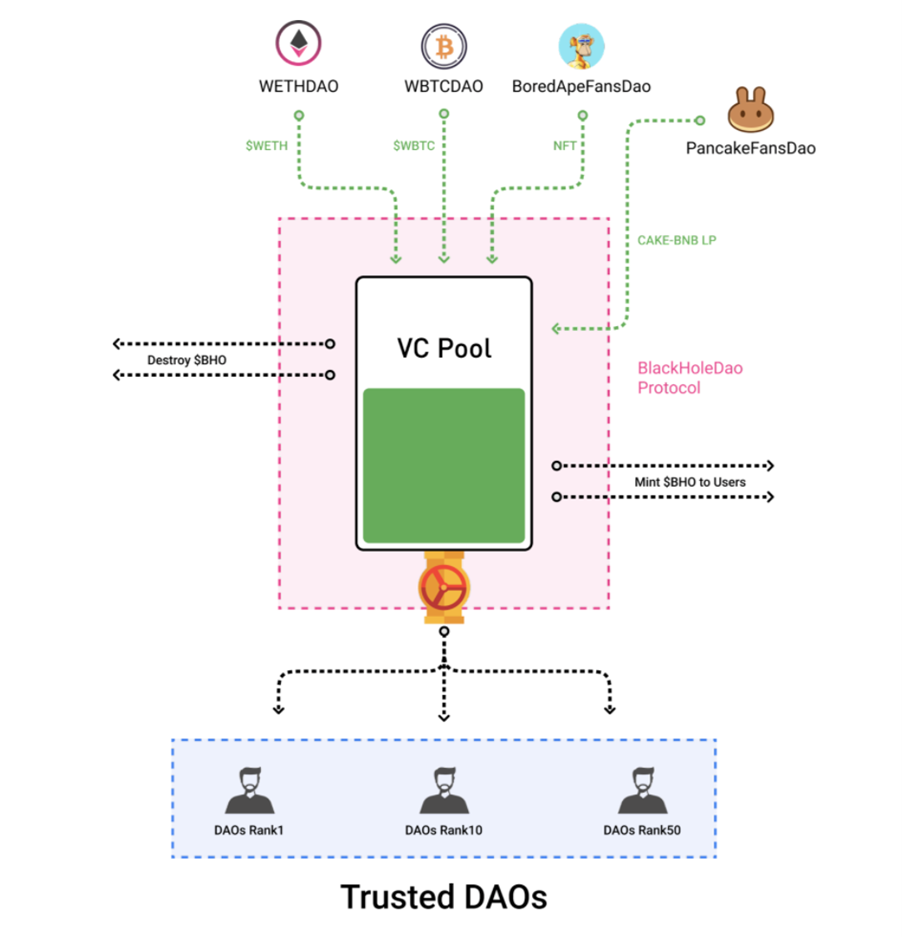

2.2 VC Pool with All Vouchers

In accordance with the legitimate doc, it is outlined as a “VC pool with vouchers”. The doc describes: [Any mission Token that enters VC Pool will undergo rigorous review and screening to prevent the malicious habits from inflicting the shortcoming of the long tail stop on doable resources, resulting in deflation and inflation of shares (BHO) and failure to play a locking purpose within the Token mission going in VC Pool.

We are in a position to peer that VC Pool is the asset administration exchange.With the last stock reflected within the intrinsic price of VC Pool.

VC Pool accepts such precious vouchers as stablecoins, NFTs and liquidity LPs. These precious vouchers, upon as a lot as an very most attention-grabbing amount in VC Pool, will workforce LP and present liquidity and LP mortgage products and companies to the third birthday party. The general claimed earnings will enter the VC Pool to enhance circulation price of the stock (BHO). Besides, one doable price of VC Pool is to relief because the credit score pool. Trudge with the DAOs workforce, it uses the DAOs workforce protocol to have the credit score and field unsecured credit score loans per the gathered credit score.

Meanwhile, VC Pool performs a regulatory purpose in BHDP

- In deflation, the percentage of the stock (BHO) minted thru VC pool will make bigger

- In inflation, the percentage of the stock (BHO) minted thru VC pool will decrease

- For BHO minted thru VC pool and coming into VC Pool, 50% resources can be former to burn BHO within the liquidity pool. The numerous 50% can be saved within the pool for DAOs workforce credit score mortgage.

3.0 Reverse Funding to Cater for Assorted Customers

3.0 Reverse Funding to Cater for Assorted Customers

Funding Establishments

The investment starts at 10,000 BUSD, in a region to accumulate earnings from transaction tax (BUSD+BHO)10% till the investment doubles.

DAOs Group

The investment starts at 1,000 BUSD, in a region to accumulate earnings from transaction tax (BUSD+BHO)3% till the investment doubles. The incomes will quit on the pause of the return period.

Folks

The investment starts at 100 BUSD, in a region to accumulate earnings from transaction tax (BUSD+BHO)2% till the investment doubles. The incomes will quit on the pause of the return period.

4.0 Unlit Hole Reactor

The personality of the Unlit Hole Reactor appears to be like to be esteem the prize pool dwelling by the mission at varied phases. To meet an very most attention-grabbing condition, the prize pool can be opened. The funds are essentially from 60% of the tax. when the market circulation reaches 10 billion BHO and the reactor amount reaches 100 million BUSD, the reactor can be opened. It’s optimistic that the quantity varies looking on the stage of the reactor, and the quantity of the reactor within the 2nd stage per chance 1 billion BUSD.

For special reasons, there are exceptions for opening the reactor

- The reactor can be opened when the market circulation triggers the Blackhole Protocol mechanism with a final deflation to 10 billion BHO and the reactor amount reaches 100 million BUSD

- No matter the consequence, the Unlit Hole Reactor can be opened after 3 years.

- At some stage within the minting course of, upon as a lot as 100 million BUSD, this can commence the Unlit Hole Reactor and quit minting.

More detailed article:https://blackholedao.substack.com/p/interpretation-of-new-defi-30-blackholedao?s=w