Compound and Synthetix seem like gaining momentum for a bullish breakout.

Key Takeaways

- Compound is up by almost 34% over the final three days.

- Synthetix has additionally risen by bigger than 26% over the the same length.

- COMP and SNX appear to relish extra space to stride up within the occasion that they derive the hot gains.

Compound and Synthetix seem like headed to greener pastures after posting over 26% gains within the closing few days. Easy, the pioneer cryptocurrency, Bitcoin, reveals just a few red flags.

Compound and Synthetix Clutch the Lead

Compound and Synthetix relish seen their native tokens amplify considerably in market value, outperforming just among the most traditional DeFi initiatives.

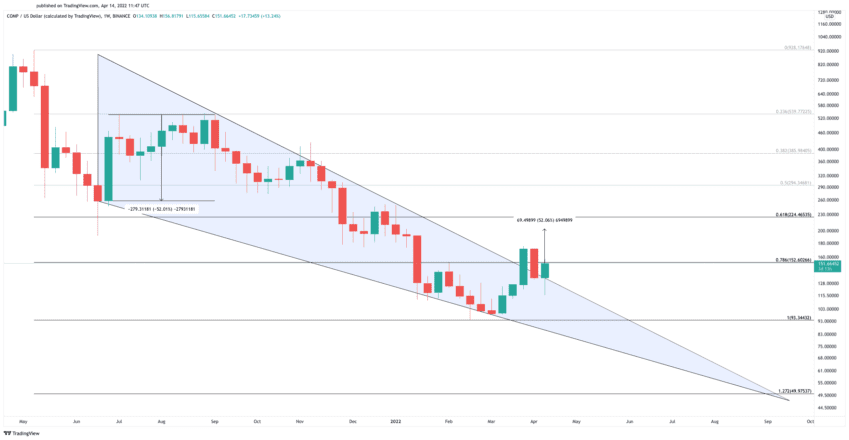

COMP has surged by almost 34% over the final three days and is now testing the $152 resistance level. This hurdle is most considerable for the DeFi token on memoir of it sits round the descending trendline of a falling wedge that has been forming on the weekly chart since gradual June 2021.

A sustained weekly candlestick shut above $152 would possibly perchance signal a breakout from the consolidation sample. Below such cases, sidelined traders would possibly perchance re-enter the market, pushing COMP by roughly 52% in opposition to $224.50.

It’s miles value noting that right here is the third consecutive time that Compound has tried to breach the $152 resistance level. For this motive, it’s imperative to await a decisive shut above it to target increased highs.

Failing to print a weekly candlestick shut above $152 would possibly perchance end result in a steep correction to the wedge’s descending trendline at $93. If this enhance level breaks, the losses can lengthen in opposition to $50.

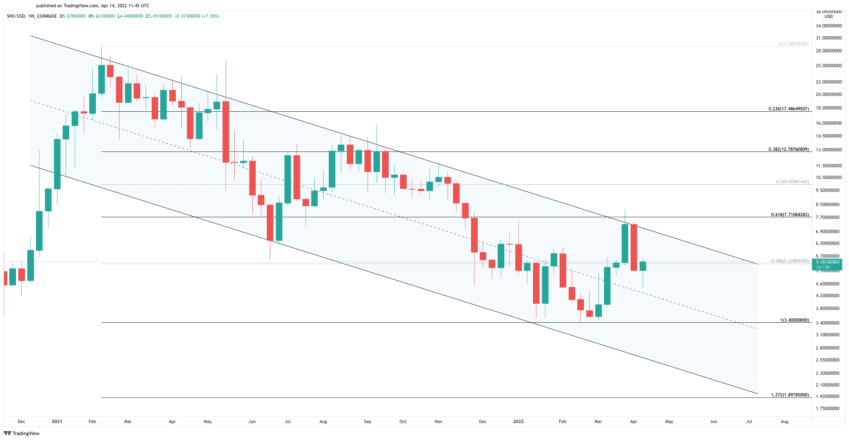

SNX has additionally posted most considerable gains over the final three days. The DeFi token seen its label upward push by bigger than 26% after testing the center trendline of a parallel channel where it has been contained since December 2020.

Tag historical previous reveals that Synthetix tends to surge to the channel’s upper boundary when the sample’s middle trendline acts as enhance. Identical label action would possibly perchance end result in a 37% upswing to $7.70. But when this resistance level breaks, SNX would possibly well enter a recent uptrend to $17.50.

It’s miles value noting that a rejection from the $7.70 resistance level would possibly perchance cease up in a steep correction to the channel’s middle or decrease trendline. These enhance ranges sit at $3.40 and $2, respectively.

Disclosure: At the time of writing, the author of this share owned BTC and ETH.

The records on or accessed by this internet space is obtained from autonomous sources we train to be factual and loyal, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any records on or accessed by this internet space. Decentral Media, Inc. is now not an funding advisor. We attain now not give personalized funding advice or other monetary advice. The records on this internet space is subject to commerce without explore. Some or all of the records on this internet space would possibly perchance develop outdated-fashioned, or it would possibly be or change into incomplete or unsuitable. Lets, but are now not obligated to, replace any outdated-fashioned, incomplete, or unsuitable records.

That it’s doubtless you’ll level-headed by no manner blueprint an funding option on an ICO, IEO, or other funding in accordance to the records on this internet space, and that you would possibly level-headed by no manner interpret or in any other case depend on any of the records on this internet space as funding advice. We strongly counsel that you search the advice of an licensed funding advisor or other qualified monetary educated should it’s doubtless you’ll perchance be in quest of funding advice on an ICO, IEO, or other funding. We attain now not settle for compensation in any build for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

What is a Crypto Airdrop: Why Tasks Airdrop Crypto

Crypto airdrops happen when recent tokens are freely dispensed to diversified wallets to be ready to drive initial increase and fabricate a neighborhood. They picture a regular marketing tactic that recent initiatives instruct to spread…

Compound Surges on Plans to Decrease Rewards

Compound has reached an crucial resistance level after the DeFi startup printed plans to eradicate its rewards distribution program. Extra searching to rep rigidity round the most modern label ranges would possibly perchance push COMP…

Ethereum DeFi Tokens Aave, Maker, Synthetix Lead Market Surge

Ethereum DeFi protocols Aave, Maker, and Synthetix relish seen their tokens rally on the assist of most modern protocol upgrades and proposed increase systems. DeFi Blue Chips Soar Wait on After a…

Original Ethereum Token Could presumably well Substitute Yield-Bearing DeFi Sources

A recent Ethereum token frequent known as ERC-4626 would possibly perchance support solve composability components in DeFi and blueprint yield-bearing tokens more stable. Meet ERC-4626 DeFi natives would possibly perchance rapidly must familiarize themselves…