On-chain records shows the Bitcoin NUPL metric at the 2nd has values that could well counsel the endure market is but to hit in pudgy swing, if the coin is in one.

Bitcoin NUPL Price Mute Now not As Low As Old Personal Markets

As pointed out by an analyst in a CryptoQuant post, the BTC NUPL metric suggests market hasn’t neared a endure market backside but.

The “uncover unrealized profile/loss” (or NUPL briefly) is a hallmark that tells us in regards to the ratio of revenue and loss in the Bitcoin market.

The metric’s price is calculated by taking the incompatibility between the market cap and the realized cap, and dividing it by the market cap.

When the NUPL has a price elevated than zero, it come there are more cash in revenue than ones in loss at the 2nd.

Alternatively, harmful values of the indicator imply that traders are, on moderate, in a direct of loss factual now.

Linked Finding out | Bitcoin Bullish Signal: Change Reserve Loses One more 50ample BTC Over Previous Week

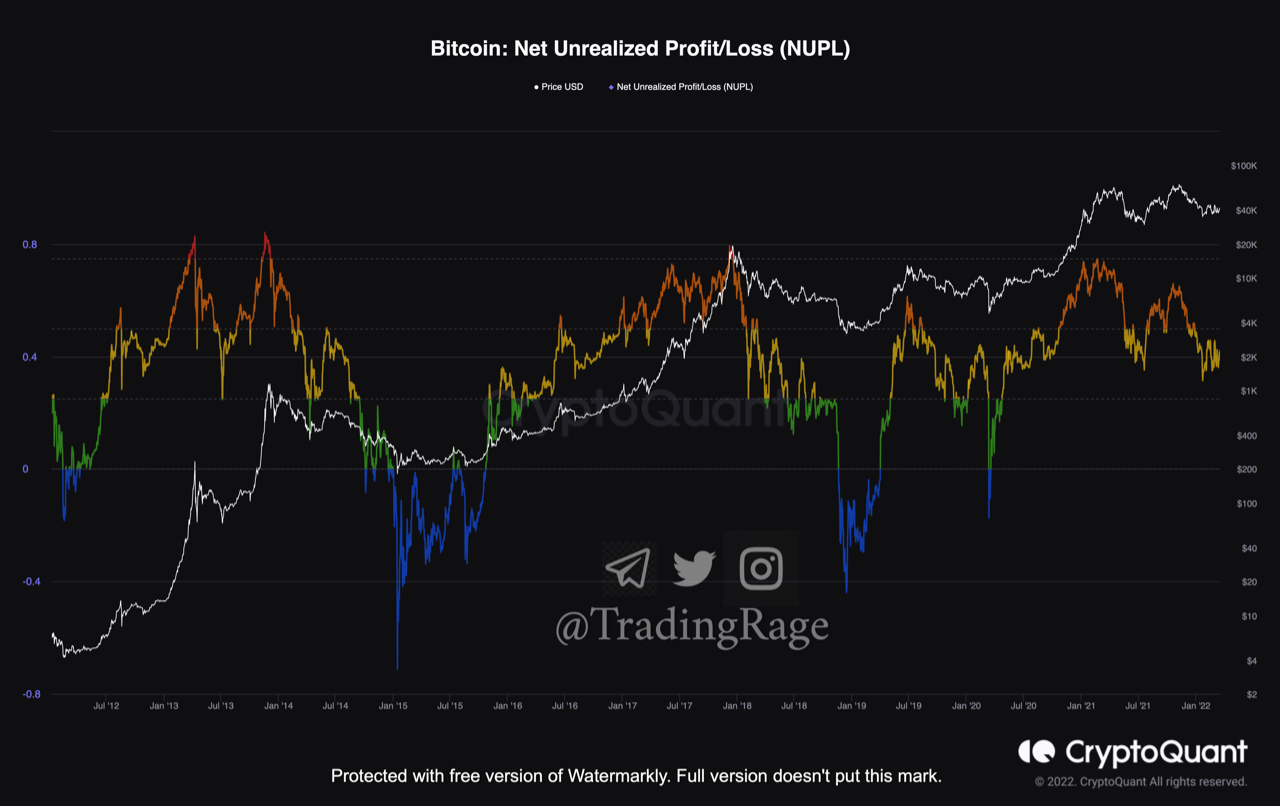

Now, here is a chart that shows the pattern in the Bitcoin NUPL over the history of the crypto:

Appears to be like adore the price of the indicator is aloof above zero | Supply: CryptoQuant

As you would compare in the above graph, the Bitcoin NUPL metric has on the total been ready to predict top and backside formations through its varied colored zones.

Within the old endure markets, the indicator’s price has on the total fallen off below zero (blue) as a backside approached.

Within the lead as much as these bearish sessions were the yellow and inexperienced phases, however at the 2nd the NUPL aloof looks to be in the yellow zone.

This could well mean that if Bitcoin has already entered into a endure market, it has aloof some systems to head earlier than complete capitulation and backside formation.

Linked Finding out | What’s Bitcoin Role After Pause of Petrodollar Machine? Arthur Hayes Says

Alternatively, it’s price noting that there were cases earlier than where the indicator dropped into the yellow zone after a bull rally, however then jumped back up soon after as the bullish pattern persevered, indicating a mid-cycle backside formation as a change.

Presumably the latest example of this turned into as soon as at some level of the mini-endure length of Also can merely-July 2021, where the coin bottomed at around $28ample and rallied on to a novel ATH.

BTC Imprint

On the time of writing, Bitcoin’s impress floats around $41.4k, up 6% in the previous week. Over the final month, the crypto has received 8% in price.

The below chart shows the pattern in the impress of the coin over the final 5 days.

The price of the crypto looks to enjoy held above $40ample over the final couple of days | Supply: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com