Judge Protocol is a decentralized blockchain-based mostly protocol that permits users to alternate tokenized synthetic sources on the Terra blockchain; every synthetic asset on Judge represents a actual-world asset, such as shares, such as NFLX or TSLA, or a commodity, relish wheat or gold.

Hosted on the Terra blockchain, the Judge Protocol will also be dilapidated for plenty of unsuitable-chain and multi-chain operations, connecting ecosystems such as Cosmos, Ethereum, and Polkadot.

Judge used to be designed with two needs in mind:

- It enables world users to alternate US equities 24 hours a day, 7 days a week. Most shopping and selling platforms are minute to equities on hand in determined geographies. Judge Protocols will also be dilapidated by someone anyplace, critically reducing the boundaries to entry to the remark financial markets.

- As one more of owning the real asset, users can put up and alternate a tokenized model of an asset through synthetic doubtless choices.

Customers making an try to get Judge protocol will get two suggestions at https://www.mirror.finance/. Customers can click on either solution to get entry to Judge’s app.

The native Judge Protocol token, MIR, provides several utilities, most of which revolve around governance– MIR will also be staked for voting rights. With most cash markets entrenched with the pursuits of orderly multi-billion greenback companies, MIR locations the governance of its synthetic shopping and selling market interior look for somebody tantalizing to motivate MIR.

Judge Protocol is now no longer without controversy. In September 2021 Terraform Labs CEO, Cease Kwon, used to be handed papers ordering compliance with investigative subpoenas constant with the U.S.Securities and Alternate Commissions’ (SEC) investigation.

In retaliation, Kwon sued the U.S. Securities and Alternate Commission (SEC) in December 2021. He acknowledged the SEC had violated its maintain guidelines and the Due Job Clause of the U.S. Structure. In February 2022, Kwon used to be ordered by a U.S. District Court mediate to follow the subpoenas.

How Does Judge Protocol Work?

Judge Protocol is hosted on the Terra Blockchain. It’s powered using dapper contracts that enable its user spoiled to alternate commodities, shares, and a gigantic selection of quite loads of financial sources. It also lets users invent a gigantic selection of synthetic sources that signify the real-time and actual-lifestyles worth of the asset.

Via Judge, investors could per chance make (or lose) from a actual-world asset’s worth fluctuations without ever truly owning it.

Terra runs on a Delegated Proof of Stake (DPos) consensus, and permits builders to make their maintain decentralized purposes, protocols, and device.

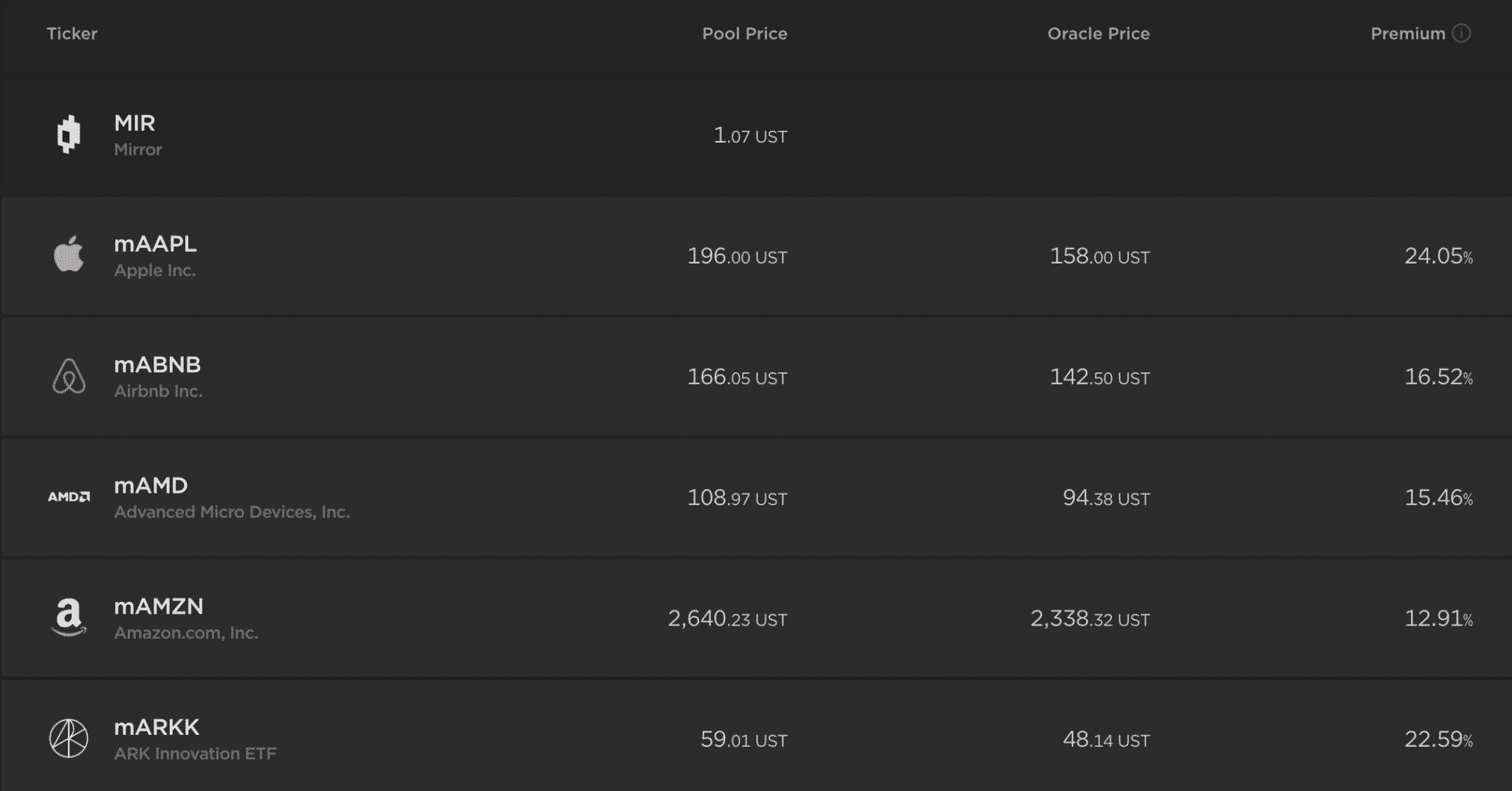

Judge Protocol combines DPoS with an commence-offer framework that builds multi-asset public Proof-of-Stake (PoS) blockchains identified as Cosmos SDK. This lets the protocol present a gigantic selection of instruments to invent synthetic sources, also identified as “mAssets”. Customers can invent a web web suppose on the protocol to kind their maintain synthetic sources that mirror the worth of their actual-lifestyles doubtless choices. As soon as performed, users then must always deposit collateral. The device will then motivate watch over all collateral offer to lower the probability for lenders and be determined there are continuously sufficient funds to quilt any mAssets.

As soon as an mAsset has been created, it’s listed against UST (Terra’s greenback-pegged stablecoin) on the Terraswap platform. Judge Protocol also helps as a design to add liquidity to the community, in conjunction with the swapping of tokens. Customers who precise the community are rewarded with Judge Tokens (MIR), that will be dilapidated for governance, shopping and selling, and several quite loads of actions.

With out a doubt one of Judge Protocol’s weird and wonderful worth propositions is that it in actuality opens native markets into world audiences. Here is amazingly treasured for quite loads of making economies web webhosting increasingly extra financially empowered populations.

These capacity investors are often minute to the platforms and funding vehicles of their maintain country, which are minute.

By using Judge Protocol, in thought, they are able to maintain a token that represents actual financial sources without eager to earn them from a foreign substitute. This reach helps lower the boundaries to entry for traders, while also giving traders the change to speculate 24 hours a day, 7 days a week.

Every mAsset is designed to be as clear and accessible as doubtless. Via dapper contracts, a synthetic asset will also be made for any actual-lifestyles asset, that will then be traded by someone.

Judge users could add liquidity to the platform and fabricate rewards in the activity, such as MIR tokens.

MIR can then be dilapidated to dispute the governance of the platform, or bought on the commence market.

Who Are the Founders of Judge Protocol? A Short History of Judge

Judge Protocol used to be founded in 2020 by the an identical physique of workers that developed Terraform Labs.

Essentially based mostly totally in South Korea, Terraform Labs has launched or incubated tasks such as Chia, a mobile funds rising primary person, Terra (UST and LUNA, two tokens currently in the prime ten biggest cryptocurrency market caps), and Judge.

Terraform Labs CEO and co-founder Cease Kwon is a Forbes’ 30 beneath 30 Asia list recipient, and has attracted investors such as Binance, Arrington XRP, and Polychain Capital for Terra.

Irrespective of being founded by a centralized firm, Judge Protocol itself is entirely decentralized, rush entirely by MIR holders, who exhaust their tokens to vote on smooth proposals and charges on the platform. In alignment with enticing distribution and decentralization, MIR tokens were now no longer pre-mined and are somewhat distributed amongst community members constant with their goal in the protocol. This provides users a reveal on the governance of the platform.

The physique of workers targets to manufacture get entry to to the financial market easy during the creation of synthetic sources.

Kwon himself has now no longer too lengthy ago been compelled by U.S regulations to present testimony after SEC attorneys acknowledged they mediate enforcement circulate will be warranted against Terrorform Labs, linking Judge Protocol with its founding firm. As a resident of South Korea, Kwon has contested the subpoena and filed a lawsuit against the SEC pointing out that a Korean firm is now no longer at probability of follow U.S regulations.

The MIR Token (MIR)

The Judge token (MIR) is Judge Protocol’s governance token. It used to be designed to be somewhat distributed amongst investors and therefore there were never any pre-sale or investor tokens. MIR is rewarded to investors who uphold the soundness of Terra. The token itself has two valuable parts:

- Within the origin, it captures collateralized debt web web suppose (CDP) closures. As soon as a Judge CDP has been closed, 1.5% is taken as a rate. These charges are dilapidated to determine MIR tokens on Terraswap, which are then paid to someone staking MIR.

- Second, protocol governance. Judge tokens play an extraordinarily necessary goal in the protocol. They’ll also be dilapidated to trade several parameters such as the shopping and selling rate rate and the web web suppose free. As well to this, it’s dilapidated to manufacture spending proposals against the on-chain crew pool. This pool holds MIR tokens which are dilapidated to advance the protocol. Shall we reveal, funding developer grants and in conjunction with further incentives to the protocol.

At open, 18.3 million MIR tokens were airdropped to LUNA stakers and participants who held UNI. This used to be to reward participants for upholding the financial steadiness of Terra and cowl the aptitude of the challenge. Individuals who staked LUNA obtained MIR on a skilled-rata basis and each UNI holder with over 100 tokens obtained 220 MIR.

The Judge physique of workers also plans to open an further 18.3 million MIR tokens at some level of 2022. These will be distributed to LUNA stakers on a weekly basis.

Liquidity miners now maintain the answer to farm Judge tokens by offering liquidity on Uniswap, Ethereum, and an identical pairs on Terraswap. Here is honest like how yield farming works on Uniswap.

All liquidity providers are rewarded over a four-one year duration, with rewards reducing by 50% till the end of the final one year.

With MIR tokens playing a key goal in the governance of the protocol, Terraform Labs has determined now to no longer motivate any of its MIR tokens for a earnings. The goal is to motivate the challenge decentralized from its onset, and to be determined all rewards high-tail to the crew. There must always no longer any admin keys or senior get entry to portals. Any adjustments made to the protocol ought to be made using MIR tokens at some level of the crew. For a governance proposal to high-tail, it requires majority approval of all Judge token holders and could per chance smooth take hold of a week to implement as soon as passed.

This present day, MIR will also be bought on a gigantic selection of exchanges such as Binance, Coinbase and Crypto.com.

It goes to even be bought on decentralized exchanges such as SushiSwap and PancakeSwap.

It goes to even be bought on most standard exchanges such as Coinbase, using fiat currencies such as USD, CAD, AUD, EUR, GBP, and heaps others, or quite loads of standard cryptocurrencies such as BTC and ETH. As soon as bought, it’s nicely matched with a gigantic selection of wallets such as the Ledger Nano S and Trezor One, as nicely as MetaMask and Belief Wallet.

Remaining Tips: Is Judge Protocol Legit?

Judge Protocol is an thrilling smooth DeFi challenge tackling financial change inequality. It provides participants in much less developed international locations get entry to to financial sources that would in another case be minute to a like few traders. This opens a world of change to its users and also provides the challenge capacity to scale with the smooth market.

It’s constructed by a physique of workers of depended on builders in an ecosystem poised for valuable enhance. Terra has up to now showcased a solid capacity to beef up quite loads of DeFi dApps and protocols with a large number of exhaust cases.

Nevertheless, synthetic sources don’t come without their boundaries. Although investors can maintain a duplicate of an asset, they’re never granted possession of the underlying asset. This methodology they’re unable to execute votes, get entry to to dividends, or shareholder rights.