Amidst the typical adoption of cryptocurrencies, rules introduced a gargantuan roadblock. Whereas other countries attempt to obtain a system in their prefer, Germany appears to be like to be embracing it with begin palms as per the most stylish guidelines issued by the Federal Finance Ministry (BMF).

Germany Makes Crypto Tax-Free

The directive from BMF used to be released on Tuesday, maintaining extra than one crypto-linked issues, which additionally incorporated the replace in profits tax (IT) law pertaining to it.

Till the announcement, Germany’s IT law mandated cryptocurrency merchants/merchants to defend their belongings for a interval of now no longer decrease than ten years in show to catch an exemption from tax.

Then all as soon as more, now, a citizen can be eligible to be exempted from positive aspects tax equipped by maintaining their cryptocurrency for only 300 and sixty five days. The positive aspects generated from the sales of these cryptos after a year of now no longer selling them can be idea to be tax-free across Germany.

This income additionally extends to the belongings invested in lending and staking protocols as smartly as mining, laborious forks, and token airdrops.

But while Germany is the most stylish nation to attain, it is miles now no longer the handiest one. Across the world, many countries contain made cryptocurrencies, and positive aspects accrued from them tax-free over time. The likes of these consist of Belarus and Portugal, who, since 2018, contain made crypto positive aspects tax-free.

The aged exempted folks and corporations from taxes for as a lot as 5 years, while the latter did no longer exempt corporations but handiest individual merchants.

Equally, El Salvador, the first nation on this planet to impact Bitcoin a loyal gentle, additionally spared international merchants from being subjected to any crypto tax in show to scheme higher investments.

As well to this, Switzerland, additionally known as the “Crypto Valley”, additionally has exemptions from the tax for crypto merchants but as per particular prerequisites.

Firstly cryptocurrency miners and qualified day merchants will incur profits tax as smartly wealth tax as per the annual catch worth. Then all as soon as more, individual merchants are free from paying capital positive aspects taxes on their crypto profits.

Furthermore, Singapore, Malaysia, Malta, Cayman Islands, and Puerto Rico additionally put collectively a linked tax methods making them a preferable location for merchants and merchants.

CBDCs – Governments’ Spoil out From Crypto

Unlike the countries talked about above, there are others that contain crypto in their crosshair, and by subjecting their voters to taxes, rules, and restrictions, these governments attempt to abolish crypto’s boost doable.

Also, as a backup, these countries are launching their dangle centrally controlled central financial institution digital currencies (CBDCs) that can act as a digital model of the present fiat currencies.

This diagram, the financial system remains within the govts withhold an eye on, taking away the freedom that comes with decentralization.

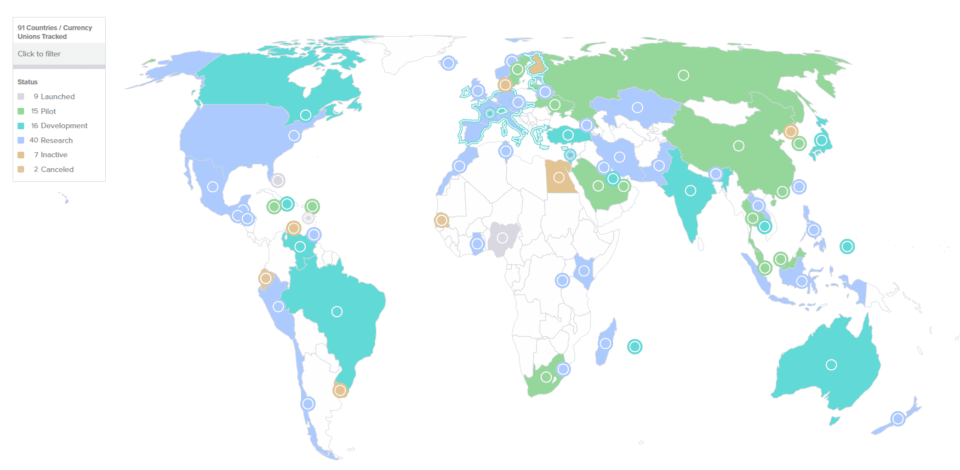

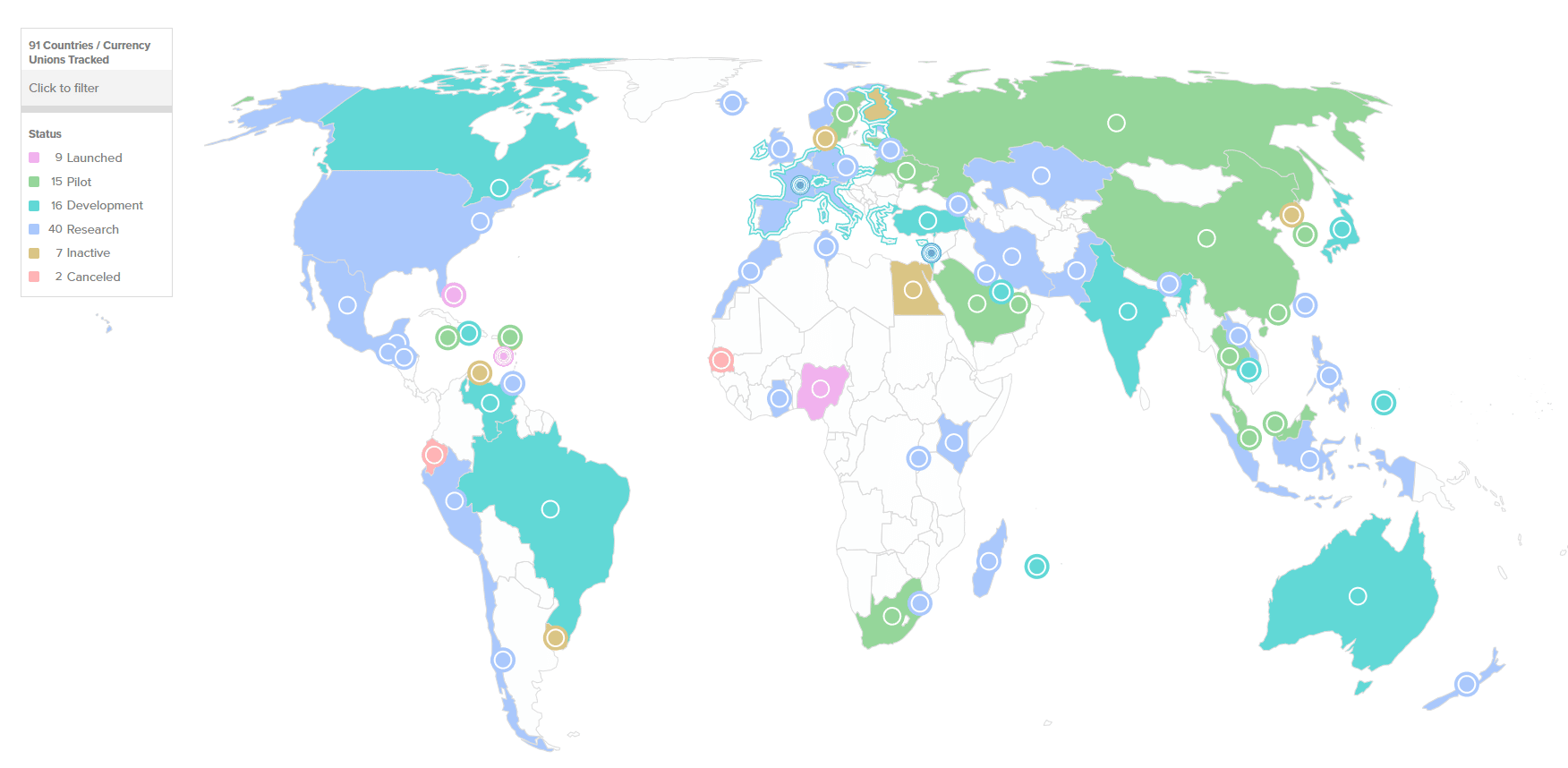

On the moment, over 9 countries already contain a rotund functioning CBDC system in explain, with but some other 15 countries running their pilot applications. China is one in every of the latter cohorts that examined their e-CNY all around the Beijing Frigid climate Olympics in February 2022.

Moreover, about 56 extra countries are presently within the Learn and Pattern half, with the likes of India searching for to delivery out its dangle CBDC by 2023.

The 2nd most prominent user of cryptocurrencies, India, has been carefully taxing cryptocurrencies (30% crypto positive aspects tax), as reported by CoinCentral which is why the decision to delivery out the “Digital Rupee” CBDC is wise.

Thus, it is miles handiest a topic of time sooner than CBDCs change loyal into a world phenomenon, making room for extra countries to hitch, equipped the presently present methods are fruitful to the financial system.