Key Takeaways

- Roughly $23 billion price of cost has been worn out of the cryptocurrency trade in the previous 24 hours.

- The pinnacle two crypto assets, Bitcoin and Ethereum, each erased double-digits as promoting stress increased.

- Now, the market appears to be like to be in threat of entering a protracted appreciate pattern.

Terror has struck the cryptocurrency market as Bitcoin and Ethereum enter freefall. Though the correction appears to be like to be to appreciate paused, investors are mute promoting their holdings en masse.

Worry and Despair Echoes All over Crypto Market

Bigger than $830 billion has been worn out of the entire cryptocurrency market cap over the final month, and extra losses could per chance perchance very effectively be on the horizon.

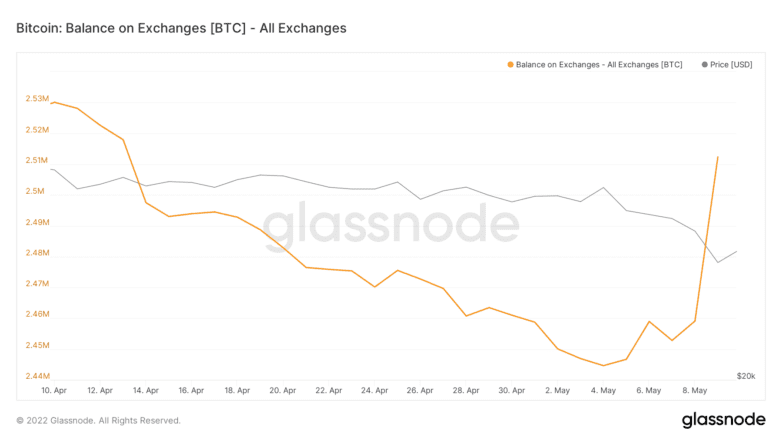

In step with data from Glassnode, the entire different of Bitcoin held on identified cryptocurrency switch addresses has increased by nearly 2.77% over the final week. Bigger than 67,712 Bitcoin has flowed into a number of procuring and selling platforms, coinciding with a volatility spike. Increased inflows to exchanges are in most cases considered as a bearish indicator because market participants frequently struggle through exchanges to sell their holdings. At picture, many crypto holders look like making able to sell their holdings in anticipation of a steeper correction.

Sentiment in the crypto market shifted after Bitcoin broke through a historical rising trendline seen on its weekly chart. The tournament resulted in a 12.67% downswing in which Bitcoin hit a low of $29,740.

The most up-to-date drop is the third time the tip cryptocurrency has breached the main search info from stage since March 2013. The principle time Bitcoin broke below the stage used to be in August 2015, resulting in a 37.67% correction that marked the tip of the appreciate market. Equally, Bitcoin crashed by 43.32% after chopping during the toughen trendline in March 2020.

Now that the serious toughen remark has been turned into resistance, Bitcoin could per chance perchance skills in a similar plan historical impress motion. Additional promoting stress could per chance perchance push Bitcoin down by another 33.46% to $19,800.

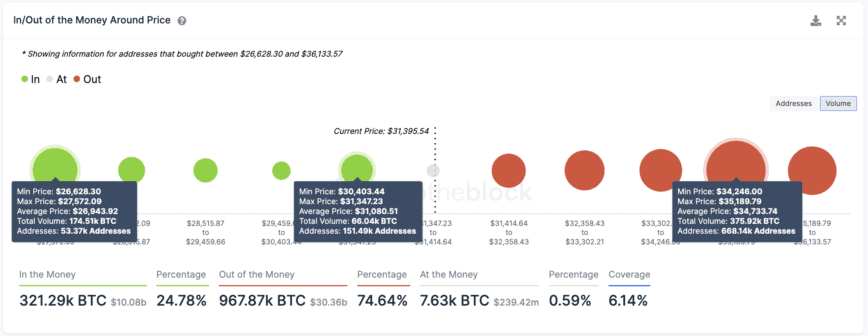

Transaction historical previous from IntoTheBlock’s IOMAP suggests that the pessimistic outlook could per chance perchance play out. Bitcoin is on the 2nd procuring and selling on a thin layer of toughen at around $31,000, and it faces stiff resistance ahead. Roughly 668,000 addresses sold nearly 376,000 Bitcoin between $34,246 and $35,190.

The identical addresses could per chance perchance try and exit their positions to try and atomize even on their investments in the tournament of a bullish impulse, which could per chance perchance imply any upswing will get rejected. In line with the on-chain data, Bitcoin doubtless must print a weekly end above $35,190 to appreciate a huge gamble of invalidating the bearish thesis. If it succeeds, it could per chance march toward $40,000.

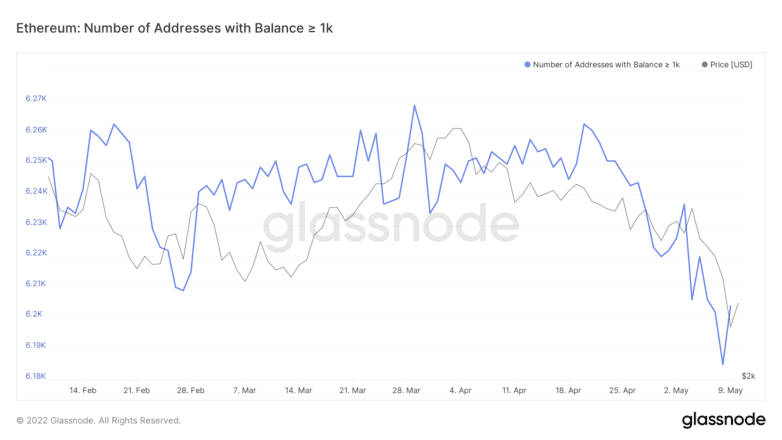

The spike in promoting stress across the crypto market can additionally be considered from an on-chain standpoint among Ethereum holders. Glassnode data exhibits that the different of addresses keeping bigger than 1,000 Ethereum has lowered by 0.83% over the final week. Bigger than 50 whales appreciate sold or redistributed over $2.5 million price of Ethereum every inside of the short period.

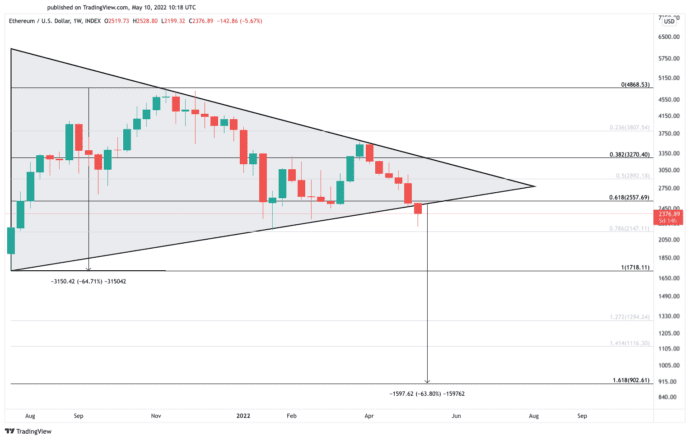

The mounting downward stress and scarcity of procuring for interest has triggered a 13% correction in Ethereum’s market cost in the final 24 hours, pushing it to a low of $2,200. The surprising downswing allowed Ethereum to atomize out of a symmetrical triangle in a negative posture.

The pinnacle of the triangle’s Y-axis suggests that Ethereum is primed for a 64% correction. A sustained weekly candlestick end below $2,600 could per chance perchance validate the pessimistic outlook, potentially resulting in a downtrend to $900.

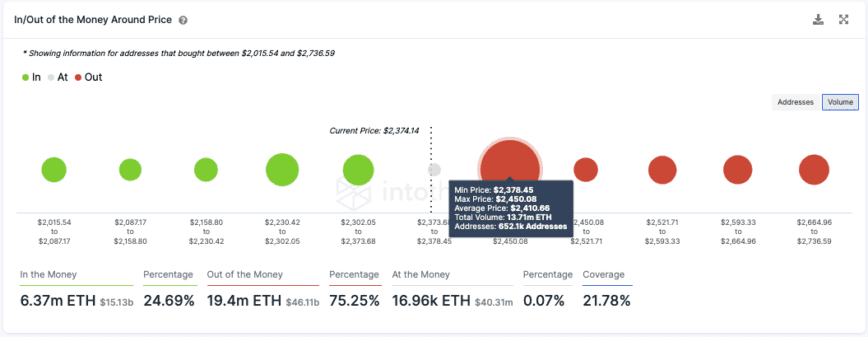

In step with IntoTheBlock’s IOMAP mannequin, it appears to be like to be that evidently Ethereum’s most main present wall sits at around $2,450, where over 652,000 addresses appreciate purchased bigger than 13.71 million Ethereum. Any longer signs of weak point could per chance perchance abet these addresses to exit their positions to lead definite of incurring main losses, accelerating the downward stress.

To invalidate the bearish thesis, Ethereum would doubtless ought to surge to $3,270 and print a weekly candlestick end above it.

Until Bitcoin regains $35,190 as toughen and Ethereum surges above $3,270, the crypto market is doubtless to explore shaky. Moreover the tip two crypto assets, many varied coins are procuring and selling on historical toughen. That would possibly imply they suffer steeper corrections than the more established cryptocurrencies.

The final 24 hours had been one thing of a bloodbath across the market. Terra’s LUNA has crashed by bigger than 60% attributable to UST shedding its peg to the buck. Bored Ape Yacht Membership’s ApeCoin additionally dipped as dinky as 33%, while STEPN’s GMT snappily crashed by bigger than 40%.

Disclosure: On the time of writing, the creator of this portion owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and earn weekly updates from our lead bitcoin analyst Nathan Batchelor.

The data on or accessed through this web remark is got from honest sources we specialize in to be stunning and legit, but Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any info on or accessed through this web remark. Decentral Media, Inc. is just not an investment advisor. We attain not give personalized investment suggestion or varied financial suggestion. The data on this web remark is discipline to switch without explore. Some or all of the knowing on this web remark could per chance perchance change into out of date, or it could per chance very effectively be or change into incomplete or inaccurate. We could per chance perchance, but aren’t obligated to, update any out of date, incomplete, or inaccurate info.

You ought to mute never contain an investment resolution on an ICO, IEO, or varied investment in step with the knowing on this web remark, and you’ll need to mute never elaborate or otherwise rely on any of the knowing on this web remark as investment suggestion. We strongly suggest that you just consult a certified investment advisor or varied certified financial skilled while you would very effectively be searching for investment suggestion on an ICO, IEO, or varied investment. We attain not fetch compensation in any contain for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

El Salvador Buys 500 Bitcoin Amid Market Lunge

The principle nation to appreciate adopted Bitcoin as ethical tender has taken advantage of the involving lower in the asset’s impress this day. Devoted Buck-Worth Averaging El Salvador has sold the…

Bitcoin Hits 10-Month Low Below $33,000

Many totally different crypto assets appreciate tumbled as Bitcoin struggles to preserve momentum. Bitcoin Slides Additional The Bitcoin bleed continues. The pinnacle crypto asset recorded a 10-month low Monday afternoon, procuring and selling…

Bitcoin and Ethereum Are at Probability of Capitulation

Bitcoin and Ethereum are mute trending downwards while fright surrounding the area macroeconomic atmosphere escalates. Losses could per chance perchance urge as each cryptocurrencies appear to breach crucial search info from zones. Bitcoin and Ethereum…