On-chain metrics can back anticipate whether Bitcoin is terminate to reaching a market backside.

Key Takeaways

- Bitcoin has misplaced bigger than 43,600 factors over the last seven months.

- The tip cryptocurrency now hovers spherical $30,000 whereas threatening to dip lower.

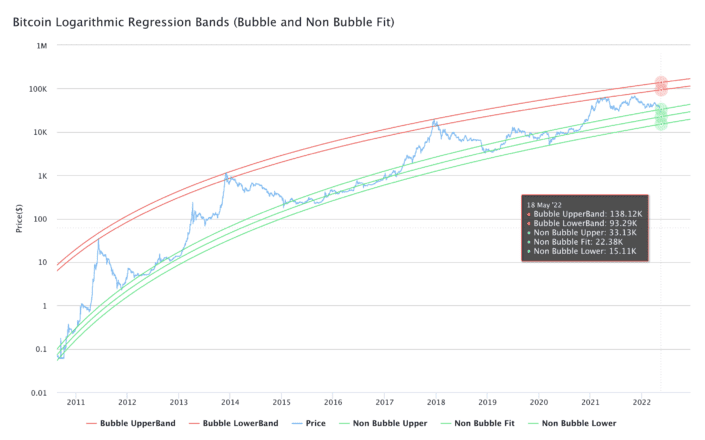

- Technical indicators counsel market backside will likely be chanced on between $22,380 and $15,110.

Bitcoin is locked in a steep downtrend that has considered it retrace by bigger than 63% over the last seven months. Composed, on-chain metrics counsel that the head cryptocurrency has extra to fall ahead of it hits a market backside.

Looking out forward to the Market Bottom

Bitcoin appears to be like to have confidence chanced on brief-term toughen spherical the psychological $30,000 stage, nevertheless but every other downswing is calm in the playing cards.

The flagship cryptocurrency has misplaced bigger than 43,600 factors in market price over the last seven months. It went from hitting an all-time excessive of nearly $69,000 in early November 2021 to not too long prior to now sweeping a multi-year low of $25,365. Even though the losses have confidence been indispensable, it’s seemingly Bitcoin’s steep downtrend has not reached exhaustion but.

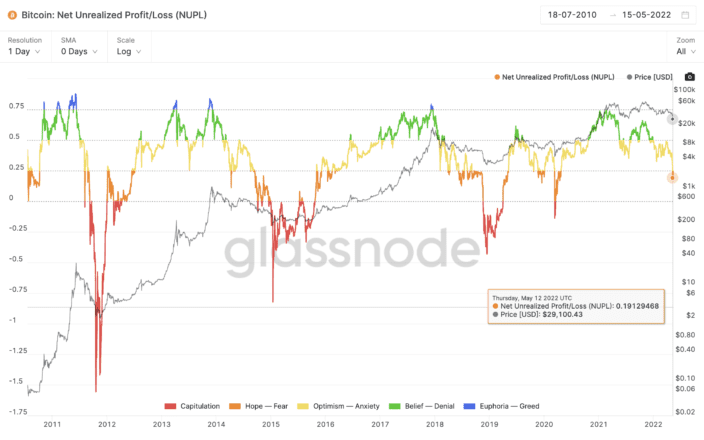

The Catch Unrealised Profit/Loss (NUPL) indicator can back anticipate shifts in market sentiment and predict market tops and bottoms on Bitcoin’s pattern. It depends on more than one on-chain records factors to expose seemingly merchants’ emotions at a given time, which helps in figuring out brand actions.

The market sentiment spherical Bitcoin appears to be like to have confidence shifted from Fright to Apprehension after prices dropped beneath $30,000. Composed, the NUPL suggests that merchants’ emotions have confidence to descend from Fright to Capitulation to stamp the spoil of the downtrend.

Logarithmic regression lines by highlighted by crypto YouTuber Benjamin Cowen account for two key brand ranges where Bitcoin might perchance perhaps perchance backside out. The non-bubble fit regression band sits at $22,380, whereas the non-bubble lower regression band hovers spherical $15,110. A downswing to those brand factors might perchance perhaps perchance seek the NUPL shift to Capitulation, presenting a utterly different different for sidelined merchants to re-enter the market.

It stays to be considered whether the combo of NUPL and the logarithmic regression lines will back anticipate a market backside as these indicators have confidence performed prior to now. It is also price noting that after the indispensable correction that Bitcoin has considered over the last few months, there is an different for it to enter a consolidation duration ahead of its next indispensable brand circulate.

Disclosure: At the time of writing, the creator of this fragment owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and gather weekly updates from our lead bitcoin analyst Nathan Batchelor.

The records on or accessed via this web pages is obtained from independent sources we mediate to be stunning and first fee, nevertheless Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any records on or accessed via this web pages. Decentral Media, Inc. will not be an funding consultant. We invent not give personalized funding recommendation or utterly different financial recommendation. The records on this web pages is discipline to commerce without specialise in. Some or the total records on this web pages might perchance perhaps perchance become outdated, or it’ll be or become incomplete or wrong. Shall we, nevertheless usually are not obligated to, update any outdated, incomplete, or wrong records.

It is seemingly you’ll be capable to have confidence to calm by no methodology originate an funding decision on an ICO, IEO, or utterly different funding per the records on this web pages, and that you might perchance perhaps have confidence to calm by no methodology elaborate or otherwise depend on any of the records on this web pages as funding recommendation. We strongly imply that you consult a certified funding consultant or utterly different qualified financial expert whereas you are looking out for funding recommendation on an ICO, IEO, or utterly different funding. We invent not settle for compensation in any produce for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Bitcoin and Ethereum Are at Threat of Capitulation

Bitcoin and Ethereum are calm trending downwards whereas agonize surrounding the global macroeconomic ambiance escalates. Losses might perchance perhaps perchance gallop up as both cryptocurrencies appear to breach indispensable quiz zones. Bitcoin and Ethereum…

Michael Saylor Defends Bitcoin-Backed Mortgage

Michael Saylor has weighed in on concerns that his company’s Bitcoin-backed loan from Silvergate will likely be margin known as by stating his willingness to connect up distinguished more Bitcoin to retain…

El Salvador Buys 500 Bitcoin Amid Market Trudge

The first nation to have confidence adopted Bitcoin as appropriate kind relaxed has taken inspire of the horny decrease in the asset’s brand this day. Devoted Dollar-Stamp Averaging El Salvador has bought the…