On-chain data suggests Bitcoin lengthy-term holders maintain started to capitulate impartial lately as the bright price drop causes fear in the market.

Bitcoin CDD Influx Indicator Jumps Up, Exhibiting Long-Timeframe Holders Salvage Been Promoting

As pointed out by a CryptoQuant put up, doubtlessly the latest price drop has pushed lengthy-term holders towards selling their BTC.

“Coin days” are the assorted of days a Bitcoin has remained dormant for. An instance: if 1 BTC doesn’t circulate for five days, it accumulates 5 coin days.

When one of these coin would be transferred or moved, its coin days would be “destroyed” as the number will reset relief to zero.

Associated Finding out | Bitcoin Slips Under $33okay As Alternate Inflows Attain Best Rate Since July 2021

The “coin days destroyed” (CDD) metric naturally measures how plenty of these coin days are being destroyed in the total market at any given time.

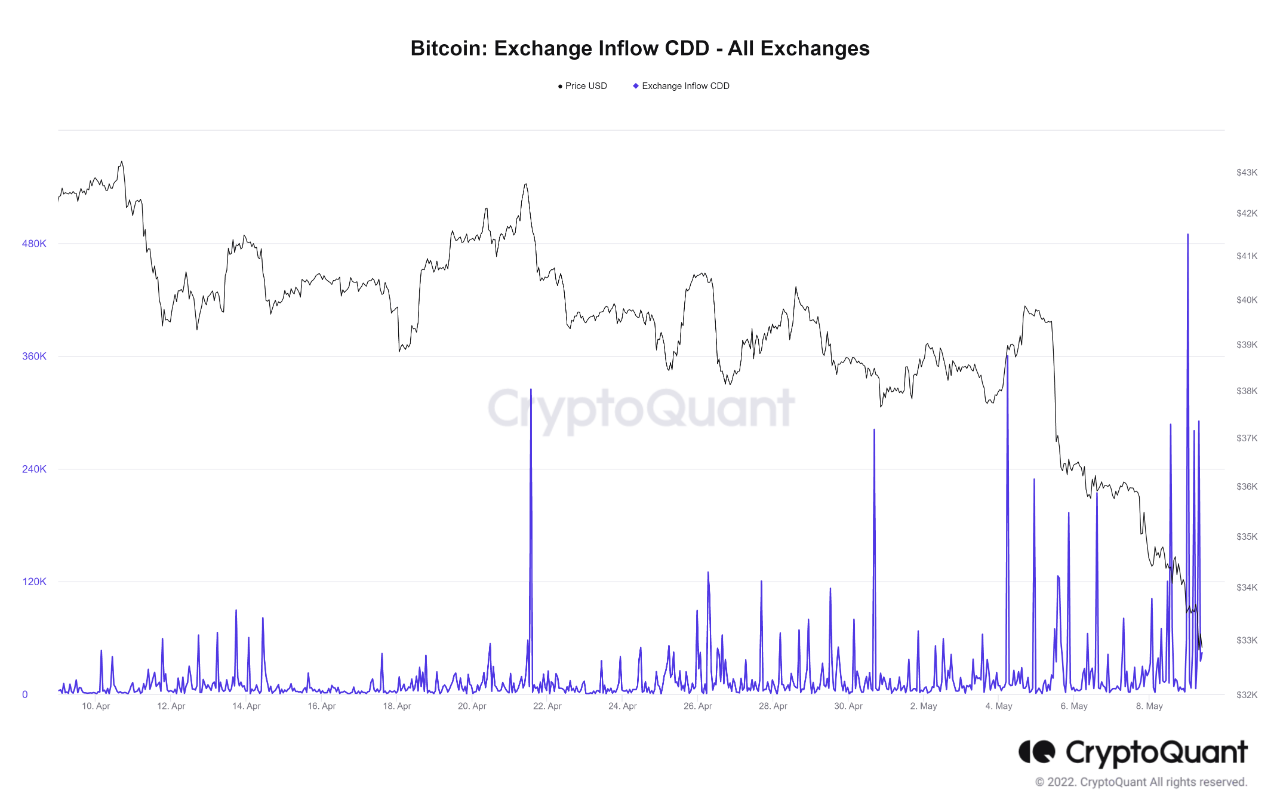

A modification of this indicator, called the “Bitcoin alternate inflow CDD,” tells us about handiest these coin days that had been destroyed by a transfer to exchanges.

A excessive price of the inflow CDD in most cases means that lengthy-term holders (who secure a colossal more than a few of coin days) are fascinating their coins to exchanges.

Investors in most cases transfer their Bitcoin to exchanges for selling applications, so LTHs transferring a colossal more than a few of their coins will also be bearish for the price of the crypto.

Now, right here is a chart that displays the pattern in the BTC inflow CDD right thru the final month:

The price of the indicator appears to maintain spiked up impartial lately | Provide: CryptoQuant

As that you just would be succesful of well scrutinize in the above graph, the Bitcoin alternate inflow CDD has seen some excessive values over the final few days.

This displays that lengthy-term holders were selling amid doubtlessly the latest fear in the market as a consequence of the price drop from $38okay to below $30okay.

Associated Finding out | Terra Beats Tesla As Second-Biggest Company Bitcoin Holder After $1.5B Internet

The especially colossal spikes in the final two days point out LTHs also can merely maintain started to wade thru a fragment of capitulation.

Since LTHs in most cases manufacture up the Bitcoin cohort that is the least at possibility of sell, capitulation from them is a detrimental signal for the price of the coin.

BTC Mark

At the time of writing, Bitcoin’s price floats around $31.6k, down 18% in the final seven days. Over the final month, the crypto has lost 26% in price.

The below chart displays the pattern in the price of the coin over the final 5 days.

Looks just like the price of BTC has seen a plunge prior to now few days | Provide: BTCUSD on TradingView

Bitcoin’s drop has persisted this day as the crypto in temporary touched below $30okay for the first time since July of final one year, sooner than rebounding relief to the brand new stage.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com