The below is an excerpt from a fresh model of Bitcoin Journal Knowledgeable, Bitcoin Journal’s top rate markets newsletter. To be amongst the main to receive these insights and other on-chain bitcoin market prognosis straight to your inbox, subscribe now.

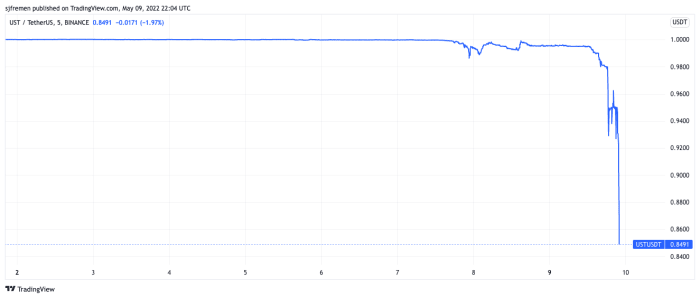

UST Buck Peg Collapses

What’s been setting up over the weekend and has been amplified on the present time is the depegging of the Terra stablecoin (UST) to the U.S. dollar now with Terra at the moment procuring and selling at $0.85. A form of these market dynamics had been taking half in out in come proper time on the present time as the location worsens and should soundless likely alternate all any other time over the following 24 hours. It started with billions of greenbacks in UST leaving the excessive-yielding Anchor Protocol over the weekend and find change into into a full-on digital bank stride.

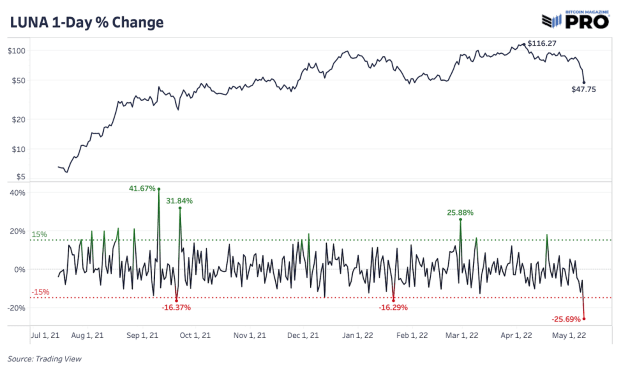

UST relies on the LUNA token to preserve its observe by algorithmic minting and burning mechanics. By plan of this form, an arbitrage opportunity is created when UST is off its $1 peg. Traders can burn LUNA and receive unusual UST when UST is priced over $1 and revenue. When UST is below $1, UST gets burned and LUNA is minted to abet stabilize the peg. But, as UST has suffered a blow to quiz and liquidity, LUNA has fallen nearly 26% in precisely one day whereas BTC is down nearly 8%.

As UST has suffered a blow to quiz and liquidity, LUNA has fallen nearly 26% in precisely one day whereas BTC is down nearly 8%.

Why this issues for bitcoin is since the centralized Luna Basis Guard (LFG) has accumulated 42,530 bitcoin ($1.275 billion at a $30,000 observe) as reserves to be susceptible in these true conditions, to defend the UST peg when it sustains below the $1. And at the moment, that is exactly what they strive to make.

As a response, the LFG voted earlier on the present time to loan out $750 million of bitcoin and $750 million of UST to OTC procuring and selling companies in efforts to abet withhold the UST peg. Later in the day, the LFG announced a withdrawal of nearly 37,000 BTC to loan out to market makers highlighting that it is at the moment being at threat of preserve UST.

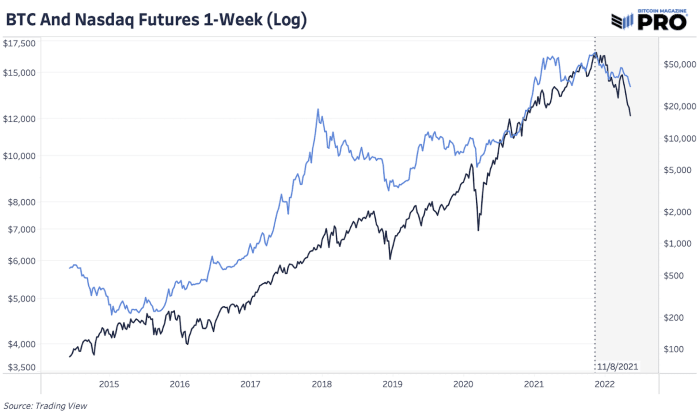

Now the main threat to the market is that the last observe buyer of bitcoin over the closing couple months will now become the market’s greatest compelled seller. The market expectations and means selling find undoubtedly played a job in bitcoin’s historical selloff on the present time, but it comes on the identical time that broader equity markets had been selling off in tandem. Bitcoin’s correlation to broader equity indexes and tech stocks is at historical highs and is following the identical market dynamics since November 2021.

Since the upward push in global interest charges, 40-one year excessive inflation, deteriorating growth and a macro credit score promote-off and unwinding unfolding, we’ve been highlighting these dynamics and the better market dangers at hand for months.