Terra is crumbling.

The blockchain challenge dwelling to the standard algorithmic stablecoin TerraUSD (UST), which had no longer too prolonged within the past become the fourth-largest stablecoin by market payment but now sits at fifth, is shut to collapse as UST repeatedly fails to maintain its $1 peg and LUNA, the blockchain’s native token, nears zero.

Terraform Labs, the tech open-up on the abet of the style of Terra, halted the production of new blocks on the network on Thursday “to forestall goverance attacks following severe $LUNA inflation and a vastly reduced payment of attack,” it mentioned on Twitter.

A governance attack grew to become more payment efficient on myth of the nearly-free worth of LUNA – an attacker can also cheaply originate ample LUNA tokens to socially attack the network by forcing a majority vote. (Since Terra depends on a derivation of proof-of-stake (PoS) for consensus in preference to hardware and electrical energy as in Bitcoin’s proof-of-work (PoW), coin possession equals vitality. In Bitcoin, the volume of BTC you recognize doesn’t grant you more vitality on the network.)

The network went live a pair of hours later as the utility patch used to be launched.

Here is one other crucial distinction between a network like Terra and Bitcoin: while within the used a minority of entities that can vote on things like halting the network, Bitcoin’s factual decentralization makes it immune to the whims of any tell group.

How Does UST Work?

Stablecoins are digital representations of payment within the invent of tokens that attemptively eliminate a one-to-one parity with a fiat forex just like the U.S. dollar. Tether (USDT) and USD Coin (USDC) lead the market capitalization unsuitable and are the most standard and widely-feeble stablecoins. Then all as soon as more, they’re issued (minted) and destroyed (burned) by centralized entities that additionally eliminate the wanted dollar-equal reserves to abet the coin.

Terra’s UST, alternatively, sought to become a stablecoin whose minting and burning course of used to be performed programmatically by a computer program – an algorithmic course of.

Below the hood, Terra “guarantees” that folk can alternate 1 UST for $1 worth of LUNA (whose payment fluctuates freely in step with make and seek files from) at any given time. If UST breaks its peg to the upside, arbitrageurs can alternate $1 worth of LUNA for 1 UST, capitalizing on the head class with an instant profit. If it breaks the peg to the method back, merchants can alternate 1 UST for $1 worth of LUNA additionally for an instant profit.

What Does Bitcoin Delight in To Produce With This?

Terra grew in consciousness among the many Bitcoin neighborhood after Terraform Labs founder Produce Kwon mentioned earlier this 365 days that the challenge would originate up to $10 billion of bitcoin for the reserves of UST.

The purchases would possibly per chance be made and coordinated by the Luna Foundation Guard (LFG), a nonprofit organization basically basically based in Singapore that works to domesticate seek files from for Terra’s stablecoins and “buttress the soundness of the UST peg and foster the development of the Terra ecosystem.”

While company treasury allocations to bitcoin grew in popularity throughout the final couple of years on the heels of MicroStrategy’s continuous BTC buys, LFG’s cross represented the major major BTC allocation as a reserve asset by a cryptocurrency challenge. The news used to be met with a mix of enthusiasm and skepticism among the many neighborhood.

Bitcoin Journal reported on the time that the algorithmic maneuver employed by the UST stablecoin to eliminate its peg used to be of doubtful sustainability, and the bitcoin purchases did no longer invent UST a stablecoin “backed by bitcoin.” Even Terraform Labs acknowledged that “questions persist regarding the sustainability of algorithmic stablecoin pegs.”

Terraform Labs additionally mentioned how there wants to be ample seek files from for Terra stablecoins within the broader cryptocurrency ecosystem to “absorb the temporary volatility of speculative market cycles” and train a better likelihood of reaching prolonged-term success. Here is what the challenge sought with BTC – manufacture seek files from for UST by conferring more confidence in peg sustainability.

How Did Terra Implode?

Given the a big selection of delivery questions regarding the sustainability of such an algorithmically-sustained peg, Terra’s assemble failed to assist in a length of stress.

As UST began shedding its peg to the method back, merchants sought to exit by redeeming each of their UST for $1 worth of LUNA. Then all as soon as more, given the brief lumber of devaluation, a huge quantity of UST tried exiting – larger than what Terra used to be in a feature to alternate for LUNA. That stretched out the on-chain swap unfold to 40% and assign extra stress on LUNA, sending its worth south sharply.

The token then went down a “death spiral.”

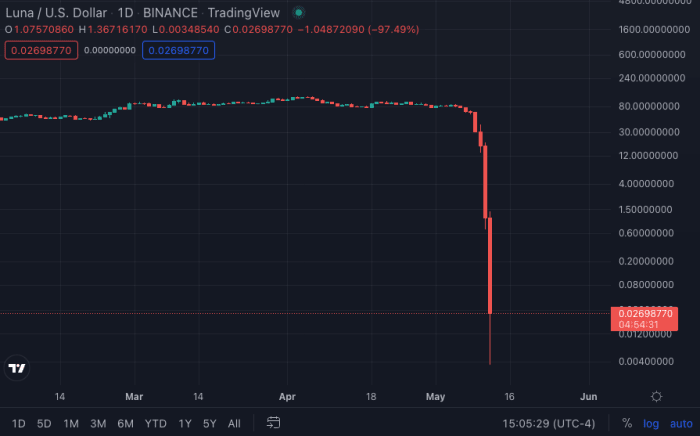

In a ripple manufacture, LUNA has plunged, shedding shut to zero on Thursday. List provide: TradingView.

What Does This Bid Us?

Briefly, it goes to also be argued that the lesson discovered from right here’s: different cryptocurrency projects (altcoins) are but an experiment, while Bitcoin is the handiest tried and tested seek-to-seek digital money.

Bitcoin used to be born out of the beliefs of the cypherpunks, a group of early cryptographers with a shared imaginative and prescient that obtained together to stumble on what privateness can also indicate within the then-upcoming digital world – especially because it pertains to money.

The cypherpunk circulate used to be spun out, for the most allotment, of the work of Dr. David Chaum, a cryptography pioneer that introduced the mathematical know-how out of the palms of authorities bureaucrats and into the realm of public files. His explorations kick-started a whole line of labor, dedicated to finding how society can also port seek-to-seek money – cash – to a digitized financial system.

With a transparent goal in thoughts, those mathematicians began crafting what an answer can also glance like thru be taught and experimentation. A protracted time later, Satoshi Nakamoto would assign it all together and add their recognize dash to reach at Bitcoin, the major and handiest decentralized and trustless invent of digital money.

As Bitcoin grew in popularity, different styles of what came to be often known as a cryptocurrency – a forex that exists within the digital realm thru the usage of cryptography – started to be created. While those cash before everything had been born to compete with Bitcoin, a whole new slew of projects later began to emerge with various payment propositions while inserting their recognize dash to the blockchain, consensus and cryptography that made Bitcoin work.

Nakamoto designed the Bitcoin protocol to leverage PoW, a consensus mechanism that depends on computing vitality and free competitors to mint new BTC on Bitcoin’s blockchain. The bitcoin mining stride, because it is known, contains hundreds of miners scattered spherical the arena with a single aim – uncover the next exact block and acquire bitcoin as reward.

The altcoins, nonetheless, recognize largely drifted away from PoW to prefer other unusual consensus mechanisms. The most standard different, PoS, permits individuals to lock their holdings of the given challenge’s native token to become block creators in preference to allowing them to compete with mining hardware and electrical energy to mine new cash.

While PoW brings valid-world charges to miners, charges in PoS are merely digital and symbolize the volume of money spent to make a decision those cash being staked. The belief with PoS is that staking those cash ensures miners recognize skin within the game and are on account of this fact impressed to behave truthfully, but there is never a proof that such commitment is ample of an incentive. Moreover, in cases where a stable devaluation occurs as with LUNA, the network risks being hit with a governance attack and can uncover itself having to method shut totalitarian actions like halting block production of what used to be presupposed to be a permissionless and unstoppable decentralized network.

The PoW-PoS dynamic is vital additionally because it highlights the experimental nature of altcoins.

As an different of copycatting Bitcoin’s model – a methodology that has been proved unsuccessful time and all as soon as more – new altcoin projects strive and “innovate” by copying some aspects of Bitcoin’s assemble and altering up others.

This ability that, projects being launched this present day float away from a whole lot of the beliefs underpinning the cypherpunk circulate that started a long time within the past. Such projects call themselves decentralized but for the most allotment recognize a founding group that infrequently ever drops its controlling feature and can steer each resolution that occurs on the network.

With this form of stable desire to innovate, “crypto” projects for the most allotment cease up rising artificial issues that don’t exist to allow them to acquire a unusual solution.

Dr. Chaum and the cypherpunks spotted a transparent advise in society: How will we recognize now money within the digital age that can no longer be spent twice without a centralized authority keeping song of balances? It took a long time of be taught for a selection of in actual fact knowledgeable scientists and mathematicians of various backgrounds to within the destroy culminate in an neat intention to this advise.

This present day, nonetheless, cryptocurrency groups method shut but a pair of years from belief period to a minimum viable product, no longer playing an organic development in prefer of gigantic amounts of capital that disproportionately favors insiders on the expense of the standard person.