Key Takeaways

- Synthetix’s native utility and governance token SNX surged roughly 70% this day after the DeFi platform turned into the third-largest protocol by procuring and selling price consumption in crypto.

- The important trace surge might maybe maybe be linked with Synthetix’s strengthening fundamentals, and particularly the a variety of rise in procuring and selling volumes and revenues.

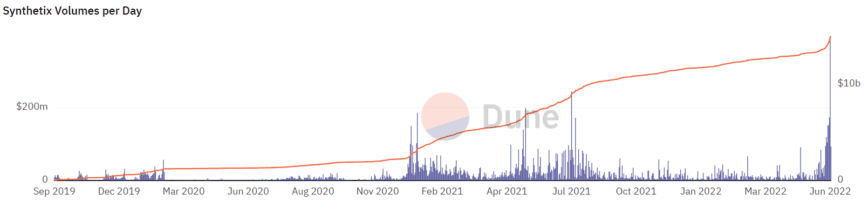

- Over the final seven days, Synthetix continuously averaged above $100 million in procuring and selling volume a day, topping at a describe-breaking $396 million on Sunday.

The decentralized synthetic asset platform Synthetix led a aid rally within the cryptocurrency market this day, surging around 100% from $1.57 to $3.16 prior to correcting to $2.88.

Synthetix Surges on Market Leap

Regarded as one of many earliest DeFi protocols looks admire it’s coming spherical any other time.

Synthetix, a decentralized platform for minting and procuring and selling synthetic property has led a aid rally within the cryptocurrency market this day. Its utility and governance token SNX jumped by around 70% on the leap, significantly outpacing the overall crypto market, which has rebounded by around 9% on the day. Aave and MakerDAO, two assorted DeFi initiatives generally described as “blue chips” alongside Synthetix, also posted double-digit positive factors because the market showed signs of existence for the main time in weeks.

Synthetix used to be really appropriate one of many main DeFi initiatives to start on Ethereum, offering customers a reach to alternate tokenized monetary devices that be aware the price of assorted property a lot like shares and gold. Alongside a host of the leading cryptocurrencies, Synthetix also helps synthetic gold and Tesla shares.

While synthetic property are the protocol’s bread and butter, the newest trace action appears to be influenced by more recent fundamentals strengthening the project, particularly the success Synthetix has viewed with a new atomic swap feature launched with the SIP-120 proposal. By integrating with the largest decentralized alternate for admire-priced property, Curve Finance, and the decentralized alternate aggregator 1inch, the feature helps customers finish mammoth-scale trades between assorted asset courses with minimal slippage. While it’s been in design since early November 2021, Synthetix upgraded atomic swaps with SIP-198 in Can also to seriously enhance the person journey. This allowed customers to whole mammoth swaps between, as an example, wBTC and ETH on 1inch in a single transaction by taking ultimate thing about Synthetix’s zero-slippage trades and Curve’s deep liquidity and low fees.

Since Synthetix applied the enhance, atomic swaps receive viewed rising adoption, accounting for most of its volume on Curve, 1inch, fixed forex, and assorted aggregators and integrators. Consequently, the protocol’s procuring and selling volumes receive surged over the final week, continuously averaging above $100 million in each day procuring and selling volume and reaching an all-time high on Sunday, with the each day volume topping $396 million.

Per info from cryptofees.info, the surge in procuring and selling volume has also propelled Synthetix to third inappropriate amongst protocols engaging the most procuring and selling fees, topping the likes of Aave, BNB Chain, and Bitcoin for the day on Sunday.

A spike in procuring and selling fees also map a surge in revenues or earnings accumulated to SNX stakers, which has propelled the staking yield for the token to 60.2% APY, with 12.4% of that coming from procuring and selling fees on my own. In step with info from Token Terminal, Synthetix’s trace-to-earnings ratio, calculated by dividing the SNX’s entirely diluted market capitalization by the protocol’s annualized revenue, is currently around 7.7x after falling 74.7% over the final week. A decrease trace-to-earnings ratio can point out that an asset is undervalued, earning more in revenues on a per-token basis.

The bettering fundamentals seem to were seen by price customers within the DeFi feature, though Synthetix has some reach to switch to reach back to its height. SNX is currently procuring and selling for around $2.86, down around 90% from the all-time high trace of $28.50 recorded in February 2021.

Disclosure: At the time of writing, the author of this half owned ETH and loads of assorted cryptocurrencies.

The guidelines on or accessed via this net feature is obtained from honest sources we imagine to be correct and reliable, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any info on or accessed via this net feature. Decentral Media, Inc. shouldn’t be an funding guide. We design not give customized funding advice or assorted monetary advice. The guidelines on this net feature is discipline to swap with out sight. Some or the overall info on this net feature can also turn into old-normal, or it is going to be or develop into incomplete or erroneous. We can also, but ought to not obligated to, change any outdated-normal, incomplete, or erroneous info.

You ought to never compile an funding decision on an ICO, IEO, or assorted funding constant with the records on this net feature, and also you might maybe never elaborate or otherwise depend on any of the records on this net feature as funding advice. We strongly suggest that you consult a licensed funding guide or assorted qualified monetary reliable whereas you fracture up searching for funding advice on an ICO, IEO, or assorted funding. We design not accept compensation in any create for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Undercover agent corpulent phrases and prerequisites.

Synthetix Launches Staking on Optimistic Ethereum

Synthetix doubles down on Layer 2. Synthetix Integrates Optimistic Ethereum Synthetix staking is now neatly suited with Optimistic Ethereum. Synthetix announced the change in a weblog post, stating the improved…

Compound, Synthetix Try to Destroy Out

Compound and Synthetix seem to be headed to greener pastures after posting over 26% positive factors within the final few days. Soundless, the pioneer cryptocurrency, Bitcoin, presentations a few red flags. …

Synthetix to Starting up Batch of Synthetic DeFi Tokens

DeFi’s favorite synthetic property protocol is getting a revamp. Bellatrix will peek Synthetix add a new batch of synthetic DeFi tokens. Synthetix Expands DeFi Choices Synthetix is launching a new…

Synthetix Team Votes To Tokenize Tesla Stocks

Synthetix’s governance board has voted so that you might maybe add Tesla shares (TSLA) to the DeFi derivatives procuring and selling protocol. Tesla Coming to Synthetix The addition of an synthetic TSLA asset used to be first officially…