Key Takeaways

- Bitcoin jumped by 20% after printing a low of $17,600 this weekend.

- Within the period in-between, Ethereum surged by over 29% from a low of $880.

- Both resources hold reached wanted areas of resistance after essentially the newest rebound.

Ethereum took the lead in essentially the newest cryptocurrency market revival, outperforming Bitcoin. Restful, both resources appear to hold extra room to ascend.

Bitcoin and Ethereum Upward thrust

The two most exciting cryptocurrencies by market capitalization, Bitcoin and Ethereum, notion primed to get better from essentially the newest market downturn as technical indicators flip bullish.

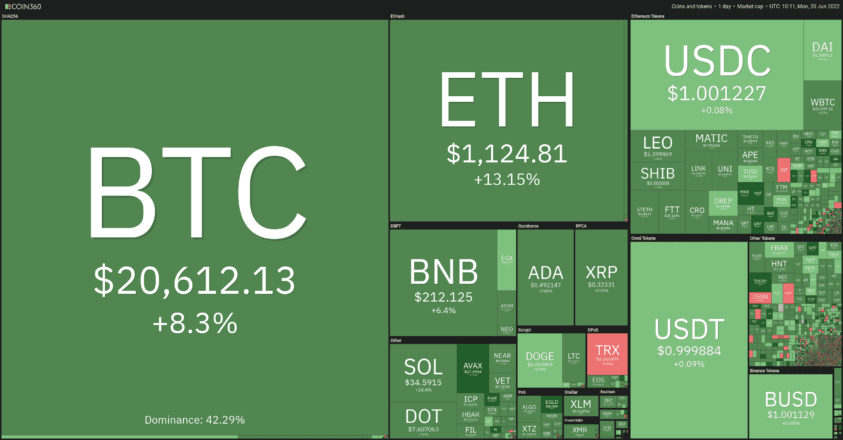

The cryptocurrency market kicked off the week with renewed self assurance as it gained over $100 billion in label in 24 hours. The surprising upswing came after Bitcoin, Ethereum, and lots of alternative resources printed contemporary yearly lows on Jun. 18, with Bitcoin shedding under $20,000 for the most significant time since December 2020. As the market tumbled, the erratic label action generated higher than $900 million value of liquidations at some point soon of all most significant crypto-derivative exchanges.

Ethereum is the wonderful-performing asset of the head 5 cryptocurrencies by market capitalization on essentially the newest rally. It traded at a low of $880 and surged by higher than 29%, hitting a native high of $1,140. Within the period in-between, Bitcoin has jumped by nearly 20% since its Jun. 18 trot.

Regardless of the necessary rebound Bitcoin and Ethereum hold registered over the previous couple of hours, both resources will seemingly be poised to upward push increased.

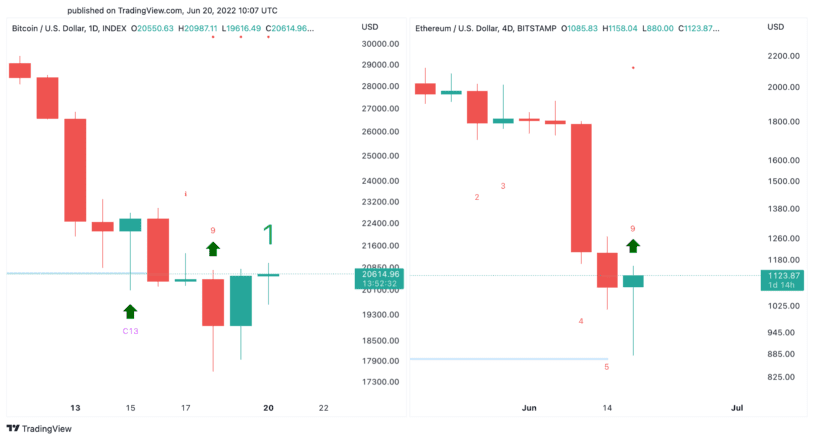

The Tom DeMark (TD) Sequential indicator has supplied dangle signals on Bitcoin’s day-to-day chart and Ethereum’s four-day chart. The bullish formations developed as purple 9 candlesticks, expecting bullish impulses forward. This blueprint of technical sample is indicative of a one to four candlesticks upswing.

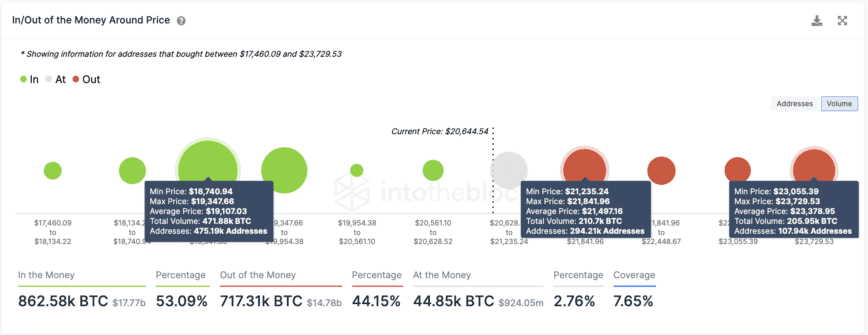

Transaction historical previous shows that Bitcoin faces stiff resistance at $21,500, the save nearly 300,000 addresses hold beforehand purchased over 210,000 coins. If the leading cryptocurrency can cut through this provide wall, it is miles going to also originate the strength to advance to the next hurdle at $23,730.

It is value noting that Bitcoin wants to retain above the $19,100 give a steal to stage to validate the optimistic outlook. Failing to kill so would perchance well order off one more sell-off toward $16,000 or even $14,000.

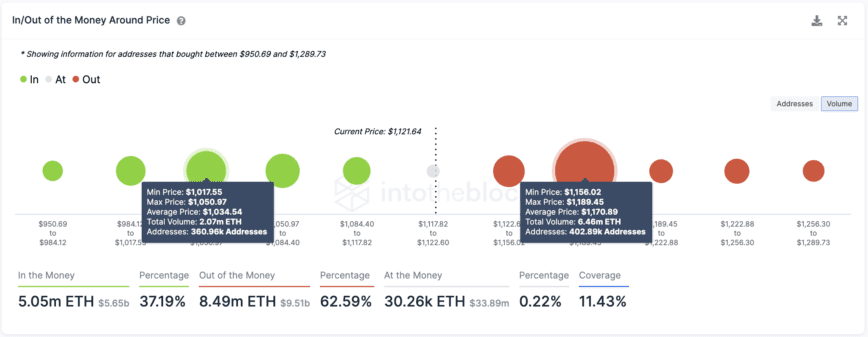

Within the period in-between, Ethereum must overcome the $1,200 resistance stage to validate the dangle value supplied by the TD Sequential. An upswing previous resistance would perchance well order off a spike in shopping for tension, potentially sending Ethereum to $1,800. Ethereum wants to retain above $1,000 to lead clear of printing lower lows, as a extended decline would perchance well lead to a atomize to $700.

Whereas the technicals display early indicators of a native backside, the macroeconomic outlook would no longer favor the bulls. The Federal Reserve’s dedication to rock climbing rates of interest has turn actual into a most significant point of disclose for crypto traders and international financial market individuals alike as increased rates of interest are inclined to damage threat-on resources. Moreover, many economists hold warned of a extended recession on the horizon, leading to mass layoffs at some point soon of some of crypto’s high exchanges.

The crypto market has been hit laborious amid the sad macro outlook, with the international cryptocurrency market cap at around $946 billion, around 68% down from its November 2021 high. For Bitcoin and Ethereum to continue the uptrend, they’re going to favor to wrestle off the fears and retain above give a steal to. If they prevail, they’ll in point of fact hold a likelihood at enticing traders wait on to the market.

Disclosure: On the time of writing, the author of this piece owned BTC and ETH.

For extra key market traits, subscribe to our YouTube channel and accumulate weekly updates from our lead bitcoin analyst Nathan Batchelor.

The guidelines on or accessed through this net order is bought from honest sources we specialize in to be actual and legitimate, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any info on or accessed through this net order. Decentral Media, Inc. is no longer an investment consultant. We kill no longer give customized investment advice or other financial advice. The guidelines on this net order is topic to trade without undercover agent. Some or all of the facts on this net order would perchance well turn into outdated-long-established, or it is miles going to be or turn into incomplete or incorrect. We are in a position to also, but are seemingly to be no longer obligated to, update any outdated-long-established, incomplete, or incorrect info.

It is best to never accumulate an investment resolution on an ICO, IEO, or other investment in accordance to the facts on this net order, and as well you have to never interpret or otherwise rely on any of the facts on this net order as investment advice. We strongly counsel that you just search the advice of an licensed investment consultant or other qualified financial official whenever that that possibilities are you’ll even be attempting to net investment advice on an ICO, IEO, or other investment. We kill no longer accept compensation in any blueprint for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Evaluate paunchy terms and prerequisites.

Bitcoin, Ethereum Tumble After Breaching Serious Enhance

The entire cryptocurrency market cap has fallen under $1 trillion for the most significant time since January 2021 as Bitcoin, Ethereum, and vital cryptocurrencies plunge in tandem. Bitcoin and Ethereum…

Four Metrics Suggest the Bitcoin Market Bottom Is Shut to

Bother has struck the cryptocurrency market after Bitcoin dropped to $20,800 this day. Now, lots of technical and on-chain metrics point out that the head cryptocurrency will seemingly be drawing finish a backside. Bitcoin Displays…

Ethereum Primed for Volatility as Impress Movements Tighten

Ethereum remains stagnant in a no-exchange zone that is getting narrower over time. Patience is instructed till ETH can ruin out of this tight label pocket. Ethereum at a Crossroads…