Examining Federal Reserve policy choices to boot to to files from the shopping managers’ index can present us three scenarios for the bitcoin mark.

Examining Federal Reserve policy choices to boot to to files from the shopping managers’ index can present us three scenarios for the bitcoin mark.

Darius Dale is the Founder and CEO of 42 Macro, an funding analysis agency that targets to disrupt the monetary companies change by democratizing institutional-grade macro threat management processes.

Key Takeaways

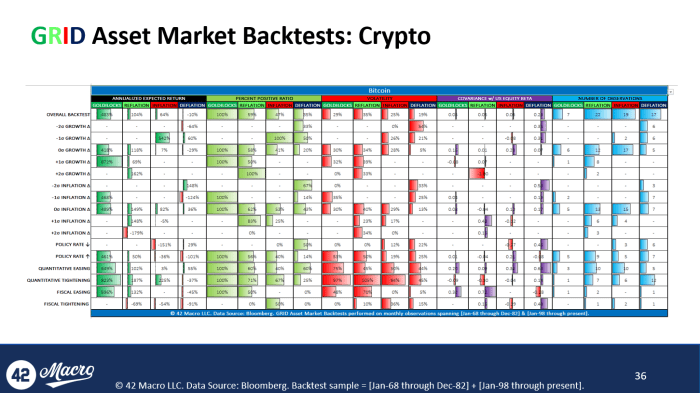

The distribution of probable financial outcomes — and by extension, monetary market outcomes — is as flat and broad because it has been in novel years. 42 Macro’s defective-case scenario of deflation requires an expected return of -10% annualized for bitcoin. Our bull case scenario of deflation plus policy rate decreases requires an expected return of +29% annualized for bitcoin. Our endure case deflation plus quantitative tightening requires an expected return of -37% annualized for bitcoin. Critically, all three scenarios are equally probable over the next three to 6 months. If we sounded highly convinced issuing sell warnings at every decrease excessive in bitcoin’s mark from early-December by July, we’re going to salvage a draw to salvage to tranquil sound equally unconvinced right now time.

The Unpleasant Case

U.S. and global growth proceed to slow, albeit at a more modest dart than in novel quarters. The Fed and other central banks proceed to procyclically tighten monetary policy by One year cease: comfortable-ish touchdown.

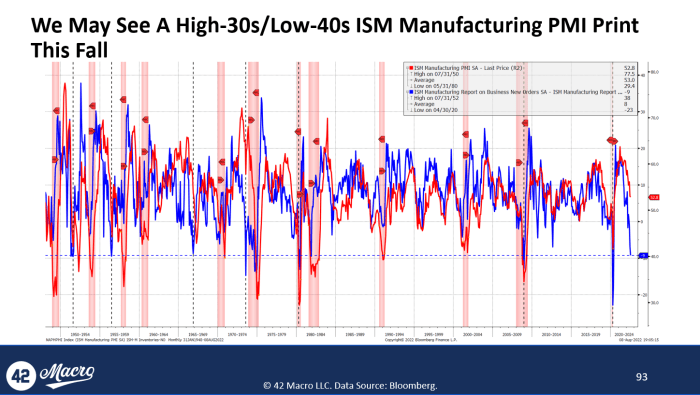

Bayesian spotlight: The slowdown within the headline ISM Manufacturing to the lowest stage since June 2020 became once an afterthought relative to the decline within the “original orders much less inventories” spread falling to -9. Right here is the lowest stage since December 2008. There salvage most attention-grabbing been eight such cases the save the spread troughed at novel or worse phases. The median trough ISM Manufacturing reading in such cases is 38.6, which is in overall reached one month later on a median basis. The median trough ISM Manufacturing reading when the spread troughs +/- 1 level from its novel stage of -9 is 42.5, which is in overall reached three months later on a median basis (n=4). All told, it’d be wise for investors to emphasise check their portfolio holdings for, at simplest, a low-40s ISM Manufacturing statistic this autumn.

The Bull Case

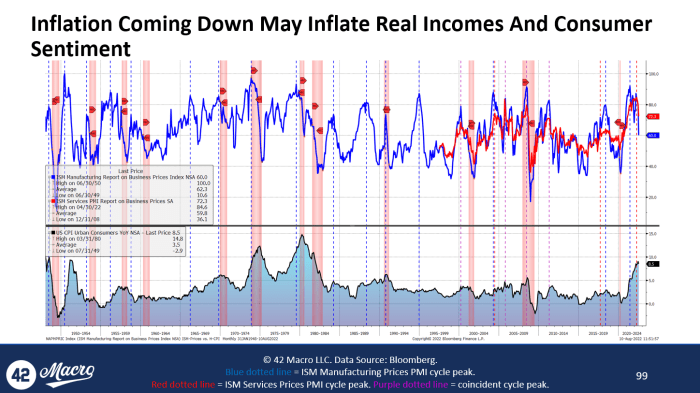

U.S. inflation momentum continues to express no sharply, possible causing the Fed to cease after a closing rate hike in September. The reach in trusty incomes pulls ahead the certain inflection in growth: comfortable touchdown.

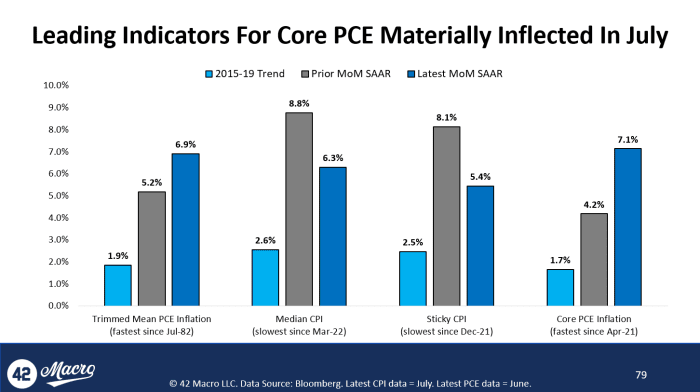

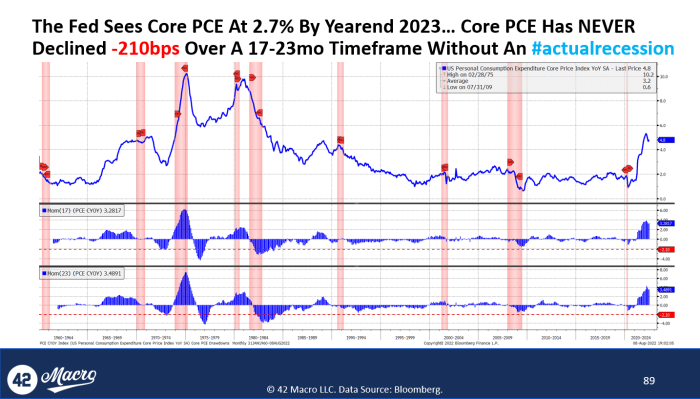

Bayesian spotlight: The July user mark index (CPI) originate represented the river card in a trifecta of files aspects: July ISM Companies PMI, July Jobs Document, July CPI, that every lend credence to the comfy-touchdown watch. Whereas the shy away surprises on both headline CPI (0.0% month-over month versus 0.2% estimate) and core CPI (0.3% month-over-month versus 0.5% estimate) were to be celebrated, the brunt of the moral files got here by task of the bright slowdowns in median CPI (-250 basis aspects to 6.3% month-over-month annualized) and sticky CPI (-270 basis aspects to 5.4% month-over-month annualized) because these indicators discover core deepest consumption expenditures (PCE) — the Fed’s most current inflation gauge — greater than most other CPI time collection. If the deceleration in these main indicators continues at the identical dart and if historical correlations persist, we are capable of even be having a to find at month-over-month annualized charges of core PCE of roughly 2% within the August or September files. Those are clearly two very gargantuan ifs, especially serious about we’re devoid of historical examples of this more or much less non-recessionary inflation dynamism to adequately prepare a mannequin on. At any rate, the probability the Fed could be heading into its November 2 meeting with “particular and confirming proof” that inflation is liable to sort lend a hand towards its 2% intention in an cheap timeframe is gorgeous to form, but form it we need to, serious about August PCE is released on Sept. 30 and September PCE is released on Oct. 23.

The Undergo Case

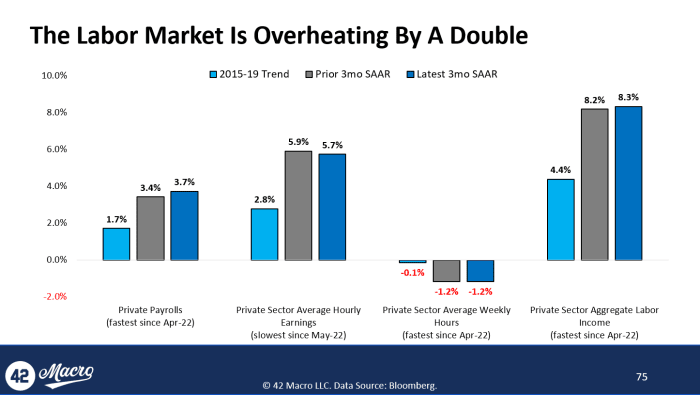

The nascent deceleration in inflation momentum stalls out at phases inconsistent with the Fed’s mark stability mandate, causing the Fed to tighten properly into 2023: onerous touchdown.

Bayesian spotlight: The labor market is overheating by a double, relative to pre-COVID traits. The hotly debated 528ample month-over-month “headline nonfarm payrolls” resolve for July clearly stole the show veil from a market response perspective. The reacceleration within the three-month annualized growth charges for headline (+40 basis aspects to a 3-month excessive of three.5%) and non-public payrolls (+30 basis aspects to a 3-month excessive of three.7%) is suggestive of a home labor financial system that is never any longer responding to the policy tightening we salvage now accumulated to this level. With the three-month annualized growth rate of non-public sector reasonable hourly earnings slowing modestly (-20 basis aspects to a two-month low of 5.7%) alongside unchanged non-public sector reasonable weekly hours growth of -1.2%, it is evident the +10 basis aspects uptick in aggregate non-public sector monthly earnings — to a 3-month excessive of 8.3% — became once largely driven by more staff finding work.

Right here is a visitor submit by Darius Dale. Opinions expressed are fully their hang and cease no longer essentially remark those of BTC Inc. or Bitcoin Journal.