Right here’s an blueprint editorial by Macro Jack, a Bitcoiner with a background in historical monetary providers and products spanning investment study, investor relatives and commerce pattern.

Environmental, social and governance (ESG) is an skill to take grasp of into consideration companies or international locations in step with their alignment with these three factors. Growing in recognition as of late, ESG has turn into a globally adopted framework and a focus of capital allocation. The theory sounds innocuous on paper since most folk are trusty and deserve to reach environmental or social considerations. Even better if we can attain it by investments. However, introducing a monetary reward for ESG’s disciples introduces a full new blueprint of incentives that accumulate seemingly no longer been totally examined by the investment community.

There is better than meets the spy. The ESG overview process is unfair, opaque and centralized, leaving essential room for corruption. It is moreover suspicious that definitely one of essentially the most well-known proponents of ESG is the BlackRock CEO, Larry Fink. BlackRock is the realm’s ultimate asset supervisor managing better than $10 trillion, and Mr. Fink’s standard of living reflects that. He enjoys flying non-public to Davos, relaxing in his Aspen mansion and telling you to minimize your carbon footprint.

Digging deeper into ESG finds a more inferior belief. While we want to be trusty stewards of the planet, we mercurial be taught that the globalists’ proposal for doing so within reason ominous and moreover illegitimate. ESG is an critical a part of the agenda to consolidate capital and centrally belief the allocation of sources, destroying the stays of the free market within the technique. Let’s dig a chunk of deeper.

ESG is better than an skill to evaluating investments; it is a social credit diagram the same to the one who exists below the Chinese language Communist Social gathering. A lot like a credit standing that determines one’s eligibility for loans in step with their previous skill to provider debts, a social credit diagram is a more invasive analysis and determines salvage admission to to no longer ultimate monetary providers and products, but moreover public providers and products, comparable to public transportation or grocery retail outlets. As an instance, China’s social credit diagram seeks to compile digital records of electorate’ social and monetary behavior to calculate a non-public score that determines what providers and products they are entitled. Per the Wall Aspect road Journal, the authentic Chinese language social credit diagram comprises mortgage reimbursement, bank card funds, adherence to web page online traffic rules, adherence to household-planning limits and “reliability” of files posted or reposted on-line, amongst quite various factors. To boot to the authentic inputs, social credit comprises political dissidence, non-public values and on-line speech into each particular person’s score. Any individual’s beliefs, political opinions and on-line behavior resolve their skill to salvage admission to providers and products comparable to insurance and banking, college admissions, files superhighway providers and products, social providers and products and job eligibility.

Social credit is a diagram that determines salvage admission to to goods and providers and products at a particular person level, whereas ESG determines a corporation’s skill to salvage admission to capital. In a roundabout design, rather then a company turning in a providers and products or products that the market calls for, companies succeed in step with their skill to compromise values and incorporate an ESG agenda. On an ESG in vogue, success will not be any longer in step with turning in providers and products to the market but on allegiance to the ruling class. ESG is a return to the monarchical model, allowing an elite few to allocate capital to causes that extra enrich them within the name of “social trusty.”

Now no longer ultimate does the ESG diagram consolidate capital to the ruling class, but it absolutely is moreover effective at destroying wealth on a nation-broad scale. As an instance, Sri Lanka’s ESG score was 98.1 ahead of its fall down. World Financial’s study explains the score. A high Emissions Index (discontinuance to 100) indicates a low environmental affect for the nation. The Emissions Index is in step with the equal weighting of carbon and methane emissions.

Sri Lanka’s fall down is due in some half to the authorities’s choice to power farmers to swap from chemical fertilizers, which use pure gas as a key enter, to natural fertilizer in April 2021. This mandate lowered cleave yields and has led to less meals, ensuing in Sri Lanka depleting its foreign forex reserves in show to import meals. In two years, Sri Lanka’s foreign forex reserves had been depleted from $7.6 billion in 2019 to $50 million by the discontinuance of 2020, a roughly 99% decrease. Your complete whereas, the nation had $81 billion in debt and meals costs accumulate almost doubled.

If the rest, the ESG score teaches us that it is miles mostly a counter indicator to a nation’s economic successfully being, indicating a lack of meals and legitimate vitality. One other recent ESG pattern was the Netherlands authorities’s recent announcement of their plans to decrease emissions of nitrogen by 50% by 2030 and Canada’s proposal for cutting fertilizer emissions by 30%. In the Netherlands, the scapegoat is farm animals and a discount in herd dimension will render many farmers bankrupt, rising meals insecurity globally and making red meat artificially scarce. By succumbing to the pressures of ESG, companies and international locations attain no longer prosper, they fall down. In preference to lifting all tides, they sink all ships.

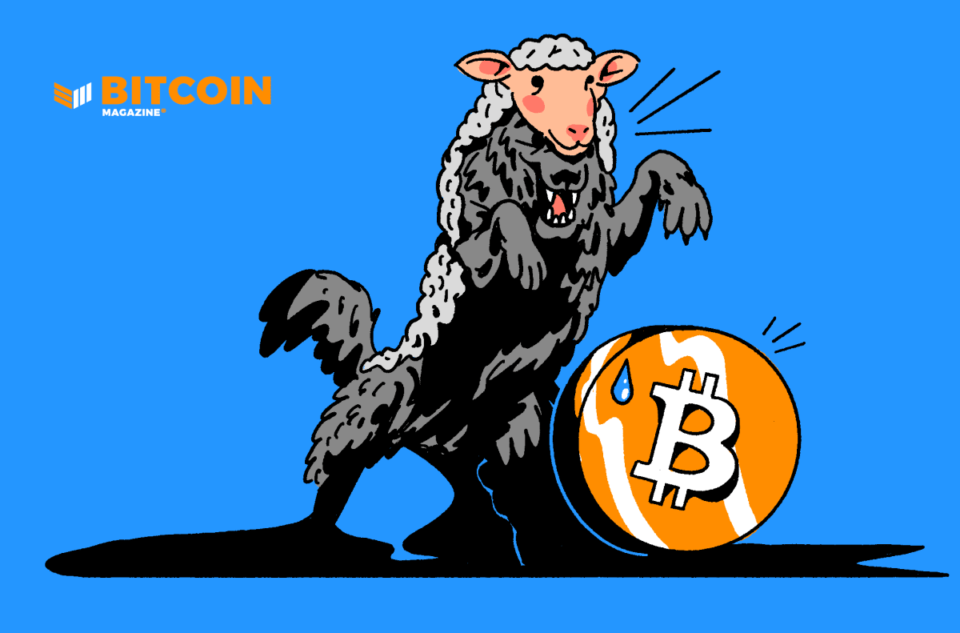

At a corporate level, the ESG draw is skill since the inventory market, particularly passive investing, has been promoted as essentially the easiest manner to function wealth, namely within the U.S. Passive autos comparable to commerce-traded funds had been championed by BlackRock and different companies. for his or her simplicity and accumulate viewed a huge growth in quiz within the previous decade. However, the unstated slay end result of passive investing is that the shareholder balloting rights are in actuality concentrated with these behemoth asset managers, which use the votes to implement their ESG agenda. The ESG cronies are appointed to board positions and administration roles, destroying the stays of capitalism. In preference to turning in shareholder stamp and rising mixture wealth, companies are compelled to concentrate on “stakeholder capitalism,” translating to woke capitalism. Companies must succumb to Marxist ideologies to take a connection to the monetary window. ESG is a social credit diagram masquerading as a “social trusty.” A brand new accomplish of crony capitalism, one in step with allegiance to the globalists and masked as a virtuous trigger.

The foundation trigger of Marxism spreading at some stage within the capital allocation process is the debt-essentially based entirely fiat money. On fable of inflation is programmed into our money, savers are compelled to make investments in Wall Aspect road products to protect their shopping energy. The inflationary forex monopolized by central banks is a field that Wall Aspect road is desirous to clear up and their solution enables them to utilize the shareholder balloting energy to push the ESG agenda. The need for a financial savings skills objective from depreciating fiat forex and Wall Aspect road’s monetary products is apparent.

Enter Bitcoin, a financial savings skills that can free us from the globalists’ attack vectors, alongside with ESG. By restoring the base layer of civilization with sound money skills, Bitcoin permits us to keep for the future. There will not be any longer always a need for Wall Aspect road products on a bitcoin in vogue since there will not be such a thing as a government, such because the Federal Reserve, diluting the provision. Bitcoin is programmatically scarce. There will ultimate ever be 21 million bitcoin and the monetary policy is fully clear and inelastic to changes in quiz. Appropriate as gold was chosen by the free market as money ensuing from its salability across rental, so too is bitcoin being adopted as financial savings skills. There is a rising quiz for sound money as fiat currencies vogue in opposition to zero. As quiz grows over time and present issuance decreases, the price will hurry up. Bitcoin is the financial savings skills that humanity wants to prosper.

Before folks exhibit the apparent, it is miles price addressing that bitcoin’s stamp is unstable. Bitcoin’s stamp does decrease in dollar terms ensuing from the instability of the fiat monetary diagram. However, bitcoin is ultimate 13 years outmoded and never but a unit of fable. As understood successfully within the bitcoin and Austrian economics rental, money follows an adoption curve: first as a collectible, then as a store of stamp, next as a medium of commerce and finally as a unit of fable. Bitcoin’s predecessor, gold, went by this monetization process over thousands of years. Bitcoin’s adoption is progressing grand sooner. Because it advances within the monetization process, this might maybe perchance well turn into more stable in dollar terms. Appropriate be aware that it is miles continually stable in bitcoin terms; 1 bitcoin = 1 bitcoin.

To enact, the restoration of sound money because the base layer of civilization removes theft from the monetary diagram. Now not like central bankers that devalue your financial savings and power you to speculate on Wall Aspect road products to protect shopping energy, bitcoin exists as a replacement to store stamp by rental and time, defunding the Cantillonares and destroying ESG within the technique.

Right here’s a visitor submit by Macro Jack. Opinions expressed are entirely their like and assign no longer necessarily replicate these of BTC Inc. or Bitcoin Magazine.