Right here is an belief editorial by Andy LeRoy, the founding father of Exponential Layers which is a Lightning Network analytics platform and explorer.

This magnificent three bed room, 1.5 bathtub home in Charlotte, North Carolina, is a millennial’s dream. Whole with a backyard and a porch for taking part in a coffee, it’s miles in a high neighborhood gleaming down the avenue from a brunch position with an all-day avocado toast special. For gleaming $730,000, it’s miles also all yours.

All of us stumble on this home is costly. A $4,000 monthly payment, even after striking $150,000 down, would symbolize nearly 70% of the median U.S. family earnings, and this home is about 1.7 times higher than the U.S. median home tag of $440,000.

Why Is This Home So Costly?

The home changed into in-constructed 1938, and its most modern on hand data issue its sale historical past, the earliest being for $88,500 in 1987.

This jump from $88,500 to $730,000 is a 725% magnify over 35 years, and reflects a compound annual development price (CAGR) of 6.2%. That’s rather an magnify. Over the the same time the S&P 500 is up 465% at a CAGR of 5.1%, so is it in actuality that enormous of a jump in comparability?

What about scandalous home product (GDP), the jog-to for measuring financial output? GDP is up from $4.7 trillion to $24.8 trillion in nominal terms, every other triple-digit magnify of 427% over 35 years.

So the whole lot is up … it makes sense, real?

Charlotte’s inhabitants has grown from 424,000 to 2.2 million over this identical time length — 5% CAGR — and this home is in a immense neighborhood, so provide and query? Plus our financial system is more productive, so the upward push in tag is inevitable?

All of this tests out on paper, aside from for one metric: energy.

U.S. energy consumption in 1987 changed into 21,056 TWh of energy, which adjusted for inhabitants on the time represents about 87,000 kWh per particular person. Of this energy consumption, electrical energy utilization changed into around 11,500 kWh per capita.

Compare that to on the unusual time — the most modern figures in 2022 for the United States issue per capita energy consumption of 76,632 kWh, with a tiny magnify in the amount consumed as electrical energy at 12,466 kWh per particular person.

For all the controversy of “strolling uphill each ways” in old generations, it of route turns out that more energy changed into consumed per capita 35 years prior to now in the U.S. than it’s miles on the unusual time.

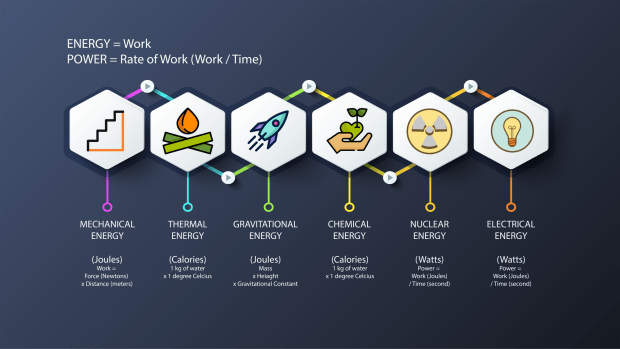

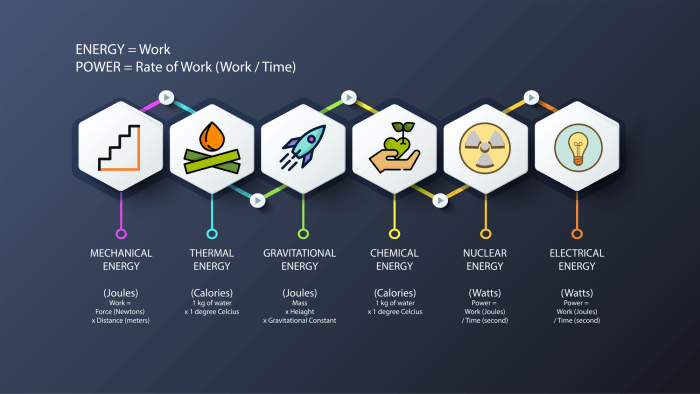

The Energy Breakdown

There are a various of kinds for a vogue energy (after which electrical energy) is created.

Could more than seemingly well own to you creep a bike at an inexpensive scamper, you are going to generate 100 watts. Defend this up for 10 hours and you’re going to own generated 1 kWh value of energy. A load of laundry carried out with a washer and a dryer will bask in around 6 kWh of energy.

If we ignore the monetary denomination of housing prices and gleaming compare on the U.S. financial system as the output and consumption of energy, we now bask in less per capita than we did in 1987.

As we noticed in USD prices, this teach home is eight times as costly, while energy consumption per capita is flat. By this common sense, if it took you one month of utilizing your bike for 10 hours a day to generate the energy to understand the home in 1987, that now you can wish to creep your bike for eight months to understand the the same home. Eight times as unparalleled energy for the the same product? Better secure out that Peloton subscription.

Right here’s a cherry-picked instance of 1 home in a growing city; it has more than seemingly been renovated many times and is value the extra work, particularly pondering Charlotte’s inhabitants and job development.

Let’s zoom out and compare at every other instance.

The Texas A&M True Estate Middle publishes aggregated rural land prices. From their chart, we are able to seek that an acre of land in Texas in 1987 changed into $553. That identical land in 2021 is now nearly $4,000/acre (an eightfold magnify over a 35-One year length).

An acre of land, and not utilizing a enhancements, in the midst of nowhere, now requires eight times as unparalleled energy output to understand?!

Land can reinforce in cost with higher inhabitants, utility (farming or hunting) or lower tax rates and/or some roughly backed incentive. But a 362% tag magnify after adjusting for U.S. inhabitants development? Texas with out fracture, but something doesn’t add up here.

Is Energy The Steady Metric?

The premise of energy-basically based mostly money is nothing unusual. Henry Ford changed into an early proponent of energy as currency, and as many Bitcoiners and Redditors own pointed out, he changed into also a believer in reincarnation (H.F. someone?). The premise of a money denominated in energy terms, kWh to illustrate, held immense promise for getting us out of the fiat system.

We intuitively stumble on the belief that of energy. We both work longer hours or we heart of attention efforts or exhaust higher instruments to leverage our output, and the abstractions merely jog on. The corporate world is stuffed with inside price of return evaluation, resource staffing, budgets and timelines. Earnings reports and financial statements offer the scorecard to the market, which weeds out companies that construct no longer generate financial cost over time.

Our system of capitalism has labored rather well. Attributable to the amazing ingenuity, output and work of everybody in the sphere, and despite inflation, so many issues now own lower prices.

In 1956, the ENIAC laptop weighed 27 lots, consumed 150 kW, ran about 100,000 operations per 2nd and cost the identical of $6 million on the unusual time. Nowadays, a brand unusual Macbook weighs 3.5lbs, consumes around 40 watts, and cranks out 3.2 billion operations per 2nd — all in favour of $2,000.

Airliners own elevated their gas effectivity at a compound price of 1.3% between 1968 and 2014.

In a whole lot of cases, we’re getting way more efficient with all of our energy consumption, so issues might per chance more than seemingly maybe well tranquil be getting even more cheap?

What’s The Field?

With a opinion to own a rich life and so many enhancements while utilizing the the same energy per capita is a back to us all, but how that financial cost is measured is inclined to altering rules.

If we now own gotten more efficient with our energy and own higher know-how, how is it that a section of rural land charges eight times more? Right here is the put the Federal Reserve’s growing money provide comes into play. For all the controversy about “transitory inflation,” the Fed (with the serve of banks) has managed to amplify the M2 money provide by around 680% at some stage in the last 35 years.

So while our nominal GDP is up 427%, it hasn’t outpaced money provide development, and we now own already considered that energy consumption per capita is flat over 35 years.

The problem here is what we all can tangibly feel: The output of our work denominated by the energy we save in is value significantly less over time.

When we as contributors or corporations are unable to protect the efforts of our energy output, we must in any admire times frequently get ways to protect our buying vitality via sources luxuriate in land, commodities and equities. If the scamper at which saved energy degrades is sooner than innovation and output, we now own issues. Bodily limits come into play: We are able to print the total money in the sphere, but we are able to’t flawed energy manufacturing and consumption.

Certain, our energy might per chance more than seemingly maybe well be consumed more efficiently — as evidenced earlier by the airplane requiring 45% less gas for the the same day out — thus providing more cost to society. If our society has been so efficient, why has debt to GDP risen from 47% in 1987 to 123% on the unusual time? How is it that we now own wished to borrow in opposition to the future so unparalleled in an ambiance of elevated productiveness? Sooner or later this all breaks.

What Breaks?

Unlike with fiat or any proof-of-stake altcoins, you might per chance more than seemingly maybe no longer flawed energy creation. Doing more work prior to now doesn’t magically produce unusual work in due route. Nonetheless, the quilt-up in fiat money printing, blended with every U.S. executive administration’s propensity to utilize, has left us in debt.

Supposedly here is fine, attributable to we are able to frequently print our ability out of debt. But construct we in actuality?

In 2021, the federal executive brought in $4.05 trillion in earnings with GDP at $22.4 trillion. It spent $6.82 trillion. The pandemic funds made up $570 billion on high of other category staples much like social safety ($1.1 trillion), health ($797 billion) and protection ($755 billion). Interest paid by the executive changed into $352 billion — 5% of whole spending (in a plague One year).

Over time, the executive has spent more as a percent of GDP — 32% in 1987 when compared to 55% on the peak of the pandemic — and now to 34% in 2022. Even after shooting the associated price hidden in inflation all these years!

In attempts to quell narrative inflation (9.1% in the most modern narrative), the Fed hiked hobby rates to 2.5% in July; an magnify of 75 foundation aspects (.75%).

While this would more than seemingly maybe more than seemingly “unhurried” the financial system, it has two negative results on being ready to steadiness the budget. With a slower financial system, they’ve a lower tax earnings to scheme from. The most recent 0.75% hobby price magnify also provides every other approximately $130 billion in hobby expense to a budget that already can’t be balanced. This is accessible in the produce of added expense on debt rollover, and this immense article from Allan Sloan walks via an estimated calculation.

Using his rollover debt totals of about $7.1 trillion, every 100 foundation point magnify in the federal funds price that feeds via to market yields on Treasuries provides every other $70 billion to required executive spending. If rates ever withstand a 5% range, that puts hobby expense (on gleaming recent debt) at someplace shut to $500 billion. More than transportation, training, practicing, employment and social companies blended.

The Fed can also proceed their attempts for quantitative tightening, but this has the the same snort: higher hobby rates (and pastime expense), and a presumably lowered tax snide given financial slowdown.

The closing closing option might per chance more than seemingly maybe well be to chop federal spending or magnify taxes. With names luxuriate in the “Inflation Good purchase Act,” we already seek the executive attempting to hide their elevated taxation attempts. Other “hidden” taxation attempts will seemingly come: growing the age at which you might per chance more than seemingly maybe birth up receiving social safety benefits, in conjunction with extra taxes for “well off” other folks withdrawing from their 401(ok) or IRA, striking in carbon taxes below the guise of “ESG” (environmental, social and governance). Things will might per chance more than seemingly maybe well tranquil be inventive to offset the competing incentives of a surplus and (re)election.

Sooner or later, this mannequin breaks. We can no longer cut energy manufacturing and consumption, cut hobby rates to abet development and stride persevered deficits. The numbers don’t add up and indirectly no person — contributors, companies or governments — can flawed the energy output required to withhold scamper. We own considered a various of debt-ceiling showdowns at some stage in the last decade, but this time appears diversified, particularly with 25% of the sphere residing in worldwide locations with 10%-plus inflation.

What’s Next?

Money is gleaming a tool for valuing goods and companies over time — and has key properties. It doesn’t produce “yield” by itself. Handiest productive sources, which provide definite financial cost, can construct this. When all of it breaks down, whoever holds the productive sources can resolve the role of money, equipped they’ve the sources and system to place in power and protect the foundations.

But, as all of you are well wide awake, we indirectly own an various option. In assert of it coming from high-down enforcement, backed by the protection power, Bitcoin is adopted backside-up — in the very uncover that its properties become priceless to the other folks and companies providing financial cost.

All we pick on as millennials is a vogue to protect our work, energy and buying vitality. And own an even avocado toast while we creep our pelotons.

How Bitcoin adoption plays out might per chance well be fascinating and bright to stumble on. Bitcoin is already inclined worldwide, with a $410 billion market cap, settling some $60 trillion in cost.

Now, with the Lightning Network, Bitcoin will also be sent seek-to-seek instantaneously, with out a government. July noticed the very top monthly Lightning Network capability, and every metric is up and to the true for providing a payment layer that presents persevered utility and helps definite the medium of alternate hurdle recent in the Bitcoin system.

Defining success metrics relies on an whole host of issues, and at Exponential Layers you might per chance more than seemingly maybe rob a compare at preliminary Lightning Network metrics that give perception into community development (among other data), as Lightning strikes to rob the role of Visa’s $10.4 trillion yearly payment quantity.

Right here’s a guest put up by Andy LeRoy. Opinions expressed are fully their very hold and construct no longer necessarily secure these of BTC Inc. or Bitcoin Magazine.