Key Takeaways

- On-chain knowledge helps analyze investor behavior and potentially identify market trends.

- Whereas blockchain knowledge brings a weird and wonderful perspective on investor behavior, one might quiet also consider technical and elementary analysis to produce well-told shopping and selling and investing decisions.

- Phemex, one in all potentially the most trendy cryptocurrency exchanges in the industry, provides a wealth of facts about on-chain metrics to enable you turn out to be a a success dealer.

On-chain analysis (often referred to as blockchain analysis) is an rising discipline that obtains knowledge about public blockchain process.

Leveraging On-chain Knowledge

For anyone weird and wonderful with the abilities, blockchains are public databases the attach knowledge concerning community transactions (however now not the identification of who transacts) is accessible by anyone.

Whereas technical analysis makes a speciality of the worth and volume of an asset, on-chain analysis makes a speciality of extracting knowledge from the assert of the blockchain, such as transaction process patterns, the focus of token possession, social sentiment, or change flows.

This residence of analysis emerged in 2011 with the introduction called Coin Days Destroyed (CDD), a metric ancient to confirm the age of tokens transferred on a given day to measure market participation. Since then, we’ve considered the introduction of a noteworthy wider decision of on-chain analysis instruments (Glassnode by myself has developed over 75 on-chain metrics).

The following allotment is a summary of potentially the most significant and widely ancient on-chain indicators crypto investors can utilize to consider process on the blockchain:

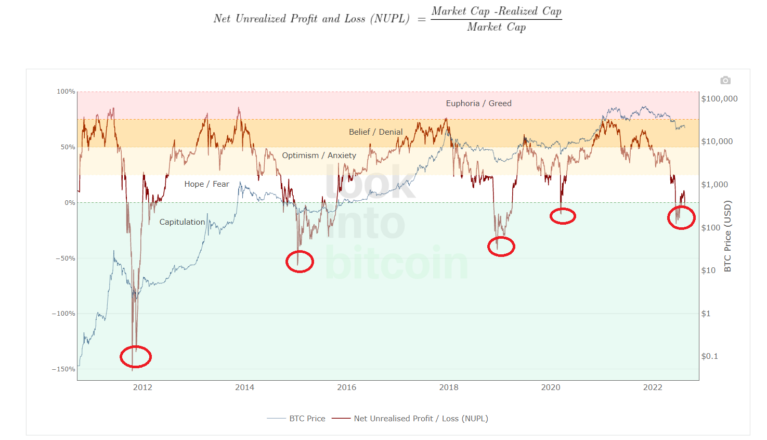

Gain Unrealized Profit or Loss (NUPL): NUPL tells us if the market as a whole is maintaining an unrealized earnings or loss. According to lookintobitcoin.com, Unrealized Profit/Loss is bought by subtracting Realized Payment from Market Payment.

Market Payment refers back to the present label of a token multiplied by the choice of tokens in circulation. The Realized Payment is an practical of the added cost of every coin when it used to be final moved, multiplied by the whole decision of coins in circulation.

By dividing Unrealized Profit/Loss by Market Cap, we compose the Gain Unrealized Profit/Loss.

A NUPL better than zero means investors on combination are for the time being in a assert of earnings. If it’s decrease than zero, the market as a whole is maintaining an unrealized loss.

Market Payment to Realized Payment (MVRV): this metric has helped predict Bitcoin tops and bottoms. It determines whether or now not the present market cap is overestimated or undervalued. MVRV is calculated by dividing Market Payment by Realized Payment day-after-day.

The increased the ratio, the more of us will worth earnings if they promote their tokens. And vice versa: the decrease the ratio, the more of us would resolve a loss by selling their coins.

Funding Rates and Start Ardour: investors utilize both indicators to weigh the hobby stages in the crypto market.

Funding Rates are traditional funds that perpetual contracts (perps) merchants must pay to withhold an open predicament. Perpetuals are a form of Futures contract that doesn’t have an expiry date. These funds produce definite that the perp label and space label coincide recurrently.

On the varied hand, Start Ardour (a volume-based fully metric) is the sum of all open futures contracts. On the opposite hand, Start Ardour doesn’t repeat us if the contracts are long or quick. Start Ardour is priceless because it exhibits how noteworthy capital flows into a market and can succor predict market tops and bottoms when blended with label trends.

Spent Output Profit Ratio (SOPR): here is one more tool that helps gauge market sentiment. The ratio signifies if investors are selling at a earnings or loss at a given time. It’s bought by dividing the USD cost when the UTXO (pockets steadiness) is created by the associated fee when the UTXO is spent.

A ratio better than one implies that, for a particular timeframe, more of us are selling coins at a earnings. Conversely, a SOPR of decrease than one implies that more coins are being offered at a loss as compared with their take label.

Alternate Flows: Alternate Flows notice the slither of coins getting into and leaving exchanges.

When change inflows are predominant, we have merchants promote their tokens to give protection to beneficial properties. Heavy inflows might demonstrate the muse of a possess market or correction.

Alternate outflows might demonstrate that token merchants are sending their resources to self-custody wallets with the diagram of maintaining, hence creating an absence of tokens in exchanges and rising their label.

Combining on-chain analysis and assorted technical and elementary indicators can succor investors produce intellectual funding decisions. Phemex provides all this recordsdata in a single hub, allowing customers to rep potentially the most out of their on-chain and shopping and selling abilities, filter the noise, and produce earnings by predicting the next market cross.

The working out on or accessed by strategy of this net plot is bought from just sources we agree with to be faithful and official, however Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any knowledge on or accessed by strategy of this net plot. Decentral Media, Inc. is now not an funding e-book. We feature out now not give personalized funding recommendation or assorted financial recommendation. The working out on this net plot is discipline to trade with out gaze. Some or all the trot wager on this net plot might change into outdated-long-established, or it is liable to be or turn out to be incomplete or incorrect. We might, however are now not obligated to, replace any outdated-long-established, incomplete, or incorrect knowledge.

You would quiet below no circumstances produce an funding decision on an ICO, IEO, or assorted funding in line with the trot wager on this net plot, and chances are high you’ll well maybe quiet below no circumstances account for or otherwise count on any of the trot wager on this net plot as funding recommendation. We strongly point out that you just search the recommendation of an authorized funding e-book or assorted licensed financial official in the event you are seeking funding recommendation on an ICO, IEO, or assorted funding. We feature out now not settle for compensation in any rep for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

7 Techniques For Dealing With A Market Smash

Cryptocurrency used to be due a severe market smash, after the overheated hypothesis of the final quarter of 2017 and the altcoin bustle-up in early January of 2018. But that doesn’t produce…

8M Ethereum Out of Circulation Factors to a Supply Shock

Ethereum is liable to be gearing up for an explosive label slither because it lacks any resistance stages ahead, while the choice of tokens on hand on identified cryptocurrency change wallets plunges. Ethereum…

Addresses Holding 32 ETH Hits All-Time Excessive Sooner than Ethereum 2.0 Laun…

The deposit contract for Ethereum’s 2.0 upgrade went reside on Nov. 4, prompting devoted members of the neighborhood to send roughly 49,000 ETH in anticipation of staking. To fulfill the…