Here is an thought editorial by Jenna Bunnell, senior supervisor for narrate material marketing at Dialpad.

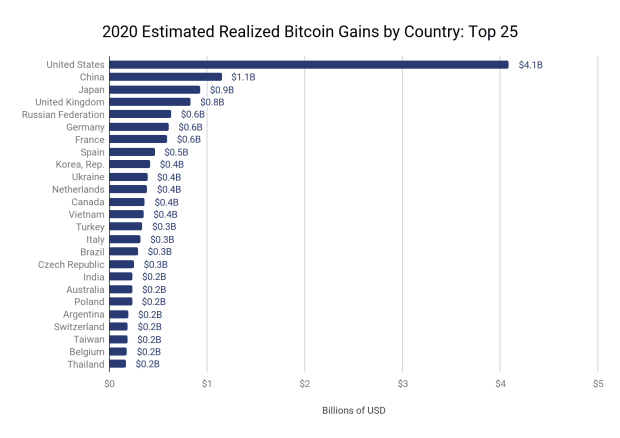

It is now not crucial what your opinions are on bitcoin, it is a ways obvious that it is a ways here to take care of and can proceed to grow in employ.

As a virtual watch-to-watch forex bitcoin has become widely accredited in a lot of international locations. You could presumably perchance presumably additionally sell your bitcoin for cash, or trade them with peers across reasonably a few networks and employ it to speculate within the rest from art to property.

On the opposite hand, as it is a ways a virtual forex, the quiz arises; what happens if you die? Whereas it’s a morbid conception, it is a ways crucial to thought forward to your loved ones and family participants. So, what happens to bitcoin if you die and how attain you encompass BTC in any inheritance plans? Is it a straightforward route of to encompass BTC in a will equivalent to that you just can with tangible sources equivalent to your condo and your financial institution accounts?

What Is Bitcoin?

Image sourced from kyivpost.com

The origins of Bitcoin lie formula abet in 2008 when a white paper became as soon as released titled “Bitcoin: A Perceive-to-Perceive Electronic Cash Machine” authored by Satoshi Nakamoto (a title assumed to be a pseudonym, per chance even belonging to better than one particular person). The conception that within the abet of the white paper became as soon as to fabricate a fully digital forex that would per chance presumably well exist outside the long-established centralized controls of banks and governments.

At its core lies watch-to-watch utility and utilizing excessive phases of encryption (per the SHA-256 algorithm designed by the U.S. National Security Company). All transactions are recorded in publicly on hand ledgers on servers across the sphere and any individual with a laptop can build up one in all these servers, known as nodes.

Whenever a transaction happens, it is a ways broadcast to your whole network and shared between nodes. These transactions are detached, roughly every 10 minutes, into a block and added to the blockchain.

Other people basically comprise the misperception that they need to capture whole units, nevertheless BTC can actually be subdivided by up to seven decimal places, rising smaller and extra reasonable units — sats.

When you’ve gotten supplied (or mined) bitcoins, then you retain them in a digital wallet which that you just can additionally access utilizing special utility. Given that these cash attain now not exist in exact lifestyles, and that ownership is per agreement among participants of the network, horny how attain you to resolve what happens to bitcoin if you die? Moreover, as many BTC owners memorize the key to their wallet and retain no reasonably a few data, what happens within the event that they die?

Memento Mori

Image sourced from data.gallup.com

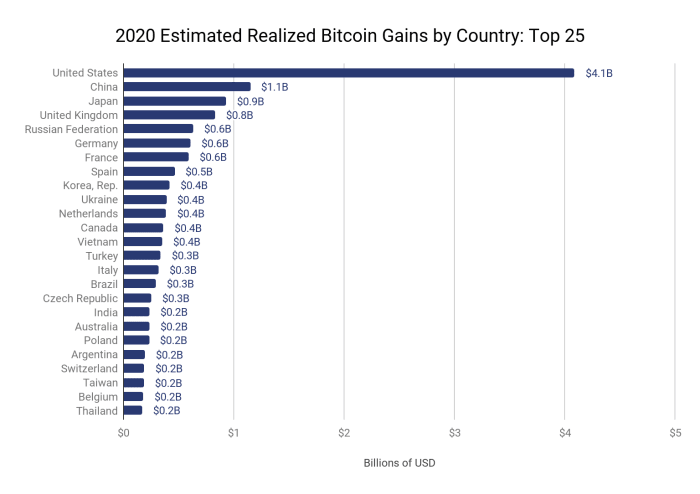

It’s now not the most good thing to talk or bear in mind, nevertheless death is inevitable. No longer up to 50% of adults within the U.S. comprise already made a will, though clearly, this identify varies across age teams — over 75% of of us over 65 comprise made one while only 20% of of us below 30 comprise made a will.

From a correct standpoint within the U.S., it’ll also be reasonably complicated. The IRS would now not be taught cryptocurrencies as currencies nevertheless reasonably as tradable commodities that will most doubtless be taxed by the relevant authorities. But we treat them as sources too and thus need to comprise some make of right control when it involves inheritance.

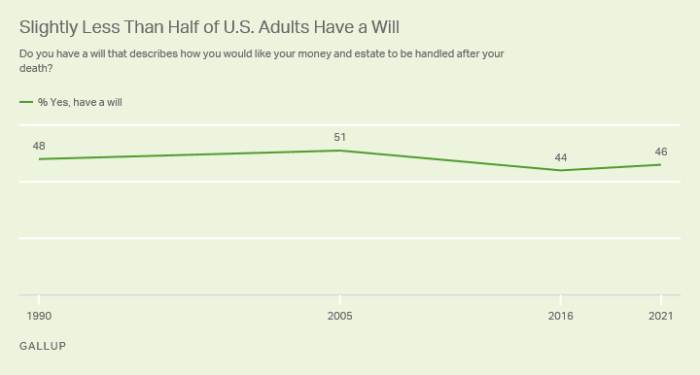

That control or oversight comes from the Revised Uniform Fiduciary Access to Digital Resources Act (RUFADAA). This law became as soon as developed in narrate to present relevant events (equivalent to lawyers or fiduciaries) with readability and a correct formula of coping with any digital sources held by a deceased particular person’s estate (or certainly when an particular particular person is incapacitated).

The law became as soon as written by the Uniform Law Commission (ULC) so that states would per chance presumably well then explore it and adopt it. As of 2021, 47 states had enacted the law. So, for the U.S. now not now not up to, there is a framework that governs management of digital sources, one thing that will advance as a reduction to many who were previously unsure.

How Does RUFADAA Work?

You could first steal into yarn that there are three teams of of us that comprise a vested pastime in what happens:

- The owner of the digital sources who would per chance presumably perchance additionally want a level of privacy.

- The custodian of these sources (companies who manufacture, retailer or sell online sources).

- The fiduciary or attorney coping with the estate.

The principle obstacle the law confronted became as soon as that, in inequity to physical sources, there has always been a level of secretiveness round digital sources. Within the early days, there were no licensed guidelines that clarified access to those digital recordsdata and wallets within the event of death or incapacitation. If the authentic owner of the digital sources had now not left a narrate of easy the appropriate technique to access these sources, then the sad actuality is that they are progressively misplaced forever.

It is critical to narrate that RUFADAA doesn’t focal level purely on cryptocurrencies, nevertheless on all digital and online sources. That involves issues equivalent to Fb or Google accounts. Custodians comprise particular rights as to what they might be able to free up or whether or now not they search data from a court docket narrate to flip over access and/or data. Within the case of issues fancy Fb accounts, the custodian would per chance presumably resolve what is “reasonably obligatory” when it involves releasing any data.

RUFADDA And Bitcoin

Image sourced from uniformlaws.org

RUFADAA only applies if the authentic owner has licensed access to their bitcoin. This could occasionally be by paperwork signed with and held by the custodian or it would steal the make of a correct doc equivalent to energy of attorney, a will or a trust doc.

A custodian would per chance presumably restrict how basic access your fiduciary has, basically to only encompass aspects that enable them enact their tasks. The custodian also has the appropriate to levy administrative prices for any access they give. This could occasionally be crucial data if you happen to’re attempting to resolve what happens to bitcoin if you die.

One in all the principle benefits of RUFADAA is that it clarifies the appropriate hierarchy when it involves documentation — and later distribution — of your digital sources. The custodian (or online management system) is considered by RUFADAA because the excellent authority when it involves ownership of a cryptocurrency yarn.

What which formula actually is that if you happen to made Person A the beneficiary to your digital sources in a doc with your custodian, then that doc takes precedence over reasonably a few right avenues equivalent to wills, POAs or trusts. If you happen to don’t comprise any beneficiary agreement with your custodian, then ownership will stir to any individual named in these long-established inheritance paperwork.

Can comprise to a challenge arise the build there could be now not one in all the long-established agreements nor a custodian agreement, then any transfer of ownership or fiduciary responsibility would per chance presumably perchance additionally be established by the custodian’s personal terms and conditions.

What Can comprise to You Make?

Image sourced from ucf.edu

You comprise two predominant choices when provocative about what happens to bitcoin if you die.

You could presumably perchance presumably additionally both query your custodian within the event that they comprise got particular tools or a framework for naming a beneficiary to your yarn, which would per chance presumably well only apply if you happen to held your bitcoin on an change — an unrecommended apply. Your reasonably a few probability is to stir the primitive route and title any beneficiary to your BTC in a will, a trust doc, below POA or in estate paperwork.

In case your estate involves BTC (or any reasonably a few cryptocurrency) then it is most practical to mute steal into yarn a thought that involves all aspects of your digital sources. This formula having a formula of passing all shrimp print equivalent to yarn shrimp print, keys and access to any hardware wallets to the actual person you’ll want to inherit these sources or to your fiduciary/attorney.

In any will or the same doc, you’ll want to encompass directives for passing on any data, particularly the most sensitive data connected to the yarn. Factual passing on the hardware tool veteran is doubtless now not sufficient for the beneficiary to steal control of the yarn.

The Takeaway

Irrespective of its command, many folk mute quiz whether or now not BTC is an right forex. But the growth, and figures very basic showcase that it is a ways one thing that is here to take care of.

You need to mute bring to mind any bitcoin you personal as an asset; it would per chance presumably perchance additionally now not be a physical one fancy your condo or automobile, nevertheless it indubitably mute has exact rate. So, it is most practical to mute carefully steal into yarn what you’ll want to happen to your bitcoin within the event of your death or incapacitation. Radiant the steps to steal and what happens to bitcoin if you die formula your sources will most doubtless be passed to the beneficiaries you want.

Here’s a guest submit by Jenna Bunnell. Opinions expressed are completely their very personal and attain now not basically replicate these of BTC Inc or Bitcoin Journal.