Proof-of-Reserves programs allow to combine the clear nature of blockchains with the comfort of the utilization of centralized exchanges.

Key Takeaways

- The level-headed FTX liquidity disaster highlighted the need for the enterprise to passe, and salvage solutions to give a boost to transparency.

- Many exchanges derive adopted Proof-of-Reserves, a vogue that uses cryptography to confirm possession of ample assets to conceal liabilities.

- Phemex, a number of the main exchanges in the crypto enterprise, now not too lengthy ago launched its Proof-of-Reserves, liabilities and solvency.

The level-headed give diagram of FTX, a number of the enterprise’s largest and most depended on crypto exchanges, has opened the controversy for surroundings requirements to whisper solvency in centralized exchanges.

Since the FTX insolvency recordsdata broke out, a host of centralized crypto exchanges derive voluntarily launched their Proof-of-Reserves to defend assist public belief and dwell a favored option in the enterprise.

Proof-of-Reserves

Proof-of-Reserves is a vogue whereby custodial exchanges share publicly accessible proof of their on-chain reserves. The blueprint is to illustrate that the assets held on deposits match up with individual balances, proving that the exchange is solvent.

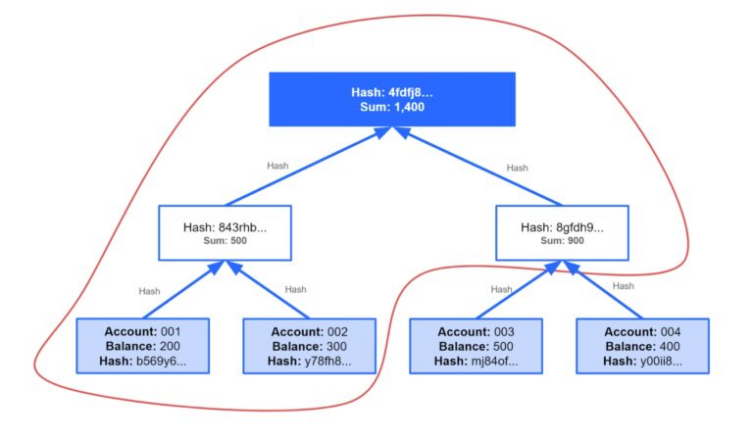

To examine on-chain assets with liabilities, exchanges depend on a machine that provides client balances and publishes the knowledge anonymously via so-known as Merkle proofs. With this mechanism, exchange customers can take a look at that their balance is included in the liabilities recordsdata role.

The Merkle tree technique uses cryptography to put up the list of client balances while warding off privacy leakage. Right here’s accomplished by sealing the overall added recordsdata with a cryptographic hash or digital signature.

To guarantee the solvency and credibility of an exchange, the superb scenario may per chance per chance per chance be to derive a few ongoing attestations with the supervision of an on-chain auditor.

The auditor would defend an anonymous snapshot of the overall added exchange balances and embody them in a Merkle root tree. The next step may per chance per chance per chance be to take a look at each and each individual’s balances in opposition to the knowledge in the Merkle tree via its corresponding transaction hash.

Vitalik Buterin, a number of the co-founders of Ethereum, now not too lengthy ago wrote an in-depth article on how centralized exchanges can direct their solvency from Merkle trees. You would also read it right here.

The above illustration shows how legend holders can take a look at their balances in opposition to the sum of all liabilities held by an exchange. On this case, legend holder 001 would handiest need the knowledge inner the purple dwelling to make certain his balance is phase of the exchange’s liabilities (1,400).

Phemex, a main cryptocurrency exchange, has also adopted the Proof-of-Reserves frequent to give a boost to transparency. Users can take a look at the exchange’s liabilities to boot to to its Proof-of-Reserves via its platform. Phemex supports on-chain balance inquiries for ETH, BTC, USDC, USDT, and USD in trading balances.

The above mannequin, even supposing removed from supreme, because it requires belief in a third-party auditor, ensures a obvious degree of privacy as heaps of system of the tree are printed to heaps of customers.

Most seriously, the more depositors take a look at their positions via the Merkle tree construction, the increased the potentialities that the exchange will now not cheat by hiding liabilities.

If the enterprise can defend away any positives from the downfall of FTX, is that standardizing a proof of reserves machine for all custodian exchanges will invite more customers to onboard our enterprise due to increased transparency.

One more positive extinguish result will be that any probably adverse player now not fascinating to whisper their solvency will be saved on the sidelines. One thing that shall be viewed as a impress of maturity in our enterprise and potentially loosen the scrutiny of regulators and policymakers.

Bettering exchange security and transparency shouldn’t come at the pricetag of leaving self-custody in the assist of though. We may per chance per chance per chance also silent also continue highlighting the significance of casting off third-party chance by educating customers basically the most involving alternate options to defend watch over their private keys. At the discontinuance of the day what is the level of the utilization of cryptography must you in the extinguish don’t defend watch over what wants to be your derive crypto? You would also learn more about these practices in the next article.

The guidelines on or accessed via this website is received from fair sources we imagine to be lawful and reliable, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any recordsdata on or accessed via this website. Decentral Media, Inc. is now not an funding consultant. We lift out now not give personalized funding recommendation or other financial recommendation. The guidelines on this website is topic to alternate with out peek. Some or all of the knowledge on this website may per chance per chance per chance also change into out of date, or it may per chance per chance per chance per chance also be or change into incomplete or wrong. We may per chance per chance per chance also, but are now not obligated to, replace any out of date, incomplete, or wrong recordsdata.

You would also silent by no manner make an funding decision on an ICO, IEO, or other funding based totally on the knowledge on this website, and likewise you may per chance per chance per chance per chance per chance also silent by no manner elaborate or in some other case depend on any of the knowledge on this website as funding recommendation. We strongly point out that you simply consult a licensed funding consultant or other qualified financial expert must you may per chance per chance per chance per chance per chance also very neatly be seeking funding recommendation on an ICO, IEO, or other funding. We lift out now not procure compensation in any invent for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

2022 in Evaluation: the Top 10 Crypto Villains of the Yr

SBF, Kwon, 3AC, and more: 2022 changed into a packed year for crypto villains. The Crypto Villains of the Yr The Crypto Briefing editorial personnel puts a host of thought into…

Binance CEO Changpeng Zhao Criticizes Crypto Bailouts

Info

Jun. 23, 2022

Binance CEO Changpeng Zhao has issued a demonstrate summarizing his conception on bailouts and leverage in the crypto enterprise. His feedback scheme handiest about a days after reports of the…

2022 in Evaluation: the Top 10 Crypto Heroes of the Yr

While villains dominated crypto real via this year, the enterprise benefited from the efforts of some heroes. The Crypto Heroes of 2022 Where lift out we initiate? After a year enjoy…