The beneath is an excerpt from a most neatly-liked edition of Bitcoin Journal Official, Bitcoin Journal’s premium markets newsletter. To be amongst the first to receive these insights and a bunch of on-chain bitcoin market prognosis straight to your inbox, subscribe now.

Binance: FUD Or Respectable Questions?

By some distance, one in every of the biggest winners within the aftermath of the FTX crumple has looked — on the outside — to be Binance. After most fascinating having 7.82% market share of the bitcoin supply on exchanges in 2018, their share is now 27.50% despite a principal wider model of bitcoin supply leaving exchanges. The bitcoin steadiness on Binance now totals 595,864 BTC, which is 3.1% of famed supply, payment $10.58 billion. This bitcoin belongs to their customers and reflects a rising model in market share over the old few years that has made Binance the largest bitcoin and cryptocurrency alternate on this planet.

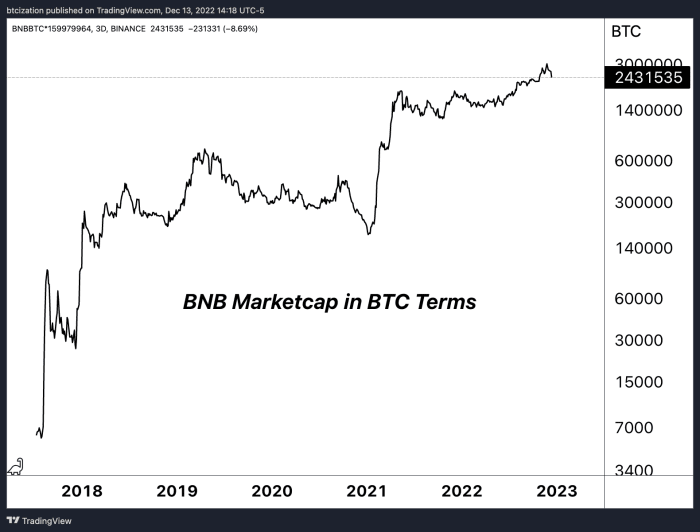

Binance now controls approximately 60% of the gap and derivatives volume within the whole market. It’s laborious to sight how any alternate within the dwelling most steadily is a “winner” within the sizzling market stipulations, but one would possibly per chance per chance well assemble the case for Binance, with the alternate’s rising energy in a decimated industry. On high of that, Binance’s BNB token, the native foreign money of Binance’s have faith Ethereum-competing Layer 1 blockchain, is peaceable one in every of the better performing tokens when valued in bitcoin terms this year.

But, is this most neatly-liked “energy” all the pieces that it seems or is it a facade? We’ve learned over the final month that no firm is receive in this industry factual now (in particular exchanges) and questions are rising around Binance’s practices, solvency, BNB token note and the final teach of their industry over the old few weeks. Is it FUD or legit? Let’s are trying to rupture about a of it down, addressing the troubles by technique of an operate and skeptical lens.

Binance Flows

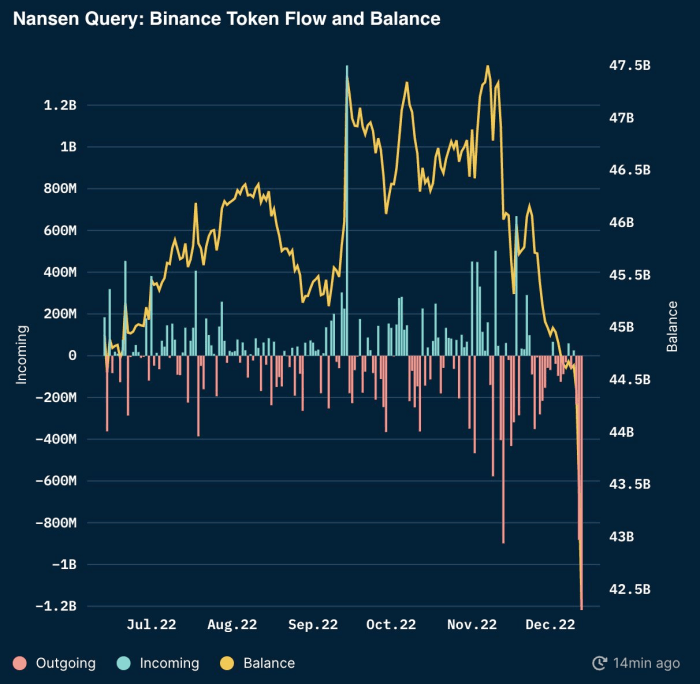

We’ve considered predominant outflows from Binance across a bunch of a bunch of tokens and bitcoin when having a have faith a look at every Nansen and Glassnode monitoring. Across ETH and ERC20 tokens, Binance saw $3 billion leaving the alternate in its largest single-day outflow since June. Across Nansen full pockets monitoring, all Binance balances are estimated at $62.5 billion with around 50% of these balances in stablecoins across BUSD and USDT.

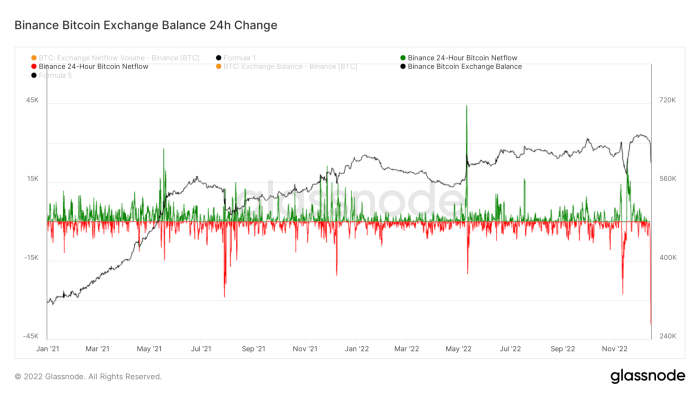

Source: Nansen

In step with Glassnode, the total bitcoin alternate steadiness on Binance is down around 6-7% over the final day, after reaching a height on December 1. Though balances live above 500,000 bitcoin and Binance has shown a rising model of bitcoin balances on the platform this year, here is a main switch for outflows in precisely 24 hours. As a general comparability, the model of bitcoin alternate balances was once a principal a bunch of myth for FTX, whose steadiness had been falling closely since June. Binance outflows over the final couple days are a chunk alarming and elevate questions: Is this a one-off tournament and factual industry as typical or is this the open of one thing extra?

Readers can song the on-chain addresses supplied by Binance without cost here.

Essentially the major location off for effort isn’t whether or not Binance has any bitcoin/crypto or not. We are in a position to transparently stumble on that the firm controls tens of billions payment of crypto resources. What isn’t exactly sure, related to FTX, is whether or not the firm has commingled users funds or whether or not the firm has any famed liabilities against consumer resources.

Binance CEO Changpeng Zhao (CZ) has mentioned that the firm has no liabilities with any a bunch of companies, but as most neatly-liked months have faith shown, phrases don’t imply all that principal. While we’re not claiming that CZ is lying to the public about the teach of Binance budget, we would possibly per chance per chance well not have faith any manner to inform in any other case.

CZ’s response as as to whether or not the firm was once going to audit liabilities against consumer resources was once, “Sure, but liabilities are more challenging. We manufacture not owe any loans to any individual. You will be ready to request around.”

Sadly, “request around” isn’t a ample sufficient reply for an ecosystem supposedly built across the ethos of “don’t have faith, confirm.”

While there is tiny query that Binance is an industry huge within the crypto derivatives industry, how attain we all know the firm isn’t doing identical things as previous actors on the subject of trading against customers the employ of consumer funds and/or proprietary knowledge. Issues love the extinct Chief Trusty Officer of Coinbase departing Binance U.S. final summer after factual three months as the CEO leaves one with many questions.

So as to add to our skepticism, the associated rate of the Binance alternate token BNB is come all-time highs in bitcoin terms, appreciating an improbable 828% against bitcoin within the final 785 calendar days.

Is BNB primarily payment approximately 14% of all bitcoin that would possibly per chance ever exist?

The arrival weeks will be fat of headlines across the teach of world crypto legislation in a publish-FTX world. In a forty eight-hour length, Reuters published news declaring that the U.S. Justice Dept is rupture up over charging Binance, Binance withdrawals for bitcoin and aggregate stablecoin pairs have faith hit all-time highs and the BNB alternate token has fallen 10% relative to bitcoin.

Out of an abundance of caution, we are in a position to continue to lumber readers working on any centralized alternate — of which Binance is most undoubtedly integrated — to look into self custody solutions. There have faith been some distance too many circumstances of incompetence and/or misconduct from exchanges.

It’s not that we don’t have faith CZ or Binance, it be the truth that we don’t have faith any individual.

The whole point of bitcoin is now we have faith an asset that is basically the criminal responsibility of no person. Check the ownership of an launch disbursed network with cryptography; don’t have faith permissioned IOUs. With the mix of regulatory issues about the world crypto derivatives industry, a questionable alternate token with inconceivable relative efficiency over the final two years and a shaky proof-of-reserves attestation — that was once incorrectly claimed to be an audit and had industry CEOs elevating eyebrows — we gain the necessity to lumber our readers to keep in mind their counterparty threat.