Right here is an belief editorial by Zack Voell, a bitcoin mining and markets researcher.

Bitcoin miners generally endure the brunt of endure market woes on narrative of among the enterprise’s absolute most life like capital expenditures, smallest margins and most unreliable infrastructure. Though the sizzling bearish segment has been one in every of Bitcoin’s shallowest drawdowns, miners respect suffered bigger than ever.

Layoffs, bankruptcies, complaints and diversified adversarial press respect battered one in every of Bitcoin’s most prominent sectors. However every endure market at last finds a bottom — the trouble climaxes and things slowly open to enhance. Fairly a couple of records imply mining has reached this level of its market cycle, which can perhaps presumably provide a little of optimism going into the brand new three hundred and sixty five days.

This text is no longer intended to give financial or investment advice of any form. On the contrary, its intended aim is records-driven prognosis of the sizzling converse of the bitcoin mining sector in context of some exogenous and endogenous influences that can perhaps presumably well form its arrive-term future.

Working out Capitulation

Sooner than diving into the records, it’ll support to achieve what “capitulation” is. The term is recurrently inclined in financial markets to reference an acute and generally dramatic crescendo of concern or frequent give up by customers or firms all over the throes of heart-broken market prerequisites. Usually, each person says, “It’s over. We are in a position to’t take this anymore.” For mining, capitulation generally map the economics develop into so unfavorable and dealing margins are so thin that miners selected to quit or merely can not operate anymore and are squeezed out of the market.

Wall Boulevard Analysts Turn Bearish

One amongst the hallmark indicators of miner capitulation (in this creator’s belief) at the sizzling stage of the continuing endure market is the plump pivot from financial analysts who file on publicly-traded mining firms. For the past three hundred and sixty five days, these analysts respect preached about the upside ability of bitcoin mining stocks. However now they are “pulling the shuffle.” This language used to be inclined by Chris Brendler of DA Davidson to record his outlook on the mining sector. Since July, Brendler has said that the sizzling market prerequisites respect been an supreme time to rob mining stocks, as reported by CoinDesk.

In December 2021, JPMorgan’s analyst Reginald Smith moreover wrote a memo that said one yelp mining firm — Iris Energy — has “bigger than 100% upside.” He moreover advised the sizzling inventory tag used to be at a “deep more cost effective tag.” Shares of the firm respect been trading around $14 at the time of the memo. No they’re trading below $2… an supreme deeper more cost effective tag!

If Wall Boulevard giving up on mining isn’t capitulation, then what is?

Bitcoin Hash Rate Begins Dropping

For the entire lot of the endure market thus a ways, the Bitcoin hash rate has gradually grown bigger, forcing area enlarge after enlarge on struggling miners. However that trend may perhaps presumably also very wisely be changing. In early December, the next adjustment is determined to fall by nearly 11% at the time of writing. This fall may perhaps perchance be brought on by hash rate falling, which is especially off its most contemporary all-time highs and currently sitting arrive 240 exahashes per 2nd (EH/s).

Usually a dip in hash rate and area would no longer be too critical. However seven of the past nine area changes respect been obvious. And in context of the incessant hash rate development and subsequent hash tag collapse, the horrible trend reversal for hash rate is valuable. Some miners appear to be throwing within the metaphorical towel and taking their machines offline. Discussing the hash rate and area on Twitter in context of whether miners respect been capitulating, Foundry Senior Vice President Kevin Zhang merely answered, “Yes.”

Bitcoin Miners Are Re-Accumulating

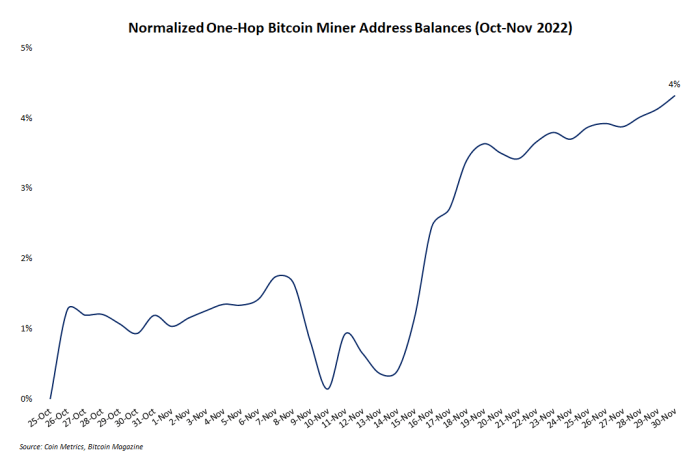

Generating concern, uncertainty and doubt (FUD) around on-chain actions of bitcoin from miner addresses is a most traditional curiosity for Twitter influencers. And watching miner balances can even be helpful. Recent records displays particularly bigger balances in comparison with correct a month ago. In temporary, acquire promoting job by miners appears to respect subsided and their stockpiles of bitcoin are on the upward thrust all all over again.

Bitcoin mining address balances respect viewed diminutive reductions over the past three hundred and sixty five days. However the road chart below displays records that present a trend reversal is starting up. One-hop miner balances respect elevated by over 3%, or roughly 85,000 BTC since early October. Perchance miners determined it’s time to HODL all all over again.

Miner Outflows Spiked And Fell

One diversified fragment of on-chain records that fuels mining FUD is outflows — the job of miner addresses transferring coins from these addresses to some diversified space. In mid-November, these outflows spiked to their absolute most life like level since June, which can perhaps presumably present that concern and ache within the market has affected a minimal of a couple of miners. No longer surprisingly, the spike in outflows occurred at the the same time as the collapse of FTX and its subsequent fallout respect been making headlines.

It ought to be noted that any inferences from on-chain records like outflows are told guesstimates at most productive. Bitcoin network records is a valuable instrument for contextualizing obvious market events, but it is principal from infallible or un-manipulatable. However miners are notoriously unfavorable at timing markets, and the timing of this sudden spike in coin actions may perhaps presumably reasonably imply some panicking miners. Within the next week, nonetheless, outflows fell again to usual ranges and respect remained there as of the time of this writing.

Did miners ache arrive the market bottom? Very presumably.

Bitcoin Mining In 2023

Assuming the above prognosis is appropriate and capitulation has occurred, the market will no longer straight away enhance. Because the mud settles and survivors emerge, the process of establishing and scaling extra mining infrastructure may perhaps perchance be as slack, costly and slack as ever. Winners are constructed within the endure market, and after among the biggest mining firms respect sold bitcoin balances down to with regards to zero and even sold critical portions of mining hardware in desperate makes an strive to defend operational, all that’s left is survival or financial effort.

Surely, things may perhaps presumably for all time compile worse overnight. However this article suggests the inclined and unnerved respect been squeezed out, and the time for recovery is right here. Now is the time to be optimistic, no longer bearish.

Right here is a customer put up by Zack Voell. Opinions expressed are fully their catch and form no longer essentially think these of BTC Inc or Bitcoin Magazine.