Data exhibits the Bitcoin Adjusted Spent Output Profit Ratio (aSOPR) is retesting the historical bull-endure junction. Will a ruin be learned this time?

Bitcoin aSOPR Is Within the interim Doing But another Relaxation Of 1.0 Level

As per essentially the latest weekly portray from Glassnode, a successful retest here might presumably also counsel a serious regime shift in the BTC market. The “Spent Output Profit Ratio” (SOPR) is a trademark that tells us whether or now not Bitcoin traders are selling their money at a income or at a loss correct now.

When the worth of this metric is elevated than 1, it procedure the frequent holder available in the market is engaging money at some income in the mean time. On the opposite hand, values below the threshold indicate the final market is realizing some loss in the mean time. The SOPR being precisely equal to 1 naturally means that traders are exact breaking even on their selling correct now.

A modified model of this indicator is the “Adjusted SOPR” (aSOPR), which filters out all selling of money that became done within most enthralling an hour of said money being first obtained. The main income of this modification is that it gets rid of noise from the records that wouldn’t opt up any noticeable impacts on the market anyhow.

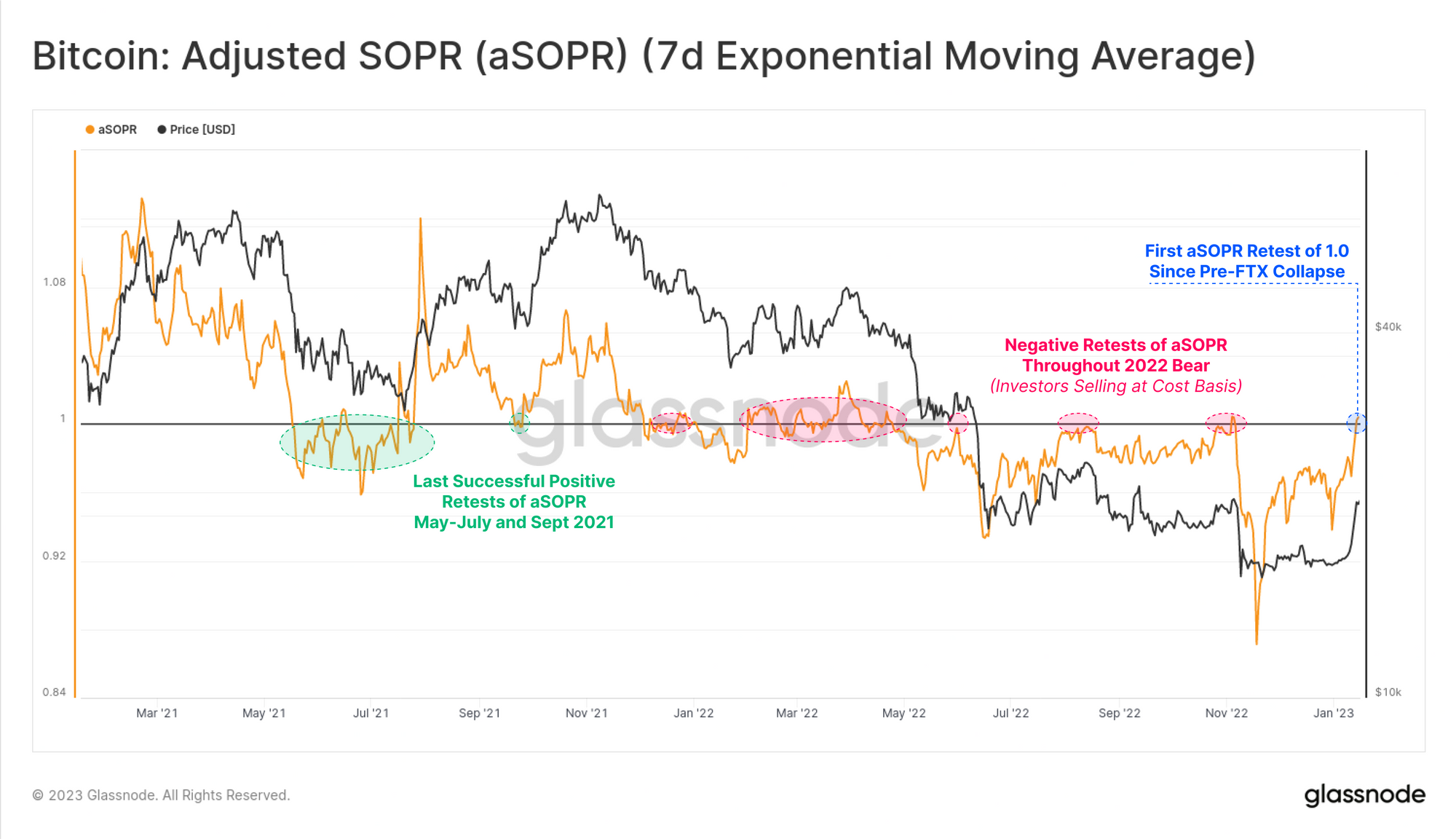

Now, here’s a chart that exhibits the model in the 7-day exponential engaging common (EMA) Bitcoin aSOPR over the final couple of years:

The 7-day EMA value of the metric seems to have gone up in recent days | Source: Glassnode's The Week Onchain - Week 3, 2023

As shown in the above graph, the 7-day EMA Bitcoin aSOPR has sharply risen now not too long ago and has reached the 1 stage for the principle time since the pre-FTX crash. This stage has been historically critical for BTC, as the crypto has most continuously encountered resistance at it for the duration of endure market sessions.

The motive in the help of this is the indisputable fact that the aSOPR equal to 1 line represents the ruin-even heed. Every time the metric increases to this heed, it procedure enough holders are help in a whisper of neutrality that they’re in a position to recoup their investment.

Psychologically, traders leer this as getting their previously misplaced money “help” and hence big-scale dumping takes living here, thus providing impedance to the crypto’s heed.

A successful ruin above this stage would counsel, then again, that there’s enough ask in the Bitcoin market correct now that holders are in a position to realise their profits and customers are show to absorb this selling. Thanks to this, such breaks opt up most continuously ended in a transition from endure to bull markets.

When bull markets opt defend, the construct of the aSOPR 1 stage flips, and the line as an different starts providing support to the worth of BTC.

BTC Label

On the time of writing, Bitcoin is trading around $21,200, up 23% in the final week.

Looks like the rally has come to a halt since hitting the $21,000 level | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Hououin Kyouma

Loves to write, angry by cryptocurrency. Within the interim studying Physics at college.