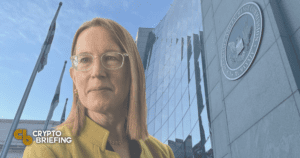

Commissioner Hester Peirce acknowledged the SEC had didn’t jam upright steerage on staking products.

Characterize: Greg Kahn. Shutterstock image by DCStockPhotography

Key Takeaways

- The SEC is forcing Kraken to shut down its staking products and companies within the United States, claiming the platform didn’t nicely register the program.

- SEC Commissioner Hester Peirce disagrees with the option.

- She argued that Kraken wouldn’t had been in a neighborhood to register its products with the SEC despite the incontrovertible truth that it had desired to.

SEC Chair Gary Gensler’s latest transfer—forcing Kraken to shut down its staking products and companies—is being met with criticism from during the agency itself.

The SEC Is to Blame

No longer all people at the SEC is cheerful with the agency’s latest transfer in opposition to Kraken.

Commissioner Hester Peirce printed a letter the day prior to this during which she criticized the Securities and Alternate Rate’s contrivance to shut down the crypto substitute’s staking products. The U.S. regulator had announced earlier within the day that it had reached a settlement with Kraken during which the firm agreed to conclude its staking products and companies within the U.S. (and pay a $30 million handsome) for failing to nicely register the program.

Peirce argued that Kraken wouldn’t had been in a neighborhood to register its staking products despite the incontrovertible truth that it had desired to. “In the most modern native climate, crypto-linked choices do now not make it by the SEC’s registration pipeline,” she acknowledged, alluding to the anxiety that crypto firms own had with getting clear regulatory frameworks from the SEC.

“We own identified about crypto staking purposes for a extraordinarily very long time,” she wrote. “As an different of taking the direction of taking into consideration by staking purposes and issuing steerage, we as soon as more chose to discuss by an enforcement motion.” SEC Chair Gary Gensler has been criticized on a form of events by alternate leaders and lawmakers alike for his “regulation by enforcement” arrangement, with Congressman Tom Emmer going to this level as calling it a technique to “jam [crypto companies] into a violation.”

Peirce additionally claimed that the settlement did itsy-bitsy to supply more readability for other staking-as-a-carrier services, since the very product raised a “host of complicated [regulatory] questions.” She added that many firms adopted diversified alternate fashions. “Staking products and companies have to now not uniform, so one-off enforcement actions and cookie-cutter prognosis does [sic] now not decrease it,” she wrote, sooner than describing the SEC’s arrangement as “paternalistic and sluggish.”

Disclaimer: On the time of writing, the author of this piece owned BTC, ETH, and quite loads of different other crypto sources.

The records on or accessed by this internet feature is got from independent sources we imagine to be fair and knowledgeable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any records on or accessed by this internet feature. Decentral Media, Inc. is now not an investment consultant. We originate now not give customized investment advice or other financial advice. The records on this internet feature is field to alternate with out undercover agent. Some or all the records on this internet feature may well also change into outdated, or it can well also very smartly be or change into incomplete or inaccurate. We may well also, but have to now not obligated to, change any outdated, incomplete, or inaccurate records.

You may possibly well also aloof by no contrivance contrivance an investment option on an ICO, IEO, or other investment per the records on this internet feature, and it is possible you’ll even aloof by no contrivance define or in any other case count on any of the records on this internet feature as investment advice. We strongly counsel that you just search the advice of a certified investment consultant or other qualified financial knowledgeable ought to you’re seeking investment advice on an ICO, IEO, or other investment. We originate now not accept compensation in any make for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Detect fleshy phrases and prerequisites.

Lawmaker Slams “Energy-Hungry” SEC in Hearing

News

Jul. 19, 2022

The SEC has been within the disclose of sending out subpoenas to crypto alternate contributors that originate now not lie within its jurisdiction, one among its high officers admitted as of late in…

Crypto Industry Slams SEC After It Publicizes Nine Tokens Securities

News

Jul. 21, 2022

The Securities and Alternate Rate declared as of late in a courtroom filing that 9 tokens listed on Coinbase had been securities, prompting true criticisms from the crypto alternate over the agency’s regulatory…

First price-Crypto SEC Commissioner Slams Agency’s Regulatory Manner

News

Jun. 23, 2022

Hester Pierce has issued a public commentary criticizing the U.S. Securities and Alternate Rate’s current regulatory agenda. She described the agency’s arrangement as “incorrect” and unhealthy for the nation’s capital…