The Bitcoin and crypto prices are influenced by a advanced internet of issues and intertwined indicators. One such influential pressure is the U.S. Dollar Index (DXY), which has gained prominence as a extraordinarily well-known gauge for Bitcoin and crypto investors.

Staunch thru the final three years, BTC and the DXY had been mostly inversely correlated, other than in occasions the save crypto-particular components overshadowed the greenback inclinations. Whenever the DXY experiences a decline, Bitcoin tends to embark on an outstanding rally. Conversely, BTC in overall falls when the DXY rises.

DXY Approaches Wanted Stage

For the reason that local excessive of 104.7 on May perhaps perhaps perhaps 31, the DXY has dropped by almost 3%. At the time of writing, the DXY stood at 101.8 and is now drawing attain the once a twelve months low at 100.8 all yet again, which served as toughen in February and April respectively and initiated a jump to the upside.

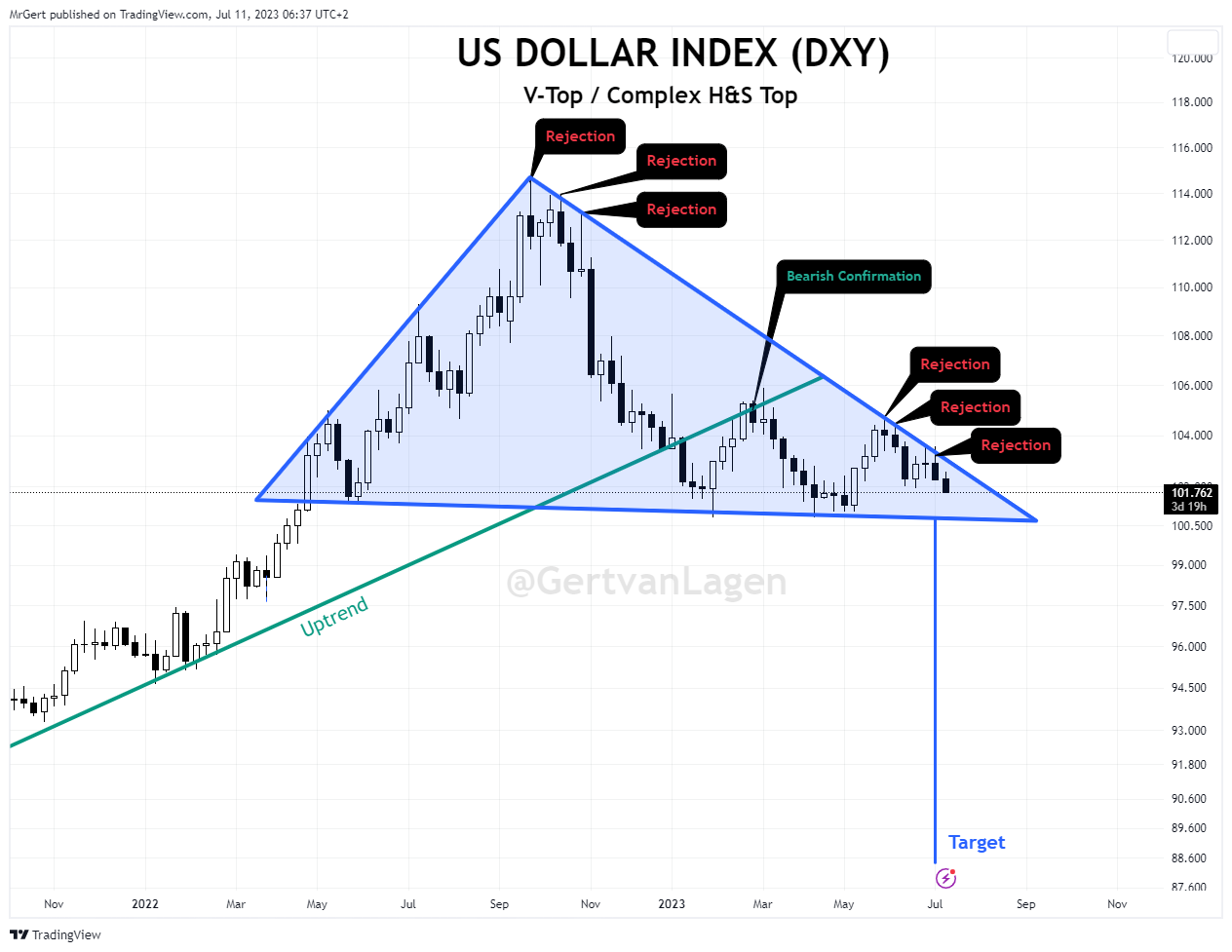

Because the neatly-known dealer Gert van Lagen noted through Twitter, the jam for the U.S. greenback index would possibly perhaps be very precarious. Van Lagen’s review, basically based on a detailed analysis of the DXY weekly chart, suggests that the US greenback is poised to continue its rush.

Lower lows, lower highs, and the failure to interrupt the blue downtrend for loads of months all make a contribution to the bearish sentiment. To boot, the DXY has abandoned the inexperienced uptrend and is showing a bearish affirmation of three consecutive weeks. According to van Lagen, a rupture of the DXY below 89 would possibly perhaps perhaps perhaps also presumably be drawing shut.

Will The Bitcoin Price Surge Sixfold?

Infamous crypto analyst “Coosh” Alemzadeh additionally currently took to Twitter to fragment an intelligent reveal concerning the correlation between the DXY and Bitcoin’s worth movements. Alemzadeh’s chart below highlights that at some stage in old cases when the DXY slipped below the severe level of 100, Bitcoin skilled a outstanding surge.

In 2017, Bitcoin witnessed a 10x rally, and in 2020, BTC soared by 7x. Alemzadeh predicts that if history repeats itself and the DXY drops to 89 as it did in the previous, Bitcoin would possibly perhaps perhaps perhaps also presumably see a appreciable worth develop of 4x to 6x. Your whole crypto market is doubtless to earnings. Alemzadeh shared the chart below and said:

DXY weekly substitute: Appears enjoy technical correction is whole which would possibly perhaps perhaps well align w/subsequent BTC impulse initiating.

Remarkably, Jan Happel and Yann Allemann, the founders of Glassnode, had been sharing the identical thought for moderately some time. Already at the discontinuance of May perhaps perhaps perhaps, the analysts urged an ABC structure, which has been the principle provide of headwinds for BTC and a quantity of risk assets.

Their prediction changed into that when the DXY topps out, this would possibly perhaps decline sharply, in direction of the 91-93 till the discontinuance of the twelve months. “The decline would possibly perhaps perhaps perhaps also gentle unfold in 5 waves doubtless into gradual 2023. This pass would possibly perhaps perhaps perhaps also gentle be very supportive of risk assets and namely Bitcoin,” convey the analysts who additionally predict the factitious of a blow-off prime for risk assets.

At press time, the Bitcoin worth remained in its sideways fashion, procuring and selling at $30,421.

Featured image from iStock, chart from TradingView.com