Another 365 days, one other Crypto Christmas special for our group at NewsBTC. In the approaching week, we’ll be unpacking 2023, its downs and ups, to pronounce what the subsequent months would possibly perhaps well bring for crypto and DeFi traders.

Like final 365 days, we paid homage to Charles Dicke’s basic “A Christmas Carol” and gathered a neighborhood of consultants to focus on about the crypto market’s previous, fresh, and future. In that potential, our readers would possibly perhaps well also request clues that will enable them to transverse 2024 and its attainable trends.

Crypto Christmas With STORM: Bitcoin ETF Must Be Out Of Your Wishlist?

For on the present time’s diagram, our group got to focus on with Sheraz Ahmed, Managing Accomplice at blockchain alternate options provider STORM and founder of Decentral Dwelling. Ahmed has been fresh at about a of the excellent crypto events in 2023 and is constantly talking with founders, organizations, and relevant actors within and out of doorways the nascent sector.

Thus, Ahmed has a distinctive standpoint on the industry, its blindspots, and imaginable catalyzers. For the duration of the interview, we talked about the downside of approving a Bitcoin discipline Replace Traded Fund (ETF) in the US and why the home would possibly perhaps well also very smartly be unprepared for a brand fresh bull cycle. This is what he told us.

Q: Our group has coincided with you in several crypto events this 365 days; where gather you possess a majority of these events coincide? And what gather you possess has been overpassed all the procedure by 2023, a account, a mission, something americans uncared for because the industry enters one other cycle?

Switzerland, Europe, Dubai, Singapore, and Rio (de Janeiro). I gather possess that we’re too early for the subsequent cycle. The broken devices of the final bull streak are but to be rebuilt. Infrastructure has improved, custody, wallets, exchanges, and stablecoins, nonetheless the enterprise devices for Dapps (Decentralized Applications) occupy no longer evolved.

I apprehension that we enter into one other vaporware cycle and, at excellent must attend 4 more years for actual exhaust cases/adoption or threat burning ourselves fully with shitcoins and scams.

Q: As Crypto enters a brand fresh cycle, what’s completely different about the industry whenever you evaluate it to early 2021 and 2017? Where can traders request the expansion? Is it in the gamers joining the industry, the monetary products, or in its neighborhood?

There is a dinky bit more maturity, though that now and then factual feels love the veterans are factual numb to the distress this industry can self-inflict. We gather request valid hobby from nice institutional gamers in the monetary, user, and impression fields. However gather we convert the following tips into adoption?

Investment in utility and fee tokens is an oxymoron. They construct no longer seem like supposed to be investment products and are no longer regulated as such. An investor would possibly perhaps well gaze into an infrastructure play, though I possess that is rather saturated on the present time at approx. $700M. My bet would possibly perhaps well be early-stage protocol ecosystem funds (equity-essentially based mostly), with a fraction of that taken in tokens for the utility of governance, etc., that will perhaps well also very smartly be linked.

Q: The upcoming approval of a discipline Bitcoin ETF in the US appears to be like love the particular indicator that crypto has made it to the mainstream, nonetheless what’s the subsequent frontier? Where does the industry droop from here?

I don’t agree. For me, it factual sounds love the bankers sooner or later possess they can gain cash off our industry. Now, does that mean it’ll be appropriate for costs in the immediate term and more eyeballs? Yes. However be careful what you wish for, as when the heavy artillery comes in, they crush all the things/all americans in their course.

In 2023, we essentially based Decentral Dwelling. An innovation centre focused on blockchain-essentially based mostly utility that provide the infrastructure to spark tips to life. I possess that by having the factual instruments for your arsenal, it is doubtless you’ll perhaps well presumably also navigate the Web3 home to search out the sunshine on the ruin of the tunnel. Without the factual guidance, WANGMI (We Are Not Gonna Make It). Let’s work together to originate an industry of belief we are able to all be proud of!

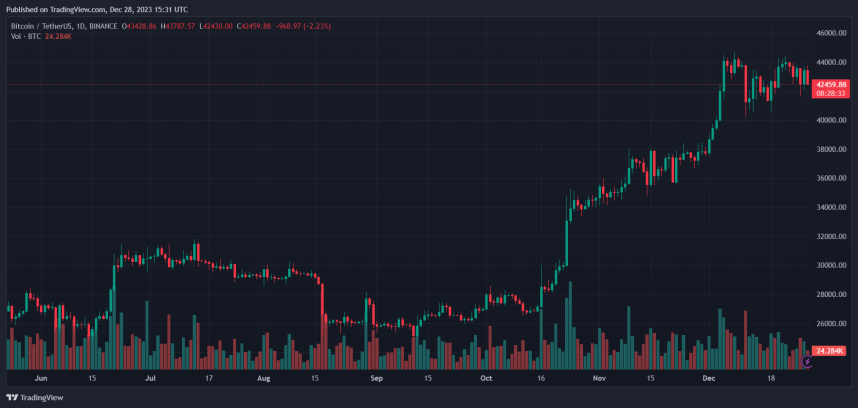

Quilt image from Unsplash, chart from Tradingview

Disclaimer: The article is equipped for academic capabilities only. It does no longer characterize the opinions of NewsBTC on whether or no longer to aquire, sell or withhold any investments and naturally investing carries risks. It’s doubtless you’ll perhaps well smartly be told to conduct your possess study sooner than making any investment decisions. Use files provided on this web set fully at your possess threat.