As Bitcoin (BTC) continues its worthy ascent, reaching a brand new all-time high (ATH) of $72,300, traders wonder when the present bull market will height. Pondering historical recordsdata and the upcoming halving match scheduled for April 2024, crypto analyst Rekt Capital has supplied insights into doable timing.

Bitcoin Top Anticipated Sooner Than Anticipated?

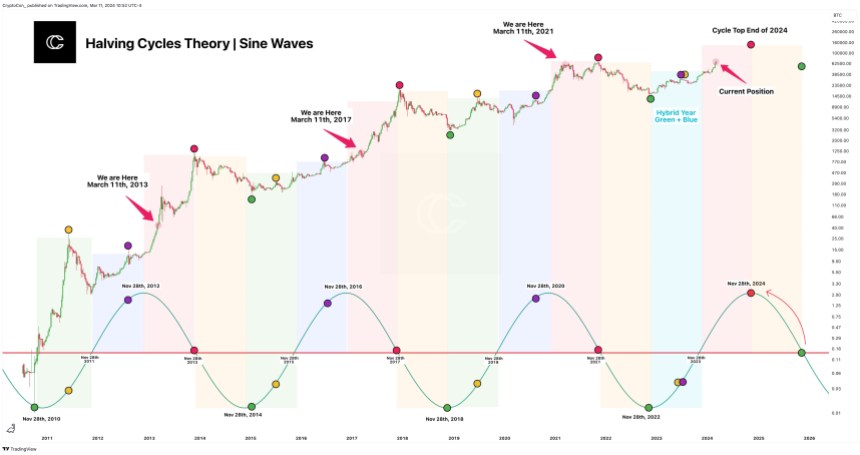

By inspecting earlier halving cycles and the “acceleration” seen in the present cycle, Rekt Capital suggests that Bitcoin’s bull market might perhaps per chance well perhaps merely height within 266-315 days from breaking its dilapidated all-time high, doubtlessly occurring in December 2024 or February 2025.

Rekt Capital’s diagnosis presentations that Bitcoin has historically peaked in its bull market approximately 518-546 days after a halving match. Alternatively, the present cycle demonstrates accelerated increase, reducing approximately 260 days.

Essentially essentially based on the analyst, this acceleration has the doable to halve the conventional cycle dimension, indicating that Bitcoin’s height in the present bull market might perhaps per chance well perhaps merely happen great before anticipated.

Rekt Capital’s level of view, measuring the bull market height from when an dilapidated all-time high is breached, presents precious insights. On this cycle, Bitcoin recently broke to new all-time highs, indicating a doable milestone in the market.

If the accelerated level of view holds, the next bull market height is estimated to happen within 266-315 days from this breakout, touchdown someplace between December 2024 and February 2025, according to the diagnosis supplied by Rekt.

Roughly each four years, Bitcoin’s halving events delight in historically played a wanted role in shaping market cycles. These events decrease the block reward miners receive, thereby reducing the rate of most contemporary Bitcoin present, but this time might perhaps per chance well perhaps be diversified, according to Rekt, one other analyst.

From Four-Year Cycle To Recent Horizons

Corresponding to Rekt’s diagnosis, market professional Crypto Con means that the “veteran four-one year cycle” might perhaps per chance well perhaps merely no longer keep, as Bitcoin is reaching new all-time highs before anticipated, and as such, Crypto Con believes that the “boundaries of the used cycle” are being pushed, doubtlessly signaling a paradigm shift in Bitcoin’s market dynamics.

Historically, Bitcoin’s tag cycles delight in adhered to a four-one year pattern, characterized by market peaks round four years after each halving match. Alternatively, Crypto Con challenges this thought, arguing that the present cycle deviates from the “used timeline.”

Bitcoin’s most contemporary entry into “tag discovery mode” and the success of most contemporary ATHs approximately a one year sooner than anticipated imply that the four-one year cycle might perhaps per chance well perhaps merely no longer keep its predictive vitality.

Crypto Con’s diagnosis indicates that the present market trajectory aligns more carefully with the 2017 bull traipse than with earlier cycles. Evaluating the first tops of cycles 1 and 3 (2013 and 2021) to the designate, each cases had been on the verge of forming their initial peaks round April, mirroring the present market prerequisites.

This order helps the opportunity of Bitcoin’s subsequent bull market height occurring in late 2024 in preference to the previously anticipated late 2025.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is outfitted for instructional capabilities only. It does no longer signify the opinions of NewsBTC on whether to buy, sell or keep any investments and naturally investing carries dangers. You can well perhaps be told to conduct your have analysis before making any funding decisions. Issue recordsdata supplied on this internet enviornment fully at your have threat.