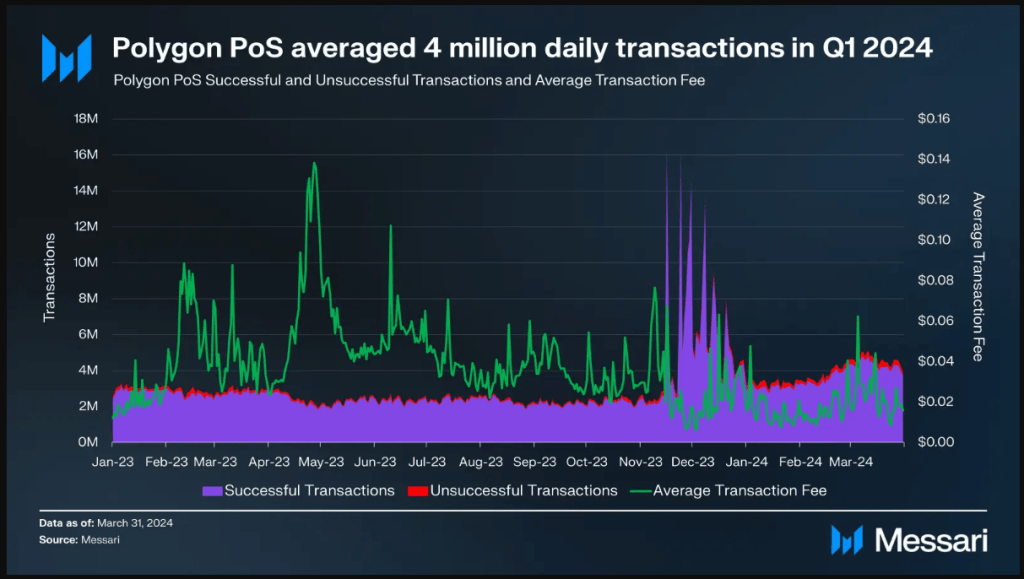

Polygon (MATIC), a Layer-2 scaling solution for the Ethereum blockchain, finds itself in a uncommon location. Newest data from Messari paints an image of a community brimming with exercise – each day consuming addresses surging in relation to 120%, unique user value-u.s.exploding by 70%, and each day transactions reaching a staggering 4 million. But, beneath this bustling floor lies a troubling undercurrent: a 19% tumble in quarterly revenue in contrast to the outdated quarter, and a hefty 40% decline 365 days-over-365 days.

Polygon: A Network On Hearth

Polygon’s user depraved is clearly smitten. The predominant quarter of 2024 witnessed a land flow, with unique addresses flocking to the community at an unparalleled rate. This surge in user adoption translated actual into a transaction frenzy, with each day interactions on the platform quadrupling.

The decentralized finance (DeFi) sector on Polygon also thrived, with the total impress locked (TVL) in DeFi initiatives climbing 30% in contrast to the outdated quarter. The non-fungible token (NFT) ecosystem on Polygon also got a shot within the arm, with sales volume rising by in relation to 20%.

The Revenue Riddle

So, why the long face amidst the celebratory confetti? The acknowledge lies in Polygon’s dwindling revenue rush. Despite the exponential development in exercise, the community’s coffers are taking a success.

The $7 million earned in Q1 2024 pales when put next to the $10 million and $12 million raked in for the duration of the outdated quarter and the identical length final 365 days, respectively. This disconnect between booming exercise and declining revenue is the million-dollar request that has analysts scratching their heads.

MATIC market cap currently at $6.8 billion. Chart: TradingView.com

Rate Fiasco Or Funding Flux?

There are two foremost suspects leisurely this revenue paradox. The predominant culprit would be Polygon’s transaction rate constructing. Presumably, in a speak to plan more users, the community reduced its costs to an extent that, no matter the extensive raise in transactions, the overall revenue generation suffered.

One other possibility lies in a seemingly shift in Polygon’s revenue sources. Presumably there became a decline in revenue from a particular source, akin to grants or partnerships, that wasn’t adequately compensated for by development in pretty loads of areas.

What Lies Ahead

Polygon faces a serious juncture. The community’s capability to plan users and foster a shiny DeFi and NFT ecosystem is discreet. On the opposite hand, if it fails to take care of the revenue conundrum, its long-term sustainability would be in possibility. Transferring ahead, transparency from Polygon in terms of its rate constructing and revenue streams will likely be a truly unparalleled in assuaging investor considerations.

Additionally, exploring different revenue units, akin to offering top rate products and services or strategic partnerships, could be the key to unlocking Polygon’s full financial seemingly.

Featured image from Zameen.com, chart from TradingView

Disclaimer: The facts stumbled on on NewsBTC is for educational functions

fully. It would not hiss the opinions of NewsBTC on whether or now to not buy, promote or abet any

investments and naturally investing carries risks. You are instructed to conduct your private

study sooner than making any funding decisions. Employ data equipped on this web area

fully at your private possibility.