Residence » Bitcoin » Bitcoin value forced by whales, long-time-frame holders, and miners: Bitfinex

by

Jun. 17, 2024

Bitcoin’s steadiness challenged by fixed selling from influential investors.

Fragment this article

Bitcoin dropped by 4.4% final week forced by long-time-frame holders (LTH), whales, and miners selling their holdings, in response to the most contemporary edition of the “Bitfinex Alpha” file.

The movements took region mainly through alternate gross sales and over-the-counter transactions.

LTHs are identified to divest for the length of bull markets and consolidation phases, are demonstrating their market have an effect on as soon as extra. The novel selling, even supposing less intense than earlier cases, underscores the plenty of impact LTHs and whales maintain on liquidity and rate fluctuations.

Particularly, on-chain metrics imprint that LTHs had been the main contributors to the novel sell-off, overshadowing ETF outflows. This relate aligns with the unwinding of the premise arbitrage trade highlighted in the earlier week’s Bitfinex Alpha file.

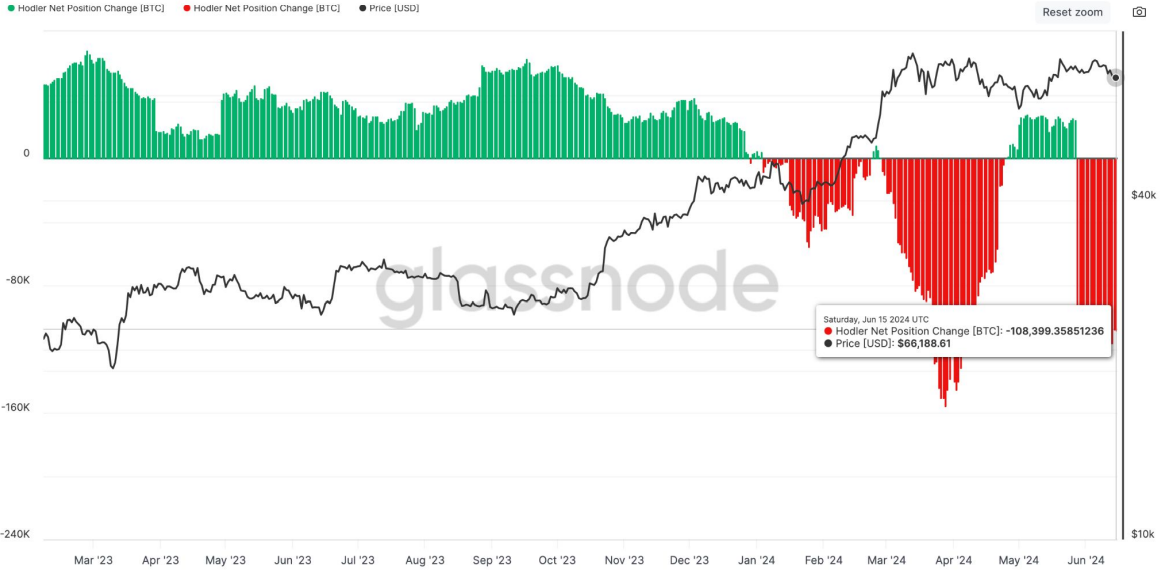

The “Hodler Gain Situation Alternate” metric, which tracks the month-to-month region adjustments of LTHs, has registered detrimental relate, indicating a selling type amongst this cohort.

Moreover, the discontinue 10 inflows into exchanges maintain risen as a proportion of whole inflows, signaling heightened whale relate. This kind most continuously precedes a value fall, even supposing the past three months maintain viewed Bitcoin’s value remain comparatively stable, per chance attributable to sturdy predicament ETF search records from. On the assorted hand, the continuing selling is apparently capping Bitcoin’s potential value features.

The Coinbase Premium Index, one more indicator of whale behavior, suggests stable selling stress from US investors on Coinbase Knowledgeable, as evidenced by a fixed detrimental proportion distinction in contrast with other predominant exchanges.

Furthermore, an inverse relationship between Bitcoin’s value and miner reserves has been observed, with a significant decline in miner reserves coinciding with the height in Bitcoin’s value round March 2024, indicating miners had been selling to capitalize on high costs and prepare for the halving tournament.

As miner reserves attain four-year lows, it suggests that selling stress from this neighborhood will likely be nearing a predominant level, doubtlessly impacting future market dynamics.

Fragment this article