Amidst the identical outdated financial market rupture in early August, Ethereum (ETH) misplaced about 30% of its cost, falling to $2,226 per unit. Notably in the outdated couple of weeks, the prominent altcoin has confirmed much resilience ice climbing wait on into the $2,600 trace role. Albeit, this most recent trace retracement is accompanied by much uncertainty on how long Ethereum can care for such upward momentum. Commenting on this dialogue, CryptoQuant analyst ShayanBTC has postulated that Ethereum can even simply seemingly resume its bearish direction.

Ethereum Trace To Suffer From Sellers’ Dominance

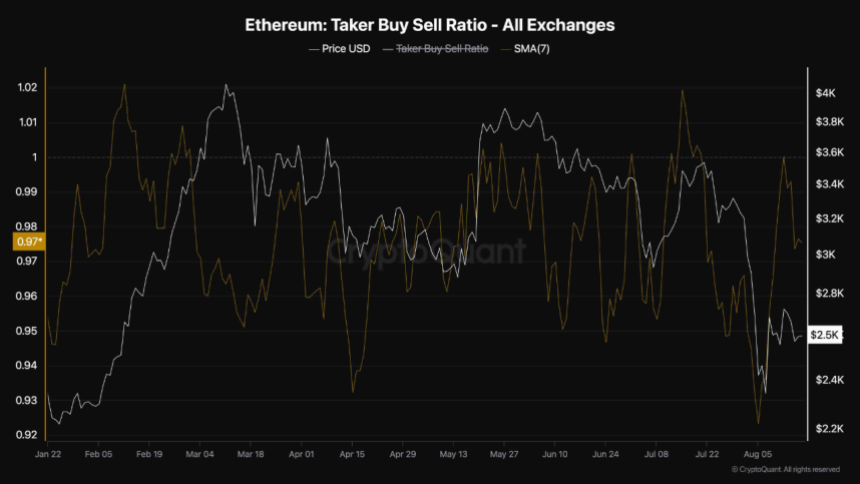

In a QuickTake publish on Saturday, ShayanBTC shared that the Taker Aquire/Sell Ratio indicated that Ethereum might presumably presumably be effect apart for more trace loss in the upcoming days. To effect, the Taker Aquire/Sell Ratio is an prognosis tool that gauges the balance between aggressive making an strive to search out and selling activity. It is calculated in conserving with the quantity of taker aquire orders and taker sell orders.

As traditional with other indicators, a Taker Aquire/Sell ratio above one suggests there might be an upward market momentum with more aggressive investors than sellers and a ratio below one represents a downward market stress with the other topic.

In step with ShayanBTC, after lately failing to surpass the $3000 trace resistance, Ethereum’s Taker Aquire/Sell Ratio declined drastically as evidenced by the asset’s trace streak. As expected, the metric furthermore experienced a rebound following ETH’s most recent trace features. Albeit, the Taker Aquire/Sell Ratio might presumably presumably not rise above 1 staying in the zero role, which indicated a lack of enough making an strive to search out stress permits the sellers to care for market regulate.

Nonetheless, ShayanBTC reviews that the TakerBuy/Sell Ratio has all over once more declined indicating that sellers are making ready to dump their sources, per chance inflicting an Ethereum trace fall. The analyst requires caution, stating that the ETH market will require a big rise in ask to care for faraway from resuming the downward trace streak.

ETH Trace Overview

In step with data from CoinMarketCap, Ethereum currently trades at $2,610 reflecting a minor 0.61% rep in the closing day. Nonetheless, the asset’s efficiency on higher time frames is aloof unimpressive with a decline of 23.93% in the closing month.

With continual features, the most prominent altcoin is effect apart to attain wait on across an early resistance on the $2,700 trace role. If making an strive to search out stress proves enough, ETH might presumably presumably pass previous this barrier rising as excessive as $3,000. Nonetheless, a big selling stress as indicated by the Taker Aquire/Sell ratio can power the asset’s trace as low as $2300.

Featured image from Adobe Stock, chart from Tradingview

Disclaimer: The data stumbled on on NewsBTC is for instructional capabilities

most efficient. It doesn’t divulge the opinions of NewsBTC on whether to aquire, sell or preserve any

investments and naturally investing carries dangers. You are suggested to habits your bask in

be taught earlier than making any funding choices. Exercise data provided on this web effect

fully at your bask in possibility.